Gifting strategies involve transferring assets to beneficiaries during life or at death. There are two main types of gifts: outright gifts and gifts made in trust. Outright gifts are gifts made directly to the beneficiary, while gifts made in trust involve setting up a trust to hold the assets for the benefit of the beneficiary. Tax implications of gifting strategies are an important consideration. The federal gift tax applies to gifts made during life, while the estate tax applies to gifts made at death. The gift tax exclusion allows individuals to gift up to a certain amount per year without incurring gift tax. In 2024, the annual gift tax exclusion is $18,000 per recipient, or $36,000 if the gift is made jointly by a married couple.

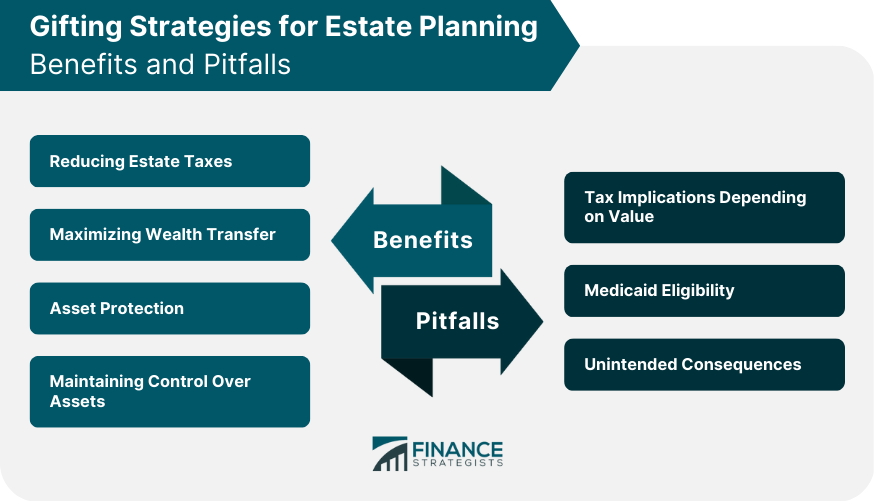

There are several gifting strategies that can be used as part of an estate plan. These include: This strategy involves making gifts up to the annual gift tax exclusion amount each year to reduce the size of the taxable estate over time. This strategy involves making gifts in excess of the annual gift tax exclusion amount, which is subject to the federal gift tax. However, each individual has a lifetime gift tax exemption, which in 2024 is $13.61 million. This strategy involves making gifts to a charity, which are tax-deductible and can reduce the size of the taxable estate. Irrevocable Trust Involves setting up a trust to hold assets for the benefit of the beneficiary. Once the assets are transferred to the trust, they are no longer considered part of the individual's taxable estate. Family Limited Partnerships involves setting up a partnership to hold assets, which can provide asset protection and tax benefits. Grantor Retained Annuity Trusts (GRATs) involves setting up a trust that pays the individual a fixed annuity for a specified period of time, after which the remaining assets are transferred to the beneficiaries. When implementing gifting strategies, there are several important considerations to keep in mind. These include: Family Dynamics and Relationships: It is important to consider how gifts will be received by beneficiaries and how they may impact family relationships. Financial Circumstances: It is important to consider the individual's financial circumstances and how gifting strategies may impact their financial stability. Legal and Tax Implications: Gifting strategies have legal and tax implications that must be carefully considered before implementing any strategy. Timing of Gifts: Timing is an important consideration when making gifts, as it can impact the tax consequences of the gift. Asset Valuation: Properly valuing assets is crucial when making gifts, as it can impact the amount of tax owed and the overall effectiveness of the gifting strategy. There are several benefits to using gifting strategies as part of an estate plan. One of the primary benefits of gifting strategies is reducing estate taxes. By making gifts during life, an individual can reduce the size of their taxable estate and therefore reduce the amount of estate tax owed upon death. The federal estate tax applies to estates that exceed a certain threshold, which in 2024 is $13.61 million. By making gifts during life, an individual can reduce the size of their taxable estate and potentially avoid or reduce the amount of estate tax owed. Another benefit of gifting strategies is maximizing the amount of wealth that can be transferred to beneficiaries. By making gifts during life, an individual can transfer assets to their beneficiaries while they are still alive, allowing them to enjoy the benefits of the assets and potentially avoiding probate. This can be especially beneficial for individuals who have significant assets and want to ensure that their beneficiaries receive the maximum amount of wealth possible. Gifting strategies can also provide asset protection. By transferring assets to a trust, an individual can protect those assets from creditors and lawsuits. This can be especially beneficial for individuals who are concerned about protecting their assets from potential lawsuits or creditors. Another benefit of gifting strategies is maintaining control over assets. By setting up a trust, an individual can