A tracker fund, also known as an index fund or an exchange-traded fund (ETF), is a type of investment fund that aims to replicate the performance of a specific financial market index, such as the S&P 500 or the FTSE 100. Instead of trying to outperform the market, the fund's goal is to match the performance of the index by investing in the same securities in the same proportion as the index. This makes it a passive investment strategy, as the fund manager does not have to make any active investment decisions. Tracker funds are a popular choice for investors who want to achieve broad market exposure at a low cost, as they typically have lower fees than actively managed funds. They also offer diversification benefits, as they provide exposure to a wide range of companies within the index. Index tracker funds are designed to replicate the performance of a specific market index, such as the S&P 500, FTSE 100, or the NASDAQ Composite. There are various types of index tracker funds, each with a unique investment strategy and weighting methodology. These funds allocate their investments based on the market capitalization of the companies in the index. This means that larger companies receive a higher proportion of the fund's assets, while smaller companies receive a smaller share. A popular example of a market capitalization-weighted index fund is the Vanguard S&P 500 ETF (VOO). In an equal-weighted index fund, each company within the index receives an equal allocation of the fund's assets, irrespective of its market capitalization. This approach can lead to higher exposure to smaller companies and lower exposure to larger companies. The Invesco S&P 500 Equal Weight ETF (RSP) is a well-known example of an equal-weighted index fund. Fundamental index funds use alternative weighting methods based on company fundamentals, such as earnings, dividends, or cash flow, instead of market capitalization. These funds aim to provide better risk-adjusted returns by focusing on companies with strong fundamentals. The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) is an example of a fundamental index fund. Sector tracker funds invest in a specific industry or sector, such as technology, healthcare, or finance. These funds offer investors the opportunity to gain targeted exposure to a particular industry without having to select individual stocks. An example of a sector tracker fund is the Financial Select Sector SPDR Fund (XLF). Commodity tracker funds invest in commodities such as gold, silver, oil, or agricultural products, either through direct investment in the physical commodity or through financial instruments such as futures contracts. The SPDR Gold Shares (GLD) and the United States Oil Fund (USO) are popular examples of commodity tracker funds. Currency tracker funds invest in foreign currencies, providing investors with exposure to currency movements and fluctuations. The Invesco CurrencyShares Euro Trust (FXE) is an example of a currency tracker fund. Bond tracker funds invest in fixed-income securities, such as government bonds, corporate bonds, or municipal bonds, with the goal of replicating the performance of a specific bond index. The iShares Core U.S. Aggregate Bond ETF (AGG) is an example of a bond tracker fund. Real estate tracker funds invest in real estate investment trusts (REITs) or other real estate-related securities, providing investors with exposure to the real estate market. The Vanguard Real Estate ETF (VNQ) is a popular example of a real estate tracker fund. Tracker funds follow a passive investment strategy, which means they aim to replicate the performance of a specific index or sector rather than attempting to outperform it through active management. As a result, tracker funds typically have lower management fees compared to actively managed funds. One of the primary advantages of tracker funds is the diversification they offer. By investing in a broad range of assets within a specific index or sector, tracker funds can help reduce the risk associated with individual securities. This diversification can lead to more stable returns and potentially lower volatility in an investor's portfolio. Due to their passive investment approach, tracker funds generally have lower management fees than actively managed funds. This cost advantage can translate into higher net returns for investors over the long term. Tracker funds are highly transparent investment vehicles, as their holdings are typically disclosed on a regular basis. This transparency allows investors to know exactly what they are invested in and helps them make more informed decisions about their investment portfolio. Tracker funds can be more tax-efficient than actively managed funds, as they tend to generate fewer capital gains distributions due to lower portfolio turnover. This can result in a lower tax burden for investors, especially in tax-advantaged accounts. Tracking error measures the difference between the performance of a tracker fund and its benchmark index. A lower tracking error indicates a closer alignment between the fund's performance and its benchmark, while a higher tracking error suggests that the fund may not be accurately tracking its underlying index. Tracking difference is the difference between the fund's annual return and the benchmark's annual return. This metric helps investors understand how closely a tracker fund is replicating the performance of its benchmark index. The information ratio measures the risk-adjusted performance of a tracker fund relative to its benchmark index. A higher information ratio indicates