A Dim Sum bond refers to a type of debt instrument denominated in Chinese yuan (CNY) and issued outside of mainland China. The name "Dim Sum" is derived from traditional Chinese cuisine, symbolizing the bond's connection to Chinese culture. These bonds are primarily issued in Hong Kong, which serves as an offshore market for yuan-denominated securities. Dim Sum bonds allow international investors to gain exposure to the Chinese yuan and invest in the Chinese market without the need for direct access to mainland China's domestic bond market. They provide diversification opportunities and access to yuan-denominated assets. Dim Sum bonds typically offer fixed interest payments and have a specific maturity date. The development of Dim Sum bonds has facilitated the internationalization of the Chinese currency and increased global investment in yuan-denominated assets. Dim Sum bonds are debt securities denominated in Chinese Renminbi (RMB) but issued outside mainland China. As an emerging market currency, the RMB has seen increased international usage, with Dim Sum bonds playing a crucial role in its internationalization. While the bonds are denominated in RMB, they are issued and traded outside mainland China, primarily in Hong Kong, Singapore, and London. This arrangement allows issuers to access offshore RMB liquidity and international investors to invest in RMB-denominated assets without being subject to mainland Chinese regulations. There are three primary types of Dim Sum bonds: corporate, sovereign, and supranational. Both Chinese and foreign companies issue corporate bonds, while foreign governments issue sovereign bonds. Supranational bonds are issued by international organizations such as the World Bank or the Asian Development Bank. Dim Sum bonds typically have varying maturity periods, ranging from short-term bonds with a maturity of one year to long-term bonds with a maturity of over ten years. The coupon rates on these bonds also differ based on the credit rating of the issuer and prevailing market conditions. The primary market for Dim Sum bonds involves issuing new bonds to investors. Issuers work with investment banks and other financial institutions to underwrite and distribute the bonds to investors, raising capital in the process. The secondary market is where existing Dim Sum bonds are traded between investors. This market provides liquidity to bondholders who want to buy or sell their bonds before maturity. Trading activity in the secondary market impacts bond prices and yields, affecting the overall attractiveness of Dim Sum bonds. Hong Kong, Singapore, and London are the three major financial centers for issuing and trading Dim Sum bonds. With its proximity to mainland China and well-developed financial infrastructure, Hong Kong remains the dominant hub for Dim Sum bond activity. However, Singapore and London have also emerged as important centers, offering more diversified opportunities for both issuers and investors. Various entities, including Chinese companies and banks, foreign companies and banks, and governments and supranational organizations, issue Dim Sum bonds. For example, Chinese corporations such as Tencent and Alibaba have issued Dim Sum bonds to raise capital for their overseas expansions. In contrast, foreign corporations like McDonald's and Volkswagen have tapped into the offshore RMB market to fund their Chinese operations. Institutional investors, such as pension funds, insurance companies, and asset management firms, are the primary investors in Dim Sum bonds. They are attracted to the bonds due to their potential for higher yields than other fixed-income investments and the opportunity to diversify their portfolios by including RMB-denominated assets. Retail investors also participate in the Dim Sum bond market, although their involvement is typically more limited. Issuers may choose to issue Dim Sum bonds to access offshore RMB liquidity, diversify their funding sources, or raise capital to finance their operations in China or other RMB-linked markets. On the other hand, investors are attracted to Dim Sum bonds due to the potential for higher yields, currency appreciation, and portfolio diversification. Additionally, investing in Dim Sum bonds can allow investors to gain exposure to China's growth story without directly investing in the mainland Chinese market. Investors in Dim Sum bonds face currency risk, as fluctuations in the RMB exchange rate can impact the value of their investments. For example, if the RMB depreciates against an investor's home currency, the value of their Dim Sum bond holdings would decrease in their home currency terms. Credit risk is the possibility that the bond issuer may default on its interest or principal payments. Although many Dim Sum bond issuers have strong credit ratings, there have been instances of defaults, such as the case of China Energy Reserve and Chemicals Group, which defaulted on its Dim Sum bond in 2018. The regulatory risk stems from changes in regulations governing Dim Sum bonds' issuance, trading, and taxation. For instance, the Chinese government's efforts to tighten capital controls or impose restrictions on RMB convertibility could impact the Dim Sum bond market, reducing issuance or trading activity. Liquidity risk refers to the risk that investors may face difficulties in buying or selling Dim Sum bonds, particularly during periods of market stress. While the secondary market for Dim Sum bonds has grown significantly, it still needs to be more liquid than established bond markets such as the US or European markets. The regulatory framework for Dim Sum bonds involves several key regulators with specific roles and responsibilities. These regulators work together to ensure the smooth functioning and integrity of the market. As the central bank of China, the PBOC plays a pivotal role in guiding the development of the offshore Chinese yuan (CNH) market. It formulates monetary policies, sets guidelines, and implements measures to regulate the issuance and trading of Dim Sum bonds. The PBOC oversees the overall stability of the offshore CNH market and ensures compliance with relevant regulations. The HKMA is the regulatory authority for the Hong Kong financial system, including the Dim Sum bond market. It works closely with the PBOC to facilitate the issuance and trading of Dim Sum bonds in Hong Kong. The HKMA supervises financial institutions, monitors market activities, and enforces regulatory compliance to maintain the integrity and stability of the market. In addition to the PBOC and HKMA, international regulators also play a role in the Dim Sum bond market. These regulators may include securities and financial authorities from other countries where Dim Sum bonds are issued or traded. They ensure compliance with local regulations, oversee cross-border transactions and facilitate cooperation and coordination among regulators for investor protection and market stability. Regulations governing Dim Sum bonds encompass various aspects of their issuance, listing, and trading processes. These regulations are designed to ensure market integrity, investor protection, and transparency in the Dim Sum bond market. Issuers of Dim Sum bonds are required to obtain approval from the relevant regulators before issuing bonds. The approval process involves assessing the issuer's credibility, financial standing, and compliance with regulatory standards. Once approved, issuers must meet specific listing requirements set by the stock exchanges where their bonds will be listed. These requirements may include minimum issuance size, credit ratings, and eligibility criteria. Issuers of Dim Sum bonds are obligated to provide comprehensive and accurate information to investors. They must disclose essential details such as the purpose of the bond issuance, terms and conditions, interest rates, maturity dates, and risk factors. Issuers are also required to submit periodic reports and financial statements to regulatory authorities and the stock exchanges where their bonds are listed. These disclosure and reporting requirements aim to promote transparency, enable informed investment decisions, and enhance investor protection. Regulations governing Dim Sum bonds prioritize investor protection. They establish rules to prevent fraudulent activities, market manipulation, and unfair practices. Regulators monitor issuers and intermediaries to ensure compliance with ethical standards and investor protection measures. Investor education initiatives may also be implemented to enhance investor awareness and understanding of Dim Sum bonds, their risks, and potential returns. Regulators, such as the People's Bank of China and the Hong Kong Monetary Authority, oversee the Dim Sum bond market to ensure compliance with regulatory requirements. They conduct periodic inspections, audits, and assessments of issuers and intermediaries to maintain market integrity. Regulators may also collaborate with international counterparts to promote cross-border regulatory harmonization and cooperation. Dim Sum bonds are a type of debt instrument denominated in Chinese yuan (CNY) and issued outside of mainland China. They offer investors the opportunity to gain exposure to the Chinese yuan and invest in the Chinese market without the need for direct access to mainland China's domestic bond market. Dim Sum bonds typically offer fixed interest payments and have a specific maturity date. There are a number of risks associated with investing in Dim Sum bonds, including currency risk, credit risk, regulatory risk, and liquidity risk. However, the potential rewards of investing in Dim Sum bonds can be significant, as these bonds offer the potential for higher yields than other fixed-income investments. Overall, Dim Sum bonds can be a valuable asset for investors who are looking to gain exposure to the Chinese yuan and invest in the Chinese market. However, it is important to carefully consider the risks involved before investing in Dim Sum bonds.What Is a Dim Sum Bond?

