Risk premium refers to the additional return an investor expects to receive from an investment to compensate for the risk associated with holding that asset. In essence, it represents the difference between the expected return on a risky asset and the return on a risk-free asset, such as government bonds. Risk premium plays a crucial role in investment decisions, as it helps investors determine the appropriate level of compensation for the risks they are taking. It also helps in evaluating potential investment opportunities, asset allocation, and performance measurement. The risk premium is directly related to the expected return and risk associated with an investment. Higher risk investments generally require a higher risk premium to attract investors, as they compensate for the increased potential for loss. The equity risk premium is the difference between the expected return on a stock or stock index and the risk-free rate. It represents the additional return investors expect to receive for investing in equities rather than risk-free assets. The credit risk premium is the additional return investors require for investing in bonds or other fixed-income securities with credit risk, compared to risk-free government bonds. This premium compensates investors for the possibility of default by the bond issuer. The liquidity risk premium compensates investors for the risk associated with holding less liquid assets that cannot be easily converted to cash without incurring significant costs. This premium is higher for investments that are more difficult to sell or trade in the market. The country risk premium is the additional return investors expect for investing in assets from a specific country, due to the risks associated with that country's economic, political, and regulatory environment. This premium varies across countries and can change over time as conditions evolve. Risk premiums are influenced by prevailing market conditions and the broader economic environment. During periods of market volatility or economic uncertainty, risk premiums may increase as investors demand higher compensation for taking on risk. Risk premiums also reflect the collective risk tolerance of investors. When investors are more risk-averse, they may demand higher risk premiums for holding risky assets, and vice versa. The time horizon of an investment also impacts risk premiums. Longer-term investments generally require higher risk premiums to compensate for the increased uncertainty over time. Different asset classes and individual investments exhibit unique risk characteristics, which can influence their associated risk premiums. For example, investments in emerging markets or high-growth sectors may command higher risk premiums due to their higher levels of risk and uncertainty. One method of estimating risk premiums is to analyze historical data on asset returns and risk-free rates. This approach assumes that past performance is indicative of future results, which may not always be accurate. Another method involves conducting surveys of investors, analysts, and other market participants to gather their expectations about future risk premiums. This approach relies on the opinions and expectations of these individuals, which can be subject to biases and may not always be accurate. The implied risk premium approach uses current market data, such as stock prices and earnings, to derive the risk premium implied by market participants' actions. This method is more forward-looking but can be complex and subject to changes in market conditions. Estimating risk premiums accurately can be challenging, as they are influenced by a variety of factors and can change over time. Additionally, the methods used to estimate risk premiums are subject to limitations, such as relying on historical data or subjective opinions, which may not always accurately predict future results. Understanding risk premiums can help investors create well-diversified portfolios, as it enables them to evaluate the trade-offs between risk and return. By holding a mix of assets with varying risk premiums, investors can optimize their portfolios to achieve their desired level of risk-adjusted returns. Risk premiums play a crucial role in asset allocation decisions. By comparing the risk premiums of different asset classes, investors can determine which assets offer the most attractive risk-adjusted returns and allocate their investments accordingly. Risk premiums are also used to evaluate the performance of investment portfolios and individual assets. By comparing the actual returns of a portfolio or asset to its expected risk premium, investors can assess whether they are being adequately compensated for the risks they have taken. The Capital Asset Pricing Model (CAPM) is a widely used finance model that helps investors calculate the expected return on an investment based on its risk premium. CAPM considers the risk-free rate, the asset's sensitivity to market risk (beta), and the market risk premium to determine the appropriate risk premium for a specific investment. In CAPM, the risk premium of an investment is directly related to its beta. A higher beta indicates a higher sensitivity to market risk, leading to a higher risk premium. Conversely, a lower beta implies a lower risk premium. CAPM can be used to analyze and optimize investment portfolios, evaluate the performance of individual investments, and determine the appropriate risk-adjusted returns for various assets. By understanding the relationship between risk premium and beta, investors can make more informed decisions about their investments and manage risk more effectively. Risk premium is a critical component of investment decision-making, as it helps investors evaluate the trade-offs between risk and return, allocate assets in their portfolios, and measure performance. A better understanding of risk premiums can enable investors to make more informed decisions and achieve their financial goals. Various factors influence risk premiums, such as market conditions, investor risk tolerance, time horizon, and the characteristics of specific asset classes and investments. By considering these factors, investors can better estimate risk premiums and make more informed investment decisions. Risk premium plays a central role in portfolio management and investment decisions. By understanding risk premiums, investors can create well-diversified portfolios, make more informed asset allocation decisions, and evaluate investment performance relative to the risks taken.What Is Risk Premium?

