Marital deduction trusts are estate planning tools that allow married couples to minimize or defer estate taxes when transferring assets to their spouse. These trusts are designed to take advantage of the unlimited marital deduction provided by the Internal Revenue Service (IRS), which permits one spouse to transfer an unlimited amount of assets to the other spouse free of federal estate taxes. The primary purpose of marital deduction trusts is to protect the assets of the surviving spouse and provide financial security. They offer several benefits, such as preserving the estate tax exemption, deferring estate taxes, and ensuring that the assets are managed and distributed according to the couple's wishes. Although the marital deduction defers estate taxes, it doesn't eliminate them entirely. When the surviving spouse passes away, the remaining assets in the trust are subject to estate taxes based on their total value at that time. In order to establish a marital deduction trust, the spouses must be legally married and considered spouses under federal tax law. This includes both opposite-sex and same-sex couples who are legally married under state law. For a trust to qualify for the marital deduction, it must meet specific criteria set forth by the IRS. These include the surviving spouse being a U.S. citizen and the property being transferred to the trust being considered "qualified terminable interest property." As of 2024, the federal estate tax exemption is $13.61 million per individual. This exemption can be adjusted for inflation, and any changes in the exemption amount should be taken into consideration when establishing a marital deduction trust. A QTIP Trust is designed to provide income and financial security to the surviving spouse while preserving the assets for the eventual transfer to the couple's beneficiaries. This type of trust qualifies for the marital deduction, ensuring that the assets are not subject to federal estate taxes upon the first spouse's death. To establish a QTIP Trust, the trust must meet specific criteria, including providing the surviving spouse with a lifetime income interest in the trust property and ensuring that no one else has the power to appoint the property during the surviving spouse's lifetime. The primary advantage of a QTIP Trust is the deferral of estate taxes until the death of the surviving spouse. However, one disadvantage is that the surviving spouse has limited access to the trust principal and cannot change the ultimate beneficiaries of the trust. An AB Trust, also known as a credit shelter trust, is a trust structure that splits the assets of a married couple into two separate trusts: Trust A (the marital trust) and Trust B (the bypass trust). This structure allows the couple to utilize both spouses' estate tax exemptions and minimize or eliminate federal estate taxes. For an AB Trust to function, the couple's assets must be divided between the two trusts, with Trust A typically holding assets up to the federal estate tax exemption amount and Trust B holding the remaining assets. The primary advantage of an AB Trust is the ability to fully utilize both spouses' estate tax exemptions. However, the disadvantages include the complexity of the trust structure and the potential limitation of the surviving spouse's access to the assets in Trust B. A Marital Disclaimer Trust is a flexible estate planning tool that allows the surviving spouse to disclaim or refuse a portion of the deceased spouse's estate, thereby transferring the disclaimed assets into a trust. This trust is designed to provide financial security for the surviving spouse while maximizing the use of the couple's estate tax exemptions. To establish a Marital Disclaimer Trust, the surviving spouse must make a valid disclaimer within nine months of the deceased spouse's death. The disclaimer must be irrevocable and must comply with specific legal requirements. The primary advantage of a Marital Disclaimer Trust is its flexibility, allowing the surviving spouse to decide whether or not to use the trust after the first spouse's death. This can be particularly beneficial in situations where the estate tax laws or the couple's financial circumstances change. However, the primary