Net worth is an estimation of the absolute monetary value of a person or business, as determined by subtracting the sum of all their liabilities from the sum of all their assets. Net worth in either context can be positive or negative. If net assets exceed net liabilities, then it is positive; if net debts or liabilities exceed assets then the net worth is negative. In the corporate world, net worth is also sometimes referred to as a business' "book value" and is effectively the same as shareholder equity. It is used to determine the value of an entity, be it an individual, a company, or an organization. It represents the difference between the total assets and total liabilities. Net worth is a useful way to take a financial snapshot of an entity at a single point in time. Companies record all of these values on its balance sheet, which is one of three essential financial statements all businesses must produce. A high net worth for a business indicates to lenders that a company's assets are high relative to debt, making them a more attractive candidate for receiving a loan. When applied to an individual, net worth gives a snapshot of one's financial health, factoring in everything owned (assets) and everything owed (liabilities). A positive net worth indicates that assets exceed liabilities, while a negative net worth suggests that one owes more than they own. Liquid assets are those assets that can be quickly and easily converted into cash without losing much, if any, of their value. Examples include cash on hand, savings accounts, money market accounts, and easily tradable securities like stocks and bonds. Having a solid foundation of liquid assets ensures that you can meet immediate or short-term financial obligations without resorting to the sale of less liquid assets or incurring debt. Non-liquid assets, on the other hand, can't be quickly converted to cash, or if they can, might require time or might result in a significant loss in value. Examples include real estate properties, art, jewelry, collectibles, and business investments. While these assets contribute significantly to one's net worth, their illiquid nature means they can't be quickly tapped into during financial emergencies. Short-term liabilities are obligations that are due within a year. These might include credit card balances, utility bills, short-term loans, and other similar debts. Prompt management and settlement of short-term liabilities are crucial to maintain financial health, as they often carry high interest rates or penalties for delayed payments. Long-term liabilities are financial obligations that extend beyond a year. This category often includes mortgages, student loans, car loans, and other extended financial commitments. While they might not present the immediate pressure of short-term debts, understanding and managing them is vital for long-term financial planning and well-being. Individuals with a significant net worth are known as high net worth individuals, and are the prime market for wealth managers since they have significant assets to invest. An important note is that corporate net worth, as calculated from figures from a balance sheet, is based on historical costs or book values, whereas individual net worth takes into account the current market value of their assets and their current debt costs. Net worth is calculated by taking the total value of all assets (both liquid and non-liquid) and subtracting the total value of all liabilities (short-term and long-term). The resulting figure provides a clear and concise representation of an individual's or entity's financial standing at a given point in time. If the figure is positive, it means the value of assets exceeds the outstanding obligations. Conversely, a negative net worth denotes that liabilities surpass assets. Net worth is a cornerstone metric in personal finance. It encapsulates an individual's financial health and stability in a single number. Whether you're planning for retirement, assessing your debt management strategy, or contemplating major life decisions, understanding your net worth can offer clarity. A steadily increasing net worth over time is usually a sign of sound financial decisions and progress. Regularly calculating and tracking one's net worth can provide valuable insights into financial trends. Seeing a consistent upward trajectory can validate financial strategies and bolster confidence. Conversely, a declining or stagnant net worth can serve as a wakeup call, prompting reevaluation and adjustment of financial habits. For many, net worth isn't just a figure, it's a benchmark against which they measure their financial goals and aspirations. Whether the goal is to reach a specific net worth threshold by a certain age, or to ensure that debts are being steadily reduced while assets grow, this metric provides a tangible target to work towards. By setting clear net worth objectives, individuals can align their financial habits and decisions to more