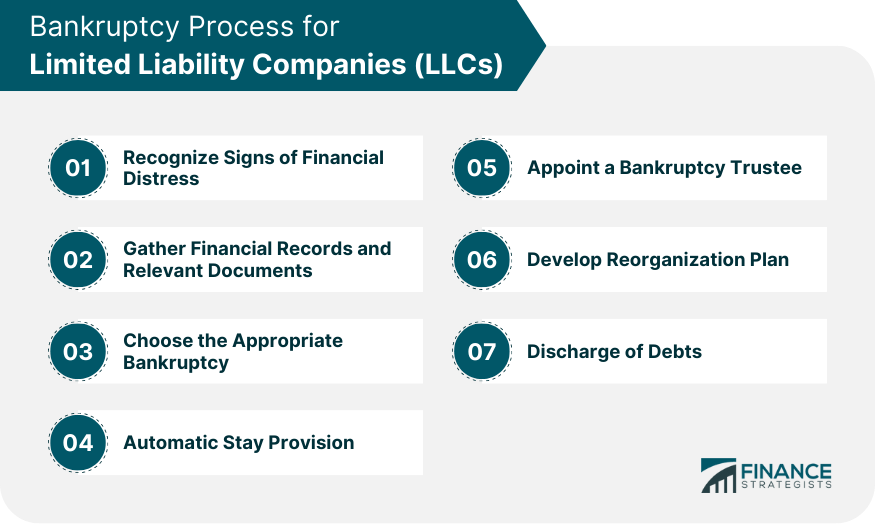

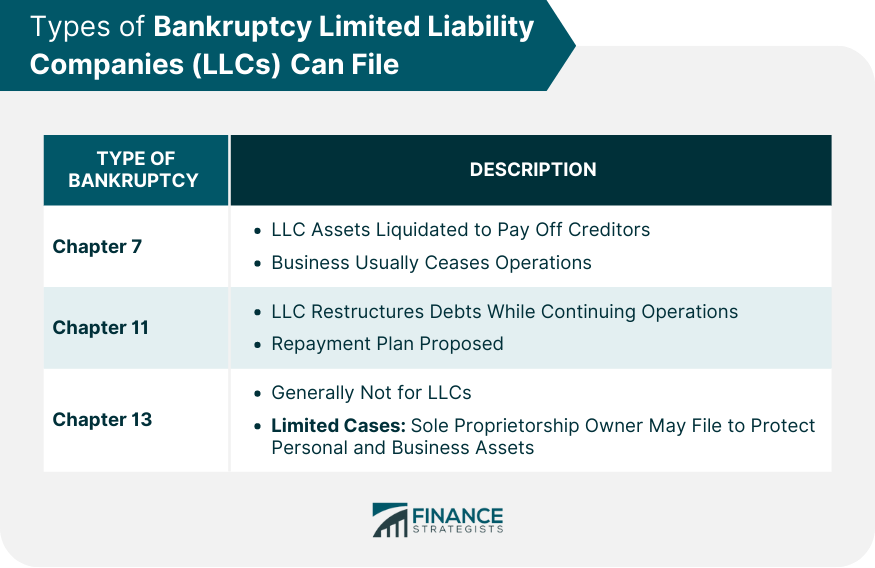

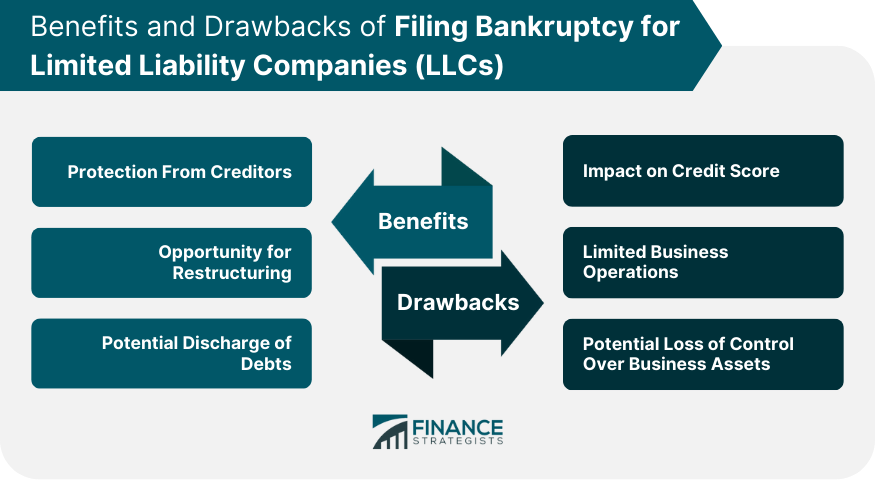

Bankruptcy for LLCs, or Limited Liability Companies, is a legal process where an LLC, burdened by debts it cannot repay, seeks protection and relief through the court system. It allows the LLC to either discharge its debts or reorganize them, depending on the type of bankruptcy filed. The process aims to provide the struggling business with a fresh start while ensuring fair treatment to the creditors. The purpose of bankruptcy is to provide an LLC with relief from crippling debt, thus offering an opportunity to regain financial stability. By going through this process, an LLC can stop or delay foreclosure on its property, prevent repossession of assets, stop wage garnishment, and halt debt collection harassment. The importance of bankruptcy lies in its ability to provide a "financial reset," enabling the company to continue operations under improved financial conditions. The bankruptcy process for Limited Liability Companies (LLCs) can be a complex and challenging undertaking. Understanding the nuances of bankruptcy and its implications for LLCs is crucial before embarking on this path. It begins with recognizing signs of financial distress within the LLC, such as mounting debts, declining revenues, or creditor pressure. Once the need for bankruptcy protection is evident, the LLC must prepare for the filing process. Gathering all financial records and relevant documents is paramount while exploring potential alternatives to bankruptcy is prudent. Choosing the appropriate bankruptcy chapter is a critical decision, whether it's Chapter 11 for reorganization or Chapter 7 for liquidation. Filing the necessary paperwork accurately and disclosing the LLC's financial state to the court is essential to proceed effectively. Upon filing, an automatic stay provision comes into effect, shielding the LLC from creditor collection actions. A bankruptcy trustee is appointed to oversee the process, assessing the LLC's assets, operations, and financial affairs. The trustee plays a pivotal role in managing bankruptcy proceedings and ensuring compliance with the law. The LLC must then develop a reorganization plan in Chapter 11 bankruptcy, outlining how it intends to restructure its finances and operations. This plan needs approval from creditors and the court. If reorganization is unviable, conversion to Chapter 7 may be necessary, leading to asset liquidation and distribution to creditors. Following the successful execution of the plan, the LLC may obtain a discharge of debts, relieving it of past financial obligations. To prevent future bankruptcies, implementing sound financial practices and learning from the bankruptcy experience is crucial for the long-term stability of the LLC. Depending on the LLC's situation and objectives, it can file for different types of bankruptcy. In a Chapter 7 bankruptcy, the LLC's assets are liquidated, and the proceeds are used to pay off creditors. After liquidation, the business typically ceases operations. A Chapter 11 bankruptcy allows an LLC to restructure its debts while continuing to operate. The company proposes a plan of reorganization, outlining how it will repay its creditors over time. Generally, LLCs cannot file Chapter 13 bankruptcy. However, in some limited circumstances, if the LLC is a sole proprietorship, the owner might file Chapter 13 to protect personal and business assets. When an LLC finds itself overwhelmed by debt, filing for bankruptcy can offer several benefits. Protection From Creditors: Firstly, it provides immediate protection