A life annuity is a financial product designed to provide a stream of income payments for the lifetime of the annuitant, typically as a means of securing retirement income. It is a contract between an individual and an insurance company, where the individual pays a premium in exchange for guaranteed income payments for the rest of their life. In a single premium life annuity, the annuitant pays a lump-sum amount upfront to purchase the annuity contract. This is a common choice for individuals who have accumulated a significant amount of retirement savings and wish to convert it into a guaranteed income stream. Flexible premium annuities allow the annuitant to make multiple premium payments over time. This option provides more flexibility for those who may not have a large lump sum to invest at once. During the accumulation phase, the insurance company invests in the premium payments in order to generate returns. The performance of the investments determines the growth of the annuity's value. When the annuity enters the distribution phase, the annuitant can choose from several payout options. Common options include life only, joint and survivor, period certain, and life with period certain annuities. Each option offers different benefits and drawbacks depending on the annuitant's needs and preferences. Annuity payouts can be made on a monthly, quarterly, semi-annual, or annual basis, depending on the annuitant's preference. Fixed life annuities provide a guaranteed income stream, with the payout amount determined at the time of purchase. The payments remain constant throughout the annuitant's life, regardless of market conditions. The main advantage of a fixed life annuity is the certainty of a stable income. However, the fixed payments may not keep up with inflation, potentially eroding the annuitant's purchasing power over time. Variable life annuities allow the annuitant to invest their premiums in a variety of investment options, such as mutual funds. The annuity's value and income payments fluctuate based on the performance of the chosen investments. Variable annuities offer the potential for higher returns and income payments but also carry higher risks due to market fluctuations. This type of annuity may be suitable for those who are comfortable with investment risk and seek growth potential. Indexed life annuities link the annuity's performance to a specific market index, such as the S&P 500. The annuity's value and income payments will fluctuate based on the performance of the chosen index, but they typically include a guaranteed minimum return to protect against negative market performance. Indexed annuities offer the potential for higher returns than fixed annuities while providing some downside protection. However, they may also have caps on the potential gains, limiting the growth potential compared to variable annuities. A life only annuity provides income payments for the annuitant's lifetime, ceasing upon their death. This option offers the highest income payments but provides no benefits to a surviving spouse or beneficiaries. A joint and survivor annuity covers two lives, typically the annuitant and their spouse. Upon the death of the first annuitant, payments continue to the survivor for their remaining lifetime. This option provides financial security for a surviving spouse but may result in lower initial income payments. A period certain annuity guarantees income payments for a specified period, such as 10 or 20 years. If the annuitant dies before the end of the period, the remaining payments are made to their beneficiaries. This option offers a balance between lifetime income and a guaranteed payment period for beneficiaries. A life with period certain annuity combines features of both life only and period certain annuities. The annuitant receives income payments for their lifetime, and if they die before the end of the specified period, the remaining payments are made to their beneficiaries. An inflation-adjusted annuity includes an annual cost-of-living adjustment (COLA) to help maintain the purchasing power of the income payments over time. This option can help protect against the erosive effects of inflation but may result in lower initial income payments. The annuitant's age and life expectancy play a significant role in determining the income payments from a life annuity. Generally, older individuals receive higher income payments due to their shorter expected lifespans. Since women tend to have longer life expectancies than men, they may receive lower income payments for the same annuity premium. Current interest rates can affect the payout of life annuities, with higher rates generally leading to higher income payments. The annuitant's choice of payout options will impact the amount and duration of income payments, as well as any potential benefits for beneficiaries. Life annuities provide a guaranteed income stream for the annuitant's lifetime, helping to ensure financial security during retirement. During the accumulation phase, the growth of a non-qualified annuity is tax-deferred, allowing the investments to compound without immediate tax consequences. By providing a reliable source of income, life annuities can help reduce financial stress and uncertainty during retirement. Incorporating a life annuity into a retirement income strategy can help diversify sources of income, reducing reliance on other investments or Social Security benefits. Fixed annuity payments may not keep up with inflation, reducing the annuitant's purchasing power over time. Once the premium is paid, it may be difficult to access the funds invested in a life annuity without incurring surrender charges or penalties. This makes life annuities less liquid compared to other investment options. The financial strength of the insurance company issuing the annuity is crucial, as the company's ability to fulfill its obligations depends on its financial stability. It is essential to research the insurer's credit ratings and financial health before purchasing an annuity. By choosing to invest in a life annuity, the annuitant forgoes the potential returns from other investment options. It is important to weigh the benefits of a guaranteed income against the potential growth from alternative investments. Life annuities are issued by insurance companies and regulated by state insurance departments. Each state has its own set of rules and regulations governing the sale and operation of annuities. FINRA oversees broker-dealers and registered representatives involved in the sale of variable and indexed annuities, ensuring compliance with applicable rules and regulations. The SEC regulates variable annuities as securities, providing additional oversight and protection for investors. Before purchasing a life annuity, it is essential to research the financial strength and credit ratings of the issuing insurance company to ensure they have the ability to fulfill their obligations. Annuities can have various fees and expenses, such as surrender charges, management fees, and mortality and expense risk charges. It is important to understand these costs and compare them across different providers and annuity products. Consider the reputation and customer service of the insurance company, as well as the experience of other annuitants. Reading reviews and seeking recommendations from trusted sources can help ensure a positive experience. Life annuities are a valuable financial tool that can provide guaranteed income for the annuitant's lifetime, offering financial security and peace of mind during retirement. By understanding the various types of life annuities, the payout options available, and the factors that affect payouts, individuals can make informed decisions when selecting an annuity product that best suits their needs. It is crucial to consider the financial strength and reputation of the issuing insurance company, as well as the fees and expenses associated with the annuity contract. Life annuities, when integrated into a comprehensive retirement income strategy, can diversify income sources, reduce reliance on other investments, and help mitigate financial risks during retirement. A professional insurance broker can help you evaluate and compare various annuity products, assess the financial strength of insurance companies, and ensure that the chosen annuity aligns with your financial goals and risk tolerance.What Is Life Annuity?

