The Capital Asset Pricing Model, or CAPM, calculates the value of a security based on the expected return relative to the risk investors incur by investing in that security. To calculate the value of a stock using CAPM, multiply the volatility, known as "beta," by the additional compensation for incurring risk, known as the "Market Risk Premium," then add the risk-free rate to that value. Its core purpose revolves around the determination of an investment's appropriate required rate of return, taking into account systematic risk and the expected return from the market. This model lays a foundation for gauging potential returns and understanding the risks associated with different investment options. The risk-free rate is the minimum return an investor expects for any investment, as it is the return of a risk-free asset, typically a government bond. This rate serves as a benchmark for assessing potential investments, grounding the return expectations in a certain degree of reality. It is generally considered the rate of a government bond of the country where the investment will take place. However, some financial analysts prefer using a global risk-free rate, such as the U.S. Treasury bill rate, for its perceived stability and low default risk. The market risk premium, represented as "RPM", is another essential element in the CAPM equation. It is defined as the expected return from the market as a whole, minus the risk-free rate. The market risk premium encapsulates the additional return an investor anticipates for taking on more risk by investing in the market instead of sticking to risk-free securities. The market risk premium may vary from country to country. Factors such as the stability of the local economy, interest rate levels, and overall market volatility can influence the size of the market risk premium in different markets. Beta, represented as "β", is a measure of an asset's systematic risk, or the risk that cannot be eliminated through diversification. It reflects the asset's sensitivity to market movements and is thus a key determinant of the asset's risk and return profile. In the International CAPM, beta takes into account not just the asset's responsiveness to the local market, but also to the global market. This additional complexity is due to the consideration of international factors such as exchange rate risks and international market conditions. Consequently, the beta of an asset in the CAPM can be significantly different from its beta in a purely domestic CAPM, leading to different risk and return expectations. The expected return on an asset, represented as "E(Ri)", is the return that an investor anticipates receiving from an investment. This return reflects both the potential income from the investment, such as dividends or interest payments, and any change in the asset's price. The expected return is the final output of the CAPM and serves as the required rate of return for an investment given its risk profile. A critical assumption underpinning the CAPM is the existence of perfectly competitive markets. In such markets, all investors have equal access to information and can freely buy and sell securities at market prices. Moreover, no investor can influence market prices through their trading activities, ensuring a level playing field. While real-world markets may not meet these stringent conditions, the assumption of perfectly competitive markets simplifies the CAPM and makes it more tractable. This assumption also underscores the importance of market efficiency and fair competition in the pricing of assets and the determination of expected returns. The CAPM assumes that investors are rational and risk-averse. This implies that investors, given a choice between two investments with the same expected return, will choose the one with the lower risk. Similarly, for two investments with the same risk, investors will opt for the one with the higher expected return. This assumption is crucial for the CAPM as it underpins the relationship between risk and return, which is at the heart of the model. While not all investors may be strictly rational or risk-averse, this assumption provides a useful simplification for understanding and predicting investor behavior. Another fundamental assumption of the CAPM is the absence of taxes and transaction costs. This means that investors can buy and sell securities without incurring any costs, and all returns from investments are received in full without any tax deductions. Although this assumption may not hold in reality, it simplifies the CAPM and facilitates its application. It underscores the impact of taxes and transaction costs on investment returns and the importance of considering these costs when making investment decisions. The CAPM also assumes that all relevant information about assets is freely available and instantly accessible to all investors. This ensures that asset prices fully reflect all available information and that no investor has an unfair advantage over others. This assumption aligns with the concept of efficient markets, where asset prices instantly incorporate all available information. While the availability and accessibility of information may vary in reality, this assumption emphasizes the role of information in asset pricing and the functioning of financial markets. The CAPM assumes that investors can borrow and lend unlimited amounts at the risk-free rate. This implies that the risk-free rate serves as a benchmark for all financial transactions, and there are no constraints on borrowing or lending activities. While this assumption may not hold in reality, it simplifies the CAPM and provides a theoretical basis for the relationship between risk and return. It highlights the role of the risk-free rate in financial markets and the impact of borrowing and lending activities on market equilibrium. The formula for CAPM is as follows: In layman's terms, the CAPM