In specie refers to the transfer of assets from one form to another without converting them into cash. It involves the direct transfer of assets, such as securities, real estate, or other investments, from one account or entity to another. This transfer is typically done without the need for the assets to be sold or liquidated. In specie transactions are an alternative to cash transactions and provide investors and wealth managers with greater flexibility and control over their assets. These transactions can be used for various purposes, such as portfolio diversification, estate planning, or implementing investment strategies. By understanding how in specie transactions work and their potential advantages and risks, wealth managers can effectively incorporate them into their wealth management strategies. In specie transactions involve the transfer of assets from one entity or account to another without converting them into cash. Instead of selling the assets, they are directly moved or re-registered to the recipient's ownership. This can be done within the same financial institution or between different institutions. The process of an in specie transaction typically begins with the identification and selection of the assets to be transferred. Valuation and due diligence are then performed to assess the fair market value and condition of the assets. Legal and regulatory considerations, such as transfer restrictions or compliance requirements, are taken into account. Finally, the execution and settlement of the transaction are completed, ensuring the assets are transferred to the intended recipient's ownership. In specie transactions play a significant role in wealth management by providing investors and wealth managers with increased flexibility and control over their investment portfolios. They allow for the transfer of assets without incurring transaction costs or disrupting the investment strategy. In specie transfers can be particularly useful when liquidating assets may result in adverse tax consequences or when there is a desire to maintain exposure to a specific investment or asset class. Additionally, in specie transactions can be utilized to rebalance and diversify investment portfolios. By transferring assets from one type or sector to another, wealth managers can optimize the risk and return characteristics of the portfolio without the need to sell and repurchase securities. This can help mitigate market risks and maintain a desired asset allocation strategy. Overall, in specie transactions provide wealth managers with a powerful tool to manage assets efficiently, preserve investment portfolios, and adapt to changing investment objectives and market conditions. One of the key advantages of in specie transactions is the preservation of the investment portfolio. Rather than liquidating assets and converting them into cash, in specie transfers allow for the direct movement of assets. This preserves the original investments and avoids the potential impact of selling assets at unfavorable prices or incurring transaction costs. By preserving the investment portfolio, wealth managers can maintain exposure to specific investments or asset classes that align with the client's long-term strategy. This is especially beneficial in situations where the assets have a long-term growth potential or are expected to generate income over time. When assets are transferred in specie, there may be opportunities to defer capital gains taxes that would otherwise be triggered by selling the assets. This can be particularly advantageous for assets with substantial unrealized capital gains. Furthermore, in specie transfers may provide the ability to utilize specific tax provisions or exemptions. For example, in some jurisdictions, transferring assets through in specie transactions may allow for tax-free transfers between certain types of accounts or entities, providing additional tax planning opportunities. In specie transactions provide wealth managers with greater flexibility and control over the assets within the investment portfolio. By directly transferring assets, wealth managers can maintain exposure to specific securities or investments that align with their investment strategy. This flexibility allows for strategic adjustments to the portfolio without the need to sell and repurchase assets. Moreover, in specie transfers provide control over the timing of the transaction. Wealth managers can choose when to execute the transfer based on market conditions, investment objectives, or other considerations. This control over the timing of the transfer can be valuable in optimizing the investment strategy and taking advantage of favorable market conditions. In specie transactions enable wealth managers to diversify investment portfolios more efficiently. By transferring assets in kind, wealth managers can move investments from one sector or asset class to another without disrupting the overall portfolio. This facilitates portfolio rebalancing and adjustments to maintain the desired asset allocation. Additionally, in specie transfers offer the opportunity to diversify across different investment vehicles. For example, wealth managers can transfer assets from individual