A bypass trust, also known as an AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away. When one spouse dies, the assets of the estate are split into two separate trusts. The first part is the marital trust or “A” trust. The second is a bypass, family trust or “B” trust. A marital trust is a revocable trust that belongs to the surviving spouse. This means that the surviving spouse has complete control over the assets in the trust and can sell, spend or give them away as they see fit. The family or B trust is irrevocable, meaning its terms cannot be changed. When the first spouse passes away, their share of the estate goes into the B trust. The surviving spouse does not own those assets but can access the trust during his or her lifetime and receive income from it. The primary purpose of a bypass trust is to minimize estate taxes. When a person dies, their estate may be subject to federal estate taxes if the estate's value exceeds the exemption amount set by the IRS. In 2024, the federal estate tax exemption is $13.61 million per individual. However, suppose a married couple utilizes a bypass trust. In that case, they may effectively double the exemption amount, allowing more of their assets to pass to their heirs without being subject to estate taxes. Have questions about Bypass Trusts? Click here.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. To assist a client in estate planning, I recommended a bypass trust to minimize estate taxes while providing for his spouse. This strategy allowed the client to allocate part of his estate to the trust, using his exemption from estate taxes. The trust supported his spouse after his death, with the remainder passing to their children tax-efficiently, preserving more wealth for future generations. If you're looking for ways to protect your family's future and ensure that your wealth is passed down efficiently and with minimal tax implications, consider exploring estate planning options like a bypass trust. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation A bypass trust is a legal arrangement that can help minimize estate taxes and protect assets. To create a bypass trust, both spouses include a provision in their will that creates a trust for the surviving spouse's benefit and funds it with an amount up to the estate tax exemption. The surviving spouse can then access the trust during their lifetime and receive income from it. When the surviving spouse passes away, the assets in the trust typically pass to the first designated beneficiaries of the spouse, free from estate tax. While bypass trusts were often used to minimize federal estate taxes, changes to federal estate tax laws in 2010 allowed for the portability of the estate tax exemption, making bypass trusts less effective for managing federal estate taxes. This change allows surviving spouses to inherit the unused portion of the other estate tax exemption of the spouse, resulting in larger estate tax exemptions that may make bypass trusts unnecessary in certain situations. However, bypass trusts can still provide benefits such as asset protection and control over the distribution of assets. A bypass trust is a type of trust that allows a grantor to transfer assets to a trust for the benefit of a spouse while also ensuring that the assets are protected from estate taxes upon the death of the first spouse. There are several types of bypass trusts, including: This type of trust is designed to maximize the use of the federal estate tax exemption. The trust is funded with assets up to the exemption amount, which is then used to provide for the surviving spouse during their lifetime. This type of trust is designed to provide for a surviving spouse while also controlling the ultimate disposition of the assets upon the death of the spouse. The assets are held in trust, and the spouse receives income from the trust during their lifetime, but the grantor can specify how the assets are distributed after the death of the spouse. The generation-skipping trust is designed to transfer assets to grandchildren or other beneficiaries of more than one generation removed from the grantor. This can be useful for preserving wealth and avoiding estate taxes. These are just a few examples of the types of available bypass trusts. The type of trust that is best for a particular situation will depend on various factors, including the goals and objectives of the grantor, the size of the estate, and the tax