AnnuiCare refers to a financial product that combines annuities with long-term care insurance. This hybrid solution addresses two important needs in a person's retirement planning: securing a steady income stream (via annuities) and financing long-term care (via insurance) in case of chronic illness or disability. The importance of AnnuiCare cannot be overstated. In an era where life expectancy is increasing, it provides a safety net for individuals who may outlive their savings or need long-term care due to physical or cognitive impairments. It offers a financial buffer, mitigating the risk of depleting retirement funds prematurely while ensuring access to quality long-term care when needed. Annuities are financial products offered by insurance companies designed to provide a steady income stream, typically during retirement. In its most basic form, an annuity is a contract between an individual and an insurance company. The individual makes a lump-sum payment or a series of payments to the insurance company, which in return, promises to make periodic payments to the individual at some future point. There are several types of annuities, each with distinct characteristics and benefits: Fixed Annuities: These offer a guaranteed interest rate and a minimum payment amount regardless of market fluctuations. Variable Annuities: The payments from these are tied to the performance of investments within the annuity; thus, the payout can vary. Indexed Annuities: These offer a return based on a market index, such as the S&P 500, providing potential for higher returns but also carrying more risk. Immediate Annuities: These begin paying out immediately after the initial investment. Deferred Annuities: The payout begins at a future date chosen by the annuitant. Annuities are essentially contracts between individuals and insurance companies. The individual (annuitant) pays a premium, either as a lump sum or through installments, to the insurance company. In return, the insurer guarantees to pay a certain amount of money periodically to the annuitant for a specific duration or for the rest of their life. AnnuiCare is a product that ingeniously combines the steady income generation feature of annuities with the protection of long-term care insurance. Essentially, it functions as an annuity, providing regular income during retirement. However, if the policyholder requires long-term care, the policy transitions into a long-term care insurance policy, providing coverage for these expenses. Since the introduction of the first hybrid annuity-long-term care product in the 1990s, AnnuiCare has evolved to become more flexible and comprehensive. Modern AnnuiCare products now offer customizable coverage options and benefits, such as inflation protection, and have features that allow unused long-term care benefits to be passed to heirs as death benefits. AnnuiCare stands as a comprehensive solution to several concerns tied to retirement, distinguished by its fundamental components that provide income and coverage for care, along with added flexibility and a provision for inheritance. A crucial part of AnnuiCare, the annuity component, assures a consistent income stream during the policyholder's retirement years. The frequency and amount of these payments typically depend on the initial investment and the terms of the policy. By delivering a regular income, this element addresses one of the primary concerns related to retirement – maintaining financial stability without an active employment income. Arguably the unique selling point of AnnuiCare, the long-term care component provides coverage for long-term care services that one might require during retirement. These services encompass a broad range, including but not limited to, assisted living, nursing home care, and home health care. By offering this feature, AnnuiCare addresses the significant financial risk associated with long-term care costs in later life. In line with the varying needs and circumstances of policyholders, AnnuiCare policies offer considerable flexibility. The terms of long-term care coverage and annuity payouts can be adjusted according to the policyholder's evolving needs and financial situation. Such flexibility allows the policy to adapt over time, providing the policyholder with an additional layer of financial security and peace of mind. The death benefit feature of AnnuiCare provides an element of financial legacy. If the policyholder does not exhaust the long-term care benefits, the remaining amount is usually passed on to the policyholder's heirs as a death benefit. In essence, this component ensures that the policyholder's investment isn't wasted, even if they don't fully utilize the long-term care coverage, offering an additional inheritance for their loved ones. One of the most significant benefits of AnnuiCare is its ability to address two major retirement concerns in one financial product - ensuring a regular income stream and covering potential long-term care costs. This dual-purpose feature simplifies financial planning and offers peace of mind to retirees. With an AnnuiCare policy, the cost of long-term care insurance can be spread out over the life of the annuity. This makes it more affordable than standalone long-term care policies that often require substantial upfront payments. This approach also alleviates the financial stress associated with unexpected long-term care expenses. In situations where the policyholder does not fully utilize their long-term care coverage, the unused benefits are typically transferred to the policyholder's heirs as a death benefit. This feature ensures that the policyholder's investment doesn't go to waste and provides an additional layer of financial security for their loved ones. One drawback of AnnuiCare is that the returns on the annuity portion might be lower than what could be achieved through direct investment in the market. This is because part of the premium is allocated towards the long-term care insurance component, reducing the amount available for income generation. Another potential issue is that the amount of long-term care coverage offered by AnnuiCare may not be sufficient for all potential long-term care needs. If care costs exceed the policy benefits, the policyholder could be faced with significant out-of-pocket expenses. If a policyholder makes withdrawals from the annuity portion for non-long-term care purposes, it can reduce the amount of long-term care coverage available. This can leave the policyholder underinsured when they most need the coverage. The cost of an AnnuiCare policy is determined by several factors, including the amount of annuity payout, the long-term care coverage desired, the policyholder's age, and health status at the time of application. These policies typically require a significant initial lump sum payment or a series of payments over a defined period. AnnuiCare policies offer various payout options, often customizable to the policyholder's needs. These options can include income for life, income for a certain period, or income until the initial investment is exhausted. It's crucial to understand these options and their implications for your retirement income and long-term care coverage. The value of an AnnuiCare policy can be affected by inflation over time, eroding the purchasing power of fixed annuity payments. Some policies offer inflation protection as an optional rider, which can help preserve the policy's real value. Regarding taxes, annuity payments, and long-term care benefits are typically taxed differently. It's important to consult with a tax professional to understand the tax implications of your AnnuiCare policy. Before purchasing an AnnuiCare policy, it's essential to evaluate your financial situation. You should have sufficient funds for the initial investment without jeopardizing your current financial stability or retirement lifestyle. Your health status and life expectancy play a significant role in determining whether AnnuiCare is a suitable option. Those with longer life expectancies can benefit more from the annuity component, while those with significant health issues may benefit more from the long-term care insurance component. It's also crucial to consider your potential long-term care needs. If you have a high likelihood of needing long-term care, either due to family health history or lifestyle factors, an AnnuiCare policy can provide valuable coverage. When choosing an insurance provider for your AnnuiCare policy, it's important to consider factors like the company's financial strength, reputation, customer service quality, and flexibility and comprehensiveness of its AnnuiCare products. The application process for an AnnuiCare policy typically involves a medical underwriting process where the insurance company evaluates your health status and longevity risk. It's important to understand this process and provide accurate and comprehensive information. Policyholders should regularly review their AnnuiCare policy statements to understand their current annuity income, remaining long-term care benefits, and any policy changes. Many AnnuiCare policies offer flexibility in making changes, such as adjusting annuity income or long-term care coverage. Policyholders should understand how to make these changes, the implications of these changes, and any costs associated with them. AnnuiCare combines annuities and long-term care insurance to offer a solution for retirement planning. It provides a steady income stream and financial protection for potential long-term care expenses. Its key components, including annuity and long-term care features, along with flexible options like a death benefit, create a comprehensive retirement plan that addresses income and care needs simultaneously. However, it's important to weigh the pros and cons of AnnuiCare. While it is affordable and addresses major retirement concerns, there are potential drawbacks such as lower returns, possible insufficient coverage, and reduced coverage due to non-care-related withdrawals. To determine if AnnuiCare is suitable for you, assess your financial situation, evaluate your health and life expectancy, and consider your long-term care needs. Remember, everyone's circumstances are unique. Consider seeking advice from an experienced insurance broker who can provide a thorough understanding of AnnuiCare and help evaluate its suitability for your retirement planning.What Is AnnuiCare?

