Blend funds is a type of mutual fund that combines growth investing and value investing strategies. These funds invest in a mix of growth and value stocks, aiming to achieve capital appreciation while minimizing risk through diversification. By balancing the two strategies, blend funds offer investors the opportunity to benefit from both market trends and undervalued stocks. Investors may choose blend funds to diversify their investment portfolios and manage risk. The main benefits of blend funds include: 1. Diversification: Blend funds invest in various types of stocks, providing a balanced exposure to different sectors and investment styles. 2. Risk Management: By combining growth and value stocks, blended funds tend to be less volatile than funds focusing solely on one investment style. 3. Potential for Higher Returns: Blend funds may offer better long-term returns by capitalizing on growth opportunities while also investing in undervalued stocks. Blend funds differ from growth and value funds in their investment approach. Growth funds focus on companies with high growth potential, while value funds seek undervalued stocks with strong fundamentals. Blend funds aim to strike a balance between these two strategies, providing investors with a more diversified and potentially less risky investment option. Equity blend funds invest in a mix of growth and value stocks across different market capitalizations: 1. Large-Cap Blend Funds: These funds invest in large, well-established companies with a balance of growth and value characteristics. 2. Mid-Cap Blend Funds: These funds focus on medium-sized companies that exhibit both growth and value potential. 3. Small-Cap Blend Funds: These funds invest in smaller companies with a mix of growth and value attributes. Fixed-income blend funds invest in a combination of bonds and other fixed-income securities with varying risk profiles, maturities, and yields. Balanced funds, also known as hybrid funds, invest in a blend of equity and fixed-income securities, providing investors with the benefits of both asset classes. Target-date blend funds adjust their asset allocation based on a predetermined retirement date, gradually shifting from a higher-risk, growth-oriented approach to a more conservative, income-focused strategy as the target date approaches. Investors should assess their risk tolerance before investing in blend funds, as different types of blend funds carry varying levels of risk. Blend funds may be more suitable for long-term investors, as they typically require a longer investment horizon to realize their full potential. Investors should consider the diversification benefits offered by blend funds and how they fit within their overall investment portfolio. It is essential to compare expense ratios and fees across different blend funds to ensure cost-effective investing. Evaluating the past performance of blend funds and comparing them to relevant benchmarks can help investors make informed decisions. In a core-satellite strategy, investors allocate a significant portion of their portfolio to a blend fund (core) and complement it with specialized funds or individual securities (satellites) to enhance returns and diversification. Tactical asset allocation involves adjusting the mix of growth and value stocks within a blend fund based on changing market conditions, aiming to capture opportunities and manage risk. Dollar-cost averaging is a strategy where investors invest a fixed amount in a blend fund periodically, regardless of market fluctuations. This approach helps mitigate the impact of market volatility and reduces the risk of investing a lump sum at the wrong time. Blend funds are exposed to market risk, as the performance of the underlying stocks and bonds can be affected by economic factors, political events, and investor sentiment. The performance of blend funds depends on the fund manager's ability to select the right mix of growth and value stocks, which may vary based on their expertise and investment strategy. Fixed-income blend funds are subject to interest rate risk, as bond prices generally fall when interest rates rise. Blend funds may underperform during periods of high inflation, as rising prices can erode the real value of investment returns. Investors should be aware of the tax implications of investing in blend funds, as they may be subject to capital gains tax, dividend tax, and interest income tax, depending on their investment holdings and jurisdiction. Tax-efficient investing strategies can help investors minimize their tax burden. Some common strategies include investing in tax-exempt municipal bonds, utilizing tax-advantaged accounts (e.g., IRAs or 401(k)s), and holding investments for longer periods to benefit from lower long-term capital gains tax rates. Blend funds are subject to various regulations and oversight by financial authorities, such as the U.S. Securities and Exchange Commission (SEC). Investors should be familiar with the regulatory environment and any potential changes that may impact their blend fund investments. Blend funds offer investors a balanced approach to investing, combining growth and value strategies to provide diversification, risk management, and the potential for higher returns. By carefully considering their risk tolerance, investment horizon, and the various factors impacting blend fund performance, investors can make informed decisions about incorporating blend funds into their portfolios. Blend funds combine growth and value investing strategies to provide diversification and risk management. Various types of blend funds are available, catering to different investor preferences and risk profiles. Evaluating performance, expense ratios, and fund managers can help investors choose the right blend fund for their needs. Blend funds come with certain risks and limitations, such as market risk and management risk. Understanding the tax implications and regulatory environment is crucial for successful blend fund investing.Definition of Blend Funds