disadvantage is that the surviving spouse must make the disclaimer decision within a limited time frame, which may be challenging during a period of grief. Proper estate planning is essential to ensure the efficient transfer of assets, minimize taxes, and provide financial security for loved ones. Marital deduction trusts play a significant role in estate planning for married couples and can help protect the surviving spouse and the couple's beneficiaries. Marital deduction trusts serve as a critical component in estate planning by allowing couples to minimize or defer estate taxes and ensure that their assets are managed and distributed according to their wishes. Marital deduction trusts can be integrated with other estate planning tools, such as wills, powers of attorney, and advanced healthcare directives, to create a comprehensive estate plan tailored to the couple's unique needs and goals. Marital deduction trusts offer significant federal estate tax benefits by allowing the unlimited transfer of assets between spouses without incurring estate taxes. Additionally, these trusts help couples maximize the use of their federal estate tax exemptions. State estate tax laws vary, and it is essential to consider the specific laws of your state when establishing a marital deduction trust. Some states may offer additional benefits or impose different requirements on trusts. While marital deduction trusts can provide estate tax benefits, they may also have income tax implications. It is essential to consult with a tax professional to understand the potential income tax consequences of establishing a marital deduction trust. Marital deduction trusts can be complex to set up and may require the assistance of an estate planning attorney. The costs associated with establishing and administering the trust should be taken into consideration. Depending on the type of marital deduction trust chosen, the surviving spouse or other beneficiaries may have limited access to the trust's assets. It is essential to weigh the benefits of tax savings against potential limitations on asset access. Estate tax portability, which allows a surviving spouse to utilize the unused portion of their deceased spouse's estate tax exemption, may provide an alternative to marital deduction trusts in some situations. Couples should carefully consider their options and consult with an estate planning professional. Each couple's needs and goals are unique, and it is essential to carefully consider your specific situation when choosing a marital deduction trust. Factors to consider include the size of your estate, the age and health of both spouses and your desired level of control over the assets. To ensure that you choose the right marital deduction trust, consult with an estate planning attorney, tax professional, and financial advisor. These professionals can help you navigate the complexities of estate planning and ensure that your trust aligns with your needs and goals. Circumstances can change over time, making it essential to periodically review and update your marital deduction trust. Changes in estate tax laws, family dynamics, or financial situations may necessitate modifications to your trust. Marital deduction trusts are valuable estate planning tools that can help married couples minimize or defer estate taxes while providing financial security for the surviving spouse and their beneficiaries. These trusts come in various forms, including QTIP Trusts, AB Trusts, and Marital Disclaimer Trusts, each offering distinct advantages and disadvantages. Proper estate planning is essential to ensure the efficient transfer of assets, minimize taxes, and provide financial security for loved ones. Marital deduction trusts play a significant role in estate planning for married couples, and their benefits should be carefully considered. If you are considering a marital deduction trust as part of your estate plan, it is crucial to assess your individual needs and goals, consult with professionals, and periodically review and update your trust. By doing so, you can help ensure that your trust serves its intended purpose and provides lasting benefits for your spouse and beneficiaries.Definition of Marital Deduction Trusts

