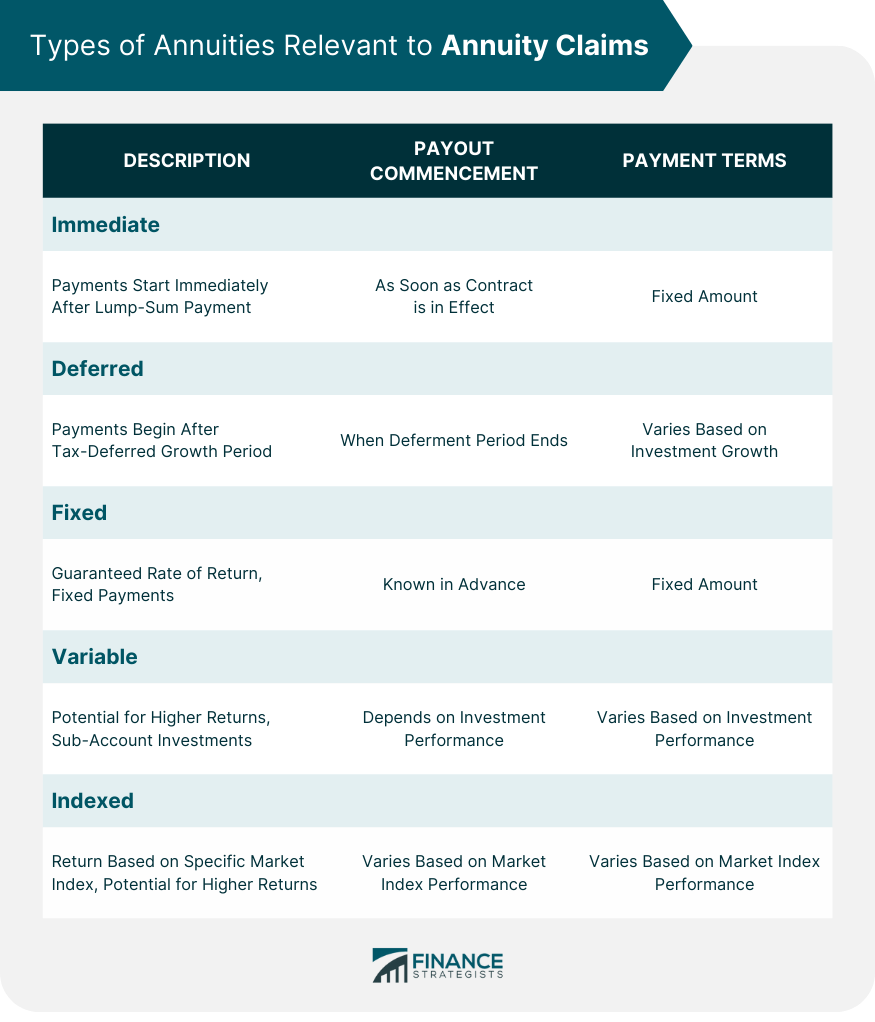

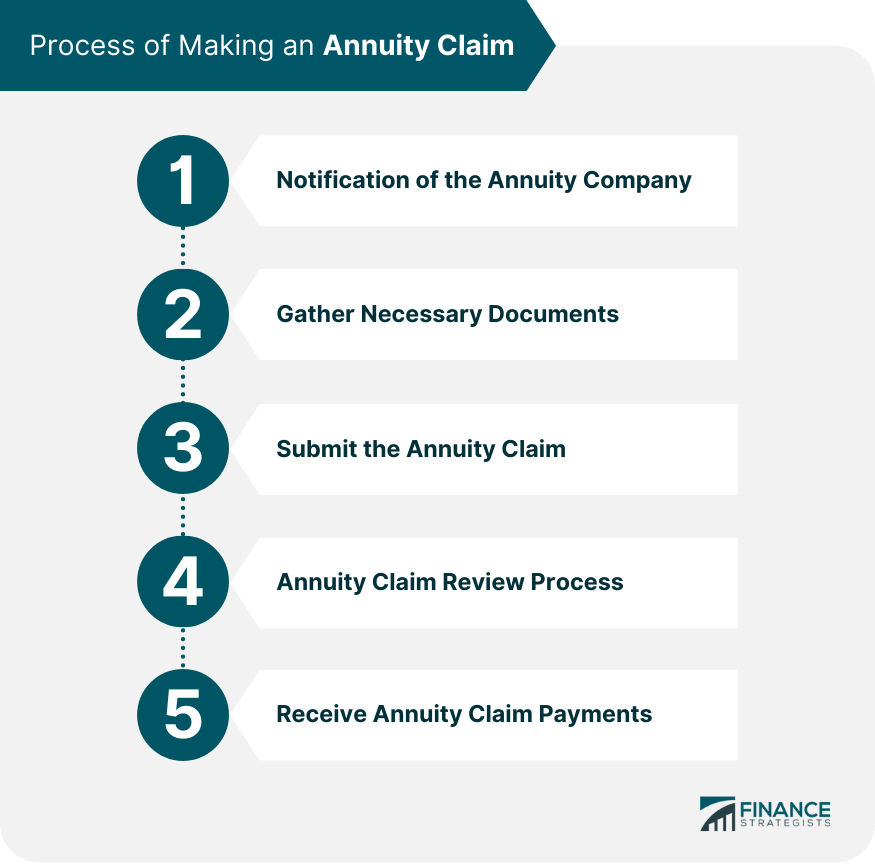

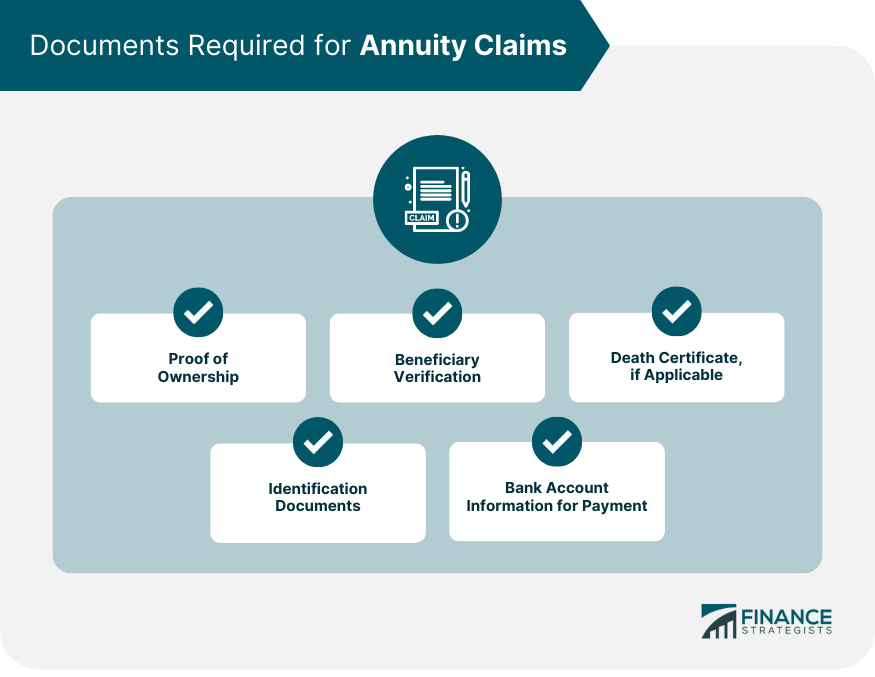

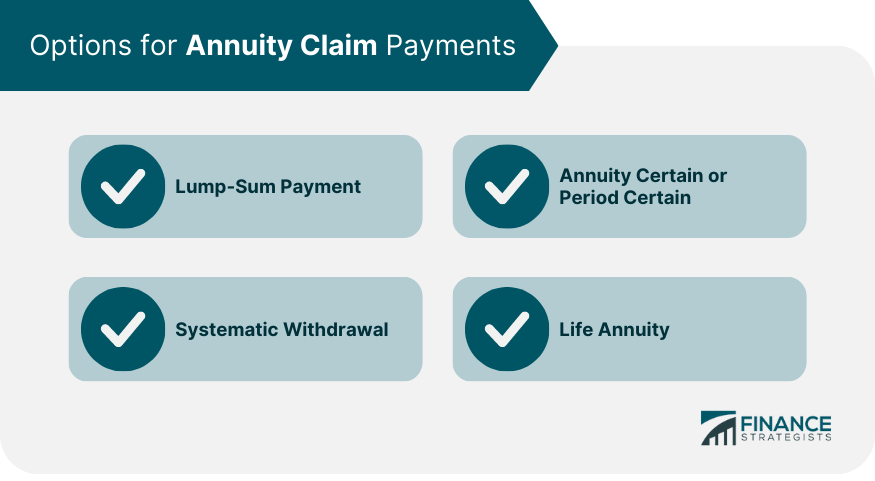

An annuity claim refers to the formal request made by an annuitant or their beneficiaries to receive payments from an annuity contract. Annuities are financial products sold by insurance companies that pay out income over a certain period. The person who buys the annuity (the annuitant) makes a lump-sum payment or a series of payments to the insurer. In return, the insurer promises to make periodic payments to the annuitant or their beneficiaries, beginning immediately or at some future date. Annuity claims are crucial as they actualize the core purpose of an annuity: providing a steady stream of income during retirement or as a means of income replacement in case of the annuitant's death. Understanding annuity claims is key to leveraging these products for financial security. Different types of annuities offer different terms for payouts, which are directly relevant when making an annuity claim. With immediate annuities, the annuitant begins receiving payments immediately after making a single lump-sum payment to the insurer. Annuity claims, in this case, are straightforward because payments start as soon as the contract is in effect. In contrast to immediate annuities, deferred annuities allow the investment to grow tax-deferred for a specified period before payments to the annuitant begin. The annuity claim process typically begins when the deferment period ends. Fixed annuities guarantee a certain rate of return on the investment, and the payments are typically a fixed amount. The annuity claim amount is known in advance, making financial planning simpler for the annuitant. Variable annuities offer a potential for higher returns but with a higher risk. The investment is typically placed in sub-accounts (similar to mutual funds), and the annuity claim amount will depend on the performance of these investments. Indexed annuities offer a return based on a specific market index, like the S&P 500. They provide a minimum guaranteed payment but can offer more if the associated index performs well. Annuity claims on these products are subject to the market's performance. Making an annuity claim involves several steps, each of which is important to ensure you receive the payments you're entitled to. The first step is to notify the insurance company of the intent to start claiming the annuity. This is typically done through a formal letter or a phone call, and you'll likely speak with a company representative who can guide you through the process. Before submitting your claim, you need to gather all necessary documentation. This may include proof of the annuity contract, identification