The assumed interest rate, or AIR, is a crucial concept in the insurance industry, specifically in the realm of annuities. Essentially, the AIR is a predetermined rate of interest or growth that an insurance company uses to calculate the value of an annuity contract. This estimated value consequently determines the regular income payment made to the holder of the annuity, also known as the annuitant. From an investor's perspective, understanding the AIR is of paramount importance for sound financial planning. By accurately anticipating the AIR, an investor can reliably predict the amount they are likely to receive from their annuity, allowing for more precise budgeting and planning for the future. This knowledge is especially critical for those using annuities as a retirement income source, as it facilitates effective management of other investment assets to ensure a comfortable post-retirement life. In the context of annuities, the AIR plays a fundamental role in establishing the periodic payments an annuitant receives. When an individual invests in an annuity, they are essentially entering a contract with an insurance company. The investor (annuitant) makes a lump-sum payment or a series of payments to the insurance company, and in return, they receive regular disbursements, which start either immediately or at some point in the future. The AIR is the rate at which the insurance company estimates the money invested in the annuity will grow over time. This growth rate directly influences the size and frequency of the annuity payments made to the annuitant. Diving deeper into the AIR's conceptual underpinnings, it becomes apparent that the AIR is, in essence, an insurance company's educated guess. It's their estimate of the rate of return they'll be able to achieve on the funds invested in the annuity over the life of the contract. It's crucial to understand that the AIR is not a guarantee—it's a projection used to calculate the initial annuity payment. The calculation of the AIR is predominantly under the discretion of the insurance company and is based on a complex set of economic factors. These can include prevailing market interest rates, the company's investment portfolio performance, and expectations for future economic conditions. While insurance companies often have internal guidelines and regulatory standards to follow, they retain substantial latitude in setting the AIR. The age of the annuitant at the time the annuitization process begins plays a significant role in determining the AIR. The concept is relatively simple; the older the annuitant at the start of the annuity, the higher the AIR tends to be. This is because older annuitants are expected to receive payouts for a shorter period of time, so insurers can afford to offer a higher interest rate. The overall state of the economy can have a profound impact on the AIR set by insurance companies. In a robust economy, when there's positive market sentiment, interest rates can generally be higher. On the other hand, during an economic downturn, insurance companies may lower the AIR to mitigate their risks. The AIR often mirrors general market interest rates. When these rates increase, annuity interest rates typically follow suit and vice versa. Insurers rely on investing annuitants' premiums in different financial instruments to earn returns, which they pass on to the annuitants as part of the interest. Thus, the yield that insurers can make in the market significantly affects the AIR. Inflation is another vital determinant of the AIR. Higher projected inflation rates can lead to higher AIRs, as insurers would need to ensure the annuity payouts retain their purchasing power over time. Conversely, in a low inflation environment, the AIR can be correspondingly lower. The AIR comes into play when calculating annuity payments. Once the AIR is determined, it is combined with other factors, such as the amount of the annuity purchase, the annuitant's life expectancy, and specific annuity contract features, to compute the annuity payments. These payments could be for a fixed period or for the remaining life of the annuitant, depending on the annuity's structure. The AIR has a direct impact on annuity payments. A higher AIR typically results in larger initial payments, but if actual investment returns fall short of the AIR, future payments may be reduced. Conversely, a lower AIR might result in smaller initial payments, but if the actual returns exceed the AIR, future payments might increase. For insurance companies, the process of selecting the AIR is intricate and relies heavily on their expectations for future economic performance. These firms need to make an educated guess that is neither too pessimistic—causing them to lose potential clients due to low initial payment offers—nor too optimistic, which might lead to unsustainable payment commitments. A fine balance is required to maintain the company's financial health while also offering attractive annuity contracts to prospective customers. The AIR has substantial implications for an insurer's liabilities. A higher AIR implies a higher expected return on investments and, consequently, higher annuity payments. If actual investment returns do not meet these expectations, insurance companies might face substantial financial pressure. Conversely, a lower AIR means lower anticipated returns and hence, lower annuity payments. If the actual returns outpace the AIR, insurers might have surplus funds. Hence, setting the AIR is a significant