that a fund has delivered better returns per unit of risk compared to its benchmark. Benchmarks and indices serve as performance yardsticks for tracker funds. By comparing a fund's performance to its benchmark index, investors can assess whether the fund is delivering the expected returns and achieving its investment objective. Tracker funds are known for their cost-effectiveness, as their passive investment approach results in lower management fees and operating expenses compared to actively managed funds. Investing in tracker funds simplifies the investment process for individual investors, as they can gain broad market exposure without the need for extensive research and analysis of individual securities. Tracker funds offer diversification benefits by investing in a wide range of assets within a specific index or sector, which can help reduce the overall risk in an investor's portfolio. Numerous studies have shown that, over the long term, tracker funds tend to outperform their actively managed counterparts due to their lower fees and more consistent returns. Tracker funds are accessible to individual investors through various investment vehicles, such as exchange-traded funds (ETFs) and index mutual funds, making it easy for investors to add them to their portfolios. Since tracker funds aim to replicate the performance of their benchmark index, they offer limited potential for outperformance compared to actively managed funds that seek to beat the market. Tracker funds are susceptible to market downturns, as their performance is directly tied to the performance of the underlying index or sector. The passive investment approach of tracker funds means that they do not benefit from the expertise of an active portfolio manager who can make tactical investment decisions in response to changing market conditions. Although tracker funds aim to replicate the performance of their benchmark index, tracking errors can occur due to various factors, such as fees, transaction costs, and portfolio adjustments. This can result in a fund's performance deviating from its benchmark index. Some tracker funds, particularly those focused on specific sectors or industries, may have a high concentration in a particular sector, which can expose investors to increased risk if that sector underperforms. ETFs are a popular investment vehicle for tracker funds, as they offer the benefits of diversification, low fees, and ease of trading. Investors can purchase and sell ETF shares on stock exchanges, just like individual stocks. Index mutual funds are another way to invest in tracker funds. These funds pool investors' money to purchase a diversified portfolio of assets that track a specific index. Unlike ETFs, index mutual funds are bought and sold at the end of the trading day at their net asset value (NAV). Some investment management firms, such as Vanguard or Fidelity, offer direct investment platforms that allow investors to purchase tracker funds without going through a broker. This can help minimize fees and commissions associated with investing. Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios based on an investor's risk tolerance and investment objectives. Many robo-advisors utilize tracker funds to build diversified portfolios for their clients. Investors can also purchase tracker funds directly through online brokerages, such as Charles Schwab, TD Ameritrade, or E-Trade. This option allows investors to have more control over their investment decisions and provides access to a wide range of tracker funds. Before investing in a tracker fund, it's crucial to assess your investment objectives and risk tolerance. This will help you determine the type of tracker fund that best aligns with your financial goals and risk appetite. When choosing a tracker fund, consider its historical performance and fees, as these factors can have a significant impact on your long-term returns. Look for funds with a consistent track record and low fees to maximize your investment potential. To build a well-diversified portfolio, consider investing in tracker funds across various asset classes (stocks, bonds, commodities) and regions (domestic and international). This can help reduce the overall risk in your portfolio and provide exposure to different economic and market conditions. Regularly monitor your tracker fund investments and rebalance your portfolio as needed to ensure that it remains aligned with your investment objectives and risk tolerance. Tracker funds have become an increasingly popular investment vehicle for their numerous advantages, including cost-effectiveness, diversification, and long-term performance. They come in various types, such as index, sector, commodity, currency, bond, and real estate tracker funds, offering investors a wide range of options to suit their investment objectives and risk tolerance. Key features of tracker funds, such as their passive investment strategy, low management fees, transparency, and tax efficiency, make them an attractive choice for many investors. However, it's essential to be aware of potential disadvantages, such as limited potential for outperformance, susceptibility to market downturns, and possible sector concentration risk. Investors have multiple options for investing in tracker funds, such as ETFs, index mutual funds, direct investment platforms, robo-advisors, and DIY investing through online brokerages. By evaluating fund performance, fees, and diversification across asset classes and regions, investors can choose the right tracker fund for their portfolio.What Is a Tracker Fund?