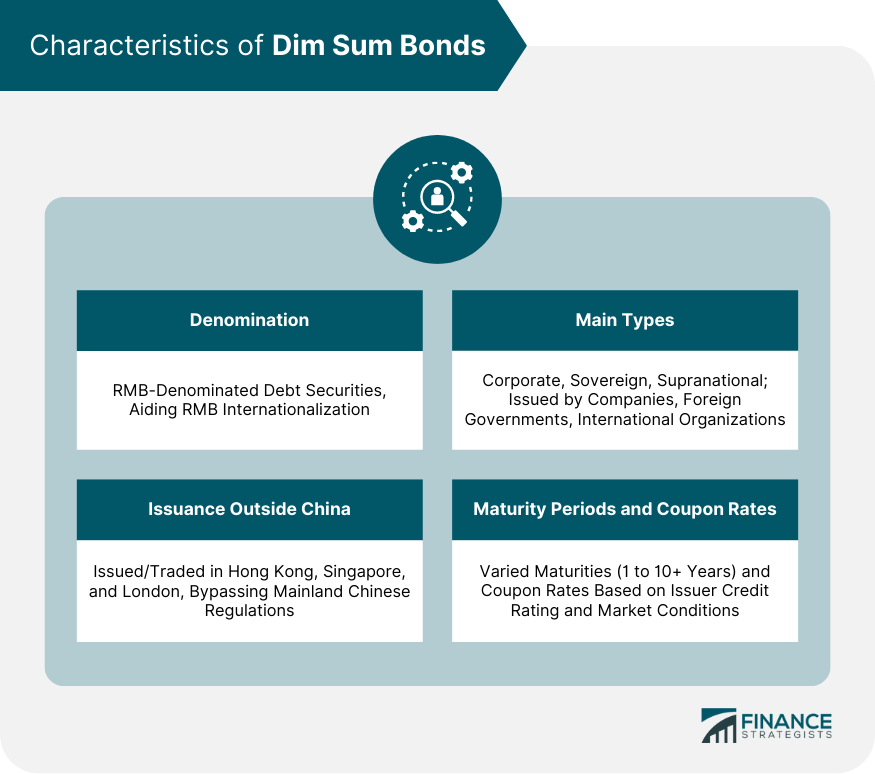

Characteristics of Dim Sum Bonds

Denominated in Chinese Renminbi (RMB)

