Bankruptcy serves as a legal process to aid those unable to pay their debts. It provides the debtor an opportunity to start afresh while granting creditors an equal claim on the debtor's assets. Bankruptcy laws work to protect both parties involved, ensuring fair treatment and preventing misuse of the process. It is an individual's or company's last resort when their debts surpass their assets or income. Judgments are final decisions rendered by a court in a lawsuit. These legal determinations solidify the rights and obligations of the parties involved in the case. Judgments could involve an order to pay damages, imprisonment, or even a directive to perform or halt certain actions. Two primary types of judgments exist: monetary and non-monetary. In many instances, filing bankruptcy can discharge a judgment against you. However, certain types of judgments are not dischargeable in bankruptcy, and the specific circumstances surrounding the debt may also play a significant role. Whether or not a judgment is dischargeable in bankruptcy largely depends on the nature of the debt and the type of bankruptcy filed. A bankruptcy attorney can provide a clear understanding of what can be discharged in your specific case. Monetary judgments are the most common types of judgments discharged in bankruptcy. These judgments require a debtor to pay a specific amount of money to a creditor. Common examples include credit card debts, medical bills, and personal loans. However, it's crucial to note that while these judgments are generally dischargeable, specific conditions apply. For instance, if a judgment lien is attached to your property, bankruptcy might not automatically eliminate the lien. Civil judgments often result from lawsuits involving issues like personal injury or breach of contract. If a court decides in favor of the plaintiff, it can award monetary damages, leading to a civil judgment against the defendant. In many cases, civil judgments are dischargeable in bankruptcy, provided they don't involve certain situations like fraud, willful injury, or debts incurred due to wrongful conduct. Contrary to popular belief, not all tax debts are insurmountable. While it's true that tax debts are generally non-dischargeable, there are exceptions. For instance, income tax debts can be discharged if they meet certain criteria, such as the tax debt being at least three years old and the taxpayer has filed a tax return for the relevant years. Despite the variety of judgments that can be discharged in bankruptcy, some remain steadfastly resistant to discharge. These include criminal judgments, certain tax judgments, and domestic support obligations. Criminal judgments usually stem from criminal proceedings, such as fines or restitution orders. These penalties are punitive in nature and designed to deter future criminal activity. As such, bankruptcy law typically prohibits the discharge of these debts to uphold the gravity and consequence of criminal behavior. While some tax debts can be discharged in bankruptcy, others cannot. Typically, recent tax debts, trust fund taxes (like payroll taxes), and tax penalties are non-dischargeable. These types of tax judgments are considered priorities, so they must be paid in full in Chapter 13 bankruptcy and can't be discharged in Chapter 7 bankruptcy. Domestic support obligations like alimony and child support are also non-dischargeable in bankruptcy. These obligations are prioritized to ensure that the individuals who rely on these payments are protected. Despite a person's financial struggles, bankruptcy law emphasizes the importance of fulfilling these obligations. Begin by thoroughly evaluating your financial circumstances, including your income, expenses, assets, and liabilities. This assessment will help you determine if bankruptcy is the right course of action and which bankruptcy chapter may be suitable for your situation. Consult with a bankruptcy attorney to understand the different bankruptcy chapters available, such as Chapter 7 or Chapter 13. They will assess your financial situation and advise you on the most appropriate chapter based on factors such as your income, assets, and debt amount. Once you've decided on the appropriate bankruptcy chapter, you need to initiate the filing process by preparing and submitting the necessary bankruptcy forms to the bankruptcy court. These forms typically include a petition, schedules, statements of financial affairs, and any required documentation. As part of the bankruptcy filing process, it is crucial to provide notice to your creditors and the court about the judgment against you. This notification ensures that the judgment is included in the bankruptcy proceedings and allows for a comprehensive resolution. Carefully fill out all required bankruptcy forms and provide accurate and complete information regarding your financial situation, assets, debts, and judgment. Gathering supporting documentation, such as bank statements, tax returns, and proof of judgment, is essential to substantiate your claims during the bankruptcy process. Bankruptcy can discharge judgments in many cases, but it depends on various factors. The nature of the debt and the type of bankruptcy filed are key considerations. Monetary judgments, such as credit card debts and medical bills, are generally dischargeable, although certain conditions may apply, such as judgment liens on property. Civil judgments resulting from personal injury or breach of contract are usually dischargeable, except for instances involving fraud, willful injury, or wrongful conduct. Regarding tax judgments, while most tax debts are non-dischargeable, specific criteria can make some income tax debts dischargeable. However, certain judgments remain non-dischargeable, including criminal judgments, certain tax judgments, and domestic support obligations like alimony and child support. Filing bankruptcy on a judgment involves assessing your financial situation, choosing the right bankruptcy chapter, initiating the filing process, notifying creditors and the court, and completing necessary forms and documentation. Overview of Bankruptcy and Judgments

Can You File Bankruptcy on a Judgment Against You?