Eligibility and Requirements of Marital Deduction Trusts

Eligible Spouses

Requirements for Marital Deduction

Federal Estate Tax Exemption

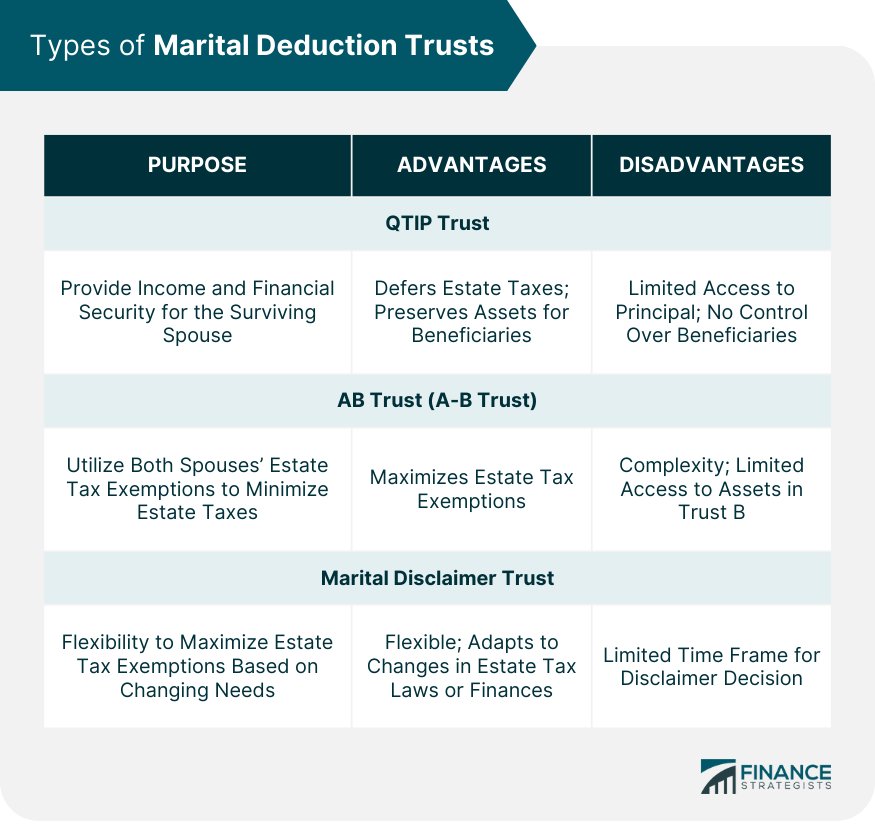

Types of Marital Deduction Trusts

QTIP Trust (Qualified Terminable Interest Property Trust)

Requirements

Advantages and Disadvantages

AB Trust (A-B Trust)

Requirements

Advantages and Disadvantages

Marital Disclaimer Trust

Requirements

Advantages and Disadvantages

Estate Planning Considerations in Marital Deduction Trusts

Importance of Proper Estate Planning

Role of Marital Deduction Trusts in Estate Planning

Integrating Marital Deduction Trusts With Other Estate Planning Tools

Tax Implications of Marital Deduction Trusts

Federal Estate Tax Benefits

State Estate Tax Considerations

Income Tax Considerations

Potential Drawbacks and Limitations of Marital Deduction Trusts

Complexities and Costs of Establishing Trusts

Possible Limitations on Beneficiaries' Access to Assets

Estate Tax Portability Considerations

Choosing the Right Marital Deduction Trusts

Assessing Individual Needs and Goals

Consulting With Professionals

Periodically Reviewing and Updating Trusts

Conclusion

Marital Deduction Trusts FAQs

Marital deduction trusts are estate planning tools that enable married couples to minimize or defer estate taxes when transferring assets to their spouse. They are important because they provide financial security for the surviving spouse, ensure efficient asset management, and help maximize estate tax exemptions.

The three main types of marital deduction trusts are QTIP Trusts, AB Trusts, and Marital Disclaimer Trusts. QTIP Trusts provide the surviving spouse with a lifetime income interest while preserving assets for beneficiaries. AB Trusts divide the couple's assets into two separate trusts, allowing both spouses to utilize their estate tax exemptions. Marital Disclaimer Trusts offer flexibility by allowing the surviving spouse to disclaim a portion of the deceased spouse's estate, which then transfers to a trust.

To establish a marital deduction trust, the spouses must be legally married and considered spouses under federal tax law. Additionally, the trust must meet specific IRS criteria, such as the surviving spouse being a U.S. citizen and the property being transferred to the trust being considered "qualified terminable interest property."

Marital deduction trusts allow couples to take advantage of the unlimited marital deduction, permitting the transfer of assets between spouses without incurring federal estate taxes. They also help couples maximize their estate tax exemptions. However, these trusts may have income tax implications, so it is essential to consult with a tax professional to understand the potential income tax consequences.

To choose the right marital deduction trust, carefully assess your individual needs and goals, such as the size of your estate, the age and health of both spouses and your desired level of control over the assets. It is also crucial to consult with estate planning professionals, such as an attorney, tax professional, and financial advisor, to help you navigate the complexities of estate planning and select the trust that best aligns with your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.