Family trustees are individuals appointed by a trust creator, also known as a grantor or settlor, to manage and administer a family trust. A family trust is a legal arrangement where the grantor transfers assets to the trust, which is then managed by the trustees for the benefit of the trust's beneficiaries, typically family members. The role of a family trustee is to ensure that the trust is managed in the best interests of the beneficiaries, in accordance with the terms of the trust and relevant laws.

Family trustees are responsible for overseeing the trust's investments, ensuring they are aligned with the trust's objectives and risk tolerance. This includes selecting and monitoring investment portfolios, rebalancing assets, and making prudent investment decisions. Family trustees may also be responsible for managing the trust's real estate holdings, which can include residential, commercial, or agricultural properties. This involves property maintenance, leasing or selling properties, and handling property taxes and other expenses. If the trust includes business interests, family trustees must oversee these assets, ensuring they are managed effectively to maximize profitability while adhering to the trust's objectives. Family trustees must adhere to the terms set forth in the trust agreement, ensuring that trust assets are used for their intended purposes, as specified by the grantor. Family trustees are responsible for maintaining accurate records of the trust's financial activities, including asset management, distributions to beneficiaries, and expenses. They must also prepare and submit annual reports to beneficiaries, detailing the trust's performance and activities. Family trustees must ensure that the trust complies with all tax obligations, including filing federal and state income tax returns and paying any taxes owed. Family trustees may be granted the authority to make discretionary distributions to beneficiaries, providing financial support as needed and in accordance with the trust's terms. In some cases, the trust agreement may mandate specific distributions to beneficiaries, either as a fixed amount or based on a predetermined schedule. Family trustees are responsible for ensuring these distributions are made in a timely and accurate manner. Family trustees must maintain open lines of communication with beneficiaries, addressing their concerns and keeping them informed about the trust's activities and performance. Family trustees must act in the best interests of the trust and its beneficiaries, avoiding conflicts of interest and self-dealing. Family trustees must exercise diligence and prudence in managing trust assets, making informed decisions, and seeking professional advice when needed. Family trustees must treat all beneficiaries fairly and impartially without favoring one beneficiary over another. The UTC provides a standardized set of rules for trust administration, which has been adopted in some form by many states. Each state may have its own trust laws that govern the creation, administration, and termination of trusts, which family trustees must understand and comply with. Family trustees must be aware of the tax implications of trust activities, including income, capital gains, and estate taxes, as well as state-specific tax laws. A family trustee should be someone the grantor and beneficiaries can trust to act in their best interests and manage the trust responsibly. A family trustee should have a strong understanding of financial and investment matters, as well as experience managing assets. A family trustee should have excellent communication skills to effectively interact with beneficiaries, professionals, and other parties involved in the trust administration. A family trustee should have the time and commitment necessary to fulfill their duties and responsibilities. Family trustees must be skilled at resolving conflicts between beneficiaries or between themselves and beneficiaries, ensuring the trust's objectives are met and family harmony is preserved. Family trustees must respect the privacy of beneficiaries and keep sensitive trust information confidential, preventing potential conflicts or misunderstandings. Family trustees must be responsive to beneficiaries' concerns and needs, providing support and guidance while maintaining a professional relationship. Family trustees must be well-versed in the intricacies of trust administration, ensuring they can effectively manage complex trust structures and comply with all legal and regulatory requirements. Family trustees should be knowledgeable about asset protection strategies, such as shielding assets from creditors or lawsuits, and ensuring the trust's assets are preserved for the benefit of the beneficiaries. Family trustees must be aware of the legal and tax implications of trust activities, ensuring they comply with all relevant laws and regulations. Family trustees should invest in their own professional development, as well as train and mentor successor trustees, ensuring a smooth transition of trust administration responsibilities. Family trustees must plan for the eventual transition of their duties to a successor trustee, carefully considering the qualifications and suitability of potential candidates. Family trustees should have contingency plans in place to address unexpected events or emergencies, ensuring the trust's assets and beneficiaries are protected. The role of family trustees is crucial in effectively managing a trust, preserving family wealth, and maintaining harmony among beneficiaries. Their primary responsibilities include managing assets, administering the trust, and distributing assets to beneficiaries while adhering to their fiduciary duties. Selecting the right trustee is critical, and factors such as trustworthiness, financial expertise, communication skills, availability, and commitment should be considered. Family trustees face various challenges, including balancing family dynamics, navigating complex trust structures, and ensuring continuity and succession planning. By addressing these challenges and focusing on effective communication, adherence to legal and regulatory requirements, and professional development, family trustees can ensure the long-term success of a family trust and provide support to its beneficiaries for generations to come.Definition of Family Trustees

