TIPS is a type of U.S. government bond specifically designed to help investors safeguard their investments against inflation. Unlike regular Treasury bonds, the principal of TIPS is tied to the Consumer Price Index (CPI), a key inflation indicator. TIPS was first issued by the U.S. Treasury in 1997 to offer investors a safe and effective way to handle inflationary risk. Before this, traditional Treasury bonds were the primary tool for fixed-income investing, but they offered no direct inflation protection. The introduction of TIPS was particularly appealing for long-term investors, such as those saving for retirement, since it could help them maintain their purchasing power over time. The principal value of TIPS is adjusted semiannually according to the changes in the Consumer Price Index for All Urban Consumers (CPI-U), a widely accepted measure of inflation in the United States. If inflation rises, the principal value of the TIPS increases. Conversely, if there's deflation, the principal value decreases. While the principal of TIPS adjusts with inflation, the interest rate is fixed and does not change throughout the life of the bond. However, because this fixed rate is applied to the inflation-adjusted principal, the actual interest payments to the investor can vary. If the principal increases due to inflation, the interest payment will rise, as it's a set percentage of a larger principal. On the other hand, if the principal decreases due to deflation, the interest payment will also fall, reflecting the principal’s movement. Interests are paid twice a year. When a TIPS matures, the investor receives the greater of the inflation-adjusted principal or the original principal. This means that if inflation has been high, leading to a large increase in the principal, the investor will receive this larger amount. If there's been deflation, the investor will still receive the original principal amount - thus ensuring they do not lose the nominal amount they originally invested. Investors can buy TIPS directly from the U.S. Treasury at original issue through a system called TreasuryDirect. TIPS can also be bought and sold on the secondary market, just like regular Treasury bonds. The minimum purchase amount for TIPS is $100. TIPS is issued in terms of 5, 10, and 30 years, giving investors a good range of options for different investment horizons. It's important to note that for TIPS, both the semiannual interest payments and the inflation adjustments to the principal are subject to federal tax in the year they are made, even though investors won't receive the inflation-adjusted principal until maturity. The specific tax implications can vary, so investors may want to consult with a tax advisor or financial planner. TIPS offers investors a reliable way to protect against inflation. The principal of a TIPS increases with inflation as measured by the CPI, thereby preserving the purchasing power of the investor's money. This can be particularly beneficial during periods of unexpectedly high inflation. When an investor buys a TIPS, they can be sure that they will earn a rate of return above inflation, as long as they hold the TIPS to maturity. The real return is equal to the fixed interest rate set at the time of issue. This makes TIPS a reliable tool for preserving capital and maintaining long-term purchasing power. TIPS, like all U.S. Treasury securities, is backed by the full faith and credit of the U.S. government. This makes it a very safe investment. As TIPS pays interest to investors twice a year, it provides a steady stream of income. The amount of this income can rise if inflation increases the principal of the TIPS. TIPS is offered in a range of terms, typically 5, 10, and 30 years. This allows investors to select the term that best fits their investment needs and goals. TIPS can be purchased for a minimum of $100, making it accessible to individual investors. TIPS can be bought and sold on the secondary market, providing liquidity for investors who need to sell before maturity. However, selling before maturity can result in a capital loss if interest rates have risen. The adjustments made to the principal of TIPS to account for inflation are considered taxable income by the IRS, even though investors don't actually receive these amounts until the bond matures. This could lead to a tax liability each year, known as "phantom income," which can be particularly problematic if an investor doesn't have sufficient cash flow to cover the tax. While TIPS offers protection against inflation, it does not provide protection against rising interest rates. If interest rates increase, the market price of TIPS will fall. This could lead to a capital loss if you need to sell your TIPS before they mature. In a period of deflation, the principal of TIPS decreases. Although you're guaranteed to get back at least your original investment if you hold to maturity, your semi-annual interest payments can be less during periods of deflation since they're based on the adjusted principal. The yield on TIPS is typically lower than on other government and corporate securities because of the inflation protection they offer. If inflation remains low, investors may end up with a lower return on TIPS compared to other securities. While TIPS can be sold on the secondary market, it isn't as active as the market for regular Treasury bonds. This could affect the price you receive if you need to sell your TIPS before they mature. TIPS is generally considered a long-term investment. For short-term investing, other types of assets may offer better returns. Before investing, you should fully understand how TIPS functions. As mentioned, the principal of TIPS increases with inflation and decreases with deflation, as measured by the CPI. When a TIPS matures, you receive the adjusted principal or the original principal, whichever is greater. Despite being considered low-risk investments, TIPS is not without its own set of risks. TIPS offers a lower yield compared to other treasury securities. Additionally, its value can fluctuate in the secondary market. Evaluate your financial situation, risk tolerance, and investment goals before investing. TIPS is best suited for buy-and-hold investors who intend to keep them until they mature. If you sell your TIPS before they mature, you may not receive the full inflation adjustment. Be aware of the "phantom income" problem. TIPS pays interest twice a year, and the principal is adjusted for inflation. But even though you don't receive the inflation adjustment until the TIPS matures, the IRS considers it taxable income each year. This could increase your tax bill without providing cash to pay the tax. One solution is to hold TIPS in a tax-deferred account, such as an IRA. While TIPS can be a valuable addition to a diversified portfolio, it should not be your only investment. Consider a mix of asset classes like equities, bonds, real estate, and cash equivalents. The value of TIPS increases with inflation, making it particularly beneficial during periods of rising prices. Keeping an eye on inflation trends and economic indicators can help you make more informed decisions about when to invest in TIPS. If you want exposure to TIPS but don't have the resources or inclination to manage individual securities, consider a TIPS mutual fund or ETF. This way, you get a diversified set of TIPS managed by professionals. However, keep an eye on the fees, as they can eat into your returns. TIPS provides investors with a valuable tool to safeguard their investments against inflation. The principal value of TIPS adjusts with changes in the CPI, allowing investors to preserve the purchasing power of their money. Aside from inflation protection, TIPS has several advantages, including guaranteed real returns, safety, regular income, flexibility, minimum investment, and liquidity. However, it is important to consider the limitations of TIPS. These include tax implications, interest rate and deflation risk, lower yield, and limited secondary market. TIPS is also not ideal for short-term investing. It is crucial to understand TIPS thoroughly before investing. Assessing your risk tolerance, considering holding until maturity, thinking about taxes, diversifying their investments, and monitoring the economy are also critical. Investors may also choose to invest in TIPS mutual funds. It is wise to consult a financial advisor for further information on TIPS. They can assess your individual financial situation, investment goals, risk profile, and time horizon to determine if TIPS is suitable for your portfolio. They can provide expertise and help you understand how TIPS aligns with your overall investment strategy.What Is Treasury Inflation-Protected Security (TIPS)?

