Modern Portfolio Theory is a financial framework that was developed by Harry Markowitz in the 1950s and earned him a Nobel Prize. MPT aims to maximize returns while minimizing risk by diversifying investments across different asset classes. The main idea behind MPT is that an investor can reduce portfolio risk by holding a diversified portfolio of assets. According to MPT, certain assets may perform better than others under different market conditions. By spreading investments across multiple asset classes, the overall portfolio risk can be reduced. MPT was developed in response to the traditional investment approach of investing primarily in stocks and bonds. Markowitz argued that this approach did not adequately account for the benefits of diversification. He believed that investors could achieve better returns with less risk through a more diversified approach. The mathematical framework operating in modern portfolio theory is a practical strategy in investment selection using diversification as a fundamental principle. The formula aims to maximize the expected return at a given specific level of risk. The approach is based on two core assumptions. First, when selecting assets for an investment portfolio, it is necessary to consider how they relate to one another in terms of potential returns and risk levels. By analyzing the portfolio as a whole, investors can choose assets with uncorrelated performance to balance risks across the portfolio. Second, predicting future investment returns can be challenging. Investors should instead review historical long-term returns as an approximation of how different investments may perform in the future. Once these principles are established, investors create various portfolios at different risk levels and expected returns using modeling techniques. Investors multiply the percentage of each asset's allocation within a model portfolio by its expected level of risk or return. This calculation results in a total percentage-adjusted risk level for the entire portfolio and a percentage-adjusted expected return for the overall portfolio. Here is an example of how John could apply MPT to his investment portfolio. John decides to divide his portfolio into four asset classes: Government bonds, US Stocks, International Stocks, and Real Estate Investment Trusts. Based on hypothetical average returns over the past ten years, he determines that each asset class has an expected return of 3%, 8%, 7%, and 8%, respectively. Assuming that each asset class has equal weight in the portfolio (i.e., 25% allocation), John can calculate the expected portfolio return by multiplying the expected return of each asset class by its allocation and adding them together. Using this approach, John can expect his portfolio to generate a total return of 6.5%, calculated as follows: (0.25 X 0.03) + (0.25 X 0.08) + (0.25 X 0.07) + (0.25 X 0.08) = 0.0075 + 0.02 + 0.0175 + 0.02 = 0.065 or 6.5% John can use this information to make informed investment decisions. For example, if John wants to achieve a higher rate of return, he can adjust the percentage allocation for each asset class accordingly. On the other hand, if John wants a more stable rate of return with lower risk, he could shift more of his investments into bonds. The following key features are central to MPT: Investors prefer investments with lower risk and more predictable returns. MPT seeks to balance risk and return by identifying investment opportunities that offer the best possible returns for a given level of risk. By taking a systematic approach to risk management, MPT provides investors with a framework for building diversified portfolios that can achieve their investment goals without taking on unnecessary risk. MPT advocates for diversification as a way to reduce risk and improve the performance of investment portfolios. By diversifying investments across various asset classes, such as stocks, bonds, and real estate, investors can reduce the risk of losses from any single asset class. MPT also emphasizes the importance of correlation analysis, a statistical tool used to measure the strength and direction of the relationship between two variables. MPT promotes investing in asset classes that are negatively correlated, which can further reduce risk in a portfolio. In the context of MPT, correlation analysis is used to determine the degree to which different asset classes are related to each other. When one investment is performing poorly, another may be rising in value, thus mitigating losses. If two asset classes have a high positive correlation, they tend to move in the same direction at the same time. Conversely, if two asset classes have a negative correlation, they tend to move in opposite directions, which can help to offset losses and reduce overall portfolio risk. Diversification and correlation analysis are key risk management strategies. Investors can build portfolios that are better positioned to weather market volatility and generate consistent returns over the long term by combining assets with different levels of risk and expected returns. The efficient frontier is a graphical representation of the optimal risk-return relationship in investment portfolios. It is a line on a graph that shows the highest expected return for a given level of risk or the lowest risk for a given expected return. Investors who prioritize lower risk will aim for a position