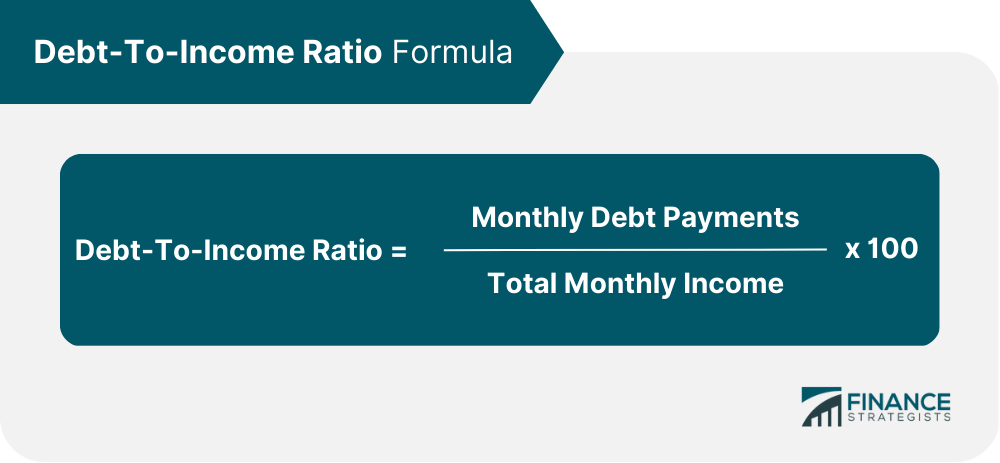

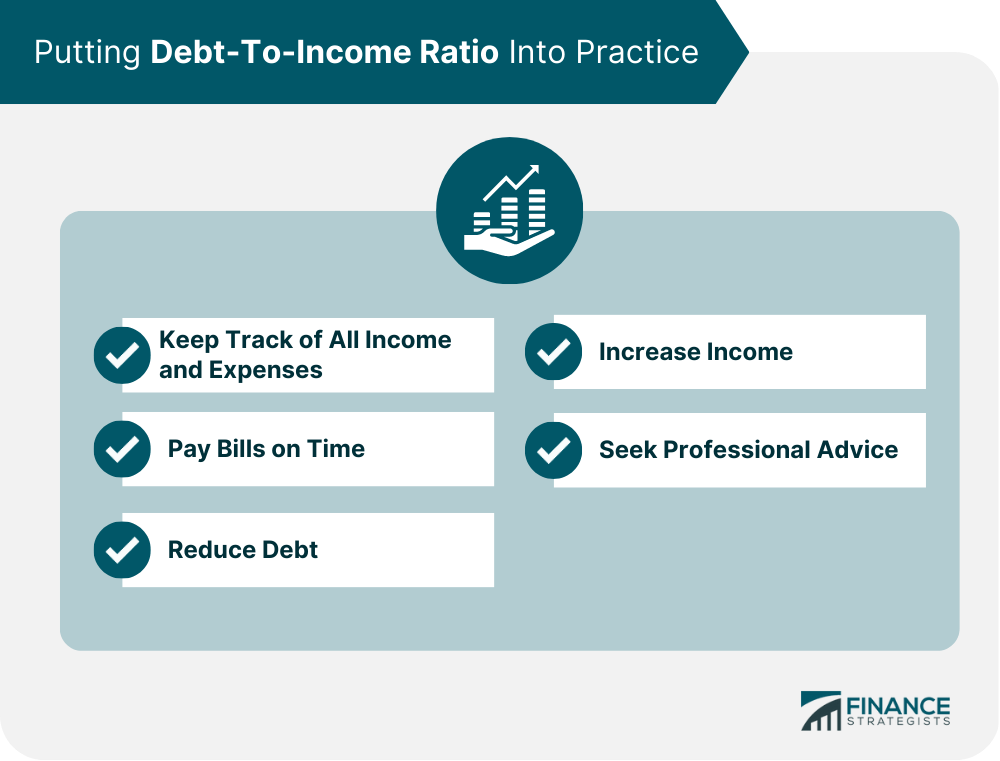

Debt-to-income ratio is a financial metric that measures the amount of debt an individual or organization has relative to their income. It is calculated by dividing the total amount of monthly debt payments by the total amount of monthly income. The resulting ratio is expressed as a percentage. Debt-to-income ratio is important in personal and business finances because it helps individuals and organizations understand their level of debt relative to their income. It provides an accurate picture of their financial situation, which can be used to make informed decisions about borrowing and spending. Debt-to-income ratio matters because it plays a crucial role in loan applications. Lenders use it to determine whether an individual or organization is capable of repaying a loan. A high debt-to-income ratio indicates a higher risk of default, which can make it difficult to obtain credit. Most lenders seek ratios of no more than 36%. Maintaining a good debt-to-income ratio is important to reducing debt and increasing income. This can be achieved through various strategies, such as paying off high-interest debt first, negotiating lower interest rates with lenders, and finding ways to increase income. Calculating the debt-to-income ratio is relatively simple. Here are the steps: Step 1. Add up all monthly debt payments, including credit card, car, and mortgage payments. Step 2. Divide the total monthly debt payments by the total monthly income. Step 3. Multiply the result by 100 to get the debt-to-income ratio as a percentage. It is essential to ensure accuracy when calculating the debt-to-income ratio. This can be achieved by double-checking all figures and including all sources of income and debt payments. Here is an example of how to calculate the debt-to-income ratio: An individual has a monthly income of $6,000 and the following monthly debt payments: Mortgage: $1,500 Car Payment: $300 Credit Card Payments: $500 Student Loan Payments: $200 The total monthly debt payments are $2,500. To calculate the debt-to-income ratio, divide $2,500 by $6,000 and multiply by 100 to get a ratio of 41.67%. A good debt-to-income ratio varies depending on the type of loan being applied for. Generally, a 36% or lower ratio is considered good, but some lenders may allow ratios up to 43% for certain types of loans. For example, a debt-to-income ratio of 43% in the mortgage industry is typically the highest ratio a borrower can have and still get qualified for a mortgage. However, lenders generally aim for ratios of no more than 36%. It is imperative to check with lenders to determine their specific requirements for debt-to-income ratio. Strategies for improving the debt-to-income ratio include reducing debt and increasing income. For example, paying off high-interest debt first can reduce the total amount of debt payments and improve the debt-to-income ratio. Finding ways to increase income, such as taking on a second job or starting a side business, can also improve the debt-to-income ratio. Maintaining a good debt-to-income