A marital trust is a legal instrument designed to provide for a surviving spouse after the death of the other spouse. It is a type of trust that allows assets to pass from one spouse to another without incurring estate taxes. Have questions about Marital Trusts? Click here.

There are several types of marital trusts available, each with its own unique benefits and considerations. A QTIP trust is a type of marital trust that allows the surviving spouse to receive the income generated by the trust assets during their lifetime. The trust assets are eventually passed on to the designated beneficiaries, often children or grandchildren. This type of trust is often used when one spouse has children from a previous marriage and wants to ensure that they are taken care of after the surviving spouse's death. An A/B trust, also known as a bypass trust, is designed to help married couples minimize estate taxes. It involves dividing the couple's assets into two trusts, with the first trust holding the maximum amount of assets that can pass tax-free, and the second trust holding the remaining assets. When the first spouse dies, the assets held in the first trust pass tax-free to the designated beneficiaries, often children or grandchildren. The assets held in the second trust are then used to provide for the surviving spouse. A charitable remainder trust is a type of trust that allows the donor to receive the income generated by the trust assets during their lifetime. After the donor's death, the assets held in trust are donated to a designated charity. This type of trust can provide significant tax benefits, including a reduction in income and estate taxes. An ILIT is a type of trust that allows the policy owner to transfer ownership of their life insurance policy to the trust. When the policy owner dies, the trust receives the death benefit, which is then used to provide for the surviving spouse and other designated beneficiaries. This type of trust can provide significant tax benefits, including a reduction in estate taxes. When creating a marital trust, it is important to choose a trustee, fund the trust, establish the terms and conditions, and consider estate planning issues. One of the first steps in creating a marital trust is choosing a trustee. The trustee is responsible for managing the trust assets and distributing them according to the terms of the trust. It is essential to choose a trustee who is knowledgeable, trustworthy, and able to carry out the duties of the position. Once a trustee has been chosen, the next step in creating a marital trust is funding the trust. This involves transferring assets, such as property, investments, and life insurance policies, into the trust. The couple must ensure that the assets are titled in the name of the trust, rather than in their individual names. The couple must also establish the terms and conditions of the trust. This includes specifying how the trust assets will be used to provide for the surviving spouse, when and how the assets will be distributed to the designated beneficiaries and any other provisions that the couple wishes to include. When creating a marital trust, it is essential to consider estate planning issues, such as the couple's overall estate plan, their tax situation, and any potential complications that may arise in the future. It is essential to work with an experienced estate planning attorney to ensure that the marital trust is properly structured and meets the couple's needs. The administration of a marital trust involves several important duties, including managing the trust assets, complying with tax laws and regulations, distributing assets to beneficiaries, and keeping accurate records. The trustee of a marital trust has several important duties, including managing the trust assets, ensuring that the assets are invested prudently, and distributing income and principal to the surviving spouse and designated beneficiaries. The trustee must also keep accurate records and provide regular reports to the beneficiaries. Marital trusts are subject to various tax laws and regulations. The trustee must ensure that the trust complies with these laws and regulations, including filing tax returns and paying any taxes owed. It is essential to work with a tax professional to ensure that the trust is properly structured and to minimize tax liabilities. The distribution of trust assets is governed by the terms of the trust. The trustee must follow these terms and distribute assets in accordance with the couple's wishes. It is important to ensure that the distribution of assets is fair and equitable and that the surviving spouse and designated beneficiaries receive the support they need. The trustee of a marital trust must keep accurate records of all trust transactions, including income, expenses, and distributions. They must also provide regular reports to the beneficiaries and keep the trust's financial records up to date. It is essential to keep thorough records to ensure that the trust is properly managed and to minimize the risk of legal disputes. Marital trusts offer significant advantages to married couples, including asset preservation, tax benefits, and provisions for the surviving spouse. Marital trusts can help preserve assets for future generations. When the surviving spouse dies, the assets held in trust are passed on to the designated beneficiaries, often children or grandchildren. By establishing a marital trust, the couple can ensure that their assets are protected and not wasted or misused. A marital trust can provide significant tax benefits. Because the trust is designed to benefit the surviving spouse, the assets held in the trust are not subject to estate taxes when the first spouse dies. Instead, they are only taxed when the surviving spouse dies, allowing the couple to defer estate taxes until the second death. One of the primary benefits of a marital trust is that it provides for the surviving spouse. The assets held in trust can be used to provide for the surviving spouse's needs, including housing, medical expenses, and other costs of living. The surviving spouse can also receive the income generated by the trust assets, ensuring financial security after the death of the other spouse. Marital trusts can also help avoid probate, the legal process of settling an estate. Because the assets held in trust are not part of the deceased spouse's estate, they do not need to go through probate. This can save time, and money, and reduce the risk of legal disputes. Marital trusts also come with risk, including restrictions on the use of trust assets, potential conflicts among beneficiaries, changing legal and tax landscapes, and trustee liability. Marital trusts often come with restrictions on the use of trust assets. The surviving spouse may not be able to access the assets held in the trust directly and may only receive the income generated by the assets. This can limit the flexibility of the surviving spouse and may require careful planning to ensure that they have the resources they need. Marital trusts can also lead to conflicts among beneficiaries. Children or other designated beneficiaries may feel that the surviving spouse is receiving too much of the trust assets or that the distribution of assets is unfair. It is essential to communicate clearly with all beneficiaries and to ensure that the terms of the trust are fair and equitable. The legal and tax landscape surrounding marital trusts can change over time. This can result in unexpected tax liabilities or legal complications. It is important to work with an experienced estate planning attorney and tax professional to ensure that the trust is properly structured and to address any changes in the legal or tax landscape. The trustee of a marital trust has significant responsibilities and can be held liable for any mistakes or wrongdoing. It is important to choose a trustee who is knowledgeable, trustworthy, and able to carry out the duties of the position. The trustee must also ensure that they comply with all legal and regulatory requirements and act in the best interests of the beneficiaries. Marital trusts can provide significant benefits for married couples, such as preserving assets, tax advantages, and provisions for the surviving spouse. There are various types of marital trusts available, each with its own unique advantages and considerations. When creating a marital trust, it is crucial to choose a trustee, fund the trust, establish the terms and conditions, and consider estate planning issues. The administration of a marital trust involves several significant duties, such as managing trust assets, complying with tax laws and regulations, distributing assets to beneficiaries, and keeping accurate records. However, marital trusts also have risks, such as restrictions on the use of trust assets, potential conflicts among beneficiaries, changing legal and tax landscapes, and trustee liability. Therefore, it is essential to work with experienced professionals, including an estate planning attorney and tax professional, to ensure that the marital trust is adequately structured and meets the couple's needs. What Is a Marital Trust?

