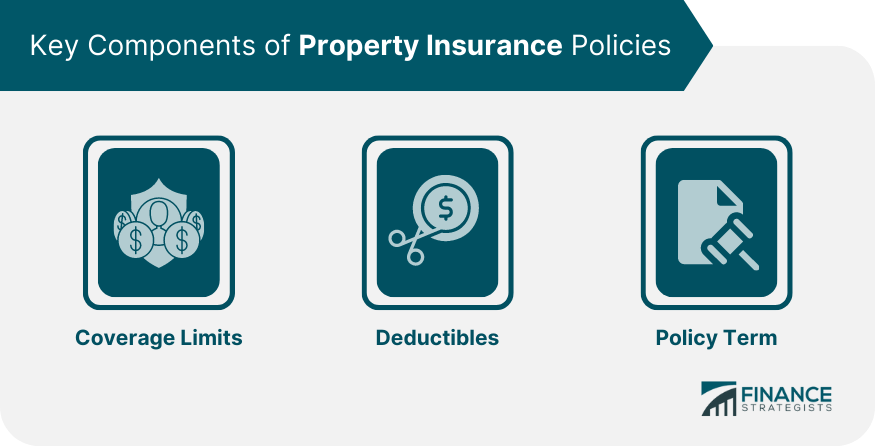

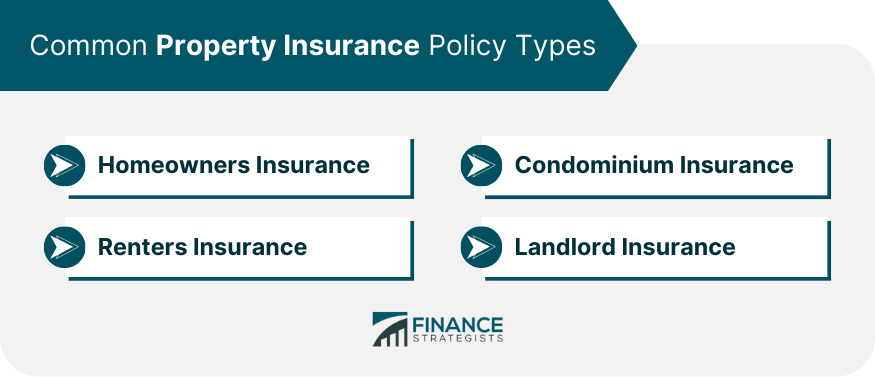

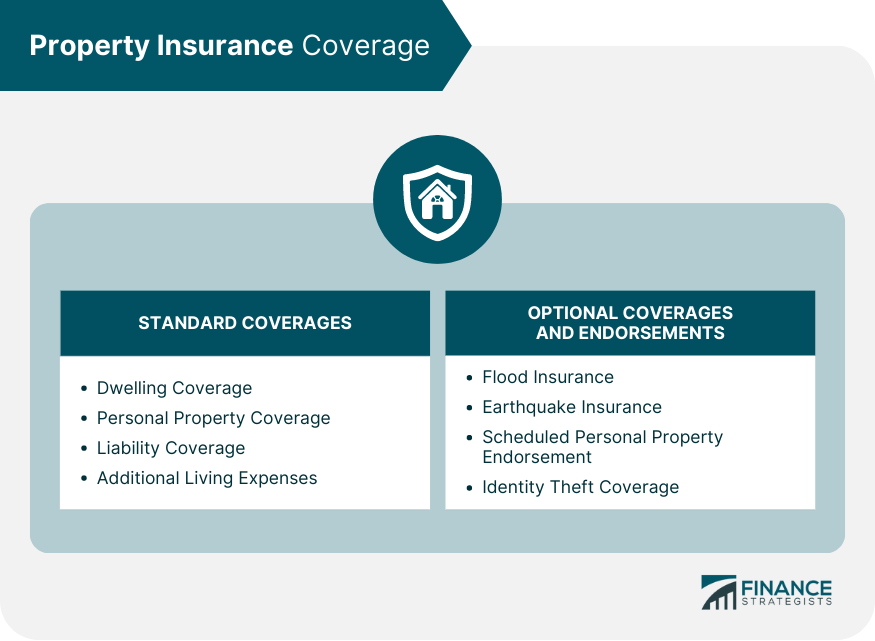

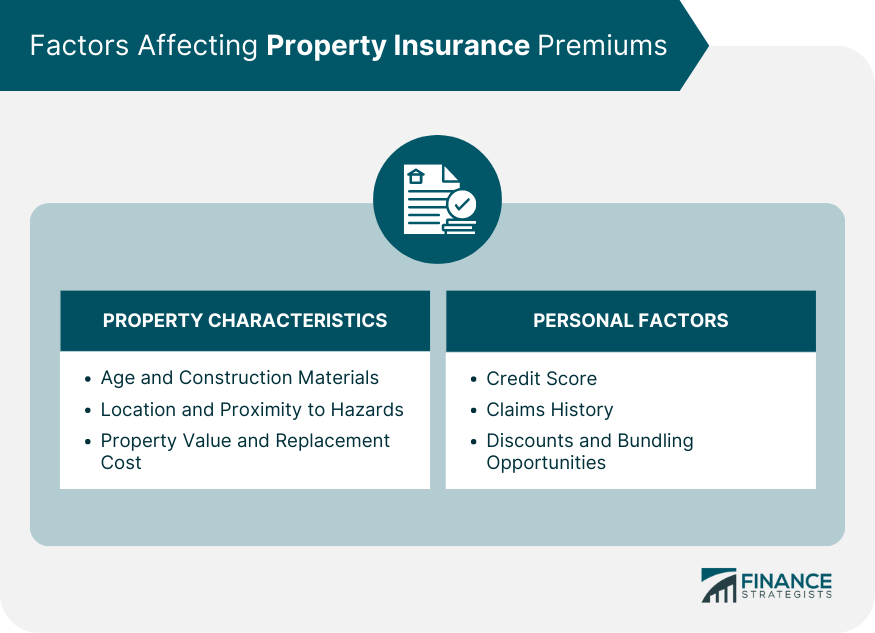

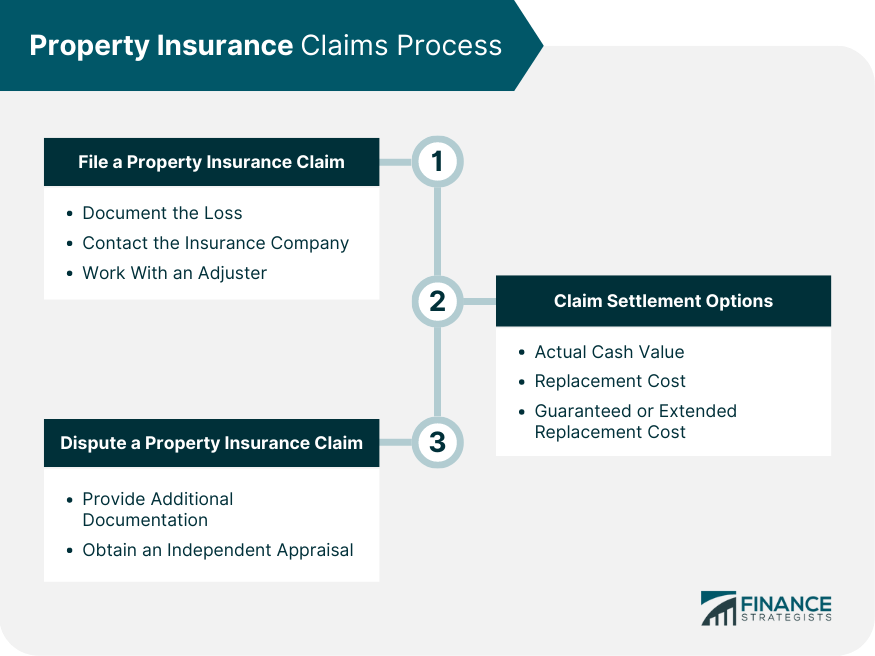

Property insurance refers to a type of insurance coverage that protects against financial losses resulting from damage or loss of property. It provides financial protection for residential, commercial, or industrial properties against perils such as fire, theft, vandalism, natural disasters, and other covered events. Property insurance policies typically cover the physical structure of the property, as well as the contents inside. This insurance is essential for property owners as it safeguards their valuable investments and provides financial security in the event of unforeseen damage or loss. Property insurance not only covers repair or replacement costs but also helps protect against liability claims arising from property-related accidents or injuries. By having property insurance, individuals and businesses can mitigate risks, minimize financial burdens, and have peace of mind knowing that their property is protected. To make informed decisions about property insurance, it is essential to understand the key components and common policy types. Coverage Limits: These represent the maximum amount that an insurance policy will pay out in the event of a claim. Coverage limits should be based on the property's value and potential risks. Deductibles: The deductible is the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. Higher deductibles generally result in lower premiums but can increase the policyholder's financial burden in the event of a claim. Policy Term: This is the duration of the insurance policy, typically ranging from one to several years, with the option to renew at the end of the term. Homeowners Insurance: This is the most common type of property insurance, providing coverage for single-family homes against a wide range of perils, such as fire, theft, and certain natural disasters. Renters Insurance: Designed for tenants, renters insurance covers the policyholder's personal property and liability within a rented property. Condominium Insurance: Condo insurance provides coverage for personal property, liability, and specific portions of the dwelling that are the unit owner's responsibility. Landlord Insurance: Also known as rental property insurance, this policy type is tailored for property owners who rent out their properties, offering coverage for dwelling, liability, and loss of rental income. Understanding the standard coverages in property insurance policies, along with optional coverages and endorsements, can help policyholders tailor their policies to their specific needs. Dwelling Coverage: This covers the physical structure of the