Bankruptcy is a legal process designed to help individuals and businesses who are struggling with overwhelming debt. It is a powerful tool that can provide a fresh start and relief from creditors, but it also has some downsides that should be carefully considered before deciding to file. This article will explore the various downsides of filing for bankruptcy, including the financial and non-financial consequences. We will also discuss alternatives to bankruptcy that may be worth considering. Bankruptcy is not without its downsides. In addition to the costs associated with filing for bankruptcy, a number of other financial repercussions come with the decision. One of the most significant downsides of filing for bankruptcy is its negative impact on an individual's credit score and credit report. When you file for bankruptcy, it stays on your credit report for up to 10 years. This can make it difficult to obtain credit or loans in the future. Bankruptcy can also make getting approved for a mortgage or renting an apartment challenging. Additionally, filing for bankruptcy can affect your credit score, which lenders use to determine your creditworthiness. A bankruptcy stays on your credit report for up to 10 years. However, the impact on your credit score can diminish over time. According to Experian, one of the three major credit bureaus, "the impact of bankruptcy on your credit score will likely lessen over time, especially if you take steps to build positive credit history after filing." This means that although bankruptcy can have a long-term impact on your credit, it is possible to recover over time. Aside from the effects on your credit score and report, bankruptcy can make it harder to get credit or loans in the future. Lenders and creditors are typically hesitant to lend money to individuals who have filed for bankruptcy, considering them a higher risk. This can make obtaining a credit card, auto loan, or mortgage challenging. If you are approved for credit, you may be required to pay higher interest rates or provide a larger down payment to offset the increased risk to the lender. Another significant downside of filing for bankruptcy is the potential loss of property and assets. When you file for bankruptcy, your assets are divided into exempt and non-exempt. Exempt assets are protected by law and cannot be seized by creditors, while non-exempt assets can be sold to repay your debts. The exemptions vary by state. Still, they typically include items such as a certain amount of equity in your home, a car, and personal belongings such as clothing, furniture, and appliances. Non-exempt assets include investments, second homes, and luxury items like jewelry or artwork. One of the drawbacks of filing for bankruptcy is the expenses and charges associated with the process. These expenses may include filing fees, attorney fees, and other administrative costs, which can quickly add up. It is important to be aware of all the fees and expenses associated with bankruptcy before proceeding with the filing. In addition to the financial consequences of filing for bankruptcy, non-financial downsides should be considered. One of the most significant is the social stigma associated with bankruptcy. Many feel ashamed or embarrassed to admit they have filed for bankruptcy, which can affect personal relationships and employment opportunities. Filing for bankruptcy can be a stressful and emotional experience and strain personal relationships. Friends and family members may not understand why you filed for bankruptcy or may view you differently. Communicate openly and honestly with your loved ones about your financial situation and why you filed for bankruptcy. Another non-financial downside of filing for bankruptcy is the potential impact on employment opportunities. While bankruptcy cannot legally be used to deny someone a job, some employers may view it negatively. This is particularly true for positions that require handling money or financial responsibilities. It is important to be upfront and honest with potential employers about your financial situation and to explain the circumstances that led to your bankruptcy. Filing for bankruptcy can also significantly impact your mental and emotional well-being. It can be a stressful and emotional experience, and it can be challenging to cope with the loss of property and assets. Taking care of your mental health and seeking support from loved ones or a mental health professional if needed is important. Many people experience stress and anxiety related to filing for bankruptcy. They may worry about the impact on their credit score and financial future or feel overwhelmed by the process. It is important to manage stress and anxiety, such as practicing relaxation techniques or seeking professional help. Several coping strategies can help deal with the emotional impact of bankruptcy. These include seeking support from loved ones, practicing self-care, and focusing on the positive aspects of your life. It is important to remember that bankruptcy is a tool to help you get back on your feet financially and is not a reflection of your worth. While bankruptcy can help manage overwhelming debt, it is not always the best option. Here are some other options to consider. Several alternatives to bankruptcy may be worth considering, including debt consolidation, negotiating with creditors, and seeking financial counseling. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can make managing your debts easier and save you money in interest charges. Several ways to consolidate debt include taking out a personal loan or using a balance transfer credit card. Debt consolidation can be a helpful tool for managing overwhelming debt. However, weighing the pros and cons before pursuing this option is essential. However, it can also extend the time it takes to repay your debts and may result in paying more interest charges over the long term. Here are some things to consider when dealing with your creditors: Negotiating with creditors involves contacting your creditors and asking for a repayment plan or a reduction in the amount you owe. This can be a valuable tool for individuals struggling to make payments but who want to avoid filing for bankruptcy. It is important to approach negotiations with a clear understanding of your financial situation and to be willing to compromise. The main advantage of negotiating with creditors is that it can help you avoid bankruptcy and potentially reduce the amount you owe. However, it can be challenging to deal with creditors, and there is no guarantee that they will agree to a repayment plan or reduction in the amount owed. Negotiating with creditors can be time-consuming and may require professional assistance. Financial counseling is a type of counseling that focuses on helping individuals and families improve their financial well-being. Financial counseling aims to help individuals develop the knowledge, skills, and confidence they need to make informed financial decisions and achieve their financial goals. It involves working with a trained professional who can provide guidance and advice on various financial topics, such as budgeting, saving, investing, debt management, credit repair, and financial planning for the future. The main benefits of financial counseling are that it can help you better understand your financial situation, develop a plan for managing your debts, and improve your financial literacy. Financial counseling can also help you avoid bankruptcy by providing alternative strategies for managing your debts. Filing for bankruptcy is a major decision that should not be taken lightly. While it can provide relief from overwhelming debt, it also has several downsides that should be carefully considered before deciding to file. These include the negative impact on your credit score and report, the potential loss of property and assets, and the fees and costs associated with the process. Additionally, there are several non-financial downsides, such as the social stigma associated with bankruptcy and the potential impact on mental health and emotional well-being. Some alternatives to bankruptcy may be worth considering, including debt consolidation, negotiating with creditors, and seeking financial counseling. These options can help you manage your debts and avoid bankruptcy while minimizing the downsides associated with the process. It is important to carefully consider all options before filing for bankruptcy. Seeking the help of a financial advisor can guide the best approach to managing overwhelming debt. A financial advisor can help create a plan for managing debts, guide budgeting, and explore alternative strategies. With the right support and guidance, it is possible to regain control of finances and achieve a brighter financial future. One of the biggest downsides of filing for bankruptcy in the UK is that you will lose any nonexempt assets to pay back your creditors. You may be able to exempt some of your possessions, but there is substantial risk of losing something important like your home or vehicle.What Is Bankruptcy?