from creditors. Upon filing, an "automatic stay" is put into effect, stopping all collection efforts, foreclosures, and- repossession activities. Opportunity for Restructuring: Bankruptcy can also provide an LLC with an opportunity to restructure its debts. Under a Chapter 11 filing, the LLC can propose a repayment plan to pay back creditors over time while still keeping the business running. Potential Discharge of Debts: In some instances, bankruptcy can lead to a discharge of debts, giving the LLC a fresh financial start. However, there are also drawbacks to filing for bankruptcy. Impact on Credit Score: Filing bankruptcy can severely impact the LLC's credit score, making it harder to secure financing in the future. Limited Business Operations: During the bankruptcy process, the business operations may be limited, affecting the LLC's ability to generate revenue. Potential Loss of Control Over Business Assets: Lastly, filing for bankruptcy could lead to a potential loss of control over business assets, especially in a Chapter 7 filing where assets are liquidated to repay creditors. A bankruptcy trustee plays a vital role in the process of an LLC bankruptcy. The trustee's duties vary depending on the type of bankruptcy filed. For Chapter 7, the trustee liquidates the LLC's assets to repay creditors. For Chapter 11, the trustee oversees the reorganization process and approves the proposed repayment plan. The bankruptcy trustee interacts with the LLC throughout the bankruptcy process, including at the meeting of creditors and in approving any reorganization plan. Deciding when to file bankruptcy is crucial for an LLC. Factors to consider include the severity of the financial situation and whether other debt-relief options, such as negotiation with creditors or asset sales, could provide sufficient relief without the need for bankruptcy. When a Limited Liability Company finds itself in a state of insolvency and yet chooses to evade bankruptcy, it exposes itself to persistent efforts by creditors to recoup its debts. This can include continuous calls, letters, and other forms of debt collection activities. Beyond the relentless pursuit of creditors, the LLC may also face severe legal consequences. These could encompass lawsuits filed by creditors in an attempt to recover their owed funds. Furthermore, there are scenarios where creditors, driven by the need to salvage their interests, may compel the insolvent LLC into a situation of involuntary bankruptcy. This situation of forced bankruptcy is usually a last-resort effort by the creditors to retrieve as much of their investment as possible. Therefore, an insolvent LLC should weigh the potential consequences before deciding to avoid bankruptcy. Bankruptcy for LLCs is a structured legal avenue that offers protection and relief to financially distressed companies. The process varies depending on the type of bankruptcy filed, be it Chapter 7, 11, or, in limited cases, Chapter 13. Through this, businesses can either discharge their debts, reorganize their financial structure, or both. The role of the bankruptcy trustee is paramount, overseeing the process and ensuring compliance. While bankruptcy offers protection from creditors and a potential fresh start, there are drawbacks, including a significant hit to credit scores and potential loss of business assets. Importantly, the decision to file should be timely and well-informed, taking into consideration alternative debt-relief options. Ignoring a dire financial state and evading bankruptcy might lead to more severe repercussions for an LLC, including involuntary bankruptcy.What Is Bankruptcy for LLCs?