formula is: Expected return of the investment = the risk-free rate + the beta (or risk) of the investment * the expected return on the market - the risk free rate (the difference between the two is the market risk premium). For each additional increment of risk incurred, the expected return should proportionately increase. If a security is found to have a higher return relative to the additional risk incurred, then the CAPM model suggests that it is a buying opportunity. Like all valuation models, CAPM has its limitations since some assumptions it uses are idealistic. For example, Beta coefficients are unpredictable, change over time, only reflect systemic risk rather than total risk. Despite its shortcomings, this model is very popular for valuing securities. A higher CAPM result implies a higher expected return, indicating that the investment is likely to be more profitable. However, it also implies a higher risk, as the expected return compensates for the systematic risk associated with the investment. Investors can use the CAPM results to compare different investments and choose the ones that best fit their risk tolerance and return expectations. Moreover, they can use the results to assess the performance of their investments, checking whether the actual returns are in line with the expected returns given the investments' risk profiles. By calculating the expected return using the CAPM, investors can assess the attractiveness of different investments and choose the ones that offer the best trade-off between risk and return. The CAPM also helps investors build efficient portfolios that maximize returns for a given level of risk. By incorporating the CAPM into their portfolio optimization strategies, investors can achieve better diversification and enhance their overall investment performance. The CAPM is frequently used to estimate the cost of equity, a key component of a company's weighted average cost of capital (WACC). The cost of equity reflects the return required by shareholders to compensate for the risk of their investment in the company. By using the CAPM to estimate the cost of equity, companies can make more informed decisions about their capital structure and investment projects. This can help companies optimize their cost of capital, enhance their financial performance, and maximize shareholder value. The exchange rate plays a crucial role. Changes in exchange rates can significantly impact the returns on international investments, adding a layer of risk that is not present in domestic investments. The International CAPM takes into account the risk associated with exchange rate fluctuations, incorporating it into the calculation of the expected return. This can provide a more accurate and comprehensive measure of the expected return on international investments, helping investors better manage their exchange rate risk. Despite its widespread use, the CAPM has been subject to numerous criticisms, many of which center on its assumptions. Real-world markets rarely meet the stringent conditions assumed by the CAPM, such as perfectly competitive markets, rational and risk-averse investors, no taxes or transaction costs, and freely available and instantly accessible information. The violation of these assumptions can lead to deviations between the CAPM's predictions and actual returns, potentially undermining the model's reliability and usefulness. However, many proponents of the CAPM argue that despite these violations, the model still provides a useful benchmark for understanding the relationship between risk and return. The CAPM has also faced empirical challenges, with numerous studies finding deviations from the model's predictions. For instance, empirical evidence has shown that low-beta stocks often outperform high-beta stocks, contrary to the CAPM's predictions. Similarly, factors other than systematic risk, such as company size and book-to-market ratios, have been found to influence returns. These empirical deviations have led to the development of multi-factor models that extend the CAPM by incorporating additional risk factors. While these models can potentially improve the accuracy of return predictions, they also add complexity and may not always outperform the CAPM. In response to the criticisms and empirical challenges, numerous extensions and revisions of the CAPM have been proposed. These include the International CAPM, which incorporates the effects of exchange rate risk and international market conditions, and the Consumption CAPM, which bases risk premiums on consumption risk instead of market risk. While these extensions and revisions can address some of the criticisms and empirical challenges of the CAPM, they also add complexity and may have their own limitations and assumptions. Nonetheless, they reflect the ongoing efforts to improve the CAPM and adapt it to the evolving realities of financial markets. The Capital Asset Pricing Model is a financial tool that calculates the value of a security based on the expected return relative to the risk investors incur by investing in that security. By incorporating the risk-free rate, market risk premium, beta, and expected return on assets, the model helps investors assess potential returns and understand the risks associated with various investment options. It finds wide application in investment decision-making, guiding the construction of efficient portfolios and optimizing capital structures for companies. Additionally, the model considers exchange rate risk in international investments, providing a comprehensive measure of expected return. However, CAPM faces criticisms due to its unrealistic assumptions and empirical deviations, leading to the development of extensions and revisions. These ongoing efforts reflect the continuous quest to enhance the model's accuracy and applicability in ever-changing financial markets.Capital Asset Pricing Model (CAPM) Overview