Purpose and Benefits of Investing in Blend Funds

Comparison to Other Types of Mutual Funds

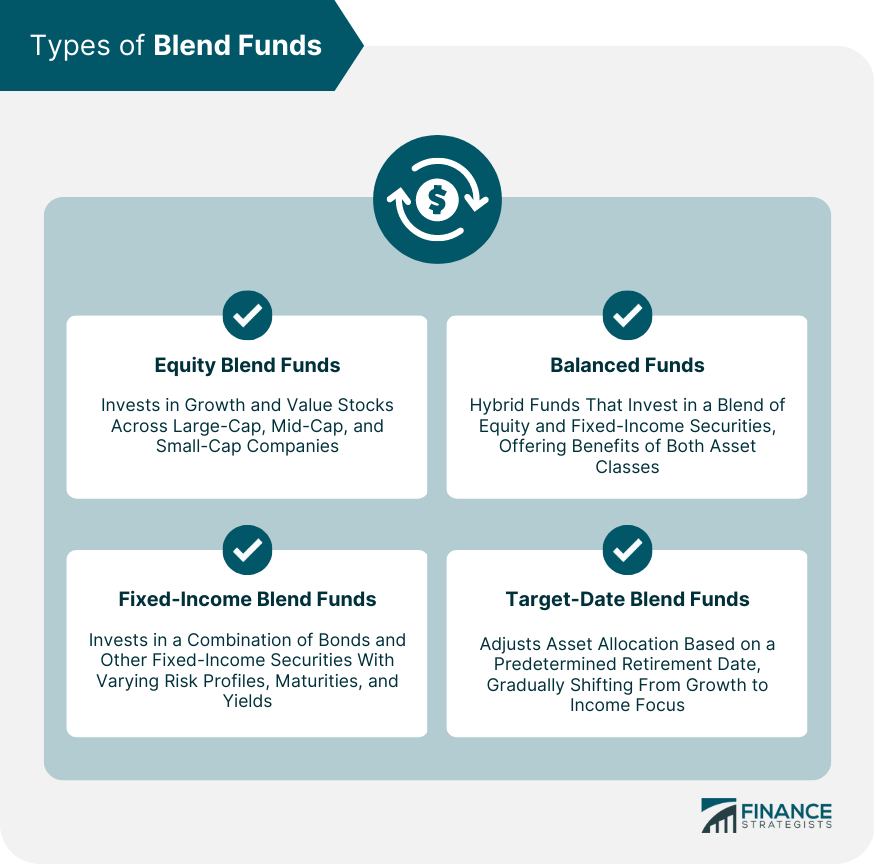

Types of Blend Funds

Equity Blend Funds

Fixed-Income Blend Funds

Balanced Funds

Target-Date Blend Funds

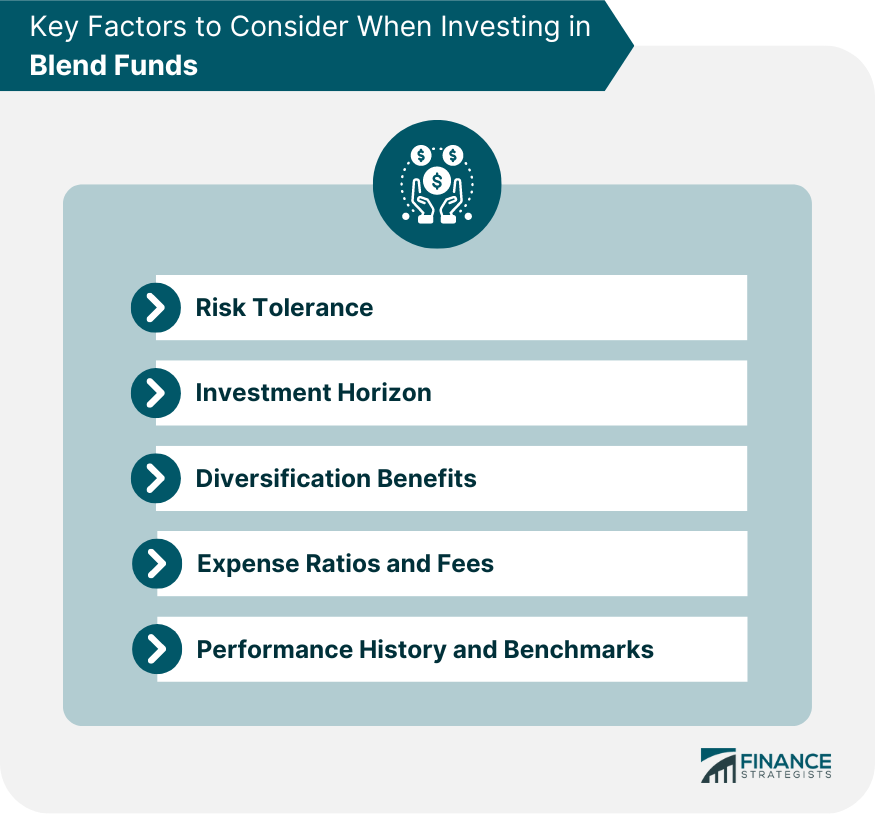

Key Factors to Consider When Investing in Blend Funds

Risk Tolerance

Investment Horizon

Diversification Benefits

Expense Ratios and Fees

Performance History and Benchmarks

Popular Blend Fund Investment Strategies

Core-Satellite Strategy

Tactical Asset Allocation

Dollar-Cost Averaging

Risks and Limitations of Blend Funds

Market Risk

Management Risk

Interest Rate Risk (for Fixed-Income Blend Funds)

Inflation Risk

Tax Implications and Regulations for Blend Funds

Tax Implications of Blend Fund Investments

Tax-Efficient Investing Strategies

Regulatory Environment for Blend Funds

Conclusion

Blend Funds FAQs

Blend funds are a type of mutual fund that combines growth and value investing strategies by investing in a mix of growth and value stocks. Investors should consider blend funds for their diversification benefits, risk management, and potential for higher long-term returns compared to investing solely in growth or value stocks.

There are several types of blend funds, including equity blend funds (large-cap, mid-cap, and small-cap), fixed-income blend funds, balanced funds (a mix of equity and fixed-income investments), and target-date blend funds, which adjust their asset allocation based on a predetermined retirement date.

To choose the right blend fund, investors should consider factors such as their risk tolerance, investment horizon, the fund's diversification benefits, expense ratios, and past performance history. Comparing different blend funds and evaluating the expertise of fund managers can also help investors make informed decisions.

Investing in blend funds comes with certain risks and limitations, such as market risk, management risk, interest rate risk (for fixed-income blend funds), and inflation risk. It is essential for investors to understand these risks and determine whether blend funds are suitable for their investment objectives.

Taxes and regulations can impact blend fund investments in various ways. Investors may be subject to capital gains tax, dividend tax, and interest income tax depending on their investment holdings and jurisdiction. It is crucial to understand the tax implications and regulatory environment for blend funds and consider tax-efficient investing strategies to minimize the tax burden.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.