maintain control over how their assets are managed and distributed, even after they have been transferred to the trust. This can be especially beneficial for individuals who want to ensure that their assets are managed and distributed in accordance with their wishes. Estate planning involves making decisions about the distribution of your assets after you pass away. One strategy that many people use is gifting, which involves transferring assets to family members or other beneficiaries while still alive. However, there are several potential pitfalls to be aware of when it comes to gifting as a strategy for estate planning. One of the main concerns with gifting is the tax implications. Depending on the value of the gift, you may be subject to gift taxes or other taxes, which can significantly reduce the amount of your assets that can be transferred to your beneficiaries. Another potential issue is Medicaid eligibility. If you require long-term care in a nursing home, the government may require you to “spend down” your assets before you can qualify for Medicaid coverage. However, if you have made gifts in the past, this could impact your eligibility, as there are strict rules about gifting and Medicaid eligibility. Finally, there may be unintended consequences of gifting. For example, if you give a large sum of money to a child, it could cause friction or resentment among your other beneficiaries. Additionally, if the recipient of the gift experiences financial difficulties or legal problems, the gifted assets may be at risk. Overall, gifting can be a useful tool in estate planning, but it’s important to be aware of the potential pitfalls and to consult with a qualified estate planning attorney or financial advisor to make sure your strategy aligns with your overall goals. Gifting strategies can be an effective way to minimize estate taxes, maximize wealth transfer, provide asset protection, and maintain control over assets. However, gifting strategies must be carefully planned and implemented to ensure that they achieve their intended goals. By working with a qualified estate planning attorney or financial advisor, individuals can develop a gifting strategy that is tailored to their unique circumstances and goals. With careful planning, gifting strategies can help individuals achieve their estate planning objectives and provide for the future financial security of their loved ones.What Are Gifting Strategies?

Gifting Strategies to Consider

Annual Exclusion Gifts

Lifetime Exemption Gifts

Charitable Gifts

Irrevocable Trusts

Family Limited Partnerships

Grantor Retained Annuity Trusts (GRATs)

Considerations When Implementing Gifting Strategies

Benefits of Gifting Strategies

Reducing Estate Taxes

Maximizing Wealth Transfer

Asset Protection

Maintaining Control Over Assets

Estate Planning Gifting Pitfalls

Tax Implications Depending on Value

Medicaid Eligibility

Unintended Consequences

The Bottom Line

Gifting Strategies for Estate Planning FAQs

Gifting strategies for estate planning involve transferring assets to beneficiaries during life or at death in order to minimize estate taxes, maximize wealth transfer, provide asset protection, and maintain control over assets.

There are two main types of gifts that can be made under gifting strategies for estate planning: outright gifts and gifts made in trust.

The federal gift tax applies to gifts made during life, while the estate tax applies to gifts made at death. The gift tax exclusion allows individuals to gift up to a certain amount per year without incurring gift tax.

Some gifting strategies to consider for estate planning include annual exclusion gifts, lifetime exemption gifts, charitable gifts, irrevocable trusts, family limited partnerships, and grantor retained annuity trusts (GRATs).

When implementing gifting strategies for estate planning, it is important to consider family dynamics and relationships, financial circumstances, legal and tax implications, timing of gifts, and asset valuation. It is recommended to work with a qualified estate planning attorney or financial advisor to develop a gifting strategy tailored to individual circumstances and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.