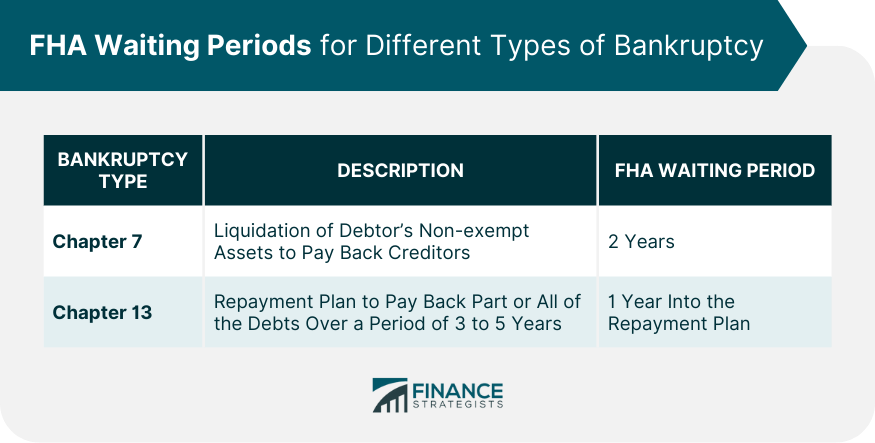

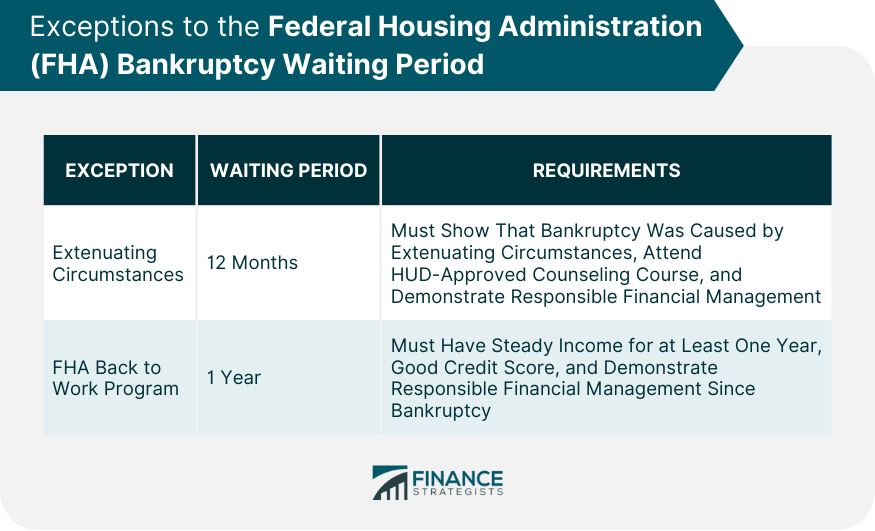

The Federal Housing Administration (FHA) bankruptcy waiting period is a compulsory interval after a significant credit event, like bankruptcy, before a borrower can apply for a new loan. This period gives borrowers time to financially recover and rebuild their credit. FHA loans, which are popular among many homebuyers, including first-timers and those with lower credit scores or limited down payments, have specific waiting periods that vary depending on the type of bankruptcy filed. The FHA, a government agency, insures these loans, protecting lenders against loss if borrowers default. This enables lenders to offer flexible terms and lower interest rates, thus widening homeownership accessibility. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves selling off a debtor's non-exempt assets to pay back creditors. It's typically filed by those with limited income who can't pay back their debts. The FHA bankruptcy waiting period after a Chapter 7 bankruptcy is generally two years. Chapter 13 bankruptcy, on the other hand, is a reorganization bankruptcy designed for debtors with regular income who can repay part or all of their debts over time. Under Chapter 13 bankruptcy, a debtor proposes a repayment plan to make installments to creditors over a period of three to five years. In terms of the FHA bankruptcy waiting period, borrowers are generally eligible for an FHA loan one year after the initiation of the Chapter 13 bankruptcy repayment plan, provided they can show a satisfactory payment history and obtain approval from the bankruptcy court. While both types of bankruptcy have significant consequences, the key difference between Chapter 7 and Chapter 13 bankruptcy lies in how debts are handled. In Chapter 7 bankruptcy, non-exempt assets are liquidated to pay off the debts. In contrast, Chapter 13 bankruptcy allows the debtor to keep their assets and repay their debts over time. The FHA bankruptcy waiting period varies between these two types, reflecting the different levels of risk associated with each type of bankruptcy. As mentioned earlier, the FHA bankruptcy waiting period is typically two years for Chapter 7 bankruptcy and one year into the repayment plan for Chapter 13 bankruptcy. It's important to remember, though, that these are general guidelines and individual circumstances may affect these timelines. The FHA recognizes that sometimes, events beyond an individual's control lead to bankruptcy. These events, referred to as 'extenuating circumstances,' could include serious illness, death of a wage earner, or a natural disaster, among others. In such cases, the FHA may consider reducing the bankruptcy waiting period. Before filing for bankruptcy, individuals must participate in a credit counseling briefing from an approved agency. After bankruptcy, attending a financial management instructional course is also mandatory. These sessions educate individuals on managing finances and debts effectively and are integral in preventing a repeat of bankruptcy. It's crucial to use the waiting period as a time to rebuild credit. Make sure to pay all bills on time, keep credit card balances low, and avoid taking on additional debt. Good credit habits during the waiting period can help improve your credit score and increase your chances of securing an FHA loan after bankruptcy. While FHA loans require a lower down payment compared to conventional loans, borrowers still need to save for it. Use the waiting period as a time to save for the down payment, closing costs, and an emergency fund. Professional guidance can be invaluable during the waiting period. Consult with a bankruptcy attorney or a financial advisor to better understand the steps you should take to improve your financial situation and navigate the waiting period successfully. If you can show that your bankruptcy was caused by extenuating circumstances, such as a serious illness, the death of a spouse, or a natural disaster, you may be able to qualify for an FHA loan after a shorter waiting period. The FHA defines extenuating circumstances as "events or circumstances beyond the borrower's control that caused the borrower to file for bankruptcy." The FHA Back to Work Program allows borrowers who have filed for Chapter 7 bankruptcy to qualify for an FHA loan after a one-year waiting period if they can meet certain requirements. These requirements include: Having a steady income for at least one year. Having a good credit score. Demonstrating that you have been able to manage your