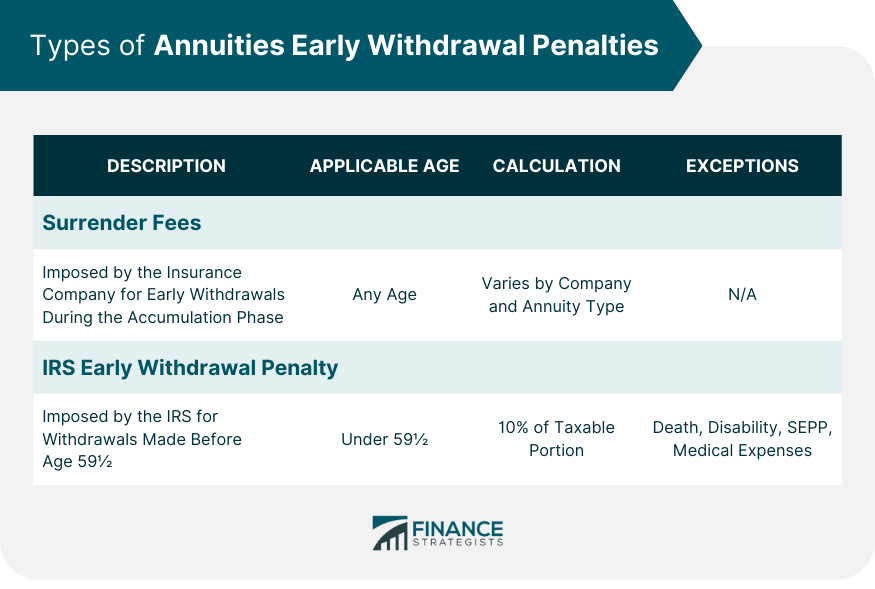

Annuities are long-term investment products designed for retirement purposes. When you purchase an annuity, you enter into a contract with an insurance company, providing you with regular income payments for a specified period of time or for the rest of your life. However, breaking this contract early—by withdrawing funds prematurely—can lead to significant penalties. In most cases, withdrawing from an annuity contract early can trigger two main types of penalties. First, the insurer issuing the annuity charges surrender fees if you withdraw funds during the annuity's accumulation phase. Second, the Internal Revenue Service (IRS) imposes a 10% early withdrawal penalty if you are under the age of 59½. These penalties can pose a substantial financial burden and may also impact the future value of your investment, making it crucial for annuity holders to understand them fully. Annuity surrender charges are fees imposed by the insurance company if you withdraw a portion of or all your funds during the surrender period. The surrender period is the initial years of the contract, usually, the first seven to ten years, where any withdrawal would be subject to these charges. The purpose of these charges is to discourage early withdrawals and to cover the insurer's cost of selling and managing the annuity. For example, if you have an annuity contract with a surrender period of seven years and you withdraw funds within the first year, you may be subject to a surrender charge of 7% or more of the withdrawal amount. Surrender charge schedules can vary widely depending on the issuing company and the type of annuity. However, the charges typically start high and decrease each year the annuity is held, eventually dropping to zero once the surrender period is over. For instance, a typical surrender schedule might look like this: 7% in the first year, 6% in the second year, 5% in the third year, and so on until the eighth year, when the surrender charge is 0%. It's important to note that these fees apply to each premium payment for the given number of years. Several factors can influence the level of surrender charges. These may include the length of the surrender period, the type of annuity, the overall contract terms, and the company's business model and strategies. For instance, annuities with longer surrender periods may have higher surrender charges. Moreover, certain types of annuities, such as variable annuities, may have more complex surrender charge structures due to the investment risk associated with them. In addition to the surrender charges levied by the insurance company, the IRS also imposes a 10% early withdrawal penalty on annuity withdrawals made before the age of 59½. This penalty is similar to the one applied to early withdrawals from other tax-advantaged retirement accounts, such as 401(k)s and IRAs. For instance, if you are 55 and withdraw $10,000 from your annuity, you would owe $1,000 as an IRS penalty, in addition to any income taxes and surrender charges. The 10% IRS penalty applies to the taxable portion of your withdrawal. This is usually the earnings on your initial investment in the annuity. The penalty is due when you file your income tax return for the year in which the withdrawal was made. There are, however, certain situations where the IRS waives this penalty, even if you're under the age of 59½. There are several exceptions to the IRS's 10% early withdrawal penalty. These exceptions include: 1. Death: If the annuity owner passes away, the beneficiaries can withdraw the annuity's value without facing the 10% penalty. 2. Disability: If you become permanently disabled, the IRS waives the early withdrawal penalty. 3. Substantially Equal Periodic Payments (SEPP): This permits early annuity withdrawals without penalties, provided they're consistent and spread over your or your beneficiary's life expectancy. 