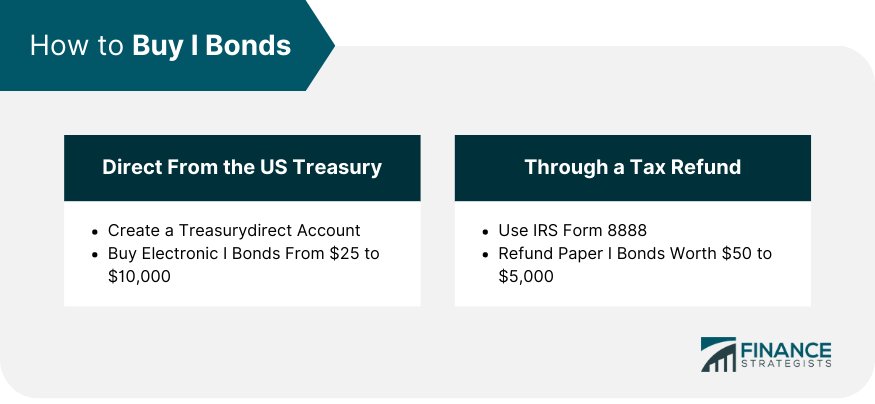

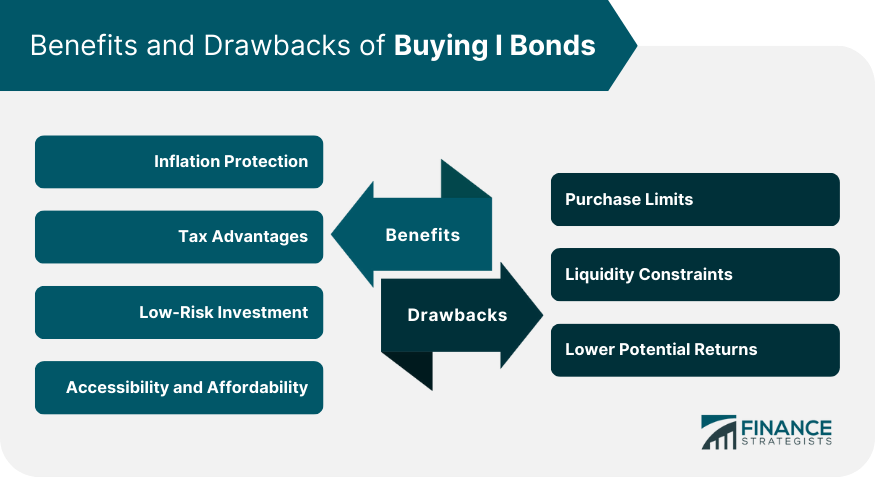

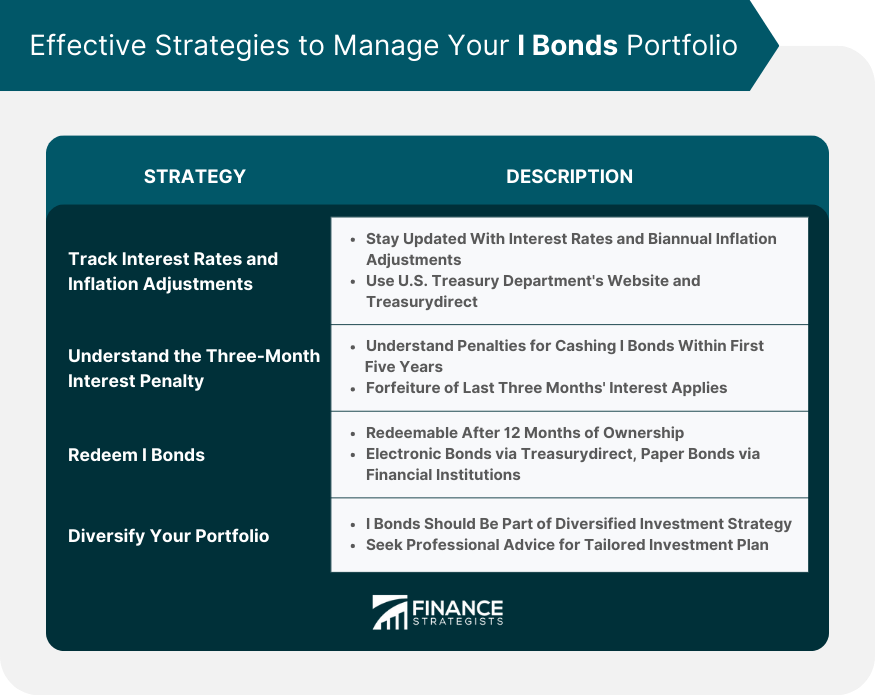

Series I Savings Bonds, commonly known as I Bonds, are low-risk, interest-bearing U.S. government bonds designed to protect investors from inflation. The U.S. Department of the Treasury issues I Bonds to support federal financing needs. Offering a fixed interest rate and an adjustable interest rate linked to inflation, I Bonds are unique in their dual-rate structure, providing both a stable return and an inflation hedge. The interest on I Bonds consists of two components: a fixed rate and an inflation rate. The fixed rate, established when you purchase the bond, remains the same throughout the life of the bond. In contrast, the inflation rate adjusts every six months (May and November) to track changes in the consumer price index for all urban consumers (CPI-U), a key measure of inflation. The combination of these two rates gives I Bonds their total return. Even in times of deflation, the composite rate cannot fall below zero, ensuring that your investment's nominal value does not decrease. To buy I Bonds directly from the U.S. government, you first need to open an account with TreasuryDirect, an online platform for purchasing and managing U.S. government securities. Opening an account is a straightforward process requiring basic personal and banking information. Once you've set up your TreasuryDirect account, you can purchase electronic I Bonds in any amount from $25 to $10,000, to the penny. For example, you could buy an I Bond for $100.37. Purchases can be made at any time, and the bonds are issued immediately and start earning interest from the first day of the month of purchase. When filing your federal tax return, you can opt to use IRS Form 8888 to buy paper I Bonds with a part or all of your refund. This form allows you to split your refund between different accounts or use it to buy savings bonds. When purchasing I Bonds with a tax refund, you'll receive paper bonds in the mail. These bonds are issued in preset denominations of $50, $100, $200, $500, and $1,000. The total value of I Bonds purchased in a calendar year using a tax refund cannot exceed $5,000. The interest rate of I Bonds adjusts every six months in response to changes in the inflation rate, as measured by the Consumer Price Index for All Urban Consumers (CPI-U). This feature ensures that your investment keeps pace with inflation, maintaining the purchasing power of your savings over time. I Bonds offer certain tax benefits that can enhance your overall investment return. The interest earned from I Bonds is exempt from state and local taxes. Furthermore, federal tax on the interest can be deferred until you redeem the bond or it reaches maturity, which can be advantageous for long-term planning. As securities issued by the U.S. government, I Bonds carry virtually no default risk. This makes them a highly secure investment for conservative investors or for those seeking to balance a portfolio with higher-risk assets. Additionally, the value of I Bonds never decreases, even when the inflation rate is negative. I Bonds are broadly accessible to most investors. With a minimum purchase amount of just $25 for electronic bonds through TreasuryDirect, they present an affordable investment option. In addition, they can be bought in exact amounts, allowing investors to invest