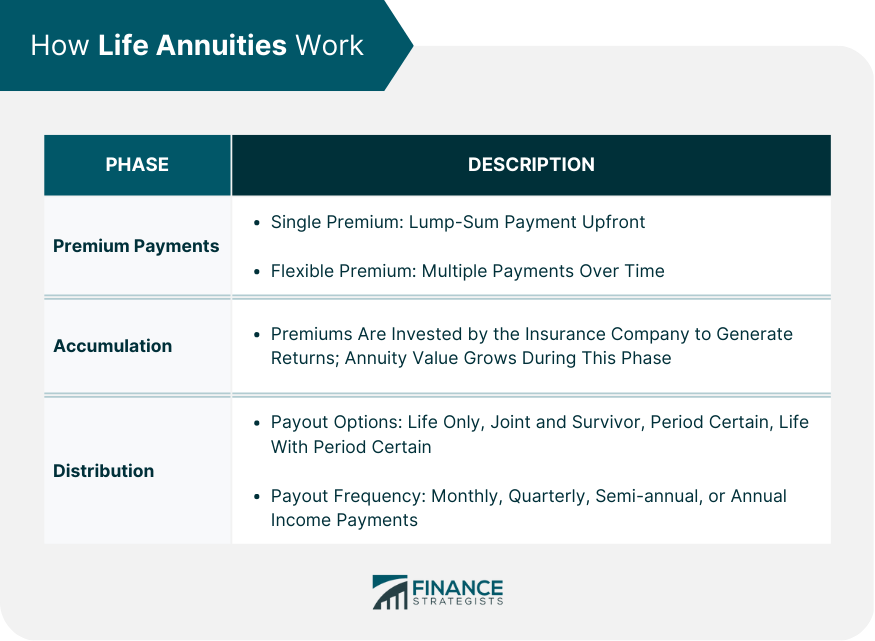

How Life Annuities Work

Premium Payments

Single Premium

Flexible Premium

Accumulation Phase

Distribution Phase

Payout Options

Payout Frequency

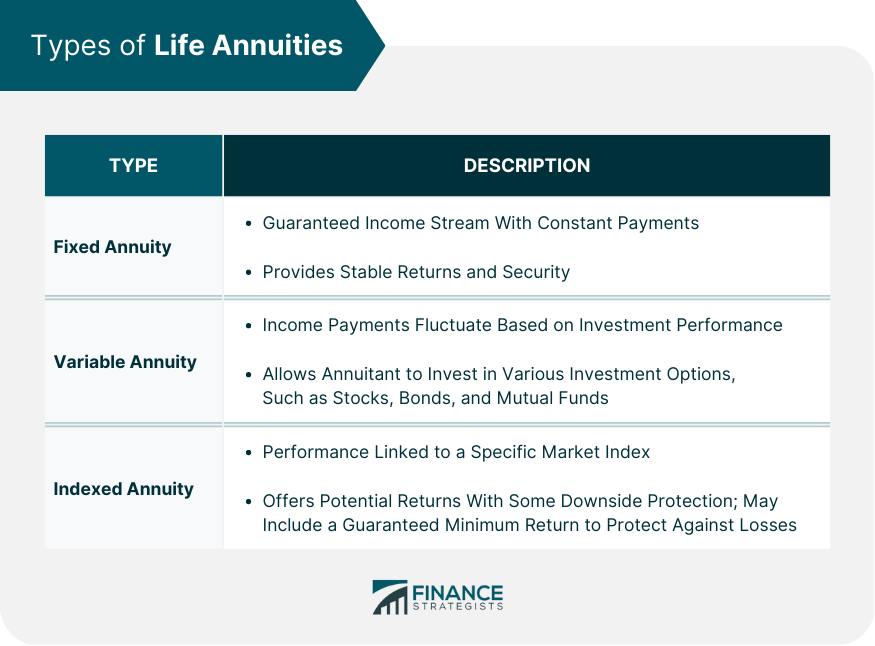

Types of Life Annuities

Fixed Life Annuity

Variable Life Annuity

Indexed Life Annuity

Life Annuity Payout Options

Life Only Annuity

Joint and Survivor Annuity

Period Certain Annuity

Life With Period Certain Annuity

Inflation-Adjusted Annuity

Factors Affecting Life Annuity Payouts

Age and Life Expectancy

Gender

Interest Rates

Payout Options Selected

Benefits of Life Annuities

Guaranteed Income for Life

Tax-Deferred Growth

Potential to Reduce Financial Stress

Diversification of Retirement Income Sources

Risks and Considerations

Inflation Risk

Loss of Liquidity

Credit Risk of the Issuing Company

Opportunity Cost

Regulation and Oversight

Insurance Companies and State Regulators

Financial Industry Regulatory Authority (FINRA)

Securities and Exchange Commission (SEC)

Choosing a Life Annuity Provider

Financial Strength and Ratings

Fees and Expenses

Reputation and Customer Service

Final Thoughts

Life Annuity FAQs

The main types of life annuities are fixed, variable, and indexed. Fixed life annuities provide a guaranteed income stream with constant payments throughout the annuitant's life. Variable life annuities allow the annuitant to invest in various investment options, with fluctuating payouts based on investment performance. Indexed life annuities link the annuity's performance to a specific market index, offering potential returns with some downside protection.

Life annuities payout options, such as life only, joint and survivor, period certain, and life with period certain annuities, can impact the amount and duration of income payments. Each option offers different benefits and drawbacks depending on the annuitant's needs, preferences, and whether they want to provide benefits to a surviving spouse or beneficiaries.

Factors affecting life annuity payouts include age and life expectancy, gender, interest rates, and the payout options selected. Older individuals generally receive higher income payments, while women may receive lower payments due to their longer life expectancies. Interest rates and payout options can also impact the amount and duration of income payments.

Risks and considerations associated with life annuities include inflation risk, loss of liquidity, the credit risk of the issuing company, and opportunity cost. Fixed annuity payments may not keep up with inflation, and annuity funds may be less liquid than other investments. It is crucial to research the financial strength of the insurance company before purchasing an annuity and to consider the potential returns from alternative investments.

Consulting an insurance broker is essential when considering life annuities, as they can help you evaluate and compare various annuity products, assess the financial strength of insurance companies, and ensure that the chosen annuity aligns with your financial goals and risk tolerance. Their expertise can guide you through the complex process of selecting the right life annuity to secure a stable retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.