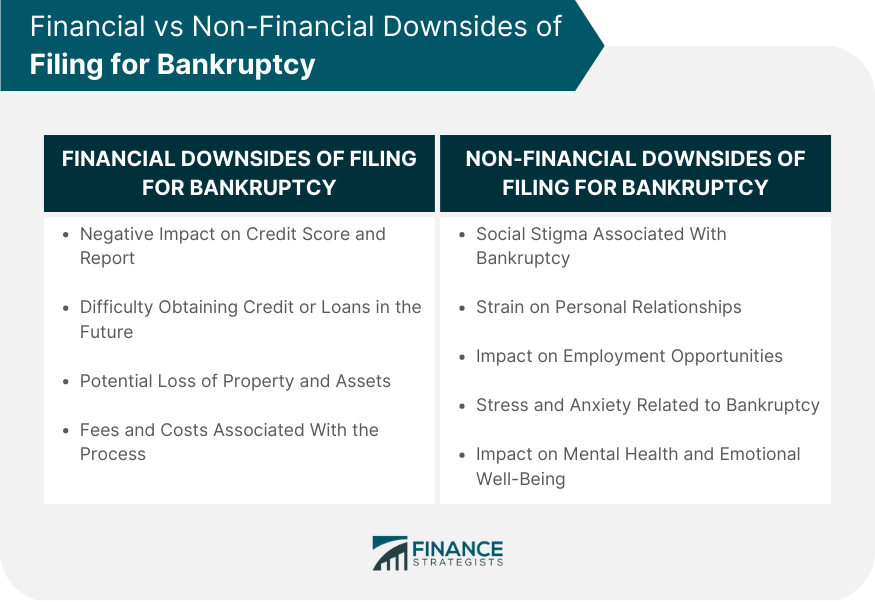

Financial Downsides of Filing for Bankruptcy

Negative Impact on Credit Score and Credit Report

How Long Bankruptcy Stays on a Credit Report

Effects of Bankruptcy on Obtaining Credit

Loss of Property and Assets

Exemptions and Non-exempt Property in Bankruptcy

Bankruptcy Fees and Costs

Non-Financial Downsides of Filing for Bankruptcy

Social Stigma Associated With Bankruptcy

How Bankruptcy Affects Personal Relationships

How Bankruptcy Affects Employment Opportunities

Impact on Mental Health and Emotional Well-Being

Stress and Anxiety Related to Bankruptcy

Coping Strategies for Dealing With the Emotional Impact of Bankruptcy

Alternatives to Filing for Bankruptcy

Debt Consolidation and Debt Management

How Debt Consolidation Works

Pros and Cons of Debt Consolidation

The main advantages of debt consolidation are that it can simplify your finances, lower your interest rates, and reduce your monthly payments. Negotiating With Creditors

How to Negotiate With Creditors

Pros and Cons of Negotiating With Creditors

Seeking Financial Counseling

How Financial Counseling Works

Benefits of Financial Counseling

Conclusion

Downsides of Filing for Bankruptcy FAQs

The downsides of filing for bankruptcy include negative impacts on credit score and report, potential loss of property and assets, and fees and costs associated with the process. Additionally, there are non-financial downsides, such as social stigma and the impact on mental health.

While bankruptcy cannot legally be used to deny someone a job, some employers may view it negatively. This is particularly true for positions that require handling money or financial responsibilities.

Yes, alternatives to bankruptcy include debt consolidation, negotiating with creditors, and seeking financial counseling.

Bankruptcy stays on a credit report for up to 10 years.

Yes, it is important to seek professional advice before deciding to file for bankruptcy. A financial advisor can guide the best approach to managing overwhelming debt and explore alternative, more appropriate strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.