4. Medical expenses: If you have unreimbursed medical expenses that exceed a certain percentage of your adjusted gross income, you can withdraw from your annuity without incurring a penalty. Remember that while these exceptions may help you avoid the IRS's 10% penalty, you may still face surrender charges from your insurance company, and you'll need to pay income tax on the taxable portion of the withdrawal. As you can see, annuity early withdrawal penalties can be quite complex, involving both insurance company surrender charges and IRS penalties. It's crucial to understand these penalties before deciding to withdraw from your annuity early, as they can significantly impact the value of your retirement savings. Good financial planning can help you avoid or minimize the impact of early withdrawal penalties. If you anticipate needing funds before the end of your surrender period or before reaching age 59½, consider spreading out your withdrawals over several years to keep them within your annual free withdrawal limit, typically around 10% of the account value. Rather than withdrawing the entire amount, making partial withdrawals can help reduce the amount of the penalty you'd have to pay. This method not only reduces the penalty but also leaves a portion of your money to continue growing tax-deferred. The IRS allows annuity owners to take substantially equal periodic payments spread over their life expectancy without imposing the 10% early withdrawal penalty. This rule, known as the 72(t) rule, can be a beneficial strategy for those who need income before turning 59½. Early withdrawal penalties can have a significant impact on the future value of an annuity. Both surrender charges and the 10% IRS penalty reduce the amount of money left to grow and compound, potentially leaving you with much less income in retirement. If your annuity provides a guaranteed income stream, early withdrawals could reduce this income. Some annuities guarantee a certain level of income regardless of the account value, but excess withdrawals could impact these guarantees, leaving you with lower income in the future. Early withdrawals from an annuity not only trigger penalties but can also result in tax consequences. The earnings portion of the withdrawal is taxable as ordinary income, potentially pushing you into a higher tax bracket for the year. Some annuities allow you to take a loan against the contract value, effectively giving you access to your money without triggering a surrender charge or IRS penalty. However, any unpaid loan balance may be considered a taxable withdrawal. Some annuity contracts offer life insurance benefits. You may be able to use the death benefit or cash value of the policy as an alternative to making an early withdrawal from the annuity. In some situations, you might consider selling your future annuity payments to a third-party company. This strategy can provide a lump sum of cash now, but you'll usually receive less than the total value of your future payments. If you need cash and want to avoid early withdrawal penalties, you might also consider other options like home equity loans, personal loans, or borrowing from your 401(k). Be sure to carefully consider the costs and benefits of these options before proceeding. Annuity early withdrawal penalties can have significant financial consequences, affecting both the value of your investment and potential income in retirement. Understanding these penalties is crucial before making any premature withdrawals. Surrender charges imposed by the insurance company discourage early withdrawals during the accumulation phase, while the IRS imposes a 10% penalty on withdrawals made before the age of 59½. There are strategies to minimize these penalties, such as planning and timing withdrawals, opting for partial withdrawals, or taking substantially equal periodic payments. It's important to consider the impact of early withdrawals on the future value of the annuity and any guaranteed income provisions. Alternatively, exploring options like loans against the annuity, utilizing annuity life insurance policy benefits, selling annuity payments, or considering other financial alternatives can help avoid or mitigate early withdrawal penalties. Careful evaluation of these alternatives is necessary to make informed decisions.Overview of Annuities Early Withdrawal Penalties

