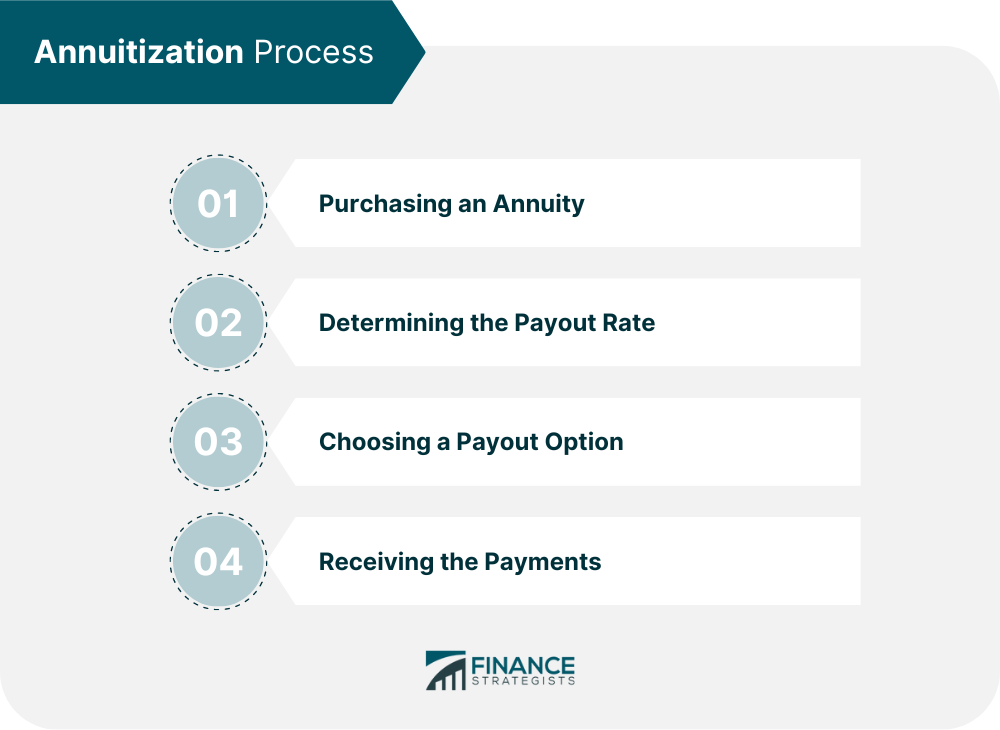

Annuitization is a financial planning strategy that allows individuals to convert a lump sum payment into a guaranteed stream of income for a specific period or for life. It is a popular option for retirees who are looking for a reliable source of income to support their retirement lifestyle. The annuitization process involves calculating how much income the insurance company can pay the annuitant based on various factors such as age, life expectancy, and interest rate. Have a financial question? Click here. The annuitization process can be broken down into several steps: The annuitization process begins with purchasing an annuity from an insurance company. The annuitant makes a lump sum payment to the insurer, and in exchange, the insurer agrees to pay the annuitant a fixed amount of money at regular intervals for a specified period or for life. Once the annuity is purchased, the insurance company calculates the payout rate. The payout rate is the amount of income that the insurer will pay to the annuitant at regular intervals, such as monthly or annually. The payout rate is determined by several factors, including the age of the annuitant, their life expectancy, and the interest rate. The insurance company will use this information to determine the payout rate, which establishes the amount of income that the insurer will pay, and the duration of the payout period. There are several types of annuity in which an annuitant has several options for receiving their payments. The most common payout options include a straight life annuity, a joint and survivor annuity, and a period certain annuity. A straight life annuity pays the annuitant a fixed income for life. This option is ideal for individuals who are looking for a guaranteed source of income for the rest of their lives. A joint and survivor annuity pays the annuitant a fixed income for life and continues to pay a percentage of the income to the surviving spouse after the annuitant dies. This option is ideal for married couples who want to ensure that both spouses have a source of income for the rest of their lives. A period of certain annuity pays the annuitant a fixed income for a specified period, such as ten years, regardless of whether the annuitant is still alive. This option is ideal for individuals who want to ensure that their beneficiaries receive a guaranteed income for a set period of time. The payout option an annuitant chooses can impact their annuitization decision. For example, a straight-life annuity typically offers the highest payout rate but only pays the annuitant for their lifetime. A joint and survivor annuity offers a lower payout rate but continues to pay the surviving spouse after the annuitant dies. Once the payout rate and option have been determined, the annuitant will begin receiving regular payments from the insurer. These payments will continue for the duration of the payout period, which may be a specified period or for the lifetime of an annuitant. If the annuitant dies before the payout period is over, the remaining balance may be paid to the beneficiaries of the annuitant. This is typically done through a death benefit, which may pay out the remaining balance as a lump sum or continue to make regular payments to the beneficiary. Once an annuity is annuitized, it is typically not reversible. However, there are some cases where an annuity can be partially or fully commuted or surrendered. Commutation involves converting a portion of the annuity into a lump sum payment, while surrendering an annuity involves canceling the annuity contract and receiving a lump sum payment. The frequency of annuitization varies depending on the annuity contract. Some annuities may be annuitized for a specific period, while others may be annuitized for life. The decision to annuitize an annuity depends on the financial needs and goals of an individual, and should be made with the help of a financial advisor. When an individual purchases an annuity, they have several payout options to choose from. The payout option that is selected will determine the duration and amount of the income stream. Understanding the various payout options available can help an individual make an informed decision that best meets their financial needs and goals. A single-life annuity, also known as a straight-life or life-only annuity, offers payments for the lifetime of the annuitant only. There is no survivor benefit, which means that if the annuitant dies before