the exact amount they wish without rounding to specific denominations. The U.S. Treasury imposes certain restrictions on the amount of I Bonds you can purchase each year. You can buy up to $10,000 in electronic I Bonds through TreasuryDirect per Social Security number each calendar year. Additionally, you can buy up to $5,000 in paper I Bonds with a tax refund, for a potential total annual limit of $15,000 per Social Security number. Although I Bonds are a low-risk investment, they come with certain liquidity constraints. You cannot redeem I Bonds within the first 12 months of ownership, and if you redeem them within the first five years, you lose the last three months of interest. This makes I Bonds less suitable for short-term investment needs. While I Bonds provide a reliable return and safety of principal, their return potential is generally lower than riskier assets like stocks or corporate bonds. For investors with a higher risk tolerance or longer time horizon, these other types of investments might offer better potential for higher returns. To effectively manage your I Bonds investments, it's crucial to stay updated with the interest rates and biannual inflation adjustments. Interest is added to an I Bond monthly and is paid when you cash the bond. The rates and adjustments impact the growth of your investment over time. The U.S. Treasury Department's website and TreasuryDirect are key resources to stay informed about these changes. If you need to cash an I Bond within the first five years of issuance, it's crucial to understand that you'll forfeit the last three months' interest as a penalty. Planning your cash needs in advance can help you avoid this penalty. You can redeem I Bonds at any time after 12 months of ownership. If you hold electronic I Bonds, you can redeem them through your TreasuryDirect account and have the funds deposited directly into your linked bank account. For paper I Bonds, most financial institutions will redeem them for you. While I Bonds are a safe and low-risk investment, they shouldn't make up your entire investment portfolio. They should be used as a part of a diversified investment strategy. A financial advisor or investment professional can help you determine how I Bonds might fit into your overall investment plan, considering factors like your risk tolerance, financial goals, and investment time horizon. I Bonds are U.S. government bonds that provide a dual-rate structure to protect investors from inflation. They offer a fixed interest rate combined with an adjustable rate tied to inflation, ensuring a stable return while safeguarding against rising prices. Purchasing I Bonds can be done directly from the U.S. Treasury through TreasuryDirect or using a tax refund through IRS Form 8888. These bonds offer benefits such as inflation protection, tax advantages, low-risk investment, and accessibility. However, it's important to be aware of limitations, including purchase limits, liquidity constraints, and potentially lower returns compared to riskier assets. Managing an I Bonds investment involves staying informed about interest rates and inflation adjustments, understanding redemption penalties, and considering diversification within an overall investment strategy. Consult with a financial advisor for further guidance on how to buy I Bonds. They can provide personalized advice tailored to your specific needs.Overview of I Bonds