Bankruptcy Process for LLCs

Recognize Signs of Financial Distress

Gather Financial Records and Relevant Documents

Choose the Appropriate Bankruptcy

Automatic Stay Provision

Appoint a Bankruptcy Trustee

Develop Reorganization Plan

Discharge of Debts

Types of Bankruptcy LLCs Can File

Chapter 7 Bankruptcy: Liquidation

Chapter 11 Bankruptcy: Reorganization

Chapter 13 Bankruptcy: Debt Adjustment (Limited Circumstances)

Benefits of Filing Bankruptcy for LLCs

Drawbacks of Filing Bankruptcy for LLCs

Role of the Bankruptcy Trustee in LLC Bankruptcy

Duties and Responsibilities

Interaction With the LLC

Assess the Right Time for an LLC to File Bankruptcy

Implications of Avoiding Bankruptcy When an LLC Is Insolvent

Conclusion

How LLCs File Bankruptcy FAQs

The primary purpose of bankruptcy for LLCs is to provide financial relief from crippling debt. It allows the company to either discharge its debts or reorganize them, enabling the company to regain financial stability and continue operations under improved financial conditions.

A bankruptcy trustee plays a crucial role in an LLC bankruptcy. For Chapter 7, the trustee liquidates the LLC's assets to repay creditors. For Chapter 11, the trustee oversees the reorganization process and approves the proposed repayment plan.

An LLC can file either Chapter 7 or Chapter 11 bankruptcy. Chapter 7 involves liquidating the company's assets to pay off creditors and typically results in the company ceasing operations. Chapter 11 allows the company to restructure its debts while continuing to operate. In limited circumstances, if the LLC is a sole proprietorship, the owner might file Chapter 13 to protect both personal and business assets.

The benefits of filing bankruptcy for an LLC include protection from creditors, an opportunity for restructuring debts, and the potential discharge of debts. Drawbacks include a significant impact on the LLC's credit score, limited business operations during the process, and potential loss of control over business assets.

If an LLC avoids bankruptcy despite being insolvent, it can face continued debt collection efforts from creditors and potential legal repercussions, including lawsuits. In some cases, creditors may force the LLC into involuntary bankruptcy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.