Risk measures are statistical metrics used in finance to quantify the level of financial risk associated with an investment portfolio, security, or company over a specific timeframe. They are crucial in identifying potential losses due to adverse market conditions or events and assisting investors and financial institutions in informed decision-making regarding investments and risk management strategies. These measures, such as the potential for variability in returns and the uncertainty linked to potential returns, become crucial as they are intrinsic elements of any investment decision, embodying the risks and the chances of straying from anticipated returns. They allow for precise risk quantification and management, aiding investors in making informed decisions, optimizing their portfolio allocations, and ultimately enhancing long-term financial performance. Market risk is the potential loss in the value of a financial instrument due to fluctuations in market variables, such as interest rates, foreign exchange rates, and equity prices. For example, an investor who holds shares in a company may experience losses if the company's stock price declines. Market risk can be divided into systematic risk, which affects the entire market, and unsystematic risk, which affects specific securities or sectors. Credit risk is the risk of loss resulting from a borrower's failure to meet their financial obligations. Lenders, such as banks and bondholders, face credit risk when they extend loans or invest in debt securities. Credit risk can be evaluated by assessing the borrower's creditworthiness, usually determined through credit ratings, financial statement analysis, and other qualitative and quantitative factors. Operational risk arises from the potential failure of a company's internal processes, systems, or people. Examples of operational risk include fraud, legal risks, IT system failures, and human errors. Financial institutions must carefully manage operational risk to maintain the trust of their clients and the stability of the financial system. Liquidity risk is the risk that an investor or financial institution cannot sell or buy an asset quickly enough to prevent or minimize losses. Assets that are more difficult to sell or buy quickly are considered less liquid and carry a higher liquidity risk. Financial institutions need to manage their liquidity risk to ensure they can meet their obligations when they become due. Risk assessment is a qualitative approach to identifying, evaluating, and prioritizing risks based on their potential impact and likelihood of occurrence. This process typically involves gathering information from various sources, such as expert opinions, historical data, and market analysis. Risk assessments help organizations understand their exposure to different types of risks and guide the development of risk management strategies. Risk control refers to implementing measures to mitigate the identified risks. These measures may include risk avoidance, risk reduction, risk transfer, and risk retention. Organizations must continuously monitor and adjust their risk control strategies in response to changes in the risk environment. Variance and standard deviation are statistical measures of the dispersion of returns around their mean. A higher variance or standard deviation indicates a greater degree of risk, as returns are more likely to deviate from their expected values. While these measures are simple and easy to compute, they assume that returns are normally distributed, which may not always be the case in financial markets. Value at Risk is a widely used risk measure that quantifies the maximum potential loss over a specified time period at a given confidence level. For instance, a VaR of $1 million at the 95% confidence level implies that there is a 5% chance of experiencing a loss greater than $1 million over the specified time period. VaR is versatile and intuitive, but it has limitations, as it does not capture the extent of losses beyond the VaR threshold. Expected Shortfall, also known as Conditional Value at Risk (CVaR), measures the expected loss in the worst-case scenarios, i.e., beyond the VaR threshold. ES provides a more comprehensive picture of the risk by considering the magnitude of extreme losses. It has gained popularity among financial institutions and regulators, especially after the 2008 financial crisis highlighted the shortcomings of VaR. Beta is a measure of the systematic risk of a security or a portfolio in relation to the market as a whole. A beta greater than 1 indicates that the security or portfolio is more volatile than the market, while a beta less than 1 indicates less volatility. Beta is a key input in the Capital Asset Pricing Model (CAPM), which calculates the expected return on an investment given its systematic risk. Modern Portfolio Theory (MPT), proposed by Harry Markowitz in 1952, revolutionized the way investors construct and manage their portfolios. MPT suggests that by diversifying their investments, investors can optimize their portfolios to achieve the highest possible return for a given level of risk or the lowest possible risk for a given level of return. The key risk