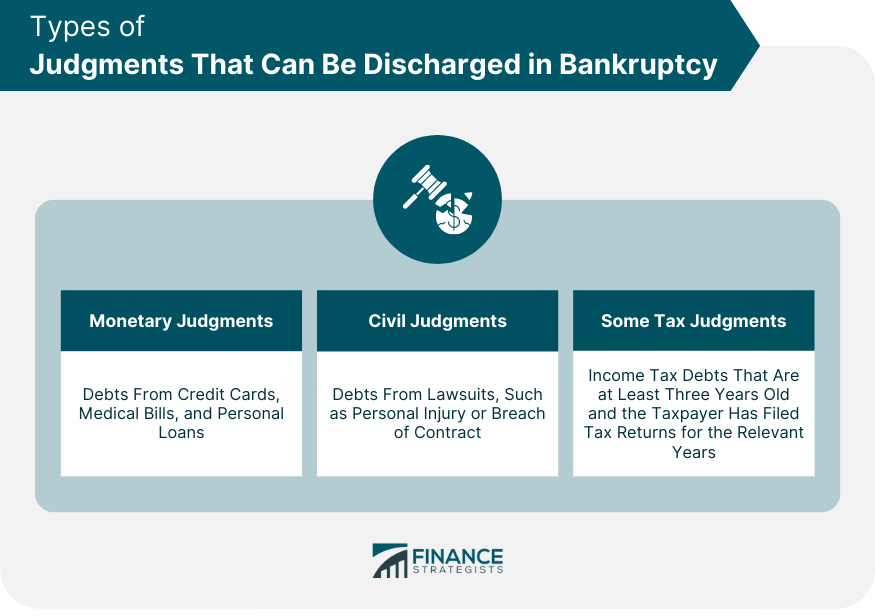

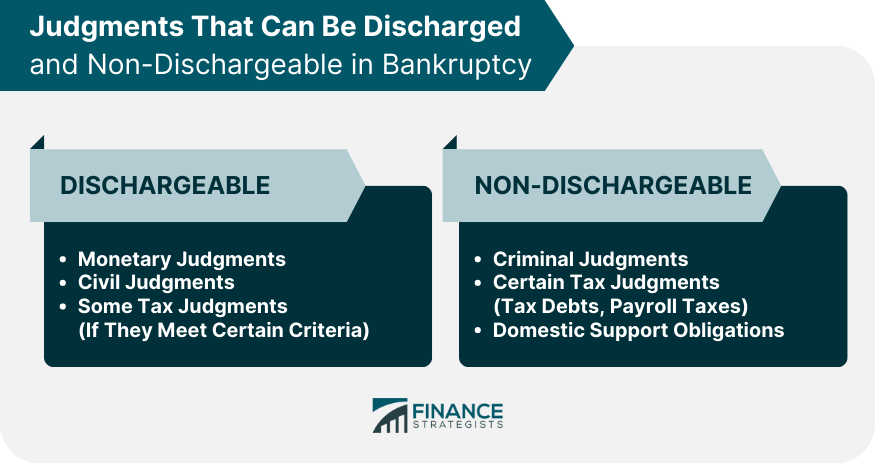

Types of Judgments That Can Be Discharged in Bankruptcy

Monetary Judgments

Civil Judgments

Some Tax Judgments

Non-Dischargeable Judgments in Bankruptcy

Criminal Judgments

Certain Tax Judgments

Domestic Support Obligations

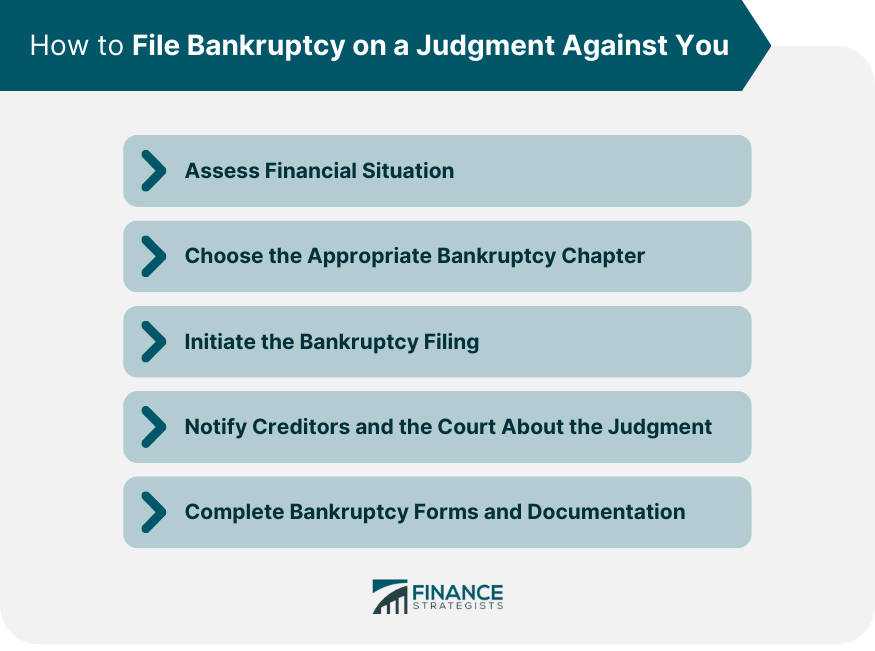

How to File Bankruptcy on a Judgment Against You

Assessing Your Financial Situation

Choosing the Appropriate Bankruptcy Chapter

Initiating the Bankruptcy Filing

Notifying Creditors and the Court about the Judgment

Completing Bankruptcy Forms and Documentation

Conclusion

Can You File Bankruptcy on a Judgement Against You? FAQs

Bankruptcy is a legal process that allows individuals or businesses unable to pay their debts to start afresh. It protects both debtors and creditors, balancing the rights of each party.

A judgment is a final decision rendered by a court in a lawsuit. It establishes the rights and obligations of the parties involved. Judgments can be monetary, requiring payment, or non-monetary, like injunctions or custody orders.

Many judgments can be discharged in bankruptcy, but it depends on the type of judgment and the specific circumstances of the debt. Some judgments, like criminal judgments and certain tax judgments, are non-dischargeable.

Factors that can affect dischargeability include the nature of the debt, the timing of the judgment, and any fraudulent or willful conduct associated with the debt.

Non-dischargeable debts typically include criminal judgments, certain tax judgments, and domestic support obligations like alimony and child support.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.