An annuity date, often referred to as the annuitization date, is a pivotal term in the context of annuity contracts. An annuity is a financial product issued by an insurance company that pays out income and can be used as part of a retirement strategy. The annuity date refers to the moment when the accumulation phase of the annuity contract ends and the annuitization phase begins. Simply, it's the date when the annuitant (the person owning the annuity) starts receiving payments from their annuity contract. The annuity date affects contract terms. An earlier date means earlier income but smaller payments due to less time for growth. Conversely, if the annuity date is further into the future, the annuitant will receive payments later, but these payments may be larger due to more time for capital growth during the accumulation phase. The annuity date sets the timeline for income payments from an annuity contract. This date, chosen at the time of contract initiation, dictates when the annuitant will start receiving scheduled payments. An annuitant may choose an immediate annuity, where payments start soon after the initial investment, or a deferred annuity, where payments begin at a later, specified annuity date. The annuity date also has a significant impact on the terms and conditions of the annuity contract. For instance, it affects the size of the annuity payments. An earlier annuity date means the payments will likely be smaller but received over a longer period, while a later annuity date results in larger payments over a shorter period. It also affects the type of annuity chosen. Immediate annuities usually have an annuity date soon after the contract initiation, while deferred annuities have a later annuity date. Lastly, the annuity date plays a crucial role in determining the tax implications of an annuity. Any interest or growth within the annuity during the accumulation phase is tax-deferred until the annuity payments start. Therefore, choosing a later annuity date allows for more tax-deferred growth within the annuity. However, once payments start, they are subject to income tax, and choosing a later annuity date can push these tax obligations further into the future. Choosing an annuity date requires careful consideration of your financial needs and goals, especially in terms of retirement planning. An annuity can provide a steady income stream during retirement, but the timing of this income stream is crucial. For example, if you plan to retire at 65 and need the annuity income immediately, your annuity date would ideally coincide with your retirement date. Income requirements are another crucial factor. If you require a larger income, it may be more beneficial to choose a later annuity date to allow for more growth during the accumulation phase. Conversely, if you need income sooner, an earlier annuity date may be more appropriate. Life expectancy significantly influences the decision of an annuity date. If you have a longer life expectancy, you may benefit from a deferred annuity with a later annuity date. This could allow for larger payments due to the extended accumulation phase. However, if your life expectancy is shorter, an immediate annuity with an earlier annuity date might be more advantageous to ensure you receive as much of your annuity as possible. Your life expectancy also impacts whether you choose an immediate or deferred annuity. Immediate annuities start paying out right away, which can be advantageous if your life expectancy is shorter. On the other hand, deferred annuities, which start paying out at a later date, can offer larger payments, which may be beneficial if you have a longer life expectancy. Market conditions, particularly interest rates, can significantly impact the annuity date decision. Interest rates directly influence the growth of your annuity during the accumulation phase. Higher interest rates could mean more growth, which could make a deferred annuity with a later annuity date more attractive. However, if interest rates are low, it might be more beneficial to opt for an immediate annuity with an earlier annuity date to start receiving income sooner. Lastly, the broader economic climate can influence your annuity date. In a booming economy, you might expect higher returns on your annuity during the accumulation phase, possibly leading you to choose a later annuity date. Conversely, in a struggling economy, you might prefer to start receiving payments sooner and opt for an earlier annuity date. Annuity payment schedules are flexible and can be tailored to meet your specific needs. The payments can be scheduled to be made on a monthly, quarterly, semi-annual, or annual basis. It's essential to understand that the frequency of payments can influence the total payout amount over the annuity's lifetime. A more frequent payment schedule will result in smaller individual