Types of Tracker Funds

Index Tracker Funds

Market Capitalization-Weighted Index Funds

Equal-Weighted Index Funds

Fundamental Index Funds

Sector Tracker Funds

Commodity Tracker Funds

Currency Tracker Funds

Bond Tracker Funds

Real Estate Tracker Funds

Key Features of Tracker Funds

Passive Investment Strategy

Diversification Benefits

Low Management Fees

Transparency

Tax Efficiency

Performance Measurement and Benchmarking of Tracker Funds

Tracking Error

Tracking Difference

Information Ratio

Benchmarks and Indices

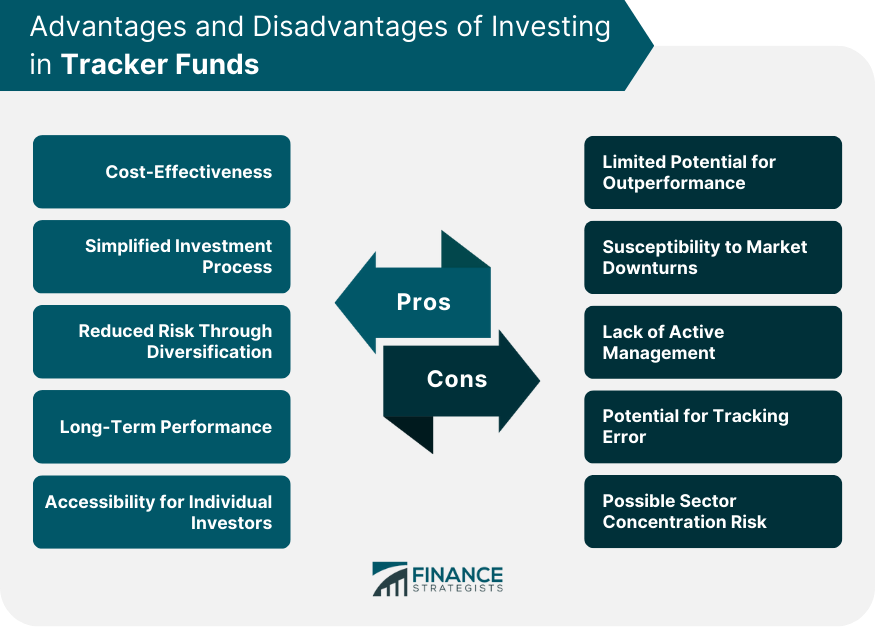

Advantages of Investing in Tracker Funds

Cost-Effectiveness

Simplified Investment Process

Reduced Risk Through Diversification

Long-Term Performance

Accessibility for Individual Investors

Disadvantages of Investing in Tracker Funds

Limited Potential for Outperformance

Susceptibility to Market Downturns

Lack of Active Management

Potential for Tracking Error

Possible Sector Concentration Risk

How to Invest in Tracker Funds

Exchange-Traded Funds (ETFs)

Index Mutual Funds

Direct Investment Platforms

Robo-Advisors

DIY Investing Through Online Brokerages

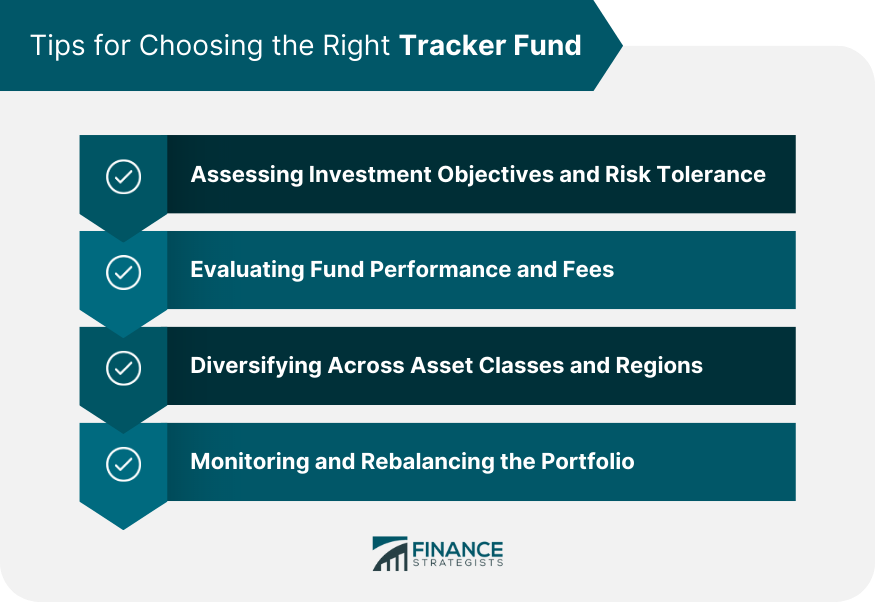

Tips for Choosing the Right Tracker Fund

Assessing Investment Objectives and Risk Tolerance

Evaluating Fund Performance and Fees

Diversifying Across Asset Classes and Regions

Monitoring and Rebalancing the Portfolio

Conclusion

Tracker Fund FAQs

A tracker fund is a type of investment fund that aims to replicate the performance of a particular market index or benchmark, such as the S&P 500 or FTSE 100. The fund holds a portfolio of securities that mirrors the composition of the index, with the objective of achieving returns that match the benchmark.

A tracker fund works by investing in a diversified portfolio of securities that replicates the composition of a particular market index. The fund buys and holds the same securities as the index in the same proportions, so the returns generated by the fund should closely match those of the index.

The advantages of investing in a tracker fund include low fees, diversification, and the ability to easily gain exposure to a particular market or asset class. As the fund simply aims to replicate the performance of an index, there is no need for active management, which keeps costs low. Additionally, the fund provides exposure to a broad range of securities, which can help to spread risk and potentially reduce volatility.

The main risk associated with investing in a tracker fund is tracking error, which is the difference between the returns generated by the fund and the returns of the index it is tracking. Tracking error can occur due to factors such as the fund's fees, portfolio management, and the cost of trading securities. Additionally, as the fund simply mirrors the composition of an index, it may not outperform the index, and investors may miss out on potentially lucrative opportunities.

When choosing a tracker fund, it's important to consider factors such as the index being tracked, the fees charged by the fund, and the size of the fund. Additionally, investors should consider the fund's performance history and the fund manager's experience and track record. It's also important to consider the fund's objective and whether it aligns with your investment goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.