property, including walls, roof, and attached structures, against damage or loss due to covered perils. Personal Property Coverage: This covers the policyholder's personal belongings, such as furniture, electronics, and clothing, against damage or loss. Liability Coverage: This protects the policyholder from financial losses resulting from legal liability for injuries or property damage caused to others. Additional Living Expenses: Also known as loss of use coverage, this covers the additional costs incurred by the policyholder if they need to temporarily relocate due to a covered loss. Flood Insurance: Standard property insurance policies typically do not cover flood damage. Purchasing a separate flood insurance policy can protect against the financial impact of flooding. Earthquake Insurance: Similar to flood insurance, earthquake coverage is usually not included in standard policies and must be purchased separately to protect against damage caused by earthquakes. Scheduled Personal Property Endorsement: This endorsement offers additional coverage for Identity Theft Coverage: This optional coverage helps policyholders recover from the financial consequences of identity theft by covering expenses related to the resolution of the issue, such as legal fees and lost wages. Several factors influence property insurance premiums, including property characteristics and personal factors. Age and Construction Materials: Older properties or those constructed with less durable materials may result in higher premiums due to increased risk of damage. Location and Proximity to Hazards: Properties located in areas prone to natural disasters or high crime rates may have higher insurance premiums. Property Value and Replacement Cost: The higher the property's value and the cost to rebuild or replace it, the higher the insurance premiums. Credit Score: A policyholder's credit score can impact their insurance premiums, as insurers often use credit history as an indicator of risk. Claims History: A history of frequent or large claims can result in higher premiums. Discounts and Bundling Opportunities: Policyholders may qualify for discounts by bundling multiple insurance policies with the same provider or taking advantage of other discounts, such as installing security systems or maintaining a smoke-free home. Navigating the property insurance claims process is an essential aspect of making the most of an insurance policy. Documenting the Loss: It is important to take photos, videos, and detailed notes of the damage before beginning any repairs or cleanup. Contacting the Insurance Company: Policyholders should contact their insurer as soon as possible to report the claim and discuss the next steps. Working With an Adjuster: An insurance adjuster will assess the damage, estimate the repair or