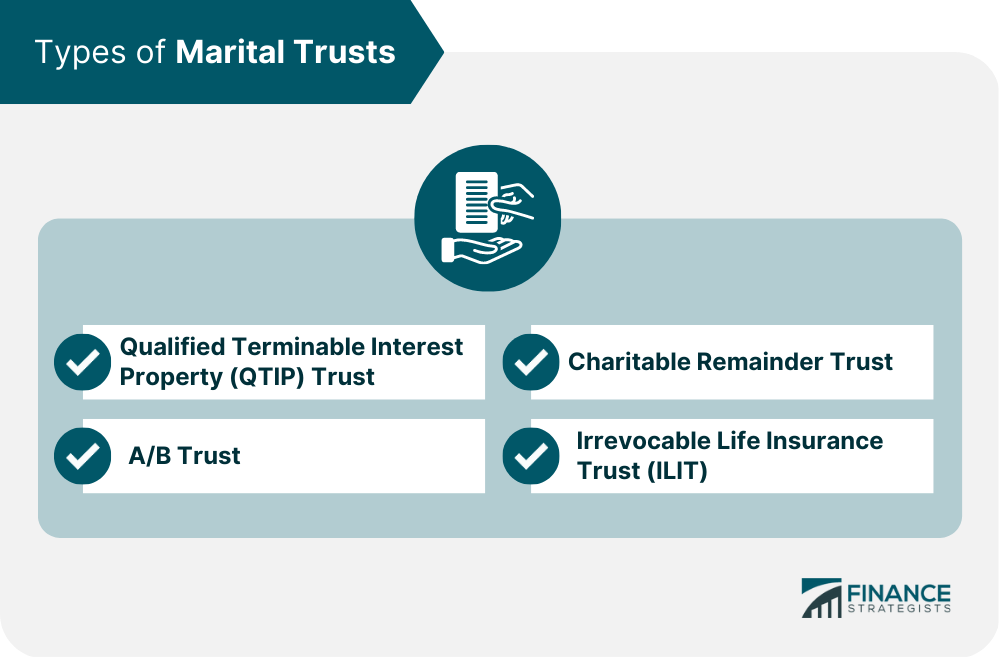

Types of Marital Trusts

Qualified Terminable Interest Property (QTIP) Trust

A/B Trust

Charitable Remainder Trust

Irrevocable Life Insurance Trust (ILIT)