stocks to exchange-traded funds (ETFs) or mutual funds, providing exposure to a broader range of securities or indices. This diversification can help manage risk and potentially enhance returns over the long term. In specie transactions provide wealth managers with advantages such as the preservation of investment portfolios, tax advantages, flexibility and control over assets, and diversification opportunities. These benefits make in specie transfers a valuable tool in managing investment portfolios and aligning them with clients' financial goals and risk profiles. One of the risks associated with in specie transactions is the potential for liquidity constraints. Certain assets may be illiquid or have limited marketability, making it challenging to find a suitable recipient for the in specie transfer. This can result in delays or difficulties in executing the transaction, potentially affecting the desired timing or efficiency of the wealth management strategy. Furthermore, the illiquidity of transferred assets can impact their valuation and pricing. In illiquid markets, determining the fair market value of the assets may be more subjective and less transparent, introducing potential valuation challenges and uncertainties. While in specie transactions can offer advantages in terms of preserving investments and avoiding transaction costs, there can still be associated costs and fees. These costs may include legal fees, valuation expenses, transfer fees, and other administrative charges. Wealth managers need to carefully consider and evaluate the transaction costs associated with in specie transfers to ensure that the benefits outweigh the expenses. Additionally, it is important to consider any tax implications related to the transfer. In some jurisdictions, transferring assets in specie may trigger tax liabilities or create complex tax reporting requirements. Wealth managers should work closely with tax advisors to understand and mitigate the potential tax consequences of in specie transactions. In specie transactions may have tax implications that need to be carefully managed. The transfer of assets may result in capital gains, capital losses, or other tax liabilities depending on the jurisdiction and applicable tax laws. Wealth managers should consider the tax implications of the transfer for both the transferring entity and the recipient entity or individual. Furthermore, compliance with regulatory requirements and legal considerations is crucial in executing in specie transactions. In specie transactions involve legal and regulatory risks that need to be addressed. These risks may include issues related to title transfers, ownership documentation, contractual obligations, and compliance with applicable laws and regulations. It is important for wealth managers to engage legal professionals with expertise in wealth management and securities laws to navigate these complexities and ensure compliance throughout the transaction process. Additionally, cross-border in specie transactions may introduce additional legal and regulatory challenges due to differences in laws and regulations across jurisdictions. In specie transactions are subject to market and valuation risks. The value of transferred assets can fluctuate based on market conditions, economic factors, and investor sentiment. Market volatility or unforeseen events can impact the fair market value of the assets, potentially resulting in gains or losses for the transferring entity or the recipient. Moreover, valuation of certain assets, especially those with complex structures or unique characteristics, can be challenging. Accurately assessing the fair market value of such assets requires expertise, comprehensive analysis, and appropriate valuation methodologies. Wealth managers need to consider the potential valuation risks and uncertainties associated with in specie transactions. It is essential for wealth managers to carefully evaluate and manage the risks associated with in specie transactions, including liquidity risks, transaction costs, tax implications and compliance, legal and regulatory risks, and market and valuation risks. By conducting thorough due diligence, engaging relevant experts, and implementing robust risk management practices, wealth managers can mitigate these risks and ensure the successful execution of in specie transactions. The first step in the process of an in specie transaction is the identification and selection of the assets to be transferred. Wealth managers assess the investment portfolio and determine which assets are suitable for transfer. Factors such as investment objectives, risk tolerance, and tax implications are taken into consideration when making these decisions. Once the assets for transfer are identified, a thorough valuation and due diligence process is conducted. Valuation experts or appraisers may be engaged to determine the fair market value of the assets. This assessment ensures that the transfer is conducted at an appropriate value and aligns with the regulatory and compliance requirements. Due diligence is performed to assess the condition, ownership documentation, and any legal or regulatory considerations associated with the assets. This step is crucial