decision that directly affects an insurer's financial stability. Insurance companies employ various strategies when setting the AIR, primarily considering their investment returns, market conditions, and the need to maintain competitive annuity offerings. They often use teams of actuaries and investment experts to analyze market trends and predict future performance. Many also use sophisticated financial models to simulate various scenarios and stress-test their ability to meet annuity payment obligations under different market conditions. When it comes to retirement planning, understanding the AIR can be a game-changer. By providing a projection of the annuity payments one can expect to receive, the AIR allows for more precise budgeting and future financial planning. It helps individuals estimate the income they'll receive from their annuity investments, which is particularly crucial for those who heavily rely on these payments for their post-retirement expenses. By anticipating the potential annuity income through AIR, retirees can determine whether their annuity investments will be sufficient to cover their estimated living costs. If the expected income falls short, they might need to consider additional investments or alternate income sources. Alternatively, if the expected annuity income comfortably covers their anticipated expenses, they may choose to use any surplus for discretionary spending or additional savings. While the AIR is a valuable tool for retirement planning, investors must remember that it's an estimate, not a guarantee. They should consider various scenarios, such as what would happen if the actual returns were higher or lower than the AIR. It's also crucial to review the AIR in the context of overall financial planning, considering other income sources, anticipated expenses, and personal financial goals. The AIR can serve as a useful benchmark when planning additional investments. By providing a sense of potential annuity income, it can help investors determine how much additional income they may need and the amount of risk they are willing to take on with other investments. For instance, if the AIR indicates a significant annuity income, an investor might choose to pursue more conservative additional investments. Conversely, a lower AIR might push investors towards higher-yielding (and possibly higher-risk) investment options. Balancing annuity investments with other investment vehicles is a nuanced process that depends on several factors, including an individual's risk tolerance, income needs, and financial goals. For example, an investor might choose to pair an annuity with a high AIR with a low-risk bond portfolio, achieving a balance between predictable income and capital preservation. The biggest risk related to assumed interest rates is the risk of interest rate changes. If interest rates rise or fall substantially, it can have a significant impact on investments, loans, and savings. The assumed rate of return is a key factor in investment decisions. If the actual return is lower than the assumed rate, the investment might not meet the expected outcomes, leading to financial loss. If interest rates increase unexpectedly, then borrowers may have difficulty meeting their obligations, leading to cash flow problems. Reinvestment Risk is associated with the possibility that an investor will be unable to reinvest cash flows (e.g., coupon payments) from an investment at a rate comparable to their current rate of return. If inflation is higher than expected, the real return on savings and investments can be less than expected. This can erode the purchasing power of future cash flows and may lead to financial loss. For pension funds and insurance companies, if retirees live longer than expected, then the assumed interest rate used in their actuarial calculations may prove inadequate, causing a financial strain. In the context of mortgage-backed securities or any other debt instrument that can be prepaid, if interest rates drop, many borrowers may refinance their loans. This is good for them but not for the investors who were expecting to earn interest over a longer period. The assumptions used for interest rates might be based on historical data, expert judgment, or models, all of which have inherent uncertainties and could be incorrect. This can lead to a risk of misjudging future interest movements, which can have serious implications for financial decision-making. The AIR is a crucial concept in the insurance industry, particularly for annuities. It determines the value of annuity contracts and the regular income payments made to annuitants. Understanding the AIR is essential for accurate financial planning, especially for retirement. Influenced by factors like age, economic conditions, market rates, and inflation, the AIR impacts annuity payments. While higher AIRs result in larger initial payments, there's a risk of future reductions if actual returns fall short. Insurance companies strive to balance attractive offerings and financial stability. Investors should also consider other factors and goals in financial planning. It's vital to be aware of associated risks such as interest rate risk and investment risk. Seeking the expertise of an insurance broker is highly recommended to navigate annuity complexities, assess financial situations, and find suitable options. Take control of your financial future by consulting an insurance broker for informed decisions on annuities.What Is the Assumed Interest Rate (AIR)?