documents, and, in some cases, a death certificate. Once you've collected all the necessary documents, you can officially submit your annuity claim. Most insurance companies offer multiple ways to submit claims, including online, by mail, or by fax. After submission, the insurance company reviews the claim. This involves verifying the details of the annuity contract and the identity of the claimant. Once verified, the company will process the claim and begin making payments. Depending on the terms of the annuity, payments can be made in a lump sum, as systematic withdrawals, or as lifetime payments. These details should be clearly outlined in the annuity contract. To process an annuity claim, certain documents are required to validate the contract and the claimant's identity. This could be the annuity contract itself or any other document that clearly shows you as the owner or the designated beneficiary of the annuity. If you are claiming as a beneficiary, you will need to provide documentation proving your relationship with the annuitant. This could be a birth certificate, marriage certificate, or similar legal documents. In the event of the annuitant's death, a death certificate will need to be presented to verify the claim. These are necessary to prove your identity as the claimant. Acceptable forms of identification typically include a driver's license, passport, or other government-issued ID. Finally, to receive your annuity claim payments, you'll need to provide your bank account details. Payments can then be deposited directly into your account, providing a convenient and secure way to receive your funds. Once an annuity claim is approved, payments can be made in different ways, depending on the terms of the annuity contract. This involves a one-time payout of the entire value of the annuity. This is less common as the purpose of an annuity is usually to provide a regular income rather than a large one-off payment. This allows the annuitant to take a series of payments until the annuity's value is depleted. The amount and frequency of the withdrawals can usually be adjusted according to the annuitant's needs. Under this option, the insurance company guarantees payments for a specific number of years. If the annuitant dies before the end of that period, the remaining payments go to the beneficiary. This guarantees payments for the rest of the annuitant's life, regardless of how long they live. This can provide significant peace of mind but doesn't usually leave anything for beneficiaries. Insurance companies play a crucial role in the annuity claim process, taking responsibility for multiple key tasks. Insurance companies are responsible for issuing and overseeing annuity contracts. They maintain records, track investment growth for variable and