in identifying any potential risks or issues that need to be addressed before proceeding with the transaction. In specie transactions involve legal and regulatory considerations that need to be carefully managed. Legal professionals specializing in wealth management and securities laws may be involved to ensure compliance with relevant regulations and to navigate any legal complexities. Contracts or agreements outlining the terms and conditions of the transfer are prepared and reviewed by legal experts. Any transfer restrictions, consent requirements, or other contractual obligations are identified and addressed. Compliance with securities laws, tax regulations, and any jurisdiction-specific regulations is of utmost importance. Once all the necessary preparations are completed, the in specie transaction is executed. The assets are transferred from the transferring entity to the recipient entity or individual. The transfer may involve re-registration of securities, updating ownership records, or other necessary steps to effectuate the transfer. Settlement of the transaction occurs, ensuring that the transferring entity receives the agreed-upon consideration, if any, and the recipient entity assumes ownership of the transferred assets. Documentation and records are updated to reflect the change in ownership and to ensure transparency and accuracy in the wealth management process. It is essential for wealth managers to follow a systematic and well-defined process when conducting in specie transactions. In specie transactions can be valuable in estate planning and wealth transfer strategies. Individuals who wish to transfer assets to their beneficiaries can utilize in specie transfers to ensure a smooth and efficient transfer process. By transferring assets in kind, the wealth manager can help minimize the disruption and potential tax consequences that may arise from selling assets. Furthermore, in specie transfers allow for the preservation of the original investments, ensuring that the beneficiaries receive the assets in their original form. This can be particularly beneficial for assets with sentimental value or unique characteristics. In specie transactions find relevance in corporate actions and restructuring activities. When companies undergo mergers and acquisitions, or spin-offs, in specie transfers can be utilized to transfer assets or securities from one entity to another. This allows for a more seamless transition and facilitates the preservation of the underlying investments. Additionally, in specie transactions can be employed in corporate restructurings, such as the conversion of debt into equity or the transfer of assets between subsidiaries. By utilizing in specie transfers, wealth managers can efficiently facilitate these corporate actions and ensure the preservation of value for their clients. In specie transactions play a significant role in portfolio rebalancing and asset allocation strategies. As investment portfolios evolve over time, wealth managers may need to adjust the allocation of assets to maintain the desired risk-return profile. In specie transfers allow for the efficient movement of assets between different sectors, asset classes, or investment vehicles. Wealth managers can use in specie transactions to rebalance portfolios by transferring assets from overallocated sectors or asset classes to underallocated ones. This helps ensure that the portfolio remains aligned with the client's investment objectives and risk tolerance. If a wealth manager wants to gain exposure to a particular industry or sector, they can transfer assets representing companies or securities within that industry directly into the client's portfolio. In specie transfers also facilitate the implementation of strategies such as tax-loss harvesting, where assets with unrealized losses are transferred to offset capital gains or reduce taxable income. By directly transferring the assets, wealth managers can strategically manage tax implications and maximize tax efficiencies for their clients. In specie involves the transfer of assets in their existing form rather than converting them into cash. It is a method of direct asset transfer that can occur in various scenarios, such as mergers, acquisitions, or distributions to shareholders. The process of in specie transfer typically involves physically or electronically transferring assets like stocks, bonds, or real estate between parties. In specie transfers offer a direct and efficient way to transfer assets. One of the main advantages of in specie transfers is the preservation of asset value and characteristics, avoiding transaction costs and market impact. It also provides flexibility in managing portfolios and transferring unique assets. However, in specie transfers come with risks. Valuation can be subjective, and there may be legal and regulatory requirements to navigate. Proper due diligence, documentation, and coordination are crucial for a successful transfer. By understanding the definition, how it works, advantages, risks, and the overall process involved, individuals and investors can make informed decisions when considering in specie transfers as part of their financial strategies.What Is In Specie?