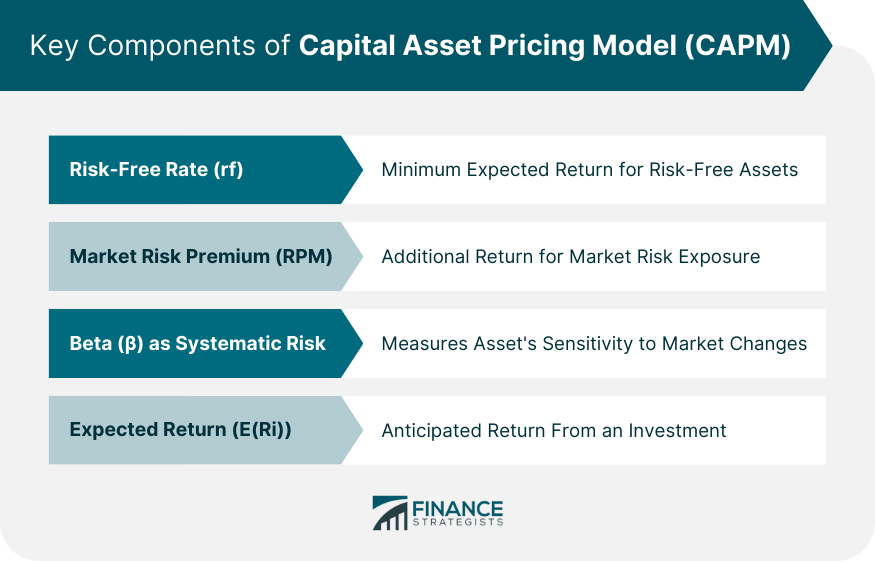

Key Components of CAPM

Risk-Free Rate (rf)

Market Risk Premium (RPM)

Beta (β) as a Measure of Systematic Risk

Expected Return on Asset (E(Ri))