ratio is crucial for personal and business finances. Here are some tips for putting the debt-to-income ratio into practice: Keep Track of All Income and Expenses. It is important to have an accurate picture of income and expenses to calculate the debt-to-income ratio accurately. Pay Bills on Time. Late payments can negatively affect credit scores, which can impact the debt-to-income ratio. Reduce Debt. Paying off high-interest debt first can reduce the total amount of debt payments and improve the debt-to-income ratio. Increase Income. Finding ways to increase income, such as taking on a second job or starting a side business, can improve the debt-to-income ratio. Seek Professional Advice. Financial advisors and accountants can provide valuable guidance on managing personal and business finances. Debt-to-income ratio is an essential financial metric that individuals and businesses must consider when managing their finances. It measures the amount of debt an individual or organization has relative to their income and provides an accurate picture of their financial situation. Debt-to-income ratio plays a crucial role in loan applications and can impact credit scores. A 36% or lower ratio is usually considered good and increases your chances for loan approval, but some lenders may allow ratios up to 43% for certain types of loans. Maintaining a good debt-to-income ratio is essential for maintaining a healthy financial situation. Individuals and businesses can improve their debt-to-income ratio and achieve their financial goals by reducing debt, increasing income, and seeking professional advice. If you need help with managing your finances or improving your debt-to-income ratio, consider seeking the advice of a financial advisor. They can provide valuable guidance on managing your finances and achieving your financial goals.What Is Debt-to-Income Ratio?

Why Debt-to-Income Ratio Matters

How to Calculate Debt-to-Income Ratio

What Is a Good Debt-to-Income Ratio?

Putting Debt-to-Income Ratio into Practice

Final Thoughts

Debt-To-Income Ratio FAQs

Debt-to-income ratio is a financial metric that measures the amount of debt an individual or organization has relative to their income.

The debt-to-income ratio is calculated by dividing the total amount of monthly debt payments by the total monthly income and multiplying the result by 100 to get a percentage.

A good debt-to-income ratio varies depending on the type of loan being applied for. Generally, a 36% or lower ratio is considered good, but some lenders may allow ratios up to 43% for certain types of loans.

You can improve your debt-to-income ratio by reducing debt and increasing income. This can be achieved through strategies such as paying off high-interest debt first, negotiating lower interest rates with lenders, and finding ways to increase income.

To maintain a good debt-to-income ratio, keeping track of income and expenses, paying bills on time, reducing debt, increasing income, and seeking professional advice from financial advisors and accountants are important.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.