payments, but the overall amount received may be the same. The frequency of your annuity payments has a direct impact on the annuity's value. A higher frequency of payments, such as monthly, means that you will receive smaller payments spread out over a more extended period. Conversely, a lower frequency of payments, such as annually, results in fewer but larger payments. In essence, the total amount you receive over the life of the annuity should remain the same regardless of the frequency; it's a matter of personal preference and income needs. The annuity date is intrinsically linked to the date of the first payment. Upon reaching the annuity date, the accumulation phase ends, and the payout phase begins. Therefore, the chosen annuity date will directly influence when you will start receiving payments from the annuity contract. If there's a delay in reaching the annuity date due to any reason, it will directly impact the annuity payment dates. Any deferral or postponement of the annuity date will push back the start of the income payments, possibly affecting the annuitant's financial plans. Annuities come with specific tax implications. During the accumulation phase of the annuity, the interest or investment income earned is tax-deferred. This means you do not pay any taxes on the gains as long as the money remains within the annuity. However, once the annuity payments start at the annuity date, each payment is subject to income tax on the earnings portion of the payment. The annuity date can significantly influence your tax obligations. If the annuity date is set further into the future, you can defer paying taxes on the annuity's growth for a longer period. However, when the payments start, you will need to pay income tax on the earnings portion of each payment. Consequently, a later annuity date could result in larger tax obligations due to more significant growth during the extended accumulation phase. One strategy to minimize tax liabilities is timing the annuity date to coincide with a period when you expect to be in a lower tax bracket. For example, many people fall into a lower tax bracket after they retire. Setting the annuity date to align with retirement could potentially reduce the tax burden on the annuity payments. Other tax-efficient strategies include considering a Roth annuity, which offers tax-free distributions, or using a "1035 exchange" to swap one annuity contract for another without triggering a taxable event. It's also beneficial to consult with a tax professional who can provide tailored advice based on your individual circumstances. Annuities can be a beneficial component of a comprehensive estate plan. They provide a predictable income stream, which can be especially valuable for a surviving spouse or other dependents. The annuity date, as a part of the annuity contract, will also become a part of the estate plan. The annuity date can significantly affect beneficiaries. If the annuity date is reached and the annuitant passes away, the remaining payments typically continue to the beneficiaries for the contract's remainder. The timing of these payments will be determined by the original annuity date and payment schedule. If an annuity owner passes away before the annuity date, the annuity contract usually provides for a death benefit. This benefit typically equals the current value of the annuity and can be paid out to the designated beneficiaries. The specific terms can vary, so it's essential to understand the contract's details. Upon the death of the annuity owner before the annuity date, beneficiaries typically have several options. They might choose to receive a lump-sum payout or continue the contract, with annuity payments starting on the originally planned annuity date. Again, the specifics can vary based on the annuity contract and the issuing insurance company's policies. An annuity date defines the moment when the accumulation phase ends and the distribution or payout phase begins. The selection of this date influences several elements of the contract, including the timing and amount of income payments, tax obligations, and potential benefits to heirs. Annuity date plays a crucial role in financial planning, particularly for retirement, where a stable and reliable income stream may be necessary. Additionally, it can impact estate planning, affecting how and when beneficiaries might receive payments. Choosing an annuity date isn't a decision to be taken lightly; it requires careful thought about personal financial goals, expected lifespan, and current market conditions. For a decision with such lasting implications, it can be valuable to consult with a professional, such as an insurance broker or financial advisor. They can provide expert guidance tailored to your unique circumstances and help you navigate this critical aspect of annuity planning. What Is an Annuity Date?

