An annuity in a 401(k) is a retirement investment product designed to provide a steady income stream for a certain period of life. It can be part of the investment options within your 401(k) plan, or you can choose to purchase an annuity with your 401(k) funds when you retire. When you invest in an annuity within your 401(k), you buy a contract from an insurance company. You make contributions to this contract over time, which can grow on a tax-deferred basis. Once you retire and start withdrawing the funds, the annuity provides periodic payments to you. The size and frequency of these payments can be determined by various factors, including your age, the amount you've invested, and the terms of your specific annuity contract. Annuities are insurance products that can provide a steady income stream, especially during retirement. Many people consider adding annuities to their retirement portfolio to help secure a guaranteed income in their later years. Within a 401(k) plan, there are potentially a couple of ways to invest in annuities: Some 401(k) plans offer annuity investment options directly within the plan. This means that you can choose to have a portion of your 401(k) contributions go into an annuity. There are various types of annuities. These include immediate annuities, which start paying out right away. Another type is deferred annuities, which start paying out at a future date. Fixed annuities are also an option; these guarantee a certain payout. Variable annuities are a type where the payout depends on the performance of the investment. The type of annuity options available will depend on the specific 401(k) plan. If your 401(k) plan does not offer annuity options, or if you're no longer with the employer who sponsored the 401(k), you can potentially roll over your 401(k) into an individual retirement account (IRA) and then purchase an annuity through the IRA. This is known as a 401(k) to IRA rollover, and it allows you to preserve the tax-advantaged status of your 401(k) funds. Qualified Longevity Annuity Contract (QLAC) is a type of deferred income annuity that you can fund from your 401(k) or other retirement account. It doesn't start paying out until a later age, such as 85, and it can help provide insurance against the risk of outliving your money. Understanding how to purchase an annuity within a 401(k) plan and the key factors to consider before making this decision is crucial to ensuring that it aligns with your retirement goals and financial situation. If your 401(k) plan offers annuity investments, you can opt for this choice similarly to any other investment within the plan. When it comes to rollovers at retirement, the process of purchasing an annuity within a 401(k) involves the following steps: 1. Choose a reputable insurance company that offers annuities. 2. Select the type of annuity that best fits your needs – whether fixed, variable, or indexed. 3. Transfer your funds directly from your 401(k) to the annuity. This direct rollover allows you to maintain the tax-deferred status of your 401(k) funds. Before purchasing an annuity within a 401(k), several key factors should be considered: Fees: Annuities often come with various fees, including administrative fees, mortality and expense risk charges, and surrender charges. High fees can significantly reduce your returns, so it's important to understand all the costs associated with the annuity. Insurance Company's Financial Strength: The guarantees of an annuity contract are backed by the financial strength of the issuing insurance company. Therefore, you should research the insurer's financial stability and credit ratings. Annuity Contract Terms: Make sure to understand the terms of the annuity contract, including the payout options, death benefits, and any special features or riders. Retirement Income Strategy: Consider how the annuity fits into your overall retirement income strategy. An annuity can provide a guaranteed income stream, but it's also less flexible and can have higher costs than other investments. One of the main advantages of annuities within a 401(k) is the guaranteed lifetime income. This feature ensures a steady income stream in retirement, providing a level of financial security. Contributions to a 401(k) are made with pre-tax dollars, which can lower your current taxable income. Moreover, any growth in the account from investment returns or interest is tax-deferred until you start making withdrawals in retirement. Certain types of annuities can protect you against market volatility. For example, fixed annuities can provide a consistent return regardless of market conditions. This can be particularly beneficial during periods of economic uncertainty. Annuities often come with higher fees and charges compared to other investment options. These fees can eat into your returns over time, including management fees, surrender charges, and insurance charges. Annuities also come with liquidity constraints. Withdrawals made from an annuity before the age of 59 ½ are subject to a 10% penalty in addition to regular income tax. Some annuities also levy surrender charges for withdrawals made within a certain period (typically within the contract's first 7 to 10 years). The financial strength of the issuing insurance company backs annuities. If the insurer experiences financial difficulty or insolvency could impact your annuity payments. Annuities can play a crucial role in supplementing retirement income. They can provide a guaranteed income stream in addition to Social Security and any pension income. This can help cover essential living costs in retirement and provide peace of mind knowing that you have a consistent income. Including an annuity in your 401(k) can balance your retirement portfolio. While it's important to have growth-oriented investments for long-term wealth accumulation, having a portion of your portfolio in an annuity can provide stability and predictability. Annuities are regulated at both the state and federal levels in the United States. State insurance commissioners oversee the solvency of insurance companies offering annuities, while the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) regulate variable annuities, which are considered securities. The regulatory environment for annuities within 401(k) plans is subject to change. For instance, the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, made it easier for 401(k) plan sponsors to offer annuities by providing safe harbor provisions that protect them from liability if the insurer fails to meet its contractual obligations. An annuity in a 401(k) is a potential investment vehicle within a 401(k) plan that provides a steady income stream in retirement, offering several advantages, including tax benefits, protection from market volatility, and a potential guaranteed income for life. Annuities within a 401(k) offer a unique blend of benefits and drawbacks. While they can provide stability and predictability in your retirement income, they also come with fees and liquidity constraints that are important to consider. As the regulatory landscape evolves, people may see more 401(k) plans offering annuities as part of their investment line-up. This could make annuities more accessible to a wider group of investors and could help address the growing concern about income stability in retirement.Overview of an Annuity in 401(k)