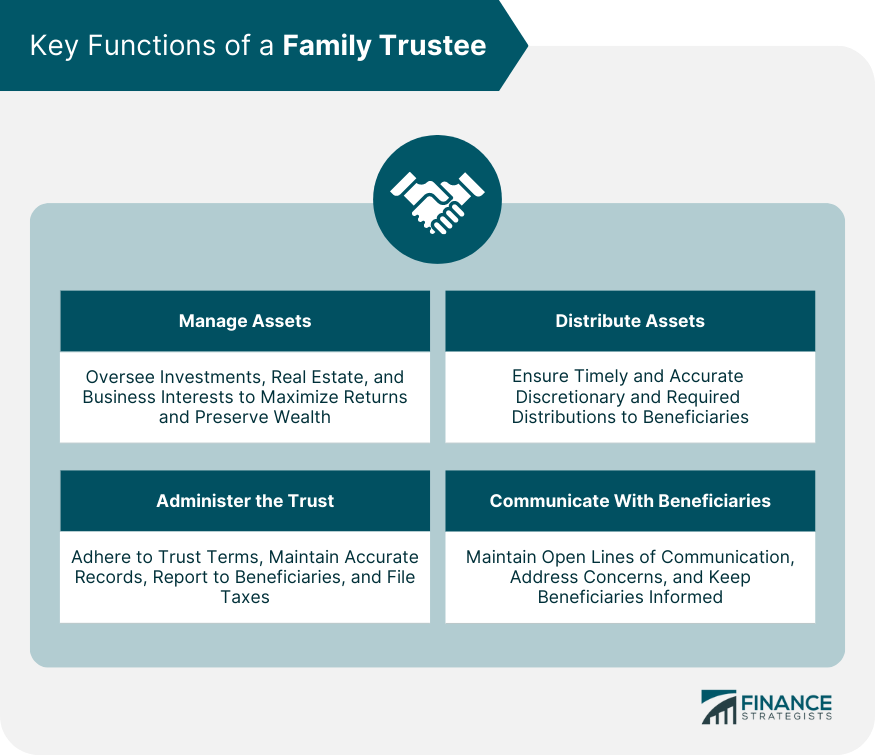

Key Functions of a Family Trustee

Managing Assets

Investment Management

Real Estate Management

Business Interests

Administering the Trust

Following the Terms of the Trust

Record Keeping and Reporting

Filing Taxes

Distributing Assets to Beneficiaries

Discretionary Distributions

Required Distributions

Communication with Beneficiaries

Legal and Regulatory Framework

Fiduciary Duties

Duty of Loyalty

Duty of Care

Duty of Impartiality

State and Federal Laws Governing Trusts

Uniform Trust Code (UTC)

State-specific Trust Laws

Tax Implications

Selection Process for Family Trustees

Criteria for Choosing a Family Trustee

Trustworthiness

Financial Expertise

Communication Skills

Availability and Commitment

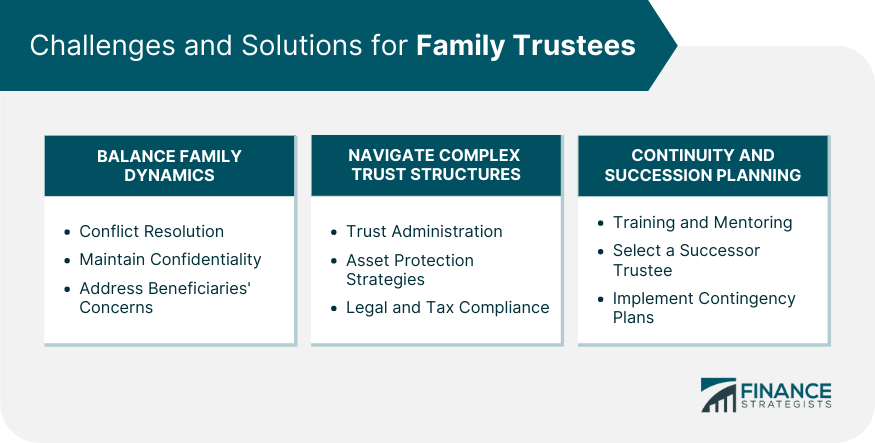

Challenges and Solutions for Family Trustees

Balancing Family Dynamics

Conflict Resolution

Maintaining Confidentiality

Addressing Beneficiaries' Concerns

Navigating Complex Trust Structures

Trust Administration

Asset Protection Strategies

Legal and Tax Compliance

Continuity and Succession Planning

Training and Mentoring

Selecting a Successor Trustee

Implementing Contingency Plans

Bottom Line

Family Trustees FAQs

Family trustees are responsible for managing assets, administering the trust, and distributing assets to beneficiaries. This includes investment management, real estate management, business interests, following the terms of the trust, record keeping, reporting, filing taxes, and communicating with beneficiaries.

Family trustees must adhere to their duty of loyalty, duty of care, and duty of impartiality. They should act in the best interests of the trust and its beneficiaries, avoid conflicts of interest, exercise diligence and prudence in managing assets, and treat all beneficiaries fairly and impartially.

When selecting family trustees, factors to consider include trustworthiness, financial expertise, communication skills, availability, and commitment. It's essential to choose someone who can effectively manage the trust, act in the best interests of the beneficiaries, and maintain open lines of communication.

Family trustees often face challenges such as balancing family dynamics, navigating complex trust structures, and ensuring continuity and succession planning. To address these challenges, they should focus on conflict resolution, maintaining confidentiality, addressing beneficiaries' concerns, understanding trust administration, implementing asset protection strategies, legal and tax compliance, training and mentoring, and implementing contingency plans.

Family trustees can maintain a balance by clearly separating their personal relationships from their professional responsibilities, treating all beneficiaries fairly and impartially, and maintaining open lines of communication. They should also consider seeking professional advice and engaging a trust protector to provide additional oversight and ensure they are acting in the best interests of the trust and its beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.