replacement costs, and determine the claim settlement amount. Actual Cash Value: This method factors in depreciation, paying out the current market value of the damaged or lost property. Replacement Cost: This method covers the cost of replacing the damaged or lost property with a new item of similar quality, without considering depreciation. Guaranteed or Extended Replacement Cost: This option provides additional coverage beyond the policy's limits, ensuring that the policyholder can rebuild or replace their property even if the costs exceed the original coverage amount. If a policyholder disagrees with their insurer's claim decision, they may follow the dispute resolution process outlined in their policy, which typically involves providing additional documentation or obtaining an independent appraisal. Selecting the right property insurance requires careful assessment, comparison, and evaluation. Policyholders should carefully evaluate their property, belongings, and potential risks to determine the appropriate coverage limits and optional endorsements. Comparing quotes from multiple insurance providers can help policyholders find the best coverage at the most competitive price. Understanding the terms, conditions, and exclusions of a property insurance policy is essential for avoiding surprises during the claims process. Consulting with an insurance agent or financial advisor can provide valuable insights and guidance in choosing the right property insurance policy. Property insurance is a crucial form of coverage that protects against financial losses caused by property damage or loss. It safeguards residential, commercial, and industrial properties from perils like fire, theft, natural disasters, and more. Property insurance covers the physical structure and contents of the property, as well as liability claims. Understanding key components of property insurance policies is vital, including coverage limits, deductibles, and policy terms. Common policy types include homeowners insurance, renters insurance, condominium insurance, and landlord insurance. Standard coverages include dwelling coverage, personal property coverage, liability coverage, and additional living expenses. Optional coverages and endorsements, such as flood insurance and identity theft coverage, can be added. Premiums are influenced by property characteristics like age and location, as well as personal factors like credit score and claims history. The property insurance claims process involves filing a claim, documenting the loss, working with an adjuster, and considering claim settlement options. When choosing property insurance, assessing coverage needs, comparing providers, reading policy documents, and seeking professional advice is essential.Definition and Importance of Property Insurance