Creating a Marital Trust

Choosing a Trustee

Funding the Trust

Establishing Terms and Conditions

Estate Planning Considerations

Administration of Marital Trust

Duties of the Trustee

Taxation of the Trust

Distribution of Assets

Accounting and Record-Keeping

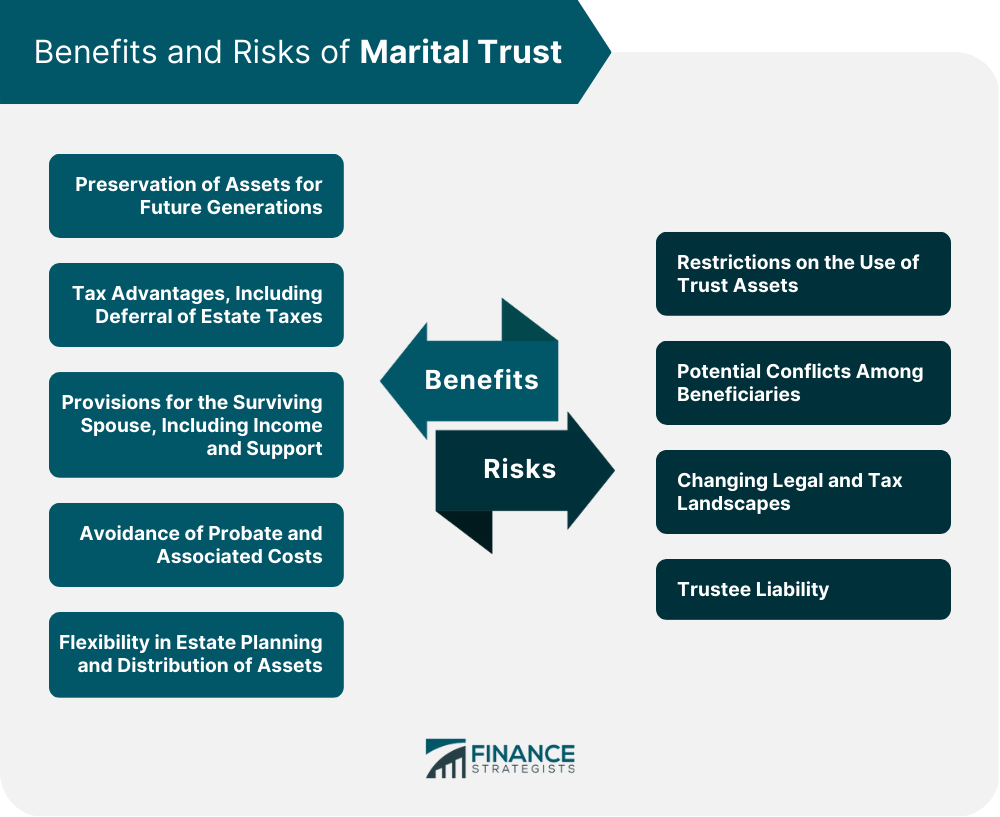

Benefits of Marital Trust

Preservation of Assets

Tax Benefits

Provides for Surviving Spouse

Avoids Probate

Risks of Marital Trust

Restrictions on the Use of Assets

Potential for Conflict Among Beneficiaries

Changing Legal and Tax Landscape

Trustee Liability

Final Thoughts

Marital Trust FAQs

A marital trust is a legal instrument that allows assets to pass from one spouse to another without incurring estate taxes. It provides for the surviving spouse after the death of the other spouse, and can also help preserve assets for future generations.

The benefits of creating a marital trust include the preservation of assets, tax advantages, provisions for the surviving spouse, and avoidance of probate.

There are several types of marital trusts, including Qualified Terminable Interest Property (QTIP) Trusts, A/B Trusts, Charitable Remainder Trusts, and Irrevocable Life Insurance Trusts (ILITs).

Creating a marital trust involves choosing a trustee, funding the trust, establishing terms and conditions, and considering estate planning issues. It is essential to work with an experienced estate planning attorney and tax professional to ensure that the trust is properly structured and meets the couple's needs.

The risks and limitations of creating a marital trust include restrictions on the use of trust assets, potential conflicts among beneficiaries, changing legal and tax landscapes, and trustee liability. It is important to consider these factors and seek the advice of professionals when creating a marital trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.