Issued Outside Mainland China

Main Types of Dim Sum Bonds

Maturity Periods and Coupon Rates

Market for Dim Sum Bonds

Primary Market: Issuance of New Bonds

Secondary Market: Trading of Existing Bonds

Major Financial Centers for Dim Sum Bonds

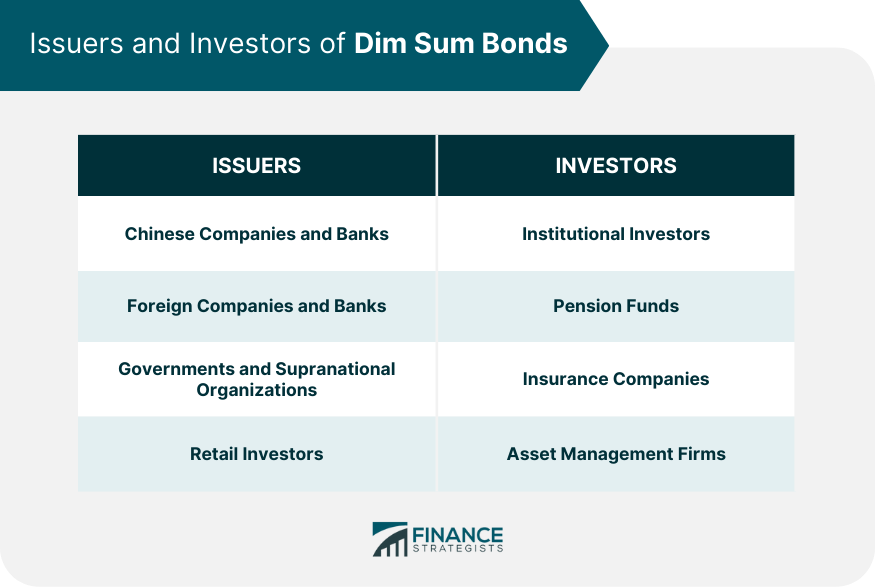

Issuers and Investors of Dim Sum Bonds

Types of Issuers

Types of Investors

Reasons for Issuing and Investing in Dim Sum Bonds

Risks Associated With Dim Sum Bonds

Currency Risk

Credit Risk

Regulatory Risk

Liquidity Risk

Regulatory Framework for Dim Sum Bonds

Key Regulators and Their Roles

People's Bank of China (PBOC)

Hong Kong Monetary Authority (HKMA)

International Regulators

Regulations Governing Dim Sum Bonds

Approval and Listing Requirements

Disclosure and Reporting Requirements

Investor Protection Measures

Regulatory Oversight

Conclusion

Dim Sum Bond FAQs

A Dim Sum Bond is a debt security denominated in the Chinese Renminbi (RMB) and issued outside mainland China, primarily in financial centers such as Hong Kong, Singapore, and London. These bonds allow international investors to gain exposure to RMB-denominated assets without being subject to mainland Chinese regulations.

Various entities, including Chinese and foreign companies, banks, governments, and supranational organizations, can issue Dim Sum Bonds. Issuers choose to issue Dim Sum bonds to access offshore RMB liquidity, diversify their funding sources, or raise capital for their operations in China or other RMB-linked markets.

Three primary types of Dim Sum Bonds exist: corporate, sovereign, and supranational. Both Chinese and foreign companies issue corporate bonds, foreign governments issue sovereign bonds, and supranational bonds are issued by international organizations such as the World Bank or the Asian Development Bank.

Investing in Dim Sum Bonds carries several risks, including currency, credit, regulatory, and liquidity risks. Currency risk arises from fluctuations in the RMB exchange rate, credit risk pertains to the possibility of the issuer defaulting on interest or principal payments, regulatory risk is related to changes in regulations governing the bonds, and liquidity risk refers to the potential difficulties in buying or selling the bonds in the secondary market.

The Dim Sum Bond market has grown significantly since 2007, reaching over 800 billion RMB in outstanding value. As China continues to liberalize its financial markets and the RMB gains prominence in global markets, the market for Dim Sum Bonds is expected to expand further. However, the market's growth may be influenced by evolving regulatory developments and changing economic conditions in China.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.