Understanding Property Insurance Policies

Key Components of Property Insurance Policies

Common Property Insurance Policy Types

Property Insurance Coverage

Standard Coverages in Property Insurance Policies

Optional Coverages and Endorsements

high-value items, such as jewelry, art, or collectibles, which may have limited coverage under a standard policy.Factors Affecting Property Insurance Premiums

Property Characteristics

Personal Factors

Property Insurance Claims Process

Filing a Property Insurance Claim

Claim Settlement Options

Disputing a Property Insurance Claim

Tips for Choosing the Right Property Insurance

Assessing Your Coverage Needs

Comparing Insurance Providers

Reading Policy Documents Carefully

Asking Questions and Seeking Professional Advice

Conclusion

Property Insurance FAQs

Property insurance is a type of insurance that provides financial compensation for damage or loss to a property due to covered perils, such as fire, theft, or natural disasters. It is essential for property owners and renters because it offers financial protection, helps cover repair or replacement costs, and provides peace of mind in the event of unexpected damages.

Common types of property insurance policies include homeowners insurance, renters insurance, condominium insurance, and landlord insurance. Each policy type caters to the unique needs of different property owners and renters, offering coverage for various risks and scenarios.

Property insurance coverage works by providing financial compensation for damages or losses to property or personal belongings due to covered perils. Standard coverages in most property insurance policies include dwelling coverage, personal property coverage, liability coverage, and additional living expenses.

Factors affecting property insurance premiums include property characteristics (age, construction materials, location, and value), personal factors (credit score and claims history), and available discounts or bundling opportunities. Policyholders can minimize costs by maintaining a good credit score, avoiding frequent claims, taking advantage of discounts, and comparing quotes from multiple insurance providers.

To choose the right property insurance policy, individuals should assess their coverage needs based on their property, belongings, and potential risks. They should also compare insurance providers and quotes, carefully read policy documents, and consult with insurance agents or financial advisors for guidance and advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.