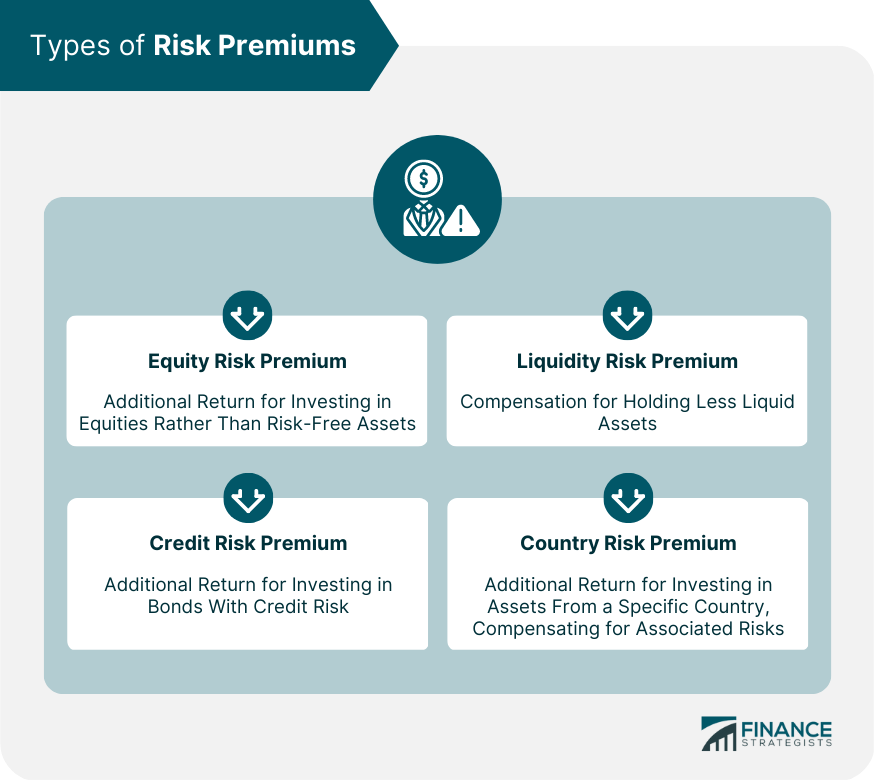

Types of Risk Premiums

Equity Risk Premium

Credit Risk Premium

Liquidity Risk Premium

Country Risk Premium

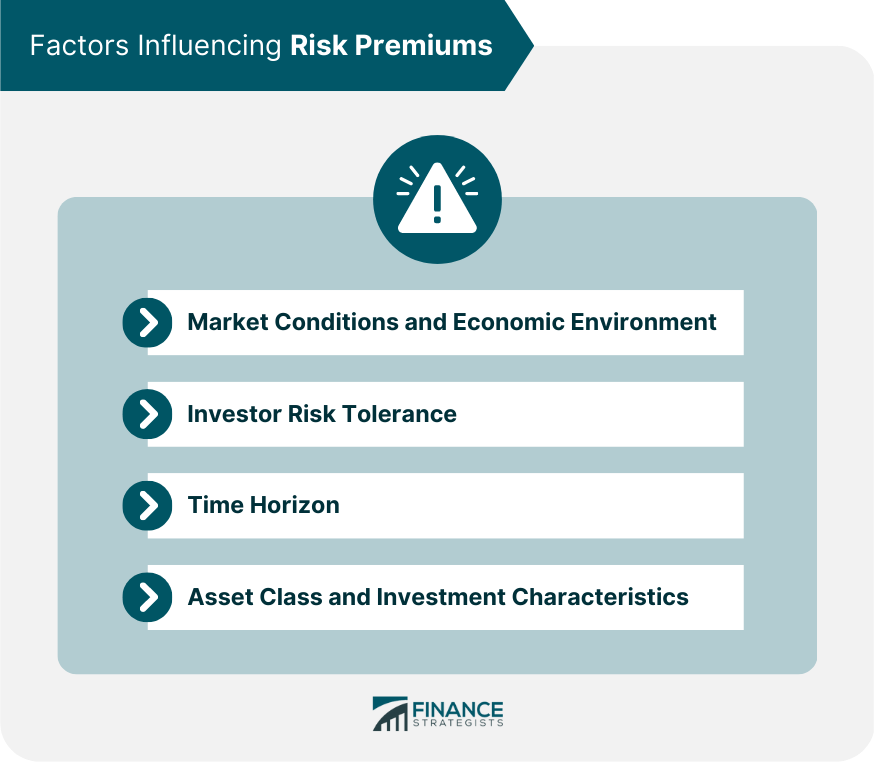

Factors Influencing Risk Premiums

Market Conditions and Economic Environment

Investor Risk Tolerance

Time Horizon

Asset Class and Investment Characteristics

Calculating Risk Premiums

Approaches to Estimating Risk Premiums

Historical Data

Surveys and Forecasts

Implied Risk Premium

Challenges and Limitations in Estimating Risk Premiums

Role of Risk Premium in Portfolio Management

Diversification and Risk Premium

Asset Allocation Decisions

Performance Evaluation and Benchmarking

Risk Premium and the Capital Asset Pricing Model (CAPM)

Overview of CAPM

Relationship Between Risk Premium and Beta

Applications of CAPM in Portfolio Management and Investment Analysis

Conclusion

Risk Premium FAQs

A risk premium is the excess return earned by an investor for taking on additional risk over and above the risk-free rate of return. It is the additional compensation an investor expects to receive for taking on a risky investment.

Risk premium is calculated by subtracting the risk-free rate of return from the expected rate of return of the risky investment. For example, if the risk-free rate of return is 2% and the expected rate of return on a risky investment is 8%, the risk premium is 6%.

Risk premium is important as it helps investors understand the potential rewards for taking on additional risk. It also helps investors to make informed decisions about investment choices and to determine whether an investment is worth the risk.

Several factors influence risk premium, including the perceived risk of the investment, the level of diversification in the investor's portfolio, the overall market conditions, the economic environment, and the investor's risk tolerance.

Yes, risk premium can change over time. It can increase or decrease depending on various factors, such as changes in market conditions, economic trends, or shifts in investor sentiment. It is important for investors to continually evaluate their investments and adjust their portfolios accordingly to account for changes in risk premiums.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.