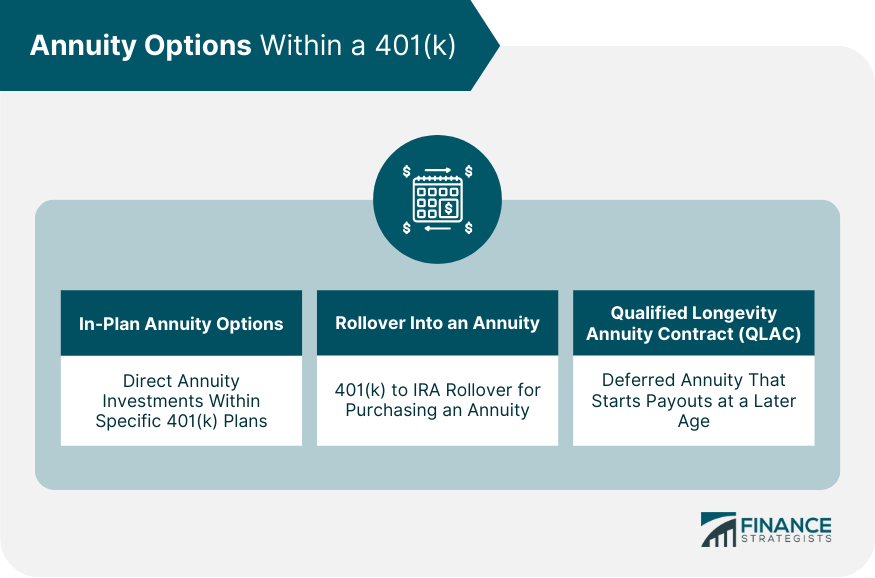

Annuity Options Within a 401(k)

In-Plan Annuity Options

Rollover Into an Annuity

Qualified Longevity Annuity Contract (QLAC)

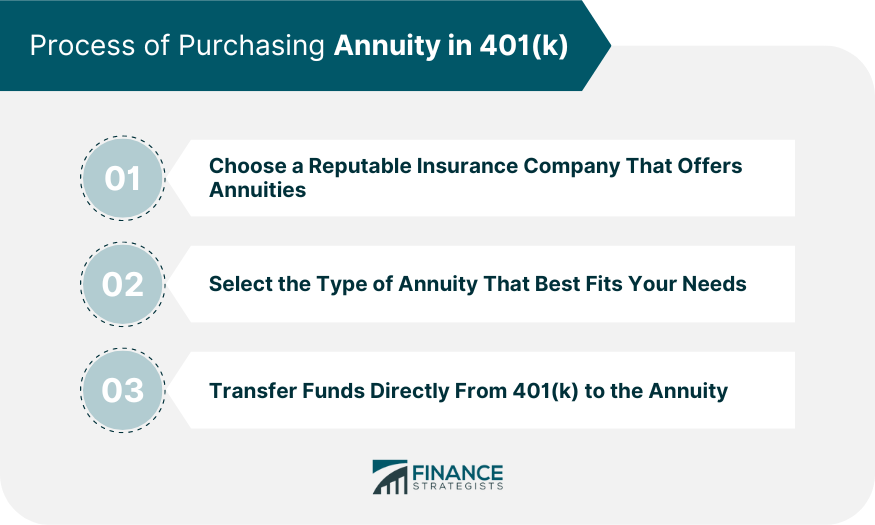

How to Purchase an Annuity Within a 401(k)