finances responsibly since your bankruptcy. If you think you may qualify for an FHA loan after bankruptcy, you should talk to a qualified mortgage lender. They will be able to assess your individual circumstances and help you determine if you are eligible for an FHA loan. Here are some examples of extenuating circumstances that may qualify you for an exception to the FHA bankruptcy waiting period: Serious Illness: If you were unable to work due to a serious illness, the FHA may consider this an extenuating circumstance. Death of a Spouse: If your spouse died and their income was a significant part of your household income, the FHA may consider this an extenuating circumstance. Natural Disaster: If your home was destroyed by a natural disaster, the FHA may consider this an extenuating circumstance. It is important to note that the FHA has the final say on whether or not you qualify for an exception to the bankruptcy waiting period. If you believe that your bankruptcy was caused by extenuating circumstances, you should talk to a qualified mortgage lender to discuss your options. Rebuilding credit is crucial after bankruptcy. Pay all bills on time, reduce debts, avoid new debt, and keep credit card balances low. Regularly check your credit report to ensure it's accurate and to monitor your progress. Over time, these actions can significantly improve your credit score. Once the waiting period is over and you've worked on improving your financial situation, you may be ready to apply for an FHA loan. Prepare for the application process by saving for a down payment, keeping your debt-to-income ratio low, and ensuring your credit score is as high as possible. The FHA bankruptcy waiting period is a mandatory duration following a significant credit event, such as bankruptcy, before a borrower can apply for a new FHA-insured loan. This period, generally two years for Chapter 7 bankruptcy and one year into a Chapter 13 repayment plan, provides borrowers an opportunity for financial recuperation, credit score rehabilitation, and demonstration of fiscal responsibility. Notwithstanding, extenuating circumstances may allow for alterations to these time frames. The waiting period, complemented by resources like the FHA Back to Work program and mandatory credit counseling, enables prudent lending practices while fostering financial resilience among borrowers. Ultimately, the FHA bankruptcy waiting period is a protective measure for both lenders and borrowers, promoting a more stable financial future for all parties involved. Consulting with a financial advisor can provide invaluable insights and help create a robust roadmap to achieve your financial goals.What Is the FHA Bankruptcy Waiting Period?

FHA Waiting Periods for Different Types of Bankruptcy

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Differentiating Chapter 7 and Chapter 13 Bankruptcy

FHA Bankruptcy Waiting Period: Detailed Explanation

Length of the Waiting Period

Extenuating Circumstances That May Affect the Waiting Period

Role of the Credit Counseling Briefing

Navigating the FHA Bankruptcy Waiting Period

Maintaining Good Credit During the Waiting Period

Planning Ahead: Saving for a Down Payment

Seeking Legal and Financial Advice

Exceptions to the FHA Bankruptcy Waiting Period

Extenuating Circumstances

FHA Back to Work Program

Life After the FHA Bankruptcy Waiting Period

Rebuilding Credit Post-bankruptcy

Applying for an FHA Loan Post-waiting Period

Final Thoughts

FHA Bankruptcy Waiting Period FAQs

The FHA bankruptcy waiting period is the mandatory period that a borrower must wait after bankruptcy before they can apply for an FHA loan. This period is typically two years for Chapter 7 bankruptcy and one year into the repayment plan for Chapter 13 bankruptcy.

Yes, the FHA may consider reducing the bankruptcy waiting period if there were extenuating circumstances that led to the bankruptcy, such as severe illness, death of a wage earner, or a natural disaster.

Maintaining good credit during the waiting period, saving for a down payment, and seeking legal and financial advice can increase your chances of securing an FHA loan post-bankruptcy.

If you cannot wait, you may look into exceptions for extenuating circumstances. However, you need to provide proof of these circumstances and demonstrate that you have recovered financially.

Yes, you can consult a financial advisor or bankruptcy attorney for guidance. Also, HUD-approved housing counseling agencies can provide valuable information and resources.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.