Understanding Annuities

Different Types of Annuities

How Annuities Work

Link Between Annuities and Annuicare

Integrating Annuities With Long-Term Care

Evolution of AnnuiCare

Key Components of AnnuiCare

Annuity Component

Long-Term Care Component

Flexibility in AnnuiCare

Death Benefit Feature

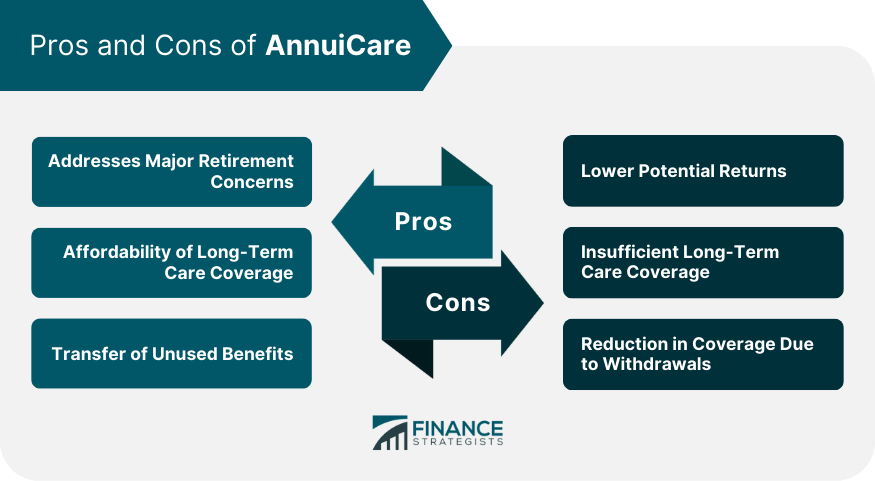

Pros of AnnuiCare

Addressing Major Retirement Concerns

Affordability of Long-Term Care Coverage

Transfer of Unused Benefits

Cons of AnnuiCare

Lower Potential Returns

Insufficient Long-Term Care Coverage

Reduction in Coverage Due to Withdrawals

Understanding the Costs and Payouts of AnnuiCare

Costs of AnnuiCare

Understanding Payout Options of AnnuiCare

How Inflation and Taxes Affect AnnuiCare

Determining if Annuicare Is Right for You

Assessing Your Financial Situation

Evaluating Your Health and Life Expectancy

Considering Your Long-Term Care Needs

How to Purchase AnnuiCare

Choose an Insurance Provider

Navigate the Application Process

Managing Your AnnuiCare Policy

Understanding Your Policy Statements

Making Changes to Your Policy

Final Thoughts

AnnuiCare FAQs

AnnuiCare is a financial product that combines annuities with long-term care insurance, designed to provide income during retirement and cover long-term care expenses if needed.

AnnuiCare provides a regular income stream during retirement through the annuity component. If the policyholder requires long-term care, the policy transitions into a long-term care insurance policy, providing coverage for these expenses.

AnnuiCare addresses two significant retirement concerns - income and long-term care costs. It also allows the cost of long-term care insurance to be spread out over the life of the annuity, and unused benefits can be transferred to heirs.

Potential drawbacks of AnnuiCare include lower returns on the annuity portion, possible insufficient long-term care coverage, and reduction in coverage due to non-care-related withdrawals.

Whether AnnuiCare is right for you depends on your financial situation, health status, life expectancy, and potential long-term care needs. It's advisable to consult with a financial advisor or insurance broker to assess its suitability for your retirement planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.