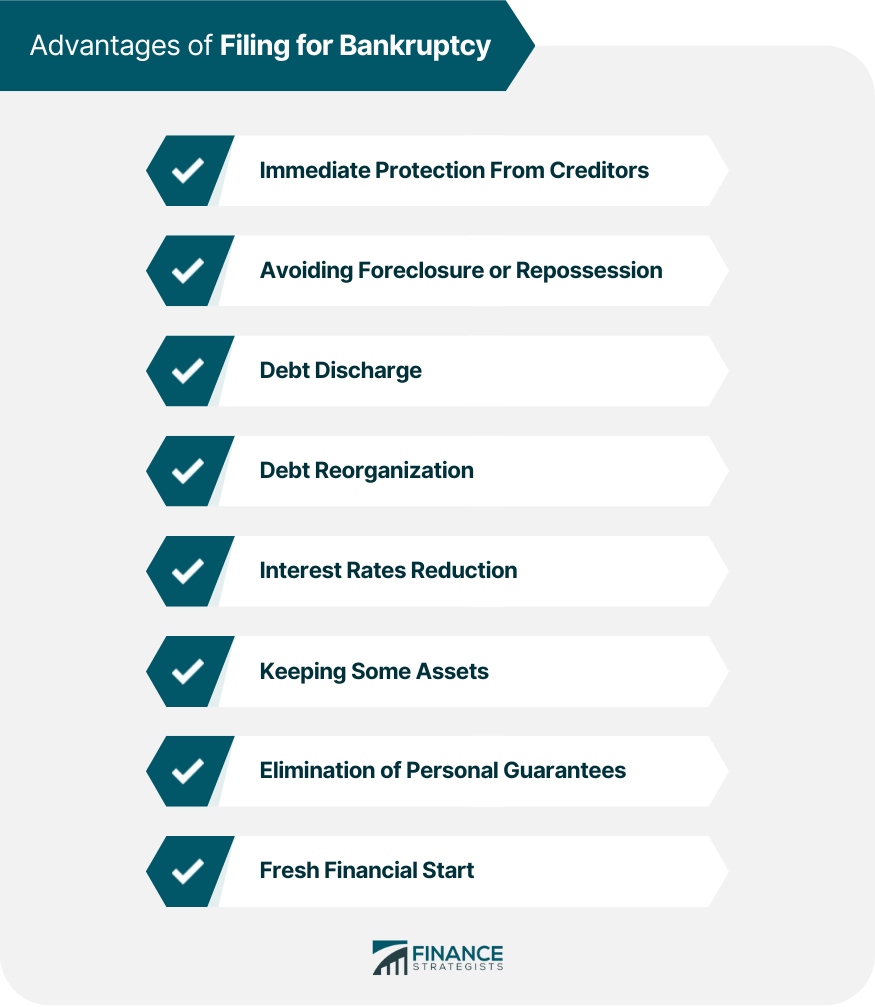

Bankruptcy is a legal process available to individuals and businesses who are struggling with debt. It is a way to eliminate or reduce liabilities and credit to get a fresh financial start. There are two primary types of bankruptcy: Chapter 7 and Chapter 13 bankruptcy. Chapter 7 bankruptcy involves liquidation or the sale of a debtor's non-exempt assets to pay off creditors. This type of bankruptcy is typically reserved for individuals with low income and few properties or other resources. Chapter 13 bankruptcy, on the other hand, is often referred to as "reorganization bankruptcy." It involves the development of a repayment plan. It is often used by individuals who have a regular income and are able to make monthly payments. Bankruptcy can help individuals avoid foreclosure or repossession of their assets and provide relief from creditor harassment. For businesses, bankruptcy can provide a way to reorganize their debts and continue operations. Note that bankruptcy is not a decision that should be taken lightly, but for those who are in a dire financial situation, it can provide significant advantages, including the following: Filing bankruptcy provides protection from creditor collection efforts promptly. As soon as a bankruptcy is filed, the automatic stay feature is triggered. It means that all collection activities, including phone calls, letters, and lawsuits, must stop. The automatic stay can also benefit debtors with a temporary reprieve from creditor harassment. Debt collection calls and letters can be stressful, overwhelming, and sometimes downright unpleasant. Once a bankruptcy petition has been filed, debtors are no longer required to communicate with their creditors directly. Instead, all communication must go through the bankruptcy court. If a creditor violates the automatic stay, they can be subject to legal penalties. This benefit is a direct consequence of the automatic stay feature associated with filing bankruptcy. Foreclosure is a creditor collection method covered by the stay. This legal process of lenders taking possession of a property when a borrower defaults is hindered by filing bankruptcy. Repossession is the legal process by which a lender takes possession of a vehicle when the borrower fails to make their car payments. The automatic stay typically prohibits creditors from enacting this legal process. In Chapter 7 bankruptcy, secured creditors may seek relief from the automatic stay to continue with foreclosure or repossession proceedings. However, debtors may be able to negotiate a payment plan with the creditor to catch up on missed payments, instead. In Chapter 13 bankruptcy, debtors have the opportunity to catch up on missed payments over time. As long as the debtor is able to comply with the plan terms, they can avert foreclosure or repossession. The amount of missed payments, the value of the property, and the type of bankruptcy filed will impact whether foreclosure or repossession can be avoided. The elimination of a debtor’s obligation to pay back certain types of debt is one of the most significant advantages of filing bankruptcy. It is essential to remember that the type of debt that can be discharged depends on the type of bankruptcy filed. In Chapter 7 bankruptcy, most unsecured debts can be discharged. Unsecured debts are those that are not backed by collateral, such as credit card debt, medical bills, and personal loans. In Chapter 13 bankruptcy, a repayment plan is developed that allows an individual to pay off their debts over time. The repayment plan typically lasts between three and five years. At the end of the repayment plan, any remaining unsecured debt may be discharged. The discharge of debt can provide significant relief to debtors who are struggling with overwhelming debt. It can eliminate the burden of unmanageable debt and help debtors avoid wage garnishment, bank account levies, and other collection activities by creditors. Note that not all debts can be discharged in bankruptcy. Debts such as child support, alimony, and some types of tax debts cannot be discharged in bankruptcy. It allows debtors to develop a repayment plan that allows them to pay off their debts over time. Reorganization of debt is associated with Chapter 13 bankruptcy, where an individual develops a repayment plan structured to eliminate debt within three to five years. The repayment plan is based on the debtor's disposable income or the amount of money left over after necessary expenses are paid. The debtor makes monthly payments to the bankruptcy court, which distributes the payment to the individual’s creditors. Debt reorganization can include mortgages, car loans, credit card debt, and medical bills. The repayment plan can also include debts that cannot be discharged in Chapter 7 bankruptcy, such as certain tax debts and student loans. Reorganization allows debtors to catch up on missed amortizations under the repayment plan, which can also have a positive impact on their credit score. By making regular payments under the plan, they can demonstrate to creditors that they are committed to repaying their debts. Decreased interest rates are a benefit that is gained particularly in relation to secured debts such as mortgages and car loans. When a debtor files for bankruptcy, they may be able to negotiate a reduction in the