the entire premium is returned, the insurance company keeps the remainder. To reduce this risk, individuals can purchase a life annuity within a certain period. A life annuity with period certain offers payments for the annuitant's lifetime, with a minimum time period for the payments, such as 10 or 20 years. If the annuitant dies before the end of the period, the payments for the remainder of that time will go to a beneficiary or the estate of the annuitant. Adding the period certain will lower the amount of the monthly payments. A joint and survivor annuity provides payments for the remainder of the lives of both the annuitant and another person, typically a spouse. This option reduces the amount of each payment compared to a straight-life annuity or a life annuity with a certain period. Individuals can also include a certain period and name a beneficiary. If both annuitants die before the end of the period, the beneficiary will collect the death benefit. A lump sum payment allows the annuitant to receive the entire value of the annuity at one time. This option can increase the tax burden substantially, as the IRS requires taxes to be paid in the year the money is distributed. A systematic annuity withdrawal allows the annuitant to choose the dollar amount and number of payments without regard to the duration of the income stream. However, the income is not guaranteed to last through the remainder of the life of the annuitant. It is entirely dependent on the cash value of the annuity contract. If an individual elects to withdraw money from their annuity before reaching the age of 59 ½, they will have to pay a penalty of 10% to the government, in addition to whatever taxes they owe on the money. If the withdrawal is within five to seven years of purchasing the annuity, they may also owe the annuity provider a surrender charge of up to 20%, depending on how much time has passed since the purchase. When choosing a payout option, individuals should consider their financial needs, goals, and personal circumstances. For example, a single-life annuity may offer the highest payout rate, but it may not be the best option for individuals who want to provide for their beneficiaries after their death. A joint and survivor annuity may provide continued income for the surviving spouse, but it may offer a lower payout rate. It is important to consult with a financial advisor to determine the best payout option for the situation of the individual. The best time to annuitize an annuity depends on a number of factors, including interest rates, life expectancy, and retirement goals. Interest rates can impact annuity payout rates, so waiting for rates to increase may be advantageous before annuitizing an annuity. Life expectancy is an important factor to consider, as annuitization may not be the best option for individuals who have a shorter life expectancy. Annuities may be advantageous for individuals who want a guaranteed source of income that they cannot outlive. Annuities can also be a good option for individuals concerned about market volatility or wanting to minimize their tax liability. However, annuities may not be the best option for individuals who need flexibility or who are concerned about the potential loss of principal. While annuitization can provide a guaranteed income stream in retirement, it is not the only option for converting retirement savings into income. Here are some alternative options to consider: One alternative is to simply withdraw a set amount of money from retirement savings each year. This allows for more flexibility in how the money is used and invested, and there are no restrictions on the length of the payout period. However, there is no guarantee that the money will last throughout the lifetime of the retiree, and there is a risk of overspending or outliving their retirement savings. Another option is to invest retirement savings in stocks that pay dividends. This can provide a steady stream of income and the potential for capital appreciation. However, dividend payments can fluctuate, and there is no guarantee of returns or income levels. A bond ladder is a portfolio of bonds with staggered maturity dates. As each bond matures, the principal can be reinvested or used for income. This provides a predictable income stream and some protection against interest rate fluctuations. However, bond ladders require active management and may not keep pace with inflation. Immediate annuities are similar to annuitization in that they provide