The Information Ratio (IR) is a crucial performance measurement tool used by investors and portfolio managers to evaluate the risk-adjusted returns of an actively managed investment portfolio. The ratio measures the excess return of a portfolio relative to a benchmark index, divided by the tracking error, which represents the volatility of the excess returns. Information Ratio is essential in investment management as it allows investors and portfolio managers to compare the performance of various portfolios, taking into account the risk associated with active management. It provides insights into the consistency of a manager's ability to generate excess returns, enabling better decision-making in manager selection and asset allocation. Active return, also known as alpha, is the difference between the return of an actively managed portfolio and the return of its benchmark index. Tracking error is the standard deviation of the active return, which reflects the volatility of the excess returns generated by the portfolio manager. The Information Ratio is calculated using the following formula: Information Ratio = (Portfolio Return - Benchmark Return) / Tracking Error A higher Information Ratio indicates better risk-adjusted performance. A positive IR suggests that the portfolio manager has consistently generated excess returns compared to the benchmark, while a negative IR indicates underperformance. An IR of zero implies that the portfolio's performance is equal to the benchmark after accounting for risk. The Information Ratio helps assess a portfolio's risk-adjusted performance, as it considers both the excess returns generated by the manager and the risk involved in achieving those returns. While both the Information Ratio and the Sharpe Ratio measure risk-adjusted performance, the Sharpe Ratio focuses on the excess return over the risk-free rate, while the Information Ratio evaluates the excess return relative to a benchmark. The Sortino Ratio measures the risk-adjusted performance of a portfolio, considering only downside risk. Unlike the Information Ratio, which accounts for the total tracking error, the Sortino Ratio specifically evaluates the downside volatility. The Treynor Ratio measures the risk-adjusted performance of a portfolio by considering the portfolio's beta, or systematic risk, instead of tracking error. The Information Ratio is more suitable for actively managed portfolios, while the Treynor Ratio is better suited for passively managed portfolios. Alpha is the excess return generated by a portfolio manager relative to a benchmark, while the Information Ratio measures the risk-adjusted excess return, accounting for the consistency and volatility of those returns. The Information Ratio is widely used to evaluate the performance of portfolio managers, as it measures their ability to consistently generate excess returns relative to a benchmark index while taking into account the risk involved in their investment strategies. Investors can use the Information Ratio to make informed asset allocation decisions, selecting portfolio managers or investment strategies that demonstrate superior risk-adjusted performance. The Information Ratio helps investors monitor and manage the risk associated with actively managed portfolios by highlighting the consistency and volatility of excess returns. The Information Ratio can be employed as a tool for performance attribution, identifying the sources of a portfolio's excess returns and the risk factors contributing to its tracking error. This analysis can help investors understand the drivers of a portfolio's performance and make informed decisions about adjustments to their investment strategies. The Information Ratio is based on certain assumptions and simplifications, such as the normal distribution of returns and constant tracking error. In reality, these assumptions may not hold, leading to potential inaccuracies in the calculation and interpretation of the Information Ratio. The Information Ratio can be misleading if not interpreted within the context of the investment strategy, market conditions, and other relevant factors. A high IR does not necessarily guarantee future performance or indicate that a portfolio manager's strategy is inherently superior. The Information Ratio can be influenced by market conditions and the investment horizon, potentially leading to inconsistencies in its interpretation across different market environments and timeframes. To overcome the limitations of the Information Ratio, investors can use complementary performance metrics, such as the Sharpe Ratio, Sortino Ratio, and Treynor Ratio, to gain a more comprehensive understanding of a portfolio's risk-adjusted performance. In addition to quantitative metrics like the Information Ratio, investors should also consider qualitative factors, such as a portfolio manager's experience, investment philosophy, and decision-making process, when evaluating their performance. Investors should regularly review and adjust their investment strategies based on the Information Ratio and other performance metrics to ensure their portfolios remain aligned with their risk tolerance and investment objectives. The Information Ratio is a valuable tool for assessing the risk-adjusted performance of actively managed portfolios. It helps investors and portfolio managers evaluate the consistency of excess returns and make better-informed decisions about manager selection and asset allocation. While the Information Ratio offers important insights, it should be used in conjunction with other performance metrics and qualitative factors to gain a comprehensive understanding of a portfolio's performance and the underlying investment strategy. As the field of investment management continues to evolve, new performance measurement tools and methods may emerge to complement or enhance the utility of the Information Ratio. Investors and portfolio managers should remain informed about these developments to ensure they are using the most effective tools to evaluate risk-adjusted performance and make informed investment decisions. To ensure sound investment decisions tailored to your specific needs and goals, it is highly recommended to work with a knowledgeable financial advisor.Definition of Information Ratio