measures in MPT are variance and covariance, which measure the risk of individual assets and the correlation between assets, respectively. The Capital Asset Pricing Model, developed by William Sharpe and others in the 1960s, is a model that describes the relationship between systematic risk and expected return for assets. The key risk measure in CAPM is beta, which measures the sensitivity of an asset's returns to the market's returns. CAPM suggests that an asset's expected return is equal to the risk-free rate plus a risk premium that is proportional to its beta. Multi-factor models extend the CAPM by considering multiple risk factors rather than just the market risk. These models recognize that various economic factors, such as interest rates, inflation, and GDP growth, may influence the returns of an asset. The key risk measures in multi-factor models are the factor sensitivities, which measure the sensitivity of an asset's returns to the factors. Multi-factor models provide a more nuanced understanding of the risks and expected returns of assets. Banks use risk measures to manage their various risks, such as credit risk, market risk, operational risk, and liquidity risk. These measures guide banks' lending decisions, portfolio management, capital allocation, and risk mitigation strategies. They also help banks comply with regulatory requirements and maintain the confidence of their stakeholders. Insurance companies use risk measures to quantify and manage their underwriting and investment risks. These measures help insurance companies determine the premiums to charge, the reserves to hold, and the investments to make. They also play a critical role in the solvency assessment of insurance companies. The Basel Accords and Solvency II are regulatory frameworks that specify the minimum capital requirements for banks and insurance companies, respectively, based on their risk exposures. These frameworks recognize the importance of risk measures in maintaining the stability of the financial system and protecting the interests of consumers. They promote advanced risk measures, such as VaR and ES, and require financial institutions to have robust risk management practices. While risk measures are powerful tools, they are not without their limitations. They are based on certain assumptions, such as the normal distribution of returns, which may not hold in reality. They may also fail to capture the full range of risks, especially the risks that are difficult to quantify, such as operational risks and strategic risks. Moreover, they rely on historical data, which may not be a reliable predictor of future risks, especially during significant market changes. Risk measures can be misinterpreted or misused, leading to a false sense of security or inappropriate risk-taking. For instance, VaR may be misunderstood as the maximum possible loss, while it only provides a threshold below which a certain proportion of losses lie. Risk measures are also susceptible to manipulation, as the choice of parameters and models can influence them. Therefore, it is important to understand the assumptions and limitations of risk measures and to use them judiciously. However, the effectiveness of risk measures in crisis prediction and management depends on their accuracy, timeliness, and the ability of decision-makers to interpret and act upon them. Conditional Value-at-Risk, or Expected Shortfall, is an advanced risk measure that quantifies the expected loss in the worst-case scenarios. By considering the magnitude of extreme losses, CVaR provides a more comprehensive picture of the risk than VaR. CVaR has been adopted by many financial institutions and regulators, especially after the 2008 financial crisis highlighted the shortcomings of VaR. Stress testing and scenario analysis are advanced risk management techniques that evaluate the impact of extreme but plausible scenarios on a portfolio or a financial institution. These techniques complement traditional risk measures by capturing the risks that are difficult to quantify or that may be overlooked in normal market conditions. They also provide insights into the potential vulnerabilities and resilience of the financial system. Risk measures are quantitative tools used to quantify the level of financial risk associated with an investment portfolio, security, or company. They are essential for investors and financial institutions to make informed decisions about investments and risk management strategies. There are a variety of risk measures available, each with its own strengths and weaknesses. Some of the most common risk measures include variance, standard deviation, value at risk (VaR), expected shortfall (ES), and beta. Risk measures are not without their limitations. They are based on certain assumptions, such as the normal distribution of returns, which may not hold in reality. Despite their limitations, risk measures are powerful tools that can help investors and financial institutions make better decisions about risk. By understanding the key points about risk measures, investors and financial institutions can use them to their advantage and improve their risk management practices.Definition of Risk Measures

