Chapter 13 bankruptcy is a legally binding process that helps individuals and businesses reorganize their debt through a three to five-year repayment plan. To file for Chapter 13 bankruptcy, individuals must first file a petition with the bankruptcy court in their jurisdiction. In addition to the petition, individuals must provide a proposed repayment plan outlining how to repay their debts over the next three to five years. Once the petition and repayment plan have been filed, a bankruptcy trustee will review the documents and make any necessary changes before submitting them to the court for approval. If the court approves the repayment plan, the individual will begin making payments to the bankruptcy trustee, who will then distribute the funds to creditors according to the terms of the repayment plan. Once the repayment plan is complete, any remaining unsecured debts will be discharged, meaning the debtor is no longer responsible for paying them. Chapter 13 bankruptcy can include student loans in the repayment plan, but discharging them is generally challenging. Federal student loans are more likely to be included than private student loans. The Bankruptcy Code does not specifically include or exclude student loans from discharge in bankruptcy. Instead, the dischargeability of student loans is determined on a case-by-case basis. While federal and private student loans can be included in a Chapter 13 repayment plan, the two have some critical differences. Federal student loans are generally more difficult to discharge in bankruptcy than private student loans. This is because federal student loans offer some borrower protections and repayment options that are not available with private student loans. Private student loans, on the other hand, are generally easier to discharge in bankruptcy than federal student loans. This is because private student loans are not subject to the same borrower protections and repayment options as federal student loans. While it is possible to discharge student loans in Chapter 13 bankruptcy, it is generally challenging. To have student loans discharged in bankruptcy, individuals must prove that repaying the loans would cause an undue hardship. Undue hardship is generally defined as a situation where the borrower cannot maintain a minimal standard of living while repaying the loans. To prove undue hardship, borrowers must typically show that they have made a reasonable faith effort to repay the loans and that their financial situation is unlikely to improve. While it is difficult to discharge student loans in Chapter 13 bankruptcy, reducing monthly payments on student loans by including them in a Chapter 13 repayment plan is possible. When student loans are included in a Chapter 13 repayment plan, the borrower's monthly payment is typically reduced based on their disposable income. Another option for dealing with student loan debt in Chapter 13 bankruptcy is to include the loans in a repayment plan that spans over three to five years. While this does not discharge the debt, it can help individuals delay their student loan payments while they work to repay their other obligations. While it is possible to include student loans in a Chapter 13 repayment plan, the likelihood of them being included depends on several factors, including: The type of student loan (federal or private) The borrower's income and expenses The borrower's financial situation The terms of the repayment plan Federal student loans are more likely to be included in a Chapter 13 repayment plan than private student loans. Additionally, borrowers with a lower income and higher expenses may be more likely to have their student loans included in the repayment plan. While Chapter 13 bankruptcy can help manage student loan debt, it is not the only option available. There are several alternatives to Chapter 13 bankruptcy for dealing with student loan debt, including: Student Loan Consolidation - This involves combining multiple student loans into a single loan with a monthly payment. Income-Driven Repayment Plan - This plan allows borrowers to make payments based on their income and family size. Loan Forgiveness Programs - These programs forgive all or a portion of a borrower's student loans in exchange for working in certain professions or meeting other eligibility criteria. Negotiating With Student Loan Lenders - Borrowers can sometimes negotiate with their student loan lenders to get lower interest rates, lower monthly payments, or other borrower protections. Chapter 13 bankruptcy is a complex process designed to help individuals and businesses reorganize their debt through a repayment plan. While many types of debt can be included in a Chapter 13 repayment plan, student loans are a topic of debate. Federal student loans offer more borrower protections and repayment options than private student loans, making them more challenging to discharge in bankruptcy. Private student loans, on the other hand, often have higher interest rates and fewer borrower protections. Several repayment options are available for federal student loans, including standard repayment, graduated repayment, income-driven repayment plans, and extended repayment plans. Defaulting on student loans can lead to a damaged credit score, wage garnishment, tax refund seizure, legal action, and loss of eligibility for federal student aid. While it is possible to include student loans in a Chapter 13 repayment plan, it is generally challenging to discharge them into bankruptcy. Borrowers must prove that repaying the loans would cause undue hardship, typically defined as the inability to maintain a minimal standard of living while repaying the loans. Several alternatives to Chapter 13 bankruptcy for dealing with student loan debt include student loan consolidation, income-driven repayment plans, loan forgiveness programs, and negotiating with student loan lenders. The best option for managing student loan debt depends on an individual's financial situation and needs. To ensure that you make the best decisions for your financial future, working with a knowledgeable financial advisor is essential. A financial advisor can help you navigate the complexities of student loan debt and bankruptcy, create a personalized financial plan, and guide you toward financial stability. So, if you are struggling with student loan debt or considering bankruptcy, take the first step and consult with a financial advisor today.Understanding Chapter 13 Bankruptcy

Does Chapter 13 Bankruptcy Cover Student Loans?

The Bankruptcy Code and Student Loans

The Difference Between Private and Federal Student Loans

The Possibility of Discharging Student Loans in Chapter 13 Bankruptcy

The Possibility of Reducing Student Loan Payments in Chapter 13 Bankruptcy

The Possibility of Delaying Student Loan Payments in Chapter 13 Bankruptcy

The Likelihood of Student Loans Being Included in a Chapter 13 Repayment Plan

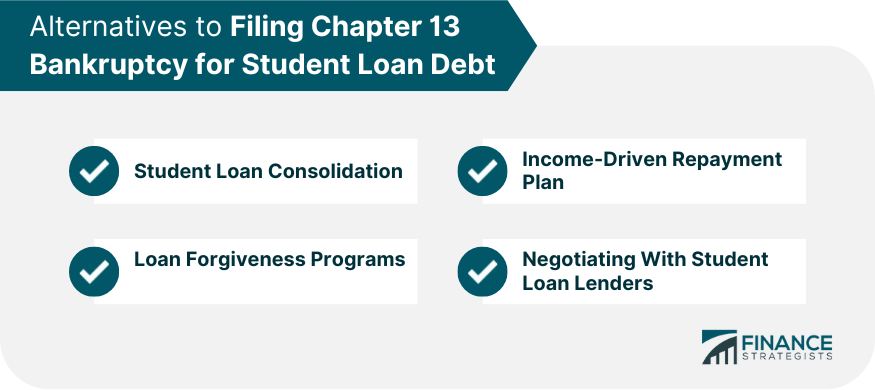

Alternatives to Chapter 13 Bankruptcy for Student Loan Debt

Conclusion

Does Chapter 13 Bankruptcy Cover Student Loans? FAQs

Yes, including student loans in a Chapter 13 repayment plan is possible. However, the likelihood of them being included depends on factors such as the type of student loan, the borrower's income and expenses, and the repayment plan terms.

While it is possible to discharge student loans in Chapter 13 bankruptcy, it is generally challenging. To have student loans discharged in bankruptcy, individuals must prove that repaying the loans would cause an undue hardship.

Federal student loans are more likely to be included in a Chapter 13 repayment plan than private student loans. This is because federal student loans offer several borrower protections and repayment options that are not available with private student loans.

If an individual defaults on their student loans, they can face the consequences such as damage to their credit score, wage garnishment, tax refund seizure, legal action, and loss of eligibility for federal student aid.

Some alternatives to Chapter 13 bankruptcy for dealing with student loan debt include student loan consolidation, income-driven repayment plans, loan forgiveness programs, and negotiating with student loan lenders. The best option for managing student loan debt will depend on an individual's financial situation and needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.