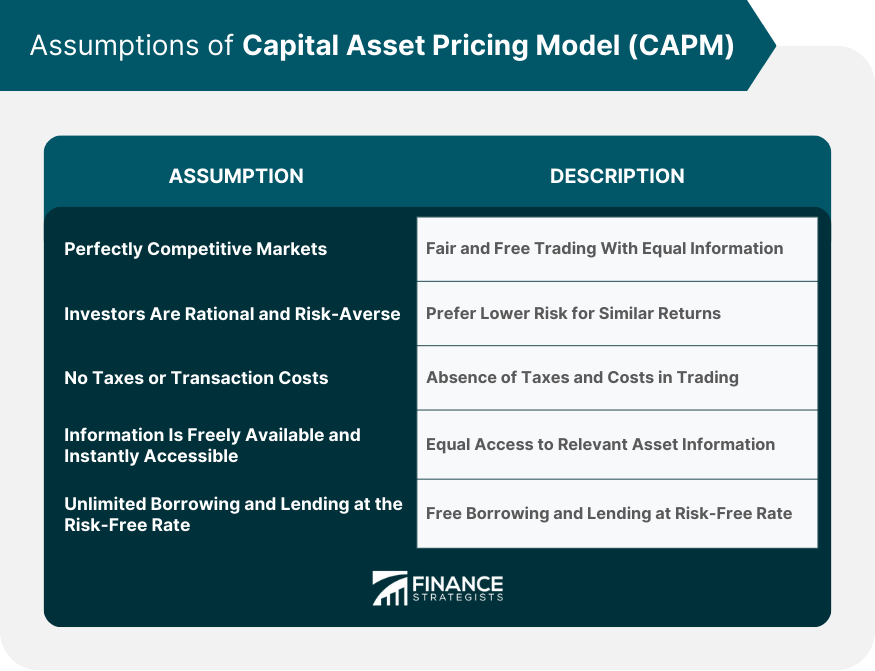

Assumptions of CAPM

Perfectly Competitive Markets

Investors are Rational and Risk-Averse

No Taxes or Transaction Costs

Information is Freely Available and Instantly Accessible

Unlimited Borrowing and Lending at the Risk-Free Rate

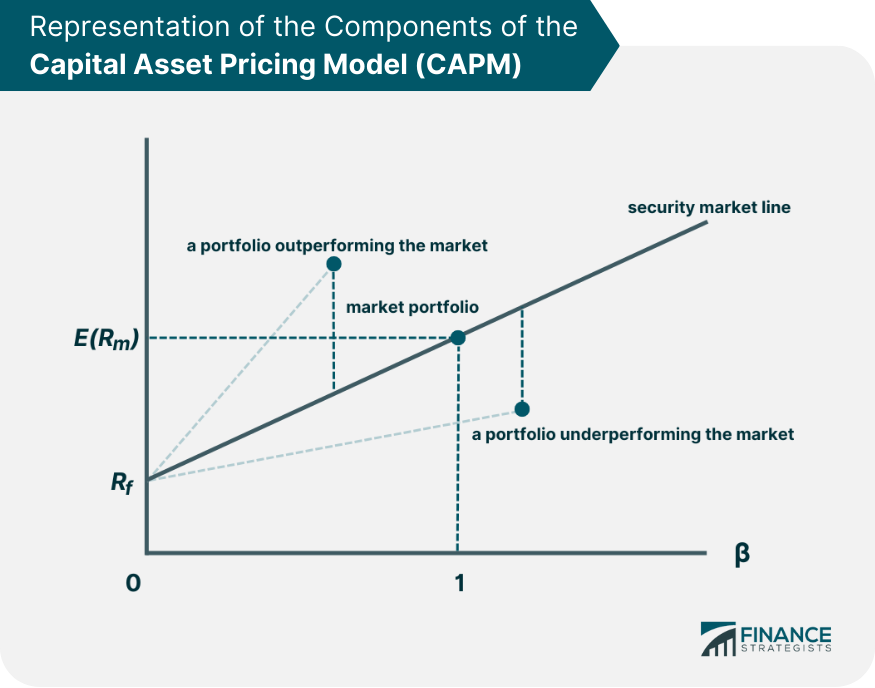

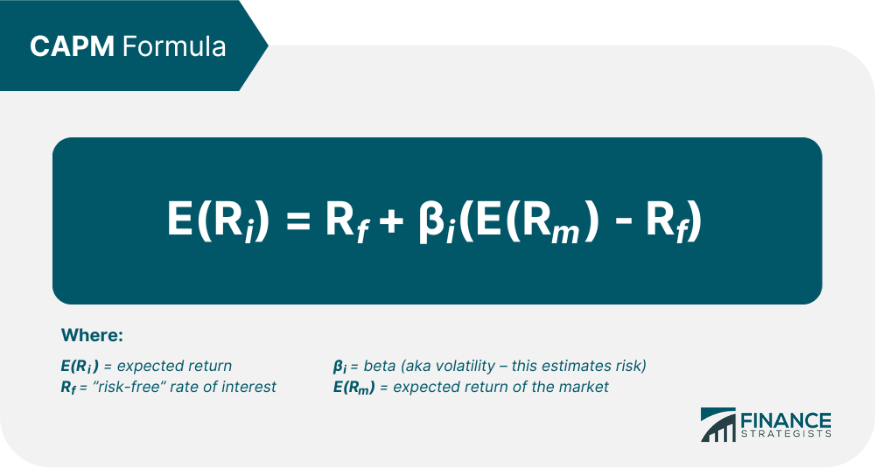

CAPM Formula

Interpreting CAPM Results

Applications of CAPM

Investment Decision-Making

Corporate Finance

Exchange Rate

Criticisms of CAPM

Violation of Assumptions

Empirical Challenges and Deviations

Extensions and Revisions

Conclusion

Capital Asset Pricing Model (CAPM) FAQs

CAPM stand for “Capital Asset Pricing Model” and is a common valuation method for stocks.

The Capital Asset Pricing Model, or CAPM, calculates the value of a security based on the expected return relative to the risk investors incur by investing in that security.

To calculate the value of a stock using CAPM, multiply the volatility, known as “beta,” by the additional compensation for incurring risk, known as the “Market Risk Premium,” then add the risk-free rate to that value.

Expected return of the investment = the risk-free rate + the beta of the investment times the expected return on the market – the risk free rate which is the market risk premium.

The basic assumptions of CAPM include perfect competition, homogenous expectations among all investors, no taxes or transaction costs, no market imperfections or monopolies, infinite investor time horizons, and one risky asset with constant returns over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.