on the left side of the efficient frontier, which represents portfolios with lower risk and lower returns. In contrast, more aggressive investors will aim for positions on the right side of the efficient frontier. The right side represents portfolios with higher risk and higher returns. If an investor's portfolio falls on the efficient frontier line, it has an optimal risk-return relationship. It represents the optimal combination of assets that maximizes returns for a given level of risk. The efficient frontier is derived by plotting the risk and return of various portfolios on a graph. The shape of the efficient frontier is determined by the expected returns on the vertical axis and the risk of the individual assets in the portfolio along the horizontal axis, as well as the correlation between these assets. In general, portfolios that are more diversified and contain assets with low correlation tend to have a more favorable risk-return profile and are located toward the upper left portion of the efficient frontier. The optimal portfolio is determined by analyzing the efficient frontier and selecting the portfolio that is most suitable for an investor's risk profile and investment goals. Although there are various efficient portfolios on the efficient frontier, there is one that is considered optimal. This is the point where the capital allocation line (CAL) intersects with the efficient frontier. The CAL demonstrates the risk-return trade-off for all investment assets, considering the presence of a risk-free asset. Additionally, the slope of the CAL, known as the Sharpe ratio, indicates the risk-adjusted returns of an asset or portfolio. The highest Sharpe ratio occurs at the intersection of the CAL and the efficient frontier, which is the optimal portfolio. MPT employs a range of statistical methods, including calculating expected returns and standard deviation. Expected returns are based on historical data and market trends, and are used to predict the future return of an asset. Standard deviation measures the degree of variation in an asset's returns over time. Moreover, MPT recognizes that assets do not exist in a vacuum and evaluates them in the context of their correlation with other assets in a portfolio. MPT relies on statistical analysis to evaluate the risk and return of different investments. To determine an asset's expected return, MPT calculates the sum of its potential returns, weighted by the probability of each return occurring. Suppose an investment opportunity has a 75% chance of providing a 12% return and a 25% chance of providing a 5% return. The expected return of this investment would be calculated as: 10.25% (75% x 0.12 + 25% x 0.05) Similarly, the expected return of a portfolio is calculated as the sum of the weight of each asset in the portfolio multiplied by their expected returns. Consider a portfolio that is made up of three assets: stocks, bonds, and real estate. The portfolio is allocated in such a way that stocks make up 50% of the portfolio, bonds make up 30%, and real estate makes up the remaining 20%. If the expected returns for stocks, bonds, and real estate are 12%, 5%, and 8%, respectively, then the expected return of the entire portfolio can be calculated as: 8.2% (0.5 x 0.12 + 0.3 x 0.05 + 0.2 x 0.08) There are several ways in which investors can use MPT to manage their portfolios. Investors can use MPT to identify the appropriate mix of assets to include in their portfolios based on their risk tolerance, investment goals, and time horizon. Asset allocation entails dividing an investment portfolio among different asset classes, such as stocks, real estate and bonds. Stocks may also be diversified by selecting shares of companies with different sizes. Bond holdings may be customized to include securities of varying ratings. Additionally, investors may opt to incorporate other asset classes, such as real estate and commodities to diversify. By using statistical analysis, investors can create portfolios that offer the best possible returns for a given level of risk. This involves identifying the optimal portfolio on the efficient frontier, which represents the portfolio with the highest value of expected return for a given level of risk. It enables investors to construct a portfolio that is balanced and diversified. Portfolio optimization analyzes the relationship between different assets in the portfolio. They identify the assets that have a low correlation with each other and combine them in a way that reduces overall risk. Investors can use a number of tools to optimize their portfolios, including software programs that use mathematical models to analyze the performance of different assets. Some of these tools take into account factors such as expected return, volatility, correlation, and diversification. The Two-Fund Theory is a simple and popular investment strategy that is based on MPT. It is grounded on the premise that investors can achieve optimal diversification by investing in only two assets - a risk-free asset and a market portfolio. This theory assumes that all investors have the same beliefs about expected returns and thus, only need to vary the allocation between the risk-free asset and the market portfolio to achieve their desired level of risk. The risk-free asset is typically a government bond, which is considered to be free of credit risk and provides a guaranteed rate