effectively achieve their long-term goals. A fundamental driver of an individual's net worth is their income and earnings. This encompasses not only the salary from employment but also other sources such as rental income, dividends, royalties, and any side hustles. The higher the income and the more diversified the earnings, the greater the potential for building and increasing net worth. However, a high income doesn't automatically translate into a high net worth. It acts as a foundation, but how it's managed plays an equally crucial role. For many, increasing their earnings through career progression, additional qualifications, or venturing into new income streams can provide a significant boost to their net worth. Income and earnings only tell half the story. Spending habits play a pivotal role in determining whether one's net worth sees a positive trajectory. Individuals who consistently live beyond their means, irrespective of how much they earn, will find it challenging to grow their net worth. On the contrary, those who adopt a frugal approach, prioritize essential expenses, and avoid impulsive purchases are more likely to see a steady increase in their net worth. Cultivating a budgeting discipline and understanding the difference between needs and wants can make a monumental difference in one's financial standing. A significant component of net worth for many individuals is their investment portfolio. Whether it's in stocks, bonds, real estate, or other assets, the performance of these investments can heavily influence net worth. Market fluctuations, interest rate changes, and global economic scenarios can either amplify or diminish the value of investments. A diversified investment portfolio can mitigate risks and offer balanced growth opportunities. It's essential to regularly review and adjust investment strategies based on goals and market conditions to optimize returns. Debts, especially when mismanaged, can be a significant drag on net worth. High-interest liabilities like credit card debts, if left unchecked, can erode one's financial standing. Effective debt management involves understanding the nature of one's obligations, prioritizing high-interest debts, and establishing a clear repayment plan. Refinancing or consolidating debts might also offer avenues for better interest rates and terms. An individual free from the shackles of debilitating debt is in a much stronger position to grow their net worth. The most straightforward strategy to increase net worth is to save consistently and invest wisely. Adopting a disciplined saving habit, even if it means setting aside a small percentage of income regularly, can lead to substantial growth over time, thanks to compound interest. Investing these savings in assets that offer returns higher than the average inflation rate ensures that the purchasing power of the money saved doesn't erode over time. Continuous education about investment opportunities and staying updated about market trends can amplify the growth trajectory of net worth. Minimizing liabilities is as vital as increasing assets when it comes to enhancing net worth. Start by listing all debts and understanding their interest rates. Focus on paying off high-interest debts first, as they tend to compound rapidly. Consider options like balance transfer offers or debt consolidation loans to secure lower interest rates. Avoid accumulating new debts, especially for non-essential purchases, and always aim to pay credit card balances in full each month to prevent interest accumulation. Consistent financial health checks can be the difference between a growing and a stagnant net worth. Regularly assessing one's finances ensures that any deviations from financial goals are promptly identified and addressed. This might involve reviewing spending habits, checking investment portfolio performance, or recalibrating debt repayment strategies. Using financial management tools or consulting with financial advisors can provide valuable insights and tailored strategies to bolster net worth. Net Worth serves as a comprehensive financial metric that encapsulates an entity's monetary value by subtracting liabilities from assets. Whether assessing personal financial health or evaluating business worth, this figure offers valuable insights. For individuals, it's a snapshot of financial standing, reflecting assets versus liabilities. Positive net worth signifies a stronger position, while negative values indicate liabilities exceeding assets. Regularly tracking net worth assists in setting goals, directing financial decisions, and gauging progress over time. Factors like income, spending habits, investments, and debt management influence net worth growth. Building net worth entails disciplined saving, wise investing, reducing debt, and consistent financial assessment. By understanding and leveraging the significance of net worth, individuals and businesses can navigate towards healthier financial futures.Net Worth Definition