laws in effect at the time. There are several advantages to using a bypass trust in estate planning. These include: A bypass trust can help reduce or even eliminate estate taxes by removing assets from the taxable estate. Since the assets placed in the trust are no longer owned by the surviving spouse, they are not included in their estate when they die. This can be particularly beneficial for couples with larger estates, as they can use both estate tax exemptions to maximize the amount of assets that can be passed onto future generations without incurring estate taxes. Bypass trusts can provide asset protection by placing assets in a trust separate from the individual's personal assets. This can help protect the assets from potential threats such as creditors, lawsuits, and divorce settlements. By placing assets in a trust, the individual can ensure that they are preserved for future generations and are not lost due to unforeseen circumstances. By using a bypass trust, the individual creating the trust can dictate how and when the assets in the trust will be distributed to beneficiaries. This can be particularly useful in situations where the beneficiaries are minors, have special needs, or where the individual wants to control how their assets are distributed even after their death. By providing clear instructions in the trust document, the individual can ensure that their wishes are followed and that the assets are used as intended. Probate is a legal process that can be time-consuming, expensive, and potentially public. By using a bypass trust, the assets held in the trust are not subject to probate, which can help avoid delays and complications associated with the process. The assets can be distributed more quickly and efficiently to the beneficiaries named in the trust, which can be particularly beneficial for those who need access to the assets soon after the death of the individual. While bypass trusts can offer several advantages in estate planning, they also have potential disadvantages that should be carefully considered before using them. Here are some of the potential disadvantages of using a bypass trust: Setting up a bypass trust can be a complex process that requires careful planning and execution. The trust must be created properly, and the assets must be transferred to the trust promptly and appropriately. Additionally, the trust must be managed properly to meet all legal and tax requirements. This can be particularly challenging for those unfamiliar with the legal and financial aspects of estate planning. Bypass trusts can be inflexible regarding how and when assets can be distributed to beneficiaries. Once the assets are placed in the trust, they must be managed according to the terms of the trust, which may limit the ability to make changes or adjustments to the trust. This can be particularly problematic if the circumstances of the individual change or if they have a change of heart about how they want their assets distributed. Assets held in a bypass trust do not receive a step-up in basis upon the death of the surviving spouse. This means that the beneficiaries who inherit the assets may be subject to capital gains taxes if they sell the assets in the future. This can be a disadvantage, particularly if the assets have appreciated significantly over time. A bypass trust requires a knowledgeable trustee who can manage it according to its terms and ensure it meets all legal and tax requirements. This can be particularly challenging for those who do not have experience managing trusts or who do not have access to a qualified trustee. The cost of hiring a trustee can also be a potential disadvantage for those who are looking to minimize expenses. A bypass trust can be an effective estate planning tool for married couples with significant assets. It allows for estate tax savings, asset protection, control over the distribution of assets, and avoidance of probate. However, a bypass trust can be complex to set up and manage and may not be the best option for every situation. It is important to carefully consider the factors discussed in this article before deciding whether to use a bypass trust in estate planning. Additionally, it is wise to consult with a knowledgeable estate planning attorney or financial advisor to ensure that the trust is structured to achieve its intended goals.What Is a Bypass Trust?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How Bypass Trusts Work