of return. The market portfolio represents a diversified collection of all risky assets available in the market, and its risk is measured by its volatility. The Two-Fund Theory offers a simple and efficient approach to investment management, which eliminates the need for complex analysis and active management. Modern Portfolio Theory offers several advantages to investors. Through the use of statistical analysis and mathematical models, MPT can help investors make more informed decisions about their investments. The use of mathematical models also helps reduce the impact of emotional biases on investment decisions. MPT provides a systematic framework for investors to quantify and manage risk. The reliance on objective data and analysis can help investors make more rational and evidence-based investment decisions. Investors reduce their risk exposure by investing in a variety of assets that are not correlated with one another. MPT helps investors reduce the impact of negative events on their portfolios. This diversification results in lower portfolio volatility and reduced risk. MPT provides a framework for understanding the relationship between risk and return. By evaluating the expected return and volatility of different investments, MPT helps investors make decisions about how much risk to take on, leading to more stable long-term investment returns. Implementing MPT aims to increase returns while reducing risk. By diversifying the portfolio, MPT helps investors identify the optimal portfolio that offers the best possible returns for a given level of risk. This optimization leads to increased returns for the investor. Furthermore, MPT advocates for identifying and investing in assets that offer a higher expected return for a given level of risk. This approach helps investors maximize their returns while still maintaining an acceptable level of risk. Passive investors prefer to minimize trading and hold a portfolio of assets for a long time to benefit from long-term market trends. MPT is an excellent tool for passive investors who seek to achieve their investment goals without constantly buying and selling assets. Passive investors who follow the principles of MPT can build a diversified portfolio that can optimize risk and return based on long-term investment goals, which enables them to minimize costs, reduce risk, and achieve their financial objectives over time. MPT's applicability to the average investor is one of its major advantages. It is not necessary to have an advanced degree in finance or to be a professional investor to understand and use MPT principles. The principles can be applied to any investment portfolio, regardless of its size or complexity. This allows the average investor who has limited knowledge to benefit from the same tools and techniques used by professional investors. Modern Portfolio Theory has its share of limitations and criticisms, which investors should be aware of before implementing it. It is only a theory, which means that it is a model of the real world and may not always accurately reflect the complexities of the markets. In practice, there are many factors that can influence investment returns. This includes geopolitical events, changes in regulations, and unexpected company news, which cannot be predicted or quantified using MPT. MPT relies heavily on historical data, which may not necessarily be indicative of future market trends. As a result, investors who rely solely on MPT to make investment decisions may be blindsided by unexpected events that are not reflected in historical data. The calculations in MPT use standard deviation as a measure of risk, which has limitations in certain scenarios. For example, standard deviation may not account for rare but significant market movements, which can have a significant impact on investment returns. Modern Portfolio Theory is a well-established financial framework that promotes diversification as a means to maximize returns while minimizing risk. Its history and main idea emphasize the importance of considering multiple asset classes when constructing an investment portfolio. The theory is based on the assumptions that assets should be selected based on potential returns and risk levels, and that historical long-term returns can be used to approximate future performance. Investors then create portfolios at different risk levels and expected returns using modeling techniques, multiplying the percentage of each asset's allocation by its expected level of risk or return to achieve a total percentage-adjusted value for the overall portfolio. MPT provides a systematic approach to investment management that emphasizes diversification, risk reduction, the application of the efficient frontier, the optimization of investment portfolios, and the analytic approach to assessing risks and returns. Investors can use MPT to design investment portfolios in allocating assets and optimizing portfolios. The advantages of MPT include mathematical rigor, reduced risk, increased returns, applicability to passive investing, and suitability for the average investor. Modern Portfolio Theory has its share of limitations, which include only being a theory, reliance on historical data, and constraints of using standard deviation. Despite these limitations, MPT can still be a useful tool for investors when used appropriately.What Is the Modern Portfolio Theory (MPT)?