Process of Purchasing

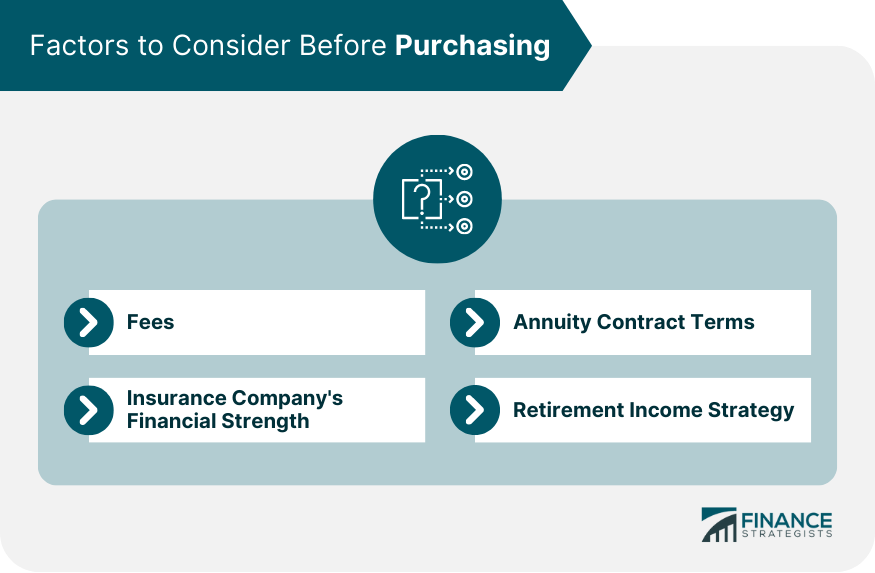

Factors to Consider Before Purchasing

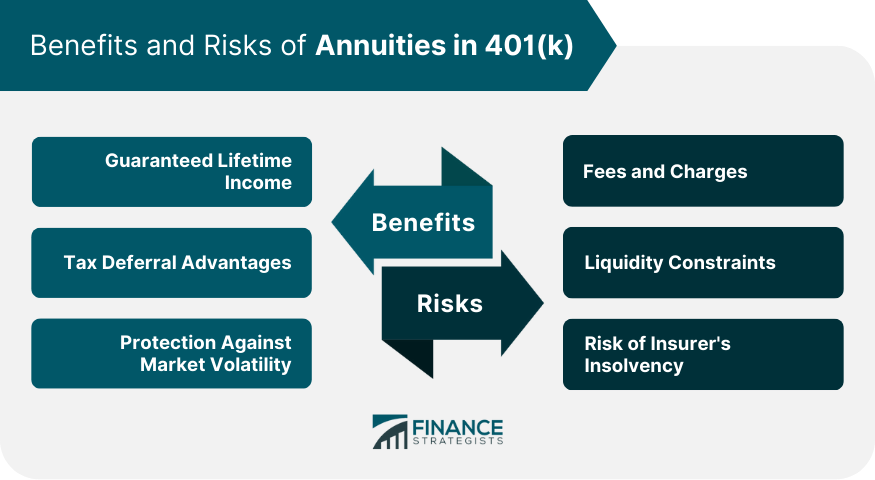

Benefits of Annuities Within 401(k)

Guaranteed Lifetime Income

Tax Deferral Advantages

Protection Against Market Volatility

Risks and Drawbacks of Annuities Within 401(k)

Fees and Charges

Liquidity Constraints

Risk of Insurer's Insolvency

Role of Annuities Within a 401(k) in Retirement Planning

How Annuities Can Supplement Retirement Income

Impact on Retirement Portfolio

Regulatory and Policy Environment Surrounding Annuities in 401(k)

Regulatory Bodies and Their Roles

Current and Proposed Legislation Affecting Annuities in 401(k)

Conclusion

Annuity in 401(k) FAQs

An annuity in a 401(k) plan is an insurance product that provides a steady income stream during retirement, either as a direct part of the 401(k) plan or through a rollover into an Individual Retirement Account (IRA).

If the 401(k) plan offers in-plan annuity options, investment directly within the plan is possible. Alternatively, the 401(k) can be rolled over into an IRA to purchase an annuity.

The availability of annuity types depends on the specific 401(k) plan, potentially including immediate, deferred, fixed, and variable annuities.

A QLAC is a deferred income annuity funded from a 401(k), starting payouts at a later age, such as 85, to provide insurance against the risk of outliving one's money.

Yes, risks of annuities can include high fees, surrender charges, potential bankruptcy of the issuing insurance company, and lack of liquidity. Furthermore, distributions are taxed as ordinary income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.