Annuity Contract and Surrender Charges

Typical Surrender Charge Schedules

Factors Influencing the Level of Surrender Charges

IRS Early Withdrawal Penalties

Explanation of the 10% Penalty

Conditions Under Which the Penalty Applies

Exceptions to the Early Withdrawal Penalty

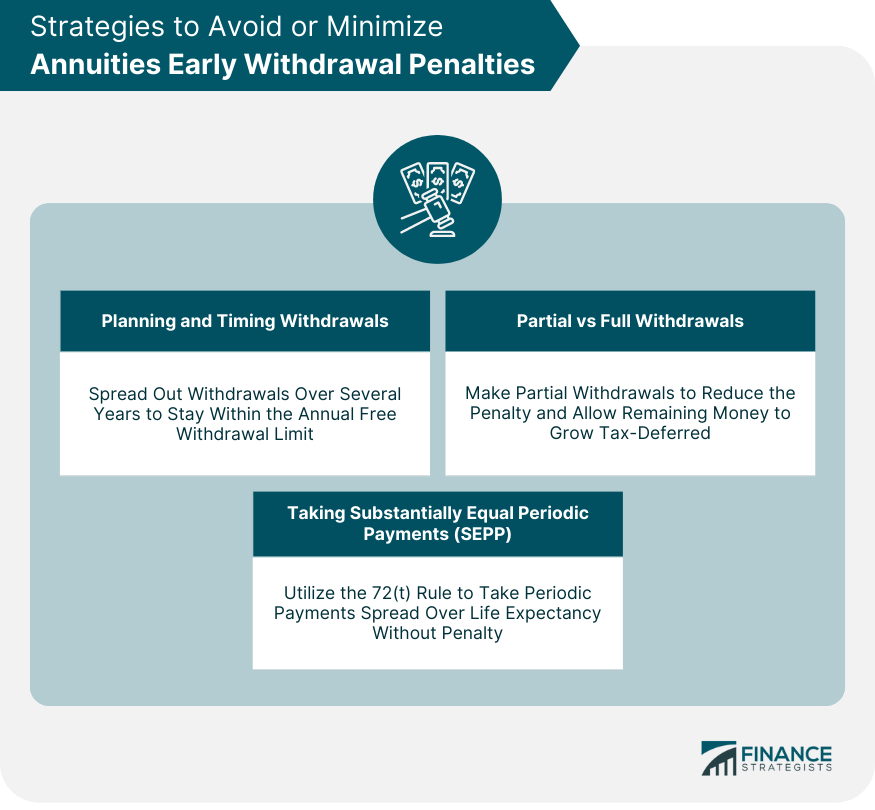

Strategies for Avoiding or Minimizing Annuities Early Withdrawal Penalties

Planning and Timing Withdrawals

Partial vs Full Withdrawals

Taking Substantially Equal Periodic Payments (SEPP)

Impact of Early Withdrawal on Annuity Value and Income

Effect of Penalties on the Future Value of the Annuity

How Withdrawals Can Impact Guaranteed Income

Tax Implications of Early Withdrawals

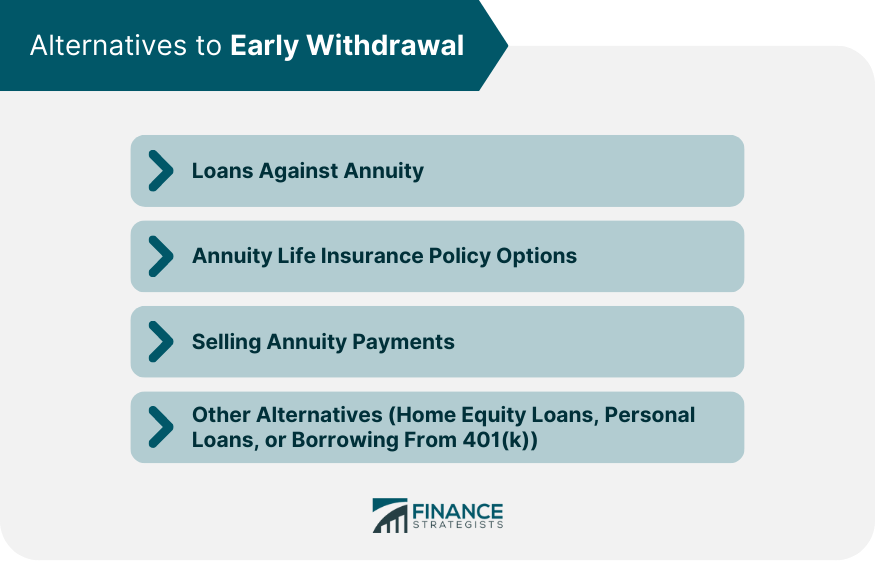

Alternatives to Early Withdrawal

Loans Against Annuity

Annuity Life Insurance Policy Options

Selling Annuity Payments

Other Alternatives

Bottom Line

Annuities Early Withdrawal Penalties FAQs

An annuity early withdrawal penalty is a fee charged when you withdraw funds from your annuity contract before a specified period or before you reach the age of 59½.

There are several strategies to avoid the annuity early withdrawal penalty, including planning and timing your withdrawals, making partial instead of full withdrawals, and taking substantially equal periodic payments.

Yes, there are certain conditions where the IRS waives the 10% early withdrawal penalty, including cases of death, disability, substantially equal periodic payments, and high medical expenses.

Alternatives include taking a loan against your annuity, selling your future annuity payments, or borrowing from other financial resources such as a home equity loan or 401(k).

The annuity early withdrawal penalty can significantly reduce the future value of your annuity and potential income in retirement, as it reduces the amount left to grow and compound.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.