How In Specie Transactions Work

Role of In Specie Transactions in Wealth Management

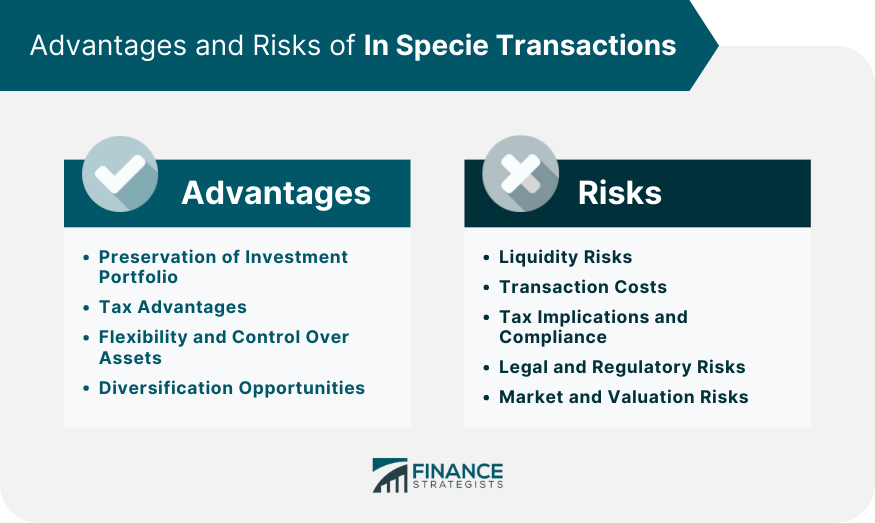

Advantages of In Specie Transactions

Preservation of Investment Portfolio

Tax Advantages

Flexibility and Control Over Assets

Diversification Opportunities

Risks and Challenges of In Specie Transactions

Liquidity Risks

Transaction Costs

Tax Implications and Compliance

Legal and Regulatory Risks

Market and Valuation Risks

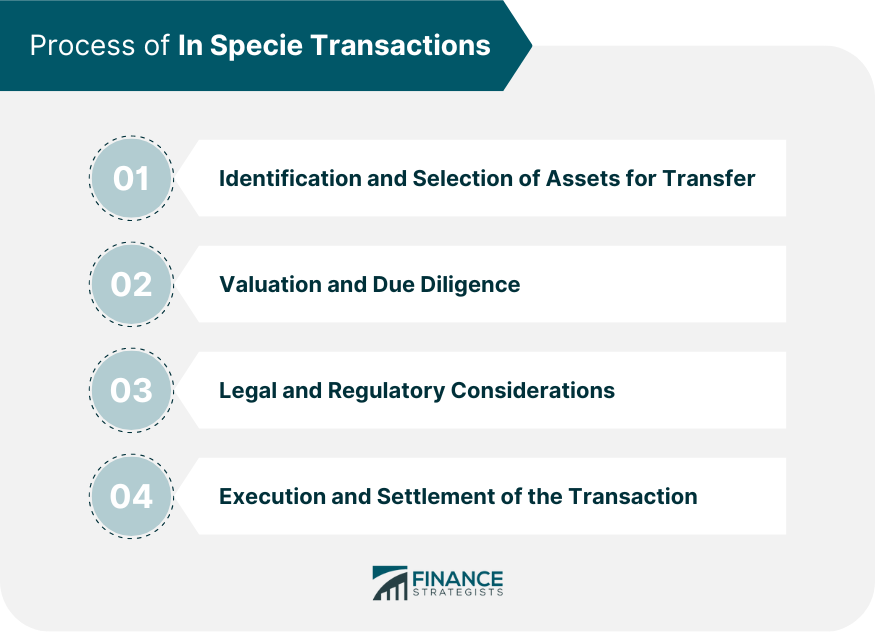

Process of In Specie Transactions

Identification and Selection of Assets for Transfer

Valuation and Due Diligence

Legal and Regulatory Considerations

Execution and Settlement of the Transaction

Use Cases of In Specie Transactions

Estate Planning and Wealth Transfer

Corporate Actions and Restructurings

Portfolio Rebalancing and Asset Allocation

Investment Strategy Implementation

Conclusion

In Specie FAQs

In Specie refers to the transfer of assets in their current form, without the need for conversion to cash, within a wealth management context.

In an In Specie transaction, assets such as securities or property are transferred directly from one account or entity to another, without selling them for cash first.

In Specie transactions offer benefits like asset preservation, tax advantages, flexibility in asset control, and opportunities for diversification.

Risks include liquidity risks, transaction costs, tax implications, legal and regulatory risks, and market and valuation risks.

In Specie transactions are often used for estate planning, corporate actions, portfolio rebalancing, and implementing specific investment strategies in wealth management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.