indexed annuities, and ensure that contractual obligations are met. Upon receiving a claim, the insurance company verifies the documents and the claimant's identity. They determine whether the claim is valid and calculate the payout amount according to the contract's terms. Once a claim is approved, the insurance company distributes payments according to the chosen payout option. They also manage tax withholdings and provide annual statements to the annuitant or beneficiaries. There are several legal considerations to bear in mind when dealing with annuity claims. The annuitant has the right to receive payments as outlined in the contract. They also have the right to change the beneficiary, unless the annuity is a life annuity with a term certain that's already begun. Beneficiaries have the right to claim and receive payments in the event of the annuitant's death as long as they are named in the contract. Annuity payments are typically subject to income tax, and there may also be penalties for early withdrawal if the annuitant is under a certain age. Tax laws regarding annuities can be complex, so it's advisable to consult with a tax professional. While the annuity claim process is usually straightforward, issues can arise. These can include a dispute about the annuitant's death, lack of proper documentation, or discrepancies in the annuity contract. It's crucial to provide accurate and complete information to avoid claim denials. If a claim is denied, the insurance company should provide a reason for the denial. The claimant can then appeal the decision, typically within a specific timeframe. If an annuity claim dispute cannot be resolved through the insurance company's appeal process, it may be necessary to seek legal assistance. An attorney specializing in insurance law can help navigate the legal process and represent the claimant's interests. An annuity claim represents a critical stage in leveraging the benefits of an annuity, a financial product designed to provide a steady stream of income over a specified period. The procedure of making an annuity claim generally involves notifying the annuity company, gathering the necessary documents, submitting the claim, and then receiving the payments. This process is overseen by insurance companies that manage annuity contracts, process the claims, and distribute the payouts. Whether you're an annuitant or a beneficiary, understanding the legal aspects of an annuity claim ensures a smooth process and allows you to make the most of your financial planning. If you're considering an annuity or have one and need to start the claim process, it is recommended to consult with an insurance broker to guide you through the process and ensure that you understand every step along the way.What Is an Annuity Claim?