How to Buy I Bonds

Direct From the US Treasury

Opening an Account With TreasuryDirect

Purchasing Process

Through a Tax Refund

Using IRS Form 8888

Receiving Paper Bonds

Benefits of Buying I Bonds

Inflation Protection

Tax Advantages

Low-Risk Investment

Accessibility and Affordability

Limitations of Buying I Bonds

Purchase Limits

Liquidity Constraints

Lower Potential Returns

Effective Strategies to Manage Your I Bonds Portfolio

Track Interest Rates and Inflation Adjustments

Understand the Three-Month Interest Penalty

Redeem I Bonds

Diversify Your Portfolio

Final Thoughts

How to Buy I Bonds FAQs

The first step to buying I Bonds is opening an account with TreasuryDirect, an online platform provided by the U.S. Treasury. You will need to provide basic personal and banking information to set up your account.

Yes, when purchasing electronic I Bonds through TreasuryDirect, you can buy them in any amount from $25 to $10,000, to the penny. This flexibility allows you to invest the exact amount you desire.

You can buy electronic I Bonds through TreasuryDirect at any time. The bonds are issued immediately and start earning interest from the first day of the month of purchase. However, keep in mind that there is a minimum holding period of 12 months before you can redeem them.

Yes, you can use your federal tax refund to purchase paper I Bonds. When filing your tax return, you can use IRS Form 8888 to specify that a portion or all of your refund should be used to buy paper I Bonds.

If you choose to buy paper I Bonds with your tax refund, they will be mailed to you in physical form. The bonds are issued in preset denominations of $50, $100, $200, $500, and $1,000. The total value of I Bonds purchased in a calendar year using a tax refund cannot exceed $5,000.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.