How Modern Portfolio Theory Works

Application of Modern Portfolio Theory

Key Features of Modern Portfolio Theory

Average Investor Is Risk Averse

Diversification and Risk Reduction

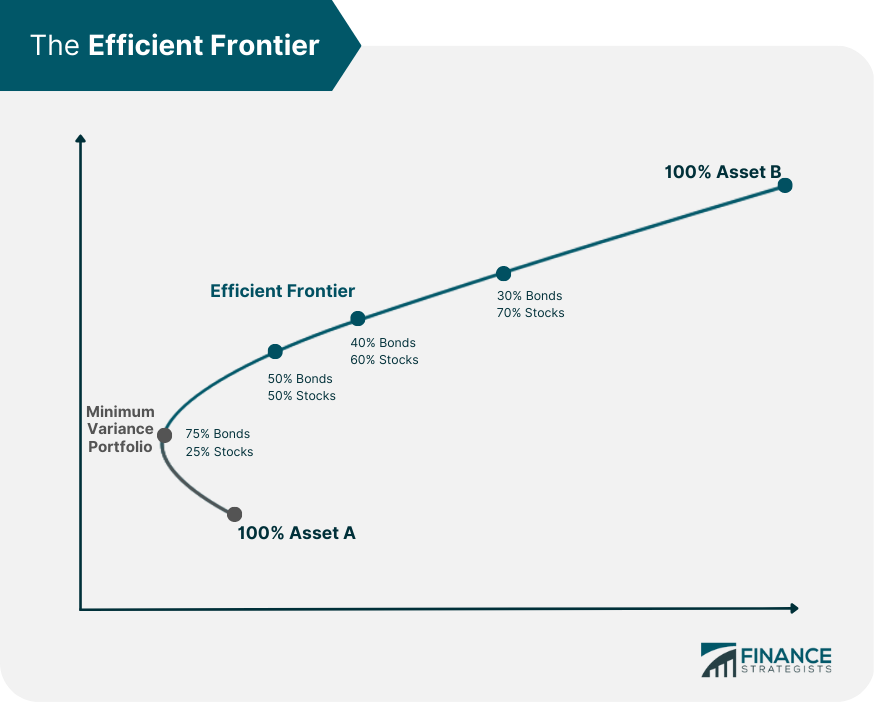

The Efficient Frontier

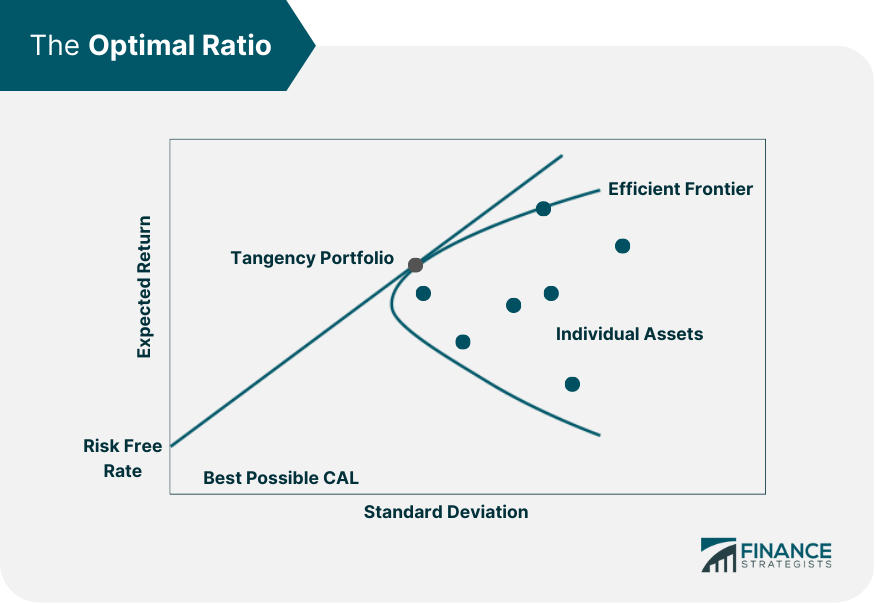

The Optimal Portfolio

Risk and Return Assessment

How Investors Use Modern Portfolio Theory

Asset Allocation

Portfolio Optimization

Two-Fund Theory

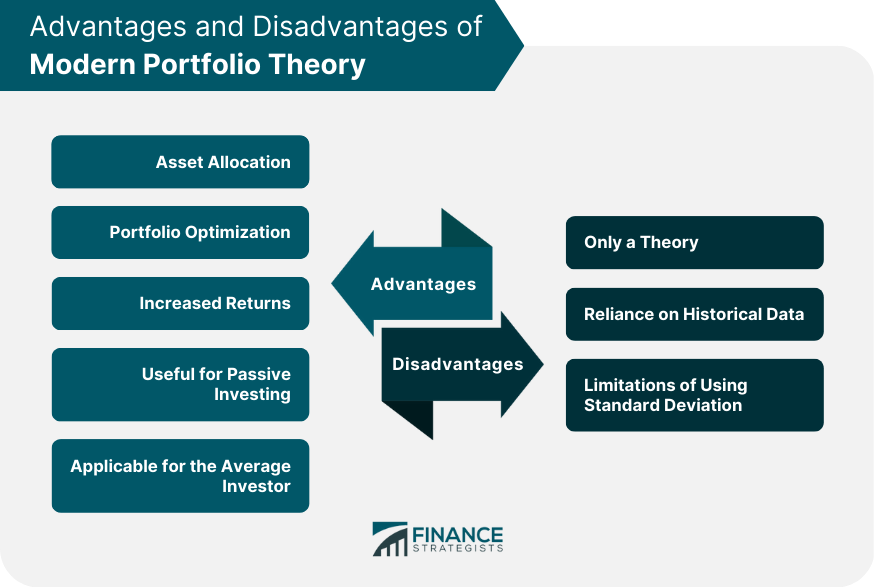

Advantages of Modern Portfolio Theory

Mathematical Rigor

Reduced Risk

Increased Returns

Useful for Passive Investing

Applicable for the Average Investor

Disadvantages of Modern Portfolio Theory

Only a Theory

Reliance on Historical Data

Limitations of Using Standard Deviation

Final Thoughts

Modern Portfolio Theory (MPT) FAQs

The benefits of Modern Portfolio Theory (MPT) include mathematical rigor, reduced risk, increased returns, applicability for passive investing, and simplicity for the average investor.

The Modern Portfolio Theory is based on the assumption that there is a normal distribution with two important parameters: the mean and the standard deviation. These parameters are significant in calculating asset returns and implementing risk management strategies.

The theory is based on two fundamental assumptions. Investors cannot view assets in their portfolio in isolation, but must consider how they relate to each other in terms of potential return and risk levels. The second assumption states that predicting future investment returns can be difficult.

A diversified behavioral portfolio is a type of investment portfolio that aims to take advantage of the principles of behavioral finance. Unlike the traditional principles of Modern Portfolio Theory, diversified behavioral portfolio management seeks to understand the behavioral biases that drive investor decision-making.

MPT has several criticisms, including the assumption that asset returns are normally distributed, reliance on historical data to predict future returns, and lack of consideration for market trends and investor behavior. MPT heavily relies on mathematical models and assumes investors are rational.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.