Define Net Worth in Simple Terms

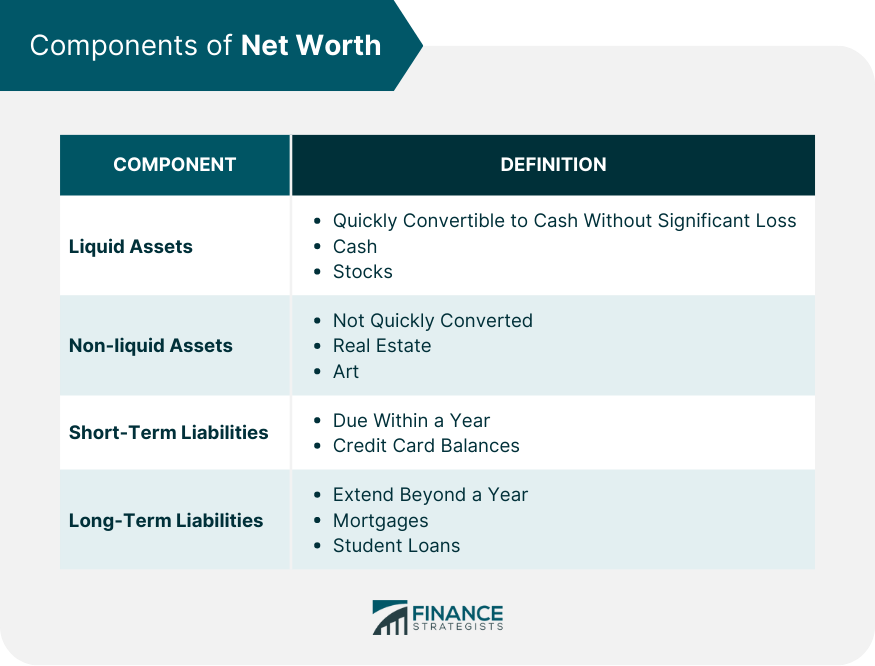

Components of Net Worth

Liquid Assets

Non-liquid Assets

Short-Term Liabilities

Long-Term Liabilities

Calculating Net Worth

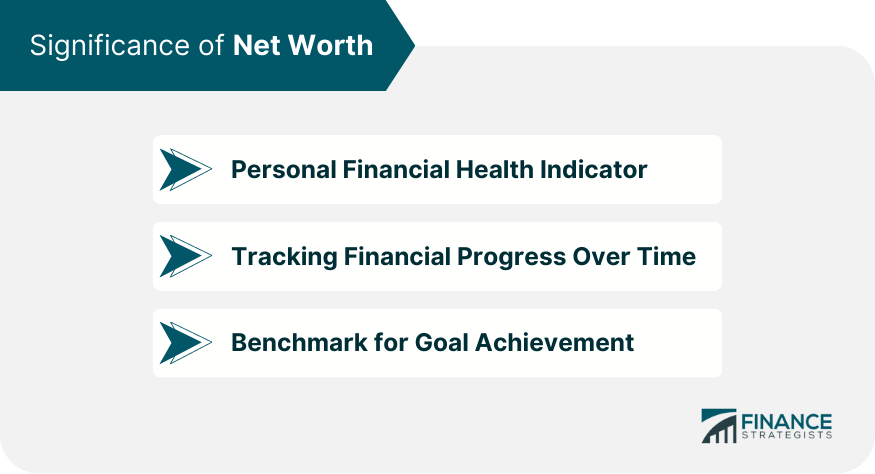

Significance of Net Worth

Personal Financial Health Indicator

Tracking Financial Progress Over Time

Benchmark for Goal Achievement

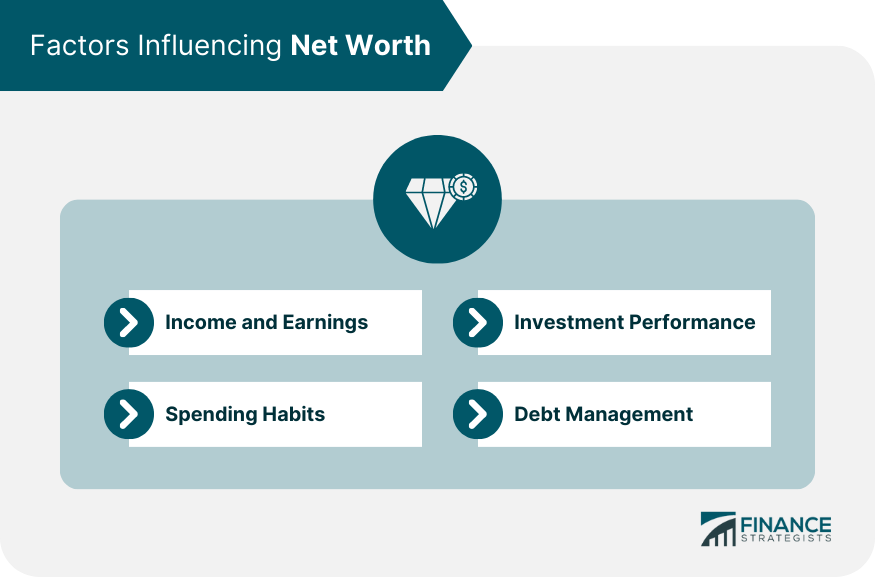

Factors Influencing Net Worth

Income and Earnings

Spending Habits

Investment Performance

Debt Management

How to Increase Net Worth

Save and Invest

Reduce Debt

Monitor and Assess Finances

Conclusion

Net Worth FAQs

Net worth is an estimation of the absolute monetary value of a person or business, as determined by subtracting the sum of all their liabilities from the sum of all their assets.

In the corporate world, net worth is also sometimes referred to as a business’ “book value” and is effectively the same as shareholder equity.

A high net worth for a business indicates to lenders that a company’s assets are high relative to debt, making them a more attractive candidate for receiving a loan.

Yes. A Net Worth can be positive or negative.

Net worth is a useful way to take a financial snapshot of an entity at a single point in time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.