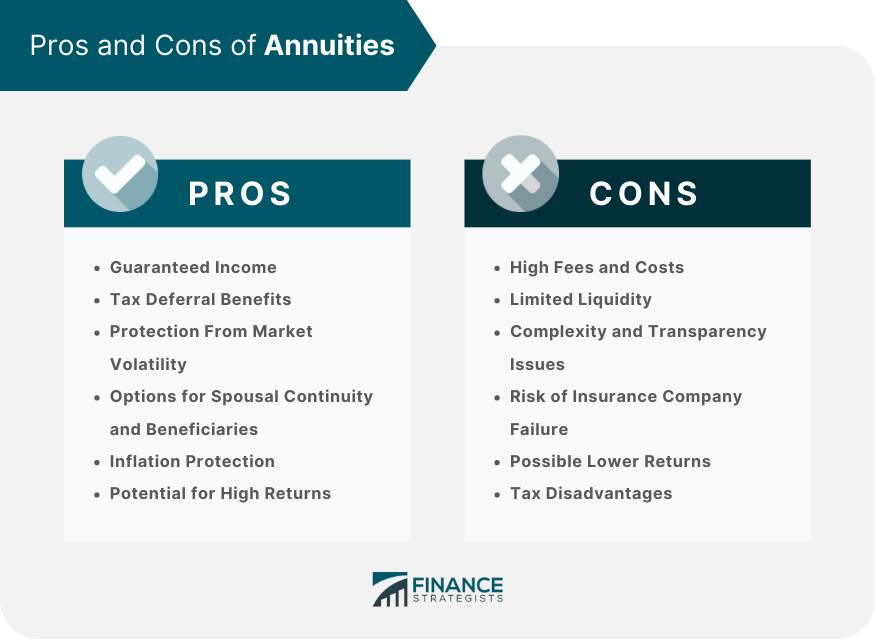

Annuities are financial products typically provided by insurance companies to help individuals secure a steady income during retirement. They're designed to accept and grow your funds, then pay out a regular stream of income at a later point in time, often during retirement. The primary purpose of annuities is to provide a reliable, consistent source of income, making them a critical tool in retirement planning. There are several types of annuities, including fixed, variable, and indexed. Each of these types offers different returns and risk levels. Fixed annuities provide a guaranteed return, variable annuities offer returns tied to a market index, and indexed annuities provide a combination of guaranteed returns and potential market-based gains. Understanding how each works is crucial to making an informed decision about whether annuities are the right fit for your financial situation. A significant benefit of annuities is the guarantee of income, which can be structured to last a lifetime or a certain period. Lifetime income ensures you will receive payments until you pass away, while certain period income provides payments for a defined period, such as ten years. In the accumulation phase, the money you invest in an annuity grows tax-deferred, meaning you don't pay taxes until you withdraw the funds. This allows your money to compound faster because you're earning returns on the full amount of your investment, including the portion you would have paid in taxes. With fixed and indexed annuities, you're protected from market downturns. Your investment is insulated from the daily fluctuations of the financial markets, providing a stable and predictable income stream. Annuities offer options for continuation of income to a spouse after the annuitant's death, known as a joint-life option. There are also death benefit options that allow a beneficiary to receive the remaining funds upon the death of the annuitant. Some annuities offer options that help protect against the eroding effects of inflation. These features may come in the form of Cost of Living Adjustments (COLAs) or increasing payment options. Variable annuities, while risky, can offer high returns if the underlying investments perform well. Additionally, some annuities offer bonus credits, which are extra amounts added to your account as a percentage of your premium payment. Annuities can come with a range of costs, including surrender charges for early withdrawal, ongoing management fees, and insurance charges. These costs can significantly reduce the value of your investment over time. If you need to access your money before the end of the surrender period (usually several years), you'll likely face steep surrender charges. Annuities are designed for long-term income, not for quick access to cash. Annuities can be complex products with various fees, features, and guarantees. This complexity can make it difficult for average investors to fully understand what they're investing in. There can also be transparency issues, with some fees or risks not clearly disclosed. Your annuity is only as secure as the insurance company that sells it. If the insurer fails, you could lose your investment. While there is some protection through state guaranty associations, it's generally limited. Compared to investing directly in the stock market, you might see lower returns from an annuity, particularly a fixed annuity. Additionally, if you die soon after buying an annuity but before you've received much income from it, you or your heirs may receive less than the original investment. Unlike capital gains or qualified dividends, any gains from annuities are taxed as ordinary income. Plus, there is no step-up in basis at death, which could result in higher taxes for your heirs. Before investing in annuities, there are several important considerations to keep in mind. First, understand the specific terms and features of the annuity, including fees, surrender charges, and any potential penalties for early withdrawals. Assess your own financial goals and risk tolerance to determine if an annuity aligns with your needs. Consider the length of the annuity contract and whether it suits your long-term plans. It's also crucial to research and evaluate the financial strength and reputation of the insurance company offering the annuity. Finally, consult with a financial advisor to ensure that an annuity is a suitable component of your overall investment strategy. Annuities offer distinct benefits, including guaranteed income, tax deferral advantages, protection from market volatility, options for spousal continuity and beneficiaries, inflation protection, and potential for high returns. However, it's essential to balance these with certain drawbacks such as high fees, limited liquidity, complexity, potential insurance company failure, the possibility of lower returns, and some tax disadvantages. Prior to investing in annuities, significant considerations should be taken into account. These include clearly defining your financial goals, understanding the diverse types of annuities, assessing the financial health of the insurance company, and engaging a financial advisor. Weighing these elements, annuities could play a pivotal role in your financial planning strategy. Nevertheless, this investment vehicle isn't a one-size-fits-all solution and should be carefully considered to align with individual financial goals and risk tolerance.Annuities Overview

Pros of Annuities

Guaranteed Income

Tax Deferral Benefits

Protection From Market Volatility

Options for Spousal Continuity and Beneficiaries

Inflation Protection

Potential for High Returns

Cons of Annuities

High Fees and Costs

Limited Liquidity

Complexity and Transparency Issues

Risk of Insurance Company Failure

Possible Lower Returns

Tax Disadvantages

Considerations Before Investing in Annuities

Conclusion

Pros and Cons of Annuities FAQs

The pros of annuities include guaranteed income, tax deferral benefits, protection from market volatility, options for spousal continuity and beneficiaries, inflation protection, and the potential for high returns. The cons include high fees and costs, limited liquidity, complexity and transparency issues, risk of insurance company failure, possible lower returns, and tax disadvantages.

The pros and cons of annuities significantly impact your retirement planning. Pros such as guaranteed income and protection from market volatility can provide a steady income stream during retirement, while cons such as high fees and limited liquidity can restrict your financial flexibility.

Given the pros and cons of annuities, they are best suited for individuals seeking stable, guaranteed income in retirement, particularly those who worry about outliving their savings. However, due to their complexity and potentially high costs, it's essential to understand your financial goals and consult with a financial advisor.

One of the significant pros of annuities is the tax deferral benefit during the accumulation phase, which allows your money to compound faster. However, a major con is that any gains from annuities are taxed as ordinary income, unlike capital gains or qualified dividends. Also, there's no step-up in basis at death, which could lead to higher taxes for your heirs.

To decide whether annuities are right for you, considering their pros and cons, you must assess your financial goals, understand different types of annuities, and evaluate the financial strength of the insurance company. Consulting with a financial advisor is also recommended to help make a decision tailored to your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.