a guaranteed income stream. However, instead of paying a lump sum upfront, the annuitant purchases an immediate annuity with a single premium payment. This can provide some of the benefits of annuitization, such as a guaranteed income stream, but without the loss of control over the initial investment. Each of these alternatives has its pros and cons. Systematic withdrawals and dividend-paying stocks offer flexibility and potential for growth but with more risk and uncertainty. Bond ladders offer stability and predictability but with limited returns. Immediate annuities provide a guaranteed income stream with less flexibility and control over the initial investment. Annuities offer a guaranteed income stream in retirement, but they also have potential drawbacks. Here are the pros and cons of annuitization: Guaranteed income stream. Annuities provide a guaranteed income stream for life, which can help retirees budget and plan for expenses. No market risk. Unlike investments in stocks or bonds, annuities are not subject to market fluctuations. No loss of principal. With fixed annuities, the principal is guaranteed, so retirees do not have to worry about losing their initial investment. Limited liquidity. Once annuitized, the initial investment cannot be accessed as a lump sum. Potential loss of purchasing power. Inflation can erode the value of fixed annuity payments over time, reducing the purchasing power of the income stream. Potential loss of value. With variable annuities, the value of the annuity may fluctuate based on the performance of the underlying investments. Most people wait until retirement; however, you can choose to annuitize your annuity at any time. You must ensure you are prepared to begin receiving payments before you annuitize. Long Life Expectancy. Annuities are a good option for those who are likely to live a long time and need a reliable source of income. Lack of Other Sources of Income. If a retiree has little or no other sources of income, annuitization can provide a stable income stream to cover living expenses. Desire for Guaranteed Income. Those who prioritize security and want a guaranteed income stream may find annuitization appealing. Need for Flexibility. Retirees who need flexibility and access to their savings may not want to annuitize their retirement funds. Desire for Growth. Those who want their investments to continue to grow may not find annuitization attractive, as it does not provide the potential for growth like investments in stocks or bonds. Already Have a Pension. Retirees who already have a pension plan may not need additional guaranteed income from an annuity. When choosing to annuitize, there are several important factors to consider. These may include the age, health, retirement goals, and financial situation of the annuitant. The age and health of an annuitant can impact their life expectancy, which can, in turn, impact their annuity payout rate. Retirement goals and financial situation can also impact the annuitization decision, as individuals may have different needs and goals when it comes to retirement income. Personal circumstances can also affect the annuitization decision. For example, individuals with other retirement income sources may not need to annuitize their annuity. Likewise, individuals with a shorter life expectancy may not benefit from annuitization. Annuitization is a financial planning strategy that can provide a guaranteed stream of income for a specific period or life by converting a lump sum payment into an annuity. The annuitization process involves purchasing an annuity, determining the payout rate, choosing a payout option, and receiving regular payments from the insurer. The financial needs and goals of an annuitant should be considered when choosing a payout option, and seeking help from a financial advisor is recommended. While annuitization can be advantageous for retirees looking for a reliable source of income, it may not be suitable for those who need flexibility or who are concerned about the potential loss of principal. Other alternatives to consider are systematic withdrawals, dividend-paying stocks, bond ladders, and immediate annuities. Factors such as age, health, retirement goals, and financial situation should be considered when making the decision to annuitize. Seeking help from a financial advisor can help individuals evaluate the advantages and disadvantages of annuitization and determine the best payout option for their situation.What Is Annuitization?