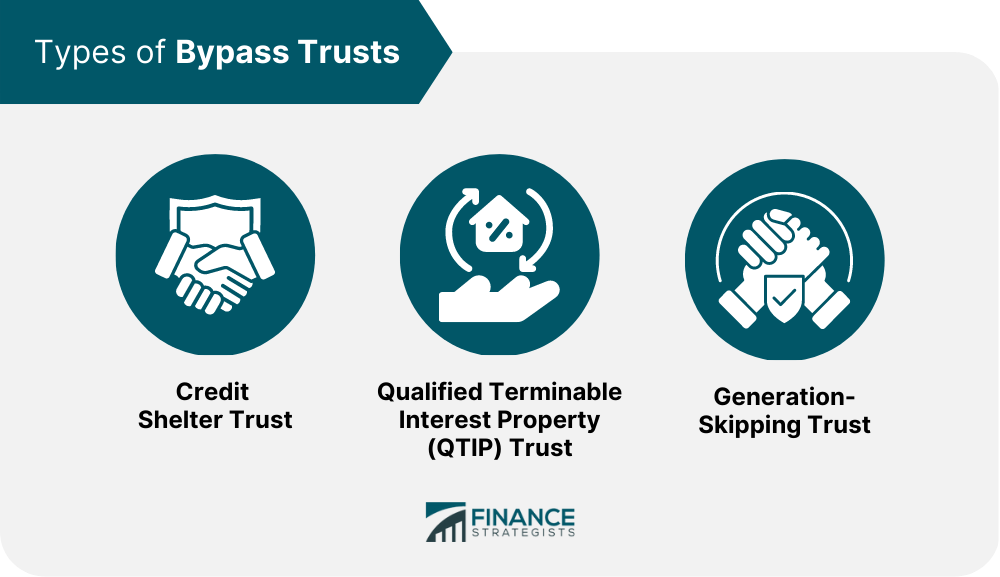

Types of Bypass Trusts

Credit Shelter Trust

Qualified Terminable Interest Property (QTIP) Trust

Generation-Skipping Trust

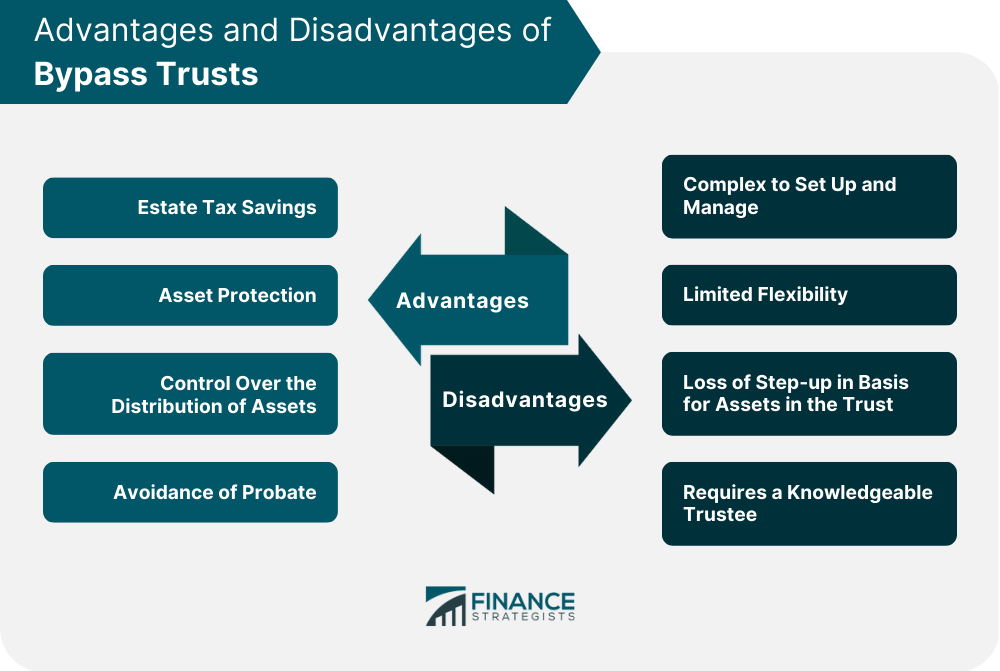

Advantages of Bypass Trusts

Estate Tax Savings

Asset Protection

Control Over the Distribution of Assets

Avoidance of Probate

Disadvantages of Bypass Trusts

Complex to Set Up and Manage

Limited Flexibility

Loss of Step-up in Basis for Assets in the Trust

Requires a Knowledgeable Trustee

Final Thoughts

Bypass Trust FAQs

A bypass trust is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away. The assets of the estate are split into two separate trusts: the marital trust, or A trust, and the bypass, family, or B trust.

When the first spouse dies, their share of the estate goes into the B trust, and the surviving spouse receives income from the trust. The marital trust belongs to the surviving spouse, who has complete control over those assets.

A bypass trust may allow for estate tax savings by removing assets from the estate and reducing or eliminating estate taxes. However, the transfer of assets to the B trust may trigger gift taxes, and assets held in the trust may not receive a step-up in basis, resulting in higher capital gains taxes when the asset is sold.

Advantages of a bypass trust include estate tax savings, asset protection, control over the distribution of assets, and avoidance of probate.

Disadvantages of a bypass trust include complexity in setting up and managing the trust, limited flexibility, loss of step-up in basis, and the need for a knowledgeable trustee to manage the trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.