Importance of Annuity Date

Setting the Timeline for Income Payments

Impact on Annuity Contract Terms

Role in Determining Tax Implications

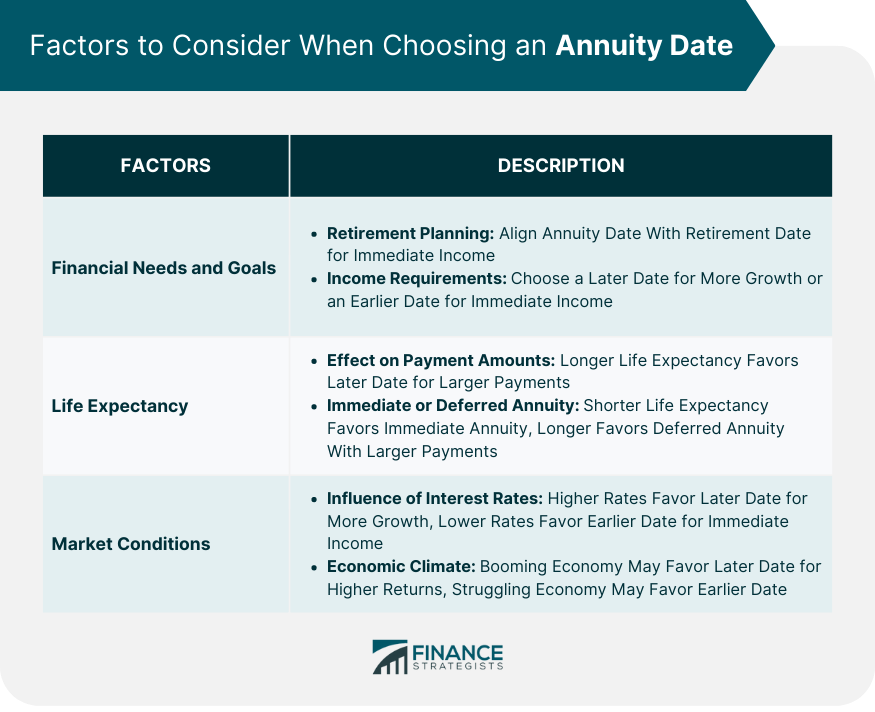

Factors to Consider When Choosing an Annuity Date

Financial Needs and Goals

Retirement Planning

Income Requirements

Life Expectancy

Effect on Payment Amounts

Impact on the Choice of Immediate or Deferred Annuity

Market Conditions

Influence of Interest Rates

Economic Climate and Its Effect on Annuity Date

Understanding Annuity Payment Dates

Scheduling Annuity Payments

Frequency Options: Monthly, Quarterly, Annually

How Payment Schedules Affect the Annuity's Value

Impact of Annuity Date on Payment Date

Connection Between Annuity Date and First Payment Date

How Delays in Annuity Date Can Impact Payment Dates

Annuity Date and Taxes

Tax Implications of Annuity Date

Tax Treatment of Annuities

How the Annuity Date Can Influence Tax Obligations

Strategies for Minimizing Tax Liabilities

Timing the Annuity Date for Optimal Tax Benefits

Other Tax-Efficient Strategies for Annuities

Role of Annuity Date in Estate Planning

Annuities as Part of an Estate Plan

Inclusion of Annuities in Estate Planning

How Annuity Date Affects Beneficiaries

Death of Annuity Owner Before Annuity Date

Impact on Remaining Annuity Value

Options for Beneficiaries

Final Thoughts

Annuity Date FAQs

An annuity date, also known as the annuitization date, is the specific date when an annuity contract transitions from the accumulation phase to the payout phase. In other words, it's the date when the annuity owner starts receiving income payments from the annuity.

The annuity date directly influences the terms of the annuity contract. The timing of the annuity date determines when income payments will start, the size of these payments, and the tax implications of the annuity.

In most cases, once the annuity date is set at the contract initiation, it cannot be changed. However, some annuity contracts may allow for flexibility under specific conditions. It's best to discuss this with your insurance broker or financial advisor.

The annuity date impacts when you'll start to owe taxes on the growth of the annuity. During the accumulation phase, growth within the annuity is tax-deferred. Once you reach the annuity date and start receiving payments, the earnings portion of these payments is subject to income tax.

If an annuity owner dies before the annuity date, the annuity contract typically provides a death benefit, which usually equals the current value of the annuity. The beneficiaries have the choice to receive a lump-sum payout or continue with the contract, with annuity payments starting on the planned annuity date.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.