interest rate on their secured debts, especially for debts that are in arrears or in default. Creditors may be willing to reduce the interest rate in order to avoid foreclosure or repossession of the collateral. In Chapter 13 bankruptcy, interest rate reduction may be included in the repayment plan. By complying with the terms of the plan, debtors demonstrate their commitment to repaying their debts. Creditors may be willing to reduce interest rates to facilitate debt repayment. Interest rate reduction can provide significant savings over time. For example, reducing the interest rate on a mortgage from 6% to 4% can result in thousands of dollars in savings over the life of the loan. It is critical to note that interest rate reduction is not guaranteed in bankruptcy. Creditors are not required to reduce the interest rate, and some may be unwilling to do so. Contrary to popular belief, bankruptcy does not necessarily mean that a debtor will lose all of their assets. It will depend on the type of bankruptcy filed and the particulars of a case. In Chapter 7 bankruptcy, assets are liquidated to pay off the debtor's creditors. However, certain assets are protected by law and cannot be seized by creditors. The types and amounts of exempt assets vary by state, but they typically include necessities such as clothing, household furnishings, and personal items. Some states also allow debtors to exempt equity in their homes, a vehicle, and retirement accounts. In Chapter 13 bankruptcy, debtors are not required to liquidate their assets but develop a repayment plan. As long as the individual is able to make their monthly payments under the plan, they can keep their assets. The ability to keep some assets in bankruptcy can provide debtors with peace of mind and a sense of stability. For example, being able to keep a vehicle can help debtors maintain their income by having transportation to work. Like interest rate reduction, the ability to keep assets in bankruptcy is not guaranteed. The specific circumstances of the case, including the type and value of the assets, will impact whether the assets can be kept. This advantage is particularly applicable to small business owners or entrepreneurs. Personal guarantees are a common requirement for small business loans, leases, and other financial transactions. They require the borrower to be personally liable for the debt, in addition to the business itself. When a small business owner files for bankruptcy, they may be able to waive their personal guarantees, meaning that they are no longer individually liable for the debt. It can help small business owners relieve the burden of unmanageable debt and focus on rebuilding their businesses. Elimination of personal guarantees can also help small business owners avoid personal bankruptcy. However, not all personal guarantees can be canceled in bankruptcy. For example, personal guarantees for tax debts or fraudulent activity may not be dischargeable. Bankruptcy can also significantly reduce a debtor's credit score, making it more difficult to obtain credit in the future. Filing for bankruptcy can provide a fresh financial start in several ways. Since bankruptcy can help eliminate or reduce debts, it can save individuals from the burden of unmanageable debt and free up income for other expenses. When debts are discharged or restructured, debtors may be able to catch up on missed payments and regain financial stability. Bankruptcy can help individuals prioritize their expenses and create a budget to manage their finances more effectively. Debtors can work with their bankruptcy attorney to develop a repayment plan that is tailored to their individual circumstances and income level. It significantly reduces the likelihood of falling into financial distress in the future. Furthermore, bankruptcy can provide debtors with a fresh start by getting rid of the stress and anxiety associated with overwhelming debt. Individuals can then focus on rebuilding their credit scores and improving their financial situation. A fresh start ultimately helps debtors regain control of their finances and achieve long-term financial success. Filing for bankruptcy is a significant decision that should not be taken lightly. However, for those who are in dire financial situations, it may be the only option. The advantages of filing for bankruptcy include immediate protection from creditors, debt discharge, debt reorganization, interest rate reduction, the ability to keep some assets, avoiding foreclosure or repossession, elimination of personal guarantees, and a fresh financial start. It is important to note that not all types of debt can be discharged in bankruptcy, and not all personal guarantees can be waived. Moreover, filing for bankruptcy can negatively impact a debtor's credit score, which may make it more difficult to obtain credit in the future. Nonetheless, with careful budgeting and responsible financial management, debtors can rebuild their credit score and regain their financial footing. Seek guidance from an experienced bankruptcy attorney or financial advisor. These experts can help you understand your options and determine if bankruptcy is the right choice for you. Remember that bankruptcy is not a magic solution, but it can provide considerable relief for those who are struggling with overwhelming debt.Overview of Filing for Bankruptcy