Types of Annuities Relevant to Annuity Claims

Immediate Annuities

Deferred Annuities

Fixed Annuities

Variable Annuities

Indexed Annuities

Process of Making an Annuity Claim

Notification of the Annuity Company

Gathering Necessary Documents

Submitting the Annuity Claim

Annuity Claim Review Process

Receiving Annuity Claim Payments

Documents Required for Annuity Claims

Proof of Ownership

Beneficiary Verification

Death Certificate, if Applicable

Identification Documents

Bank Account Information for Payment

Understanding Annuity Claim Payments

Lump-Sum Payment

Systematic Withdrawal

Annuity Certain or Period Certain

Life Annuity

Role of Insurance Companies in Annuity Claims

Managing Annuity Contracts

Processing Annuity Claims

Paying Out Annuity Claims

Legal Considerations for Annuity Claims

Rights of the Annuitant

Rights of the Beneficiaries

Tax Implications of Annuity Claims

Troubleshooting Issues in Annuity Claims

Common Reasons for Denial of Annuity Claims

Appeal Process for Denied Annuity Claims

Seeking Legal Help for Disputed Annuity Claims

Final Thoughts

Annuity Claims FAQs

An annuity claim is a formal request made by an annuitant or their beneficiaries to start receiving payments from an annuity contract.

For an annuity claim, you typically need proof of ownership, beneficiary verification, a death certificate (if applicable), identification documents, and bank account information for payment.

An annuity claim can be paid out in several ways, including a lump-sum payment, systematic withdrawal, annuity certain (a fixed period), or a life annuity (for the rest of your life).

Yes, an annuity claim can be denied for reasons such as a dispute about the annuitant's death, lack of proper documentation, or discrepancies in the annuity contract.

If your annuity claim is denied, you can appeal the decision with the insurance company. If this doesn't resolve the issue, you may need to seek legal help.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.