Types of Financial Risks

Market Risk

Credit Risk

Operational Risk

Liquidity Risk

Qualitative Risk Measures

Risk Assessment

Risk Control

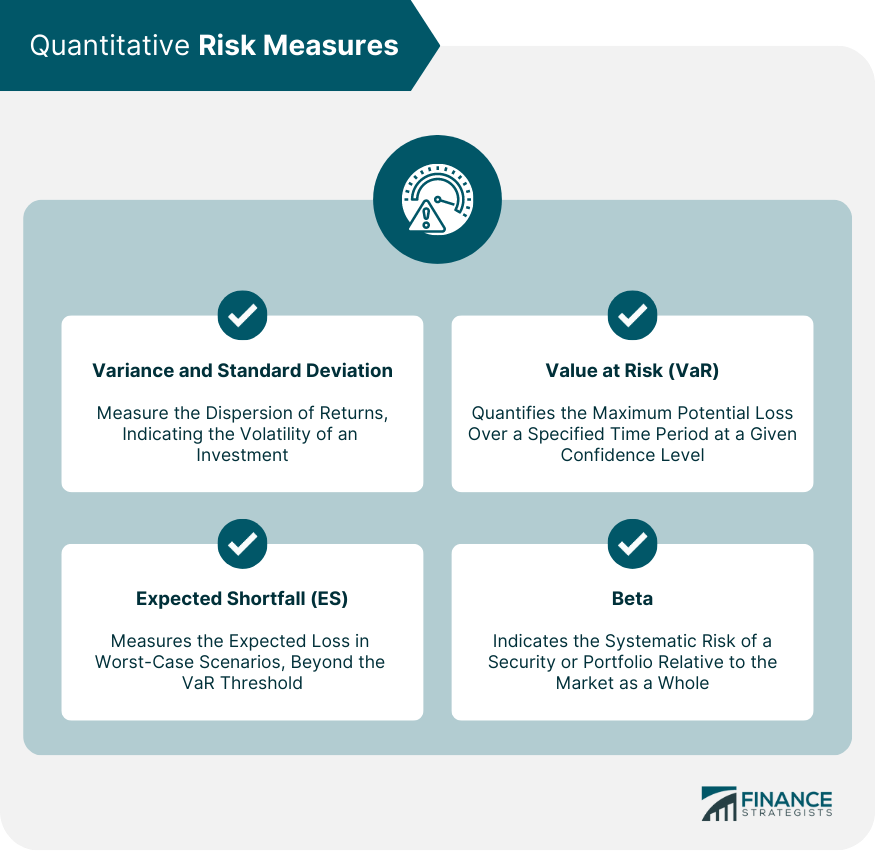

Quantitative Risk Measures

Variance and Standard Deviation

Value at Risk (VaR)

Expected Shortfall (ES)

Beta

Risk Measures in Portfolio Theory

Modern Portfolio Theory (MPT)

Capital Asset Pricing Model (CAPM)

Multi-Factor Models

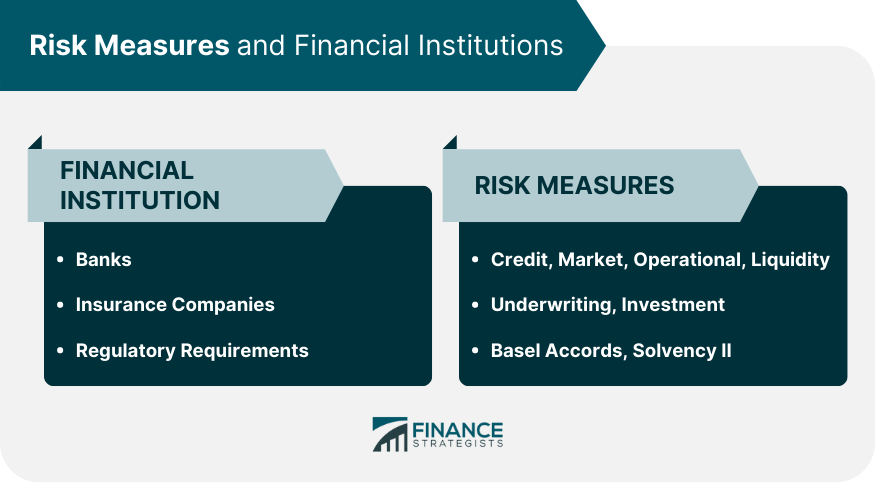

Risk Measures and Financial Institutions

Banks

Insurance Companies

Regulatory Requirements: Basel Accords and Solvency II

Limitations of Risk Measures

Assumptions and Shortcomings

Misinterpretation and Misuse

Advanced Risk Measures

Conditional Value-at-Risk (CVaR)

Stress Testing and Scenario Analysis

Conclusion

Risk Measures FAQs

Risk measures help quantify the potential uncertainty or risk associated with an investment or portfolio. They are important because they provide investors and financial institutions with a way to compare and manage the risks of different investments, assisting in decision-making and risk management.

Risk measures address various types of financial risks, including market risk, credit risk, operational risk, and liquidity risk. Each type of risk has specific measures. For instance, Value at Risk (VaR) and Expected Shortfall (ES) are commonly used for market risk, while credit ratings and spreads are used for credit risk.

Financial institutions use risk measures for various purposes, such as portfolio construction, risk monitoring and management, performance evaluation, and regulatory compliance. For instance, banks use risk measures to guide lending decisions, manage their portfolios, allocate capital, and comply with regulatory requirements like the Basel Accords.

While risk measures are powerful tools, they have limitations. They rely on certain assumptions that may not hold in reality, fail to capture the full range of risks and depend on historical data, which may not predict future risks accurately. Risk measures can also be misinterpreted or misused, leading to a false sense of security or inappropriate risk-taking.

Advanced risk measures like CVaR and stress testing provide a more comprehensive risk picture. CVaR quantifies the expected loss in worst-case scenarios, while stress testing evaluates the impact of extreme but plausible scenarios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.