Role of AIR in Annuities

Understanding the AIR

Conceptual Foundation of AIR

How the AIR is Calculated

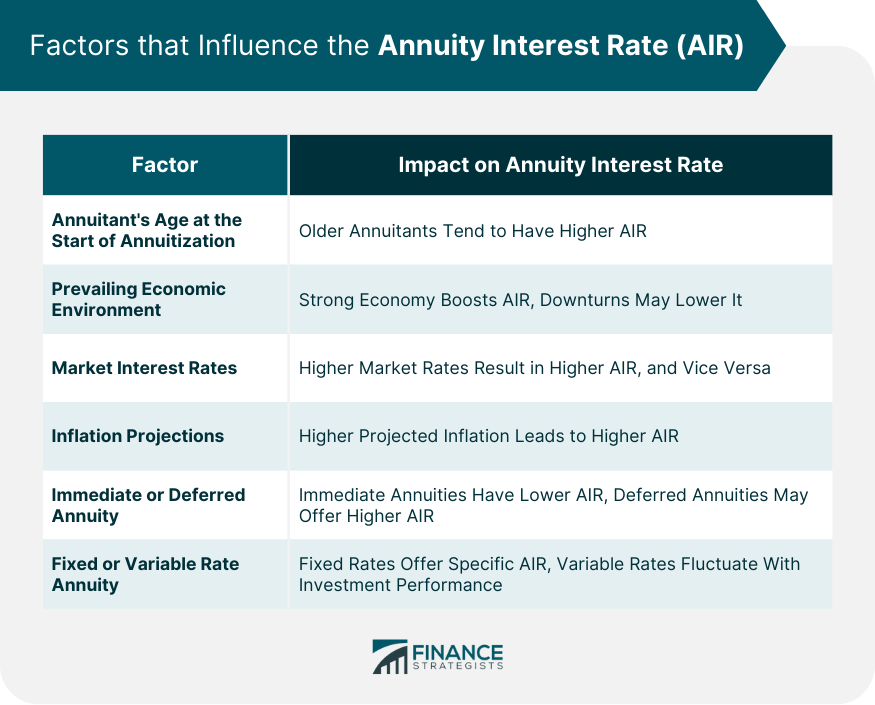

Factors that Influence the AIR

Annuitant's Age at the Start of Annuitization

Prevailing Economic Environment

Market Interest Rates

Inflation Projections

Role of AIR in Determining Annuity Payments

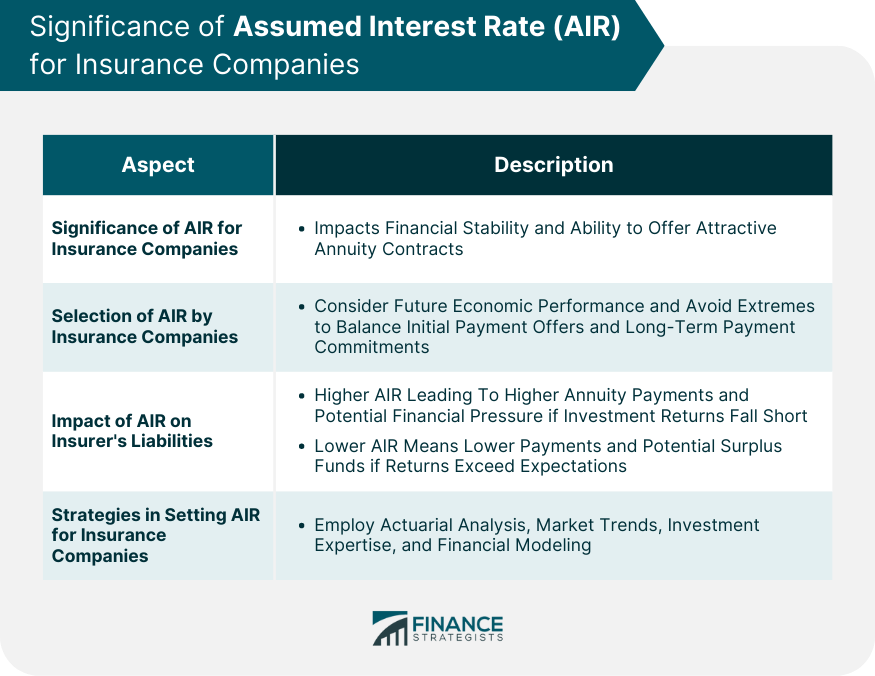

Significance of AIR for Insurance Companies

Insurance Companies and the Selection of AIR

AIR's Impact on Insurer's Liabilities

Insurance Companies' Strategies in Setting AIR

AIR and Retirement Planning

How AIR Influences Retirement Planning

AIR's Role in Anticipating Retirement Income From Annuities

Considerations for Investors When Planning Retirement Based on AIR

Assumed Interest Rate and Additional Investments

How AIR Helps in Planning Additional Investments

Strategies for Balancing Annuity Investments and Other Investment Vehicles

Risks Related to AIR

Interest Rate Risk

Investment Risk

Cash Flow and Liquidity Risk

Reinvestment Risk

Inflation Risk

Longevity Risk

Prepayment Risk

Risk of Incorrect Assumptions

Final Thoughts

Assumed Interest Rate (AIR) FAQs

The assumed interest rate (AIR) is an interest or growth rate estimated by an insurance company. This rate is used to calculate the value of an annuity contract, which then determines the annuity payments to the annuitant.

The AIR directly impacts the size of annuity payments. A higher AIR usually results in larger initial annuity payments. However, if actual investment returns fall short of the AIR, future payments might decrease.

The calculation of the AIR is mostly at the discretion of the insurance company. It is based on various economic factors, such as prevailing market interest rates, the company's past investment performance, and future economic predictions.

Key factors that influence the AIR include the annuitant's age at the start of annuitization, the prevailing economic environment, market interest rates, and inflation projections. Certain features of the annuity contract can also affect the AIR.

The main risk associated with the AIR lies in its potential fluctuations. Changes in economic conditions can lead to adjustments in the AIR, which can, in turn, cause variability in annuity payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.