Importance of Information Ratio in Investment Management

Key Components of Information Ratio

Active Return

Tracking Error

Calculating Information Ratio

Formula for Information Ratio

Interpretation of Information Ratio Values

Relationship Between Information Ratio and Risk-Adjusted Performance

Comparing Information Ratio to Other Performance Metrics

Information Ratio vs Sharpe Ratio

Information Ratio vs Sortino Ratio

Information Ratio vs Treynor Ratio

Information Ratio vs Alpha

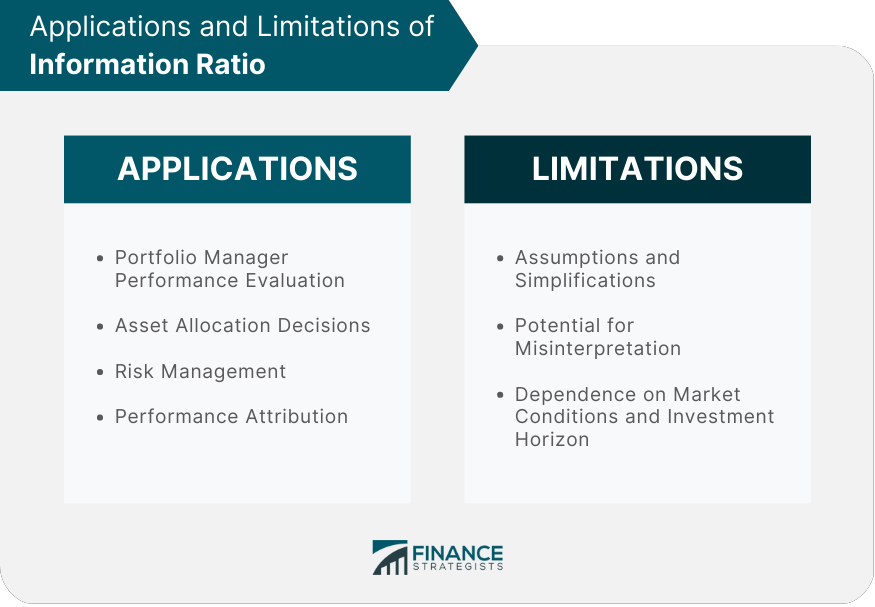

Applications of Information Ratio

Portfolio Manager Performance Evaluation

Asset Allocation Decisions

Risk Management

Performance Attribution

Limitations of Information Ratio

Assumptions and Simplifications

Potential for Misinterpretation

Dependence on Market Conditions and Investment Horizon

Enhancing the Utility of Information Ratio

Complementary Performance Metrics

Qualitative Assessments of Portfolio Managers

Periodic Review and Adjustment of Investment Strategies

Conclusion

Information Ratio FAQs

The Information Ratio (IR) is a performance measurement tool that evaluates the risk-adjusted returns of an actively managed investment portfolio compared to a benchmark index. It is essential in investment management as it helps compare portfolios, assess portfolio manager performance, and make informed asset allocation decisions.

The Information Ratio is calculated using the following formula: Information Ratio = (Portfolio Return - Benchmark Return) / Tracking Error

The Information Ratio focuses on the excess return relative to a benchmark index, while the Sharpe Ratio measures excess return over the risk-free rate. The Sortino Ratio evaluates risk-adjusted performance, considering only downside risk, unlike the Information Ratio, which accounts for the total tracking error.

The Information Ratio has various applications, such as evaluating portfolio manager performance, making asset allocation decisions, managing risk, and attributing performance to specific investment strategies or decisions.

The limitations of the Information Ratio include assumptions and simplifications (e.g., normal distribution of returns), potential for misinterpretation, and dependence on market conditions and investment horizon. It is essential to consider these limitations when using the Information Ratio to make investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.