How TIPS Works

Principal and Inflation Adjustment

Interest Payments

Maturity and Final Payment

Purchase and Sale

Tax Considerations

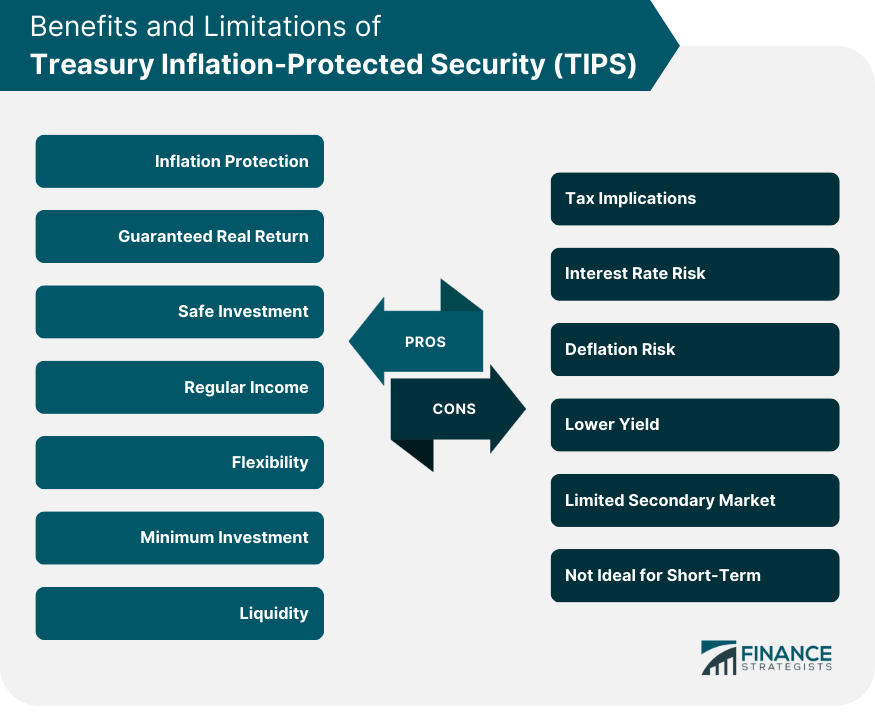

Benefits of Investing in TIPS

Inflation Protection

Guaranteed Real Return

Safe Investment

Regular Income

Flexibility

Minimum Investment

Liquidity

Limitations of TIPS

Tax Implications

Interest Rate Risk

Deflation Risk

Lower Yield

Limited Secondary Market

Not Ideal for Short-Term

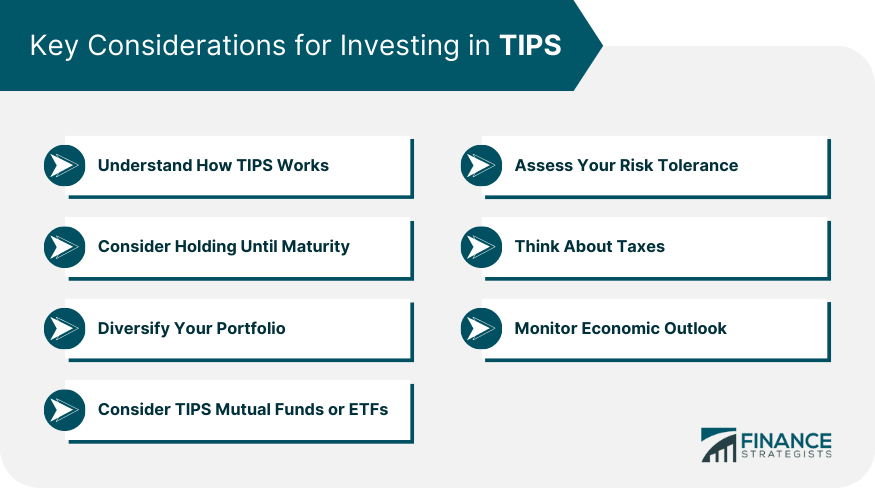

Key Considerations for Investing in TIPS

Understand How TIPS Works

Assess Your Risk Tolerance

Consider Holding Until Maturity

Think About Taxes

Diversify Your Portfolio

Monitor Economic Outlook

Consider TIPS Mutual Funds or ETFs

Final Thoughts

Treasury Inflation-Protected Security (TIPS) FAQs

While TIPS is considered a relatively low-risk investment backed by the U.S. government, it still carries some risks. It is subject to inflation and interest rate risk, and its value can fluctuate in the secondary market. However, TIPS does offer a level of protection against inflation, making it a potentially safer option compared to traditional bonds.

Both the semiannual interest payments and the inflation adjustments to the principal of TIPS are subject to federal tax in the year they are made, even though investors do not receive the inflation-adjusted principal until maturity. The specific tax implications can vary, so it is recommended to consult with a tax advisor or financial planner for personalized guidance.

Yes, TIPS can be bought and sold on the secondary market, providing liquidity for investors who need to sell before maturity. However, selling before maturity can result in a capital loss if interest rates have risen, and the secondary market for TIPS is not as active as the market for regular Treasury bonds.

TIPS protects against inflation by adjusting the principal value with changes in the Consumer Price Index (CPI), a measure of inflation. As inflation increases, the principal value of TIPS rises, preserving the purchasing power of the investment. This adjustment helps mitigate the erosion of value caused by inflation.

Yes, TIPS can be held in retirement accounts such as an Individual Retirement Account (IRA). Holding TIPS in a tax-deferred account can help address the tax implications associated with TIPS, as the tax on interest payments and inflation adjustments can be deferred until withdrawals are made from the retirement account. It is recommended to consult with a financial advisor or tax professional for specific guidance related to retirement account holdings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.