How Annuitization Works

Step 1: Purchasing an Annuity

Step 2: Determining the Payout Rate

Step 3: Choosing a Payout Option

Step 4: Receiving the Payments

How Often Are Annuities Annuitized?

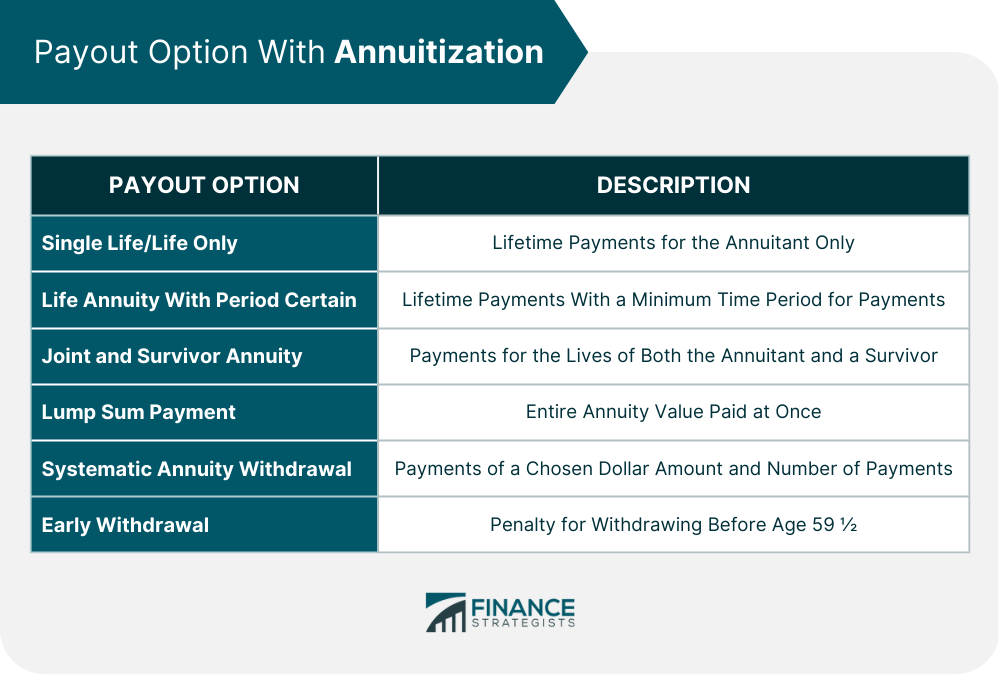

Payout Options With Annuitization

Single-Life/Life Only

Life Annuity with Period Certain (Fixed Period/Guaranteed Term)