Immediate Protection From Creditors

Avoiding Foreclosure or Repossession

Debt Discharge

Debt Reorganization

Interest Rates Reduction

Keeping Some Assets

Elimination of Personal Guarantees

Fresh Financial Start

Final Thoughts

What Are the Advantages of Filing for Bankruptcy? FAQs

Filing for bankruptcy is a legal process designed to help individuals and businesses eliminate or reduce their debts and get a fresh financial start.

When a debtor files for bankruptcy, an automatic stay is put in place that provides immediate protection from creditor collection efforts, including phone calls, letters, and lawsuits. The debtor is no longer required to communicate with creditors directly, and any violation of the automatic stay can lead to legal penalties.

It depends on the type of bankruptcy filed. In Chapter 7 bankruptcy, most unsecured debts, such as credit card debt and medical bills, can be discharged. In Chapter 13 bankruptcy, a repayment plan is developed, and any remaining unsecured debt may be discharged at the end of the plan.

Filing for bankruptcy can help eliminate or reduce debt, free up income for other expenses, and allow debtors to develop a repayment plan that is tailored to their individual circumstances and income level. It can also help debtors prioritize their expenses, create a budget, and rebuild their credit score over time.

Yes, filing for bankruptcy can help individuals avoid foreclosure or repossession of their assets through the automatic stay, which prohibits creditors from enacting this legal process. In Chapter 13 bankruptcy, debtors have the opportunity to catch up on missed payments over time, allowing them to avert such creditor action.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.