Joint and Survivor Annuity

Lump Sum Payment

Systematic Annuity Withdrawal

Early Withdrawal

Best Time to Annuitize

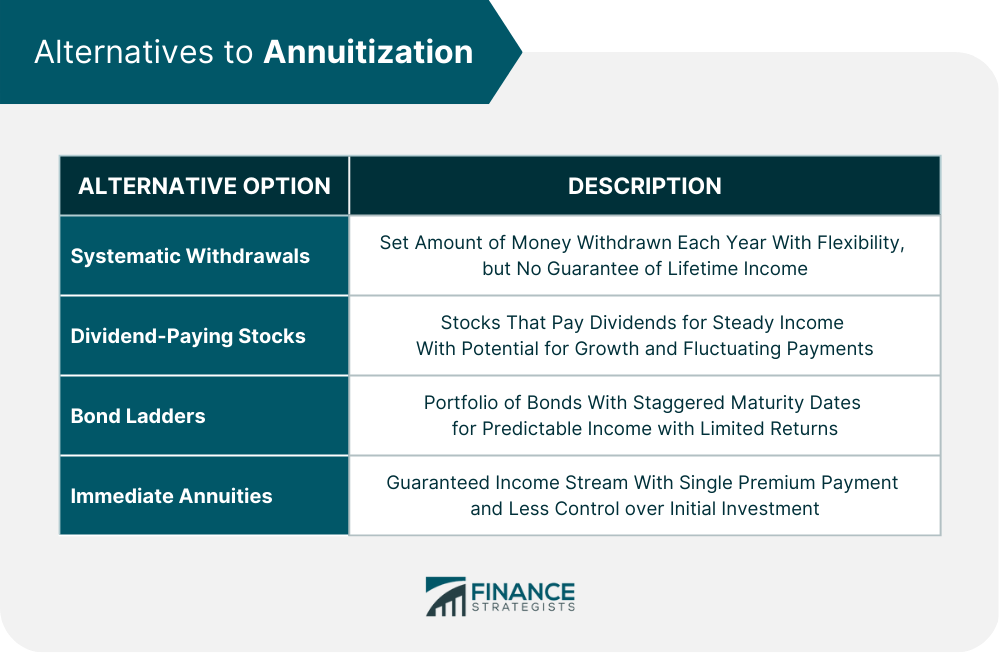

Alternatives to Annuitization

Systematic Withdrawals

Dividend-Paying Stocks

Bond Ladders

Immediate Annuities

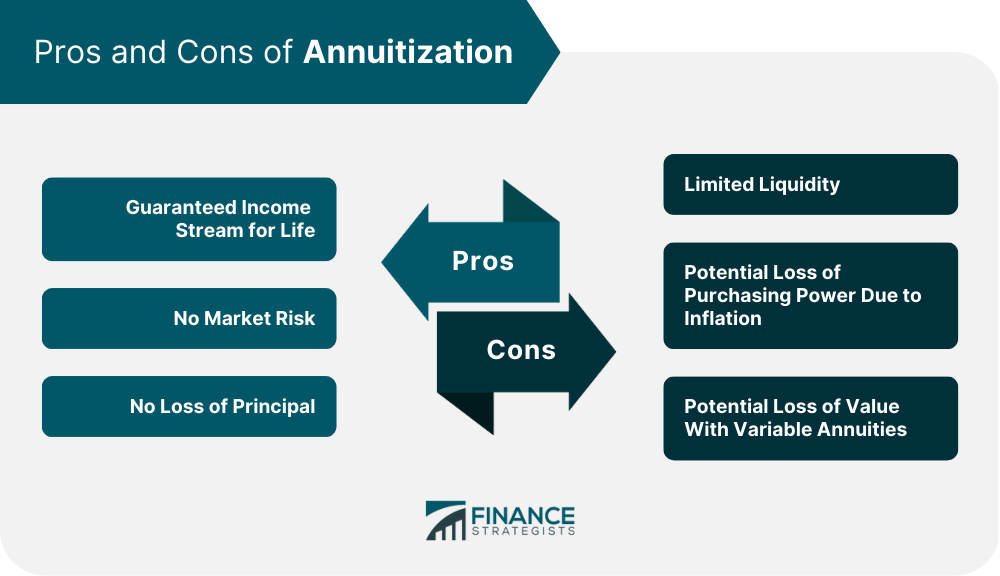

Pros and Cons of Annuitization

Advantages of Annuitization

Disadvantages of Annuitization

When to Annuitize

Situations Where Annuitization May Be Appropriate

Situations Where Annuitization May Not Be Appropriate

Factors to Consider When Choosing to Annuitize

Final Thoughts

Annuitization FAQs

Annuitization is a financial strategy that involves converting a lump sum payment into a guaranteed stream of income for a specific period or for life. It is typically done through the purchase of an annuity from an insurance company.

The annuitization process involves calculating how much income the insurance company can pay the annuitant based on various factors such as age, life expectancy, and interest rate. Once the payout rate and option have been determined, the annuitant will begin receiving regular payments from the insurer.

The pros of annuitization include a guaranteed income stream for life, no market risk, and no loss of principal with fixed annuities.

The cons of annuitization include limited liquidity, potential loss of purchasing power due to inflation, and potential loss of value with variable annuities.

Annuitization may be appropriate for those with a long life expectancy, lack of other sources of income, and a desire for a guaranteed income stream. It may not be appropriate for those needing flexibility or wanting growth in their investments. Ultimately, the decision to annuitize should be made with the help of a financial advisor based on the personal circumstances and goals of the individual.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.