Amortized bonds refers to a type of fixed-income security where the principal repayment is spread out over the bond's life, rather than being paid in one lump sum at maturity. These bonds are different from traditional bonds, which typically pay periodic interest (also known as coupon payments) and return the principal amount in full at the end of the bond term. In an amortized bond, each payment made by the issuer consists of both interest and a portion of the principal. Over time, the interest portion of each payment decreases while the principal portion increases, as the outstanding principal balance is gradually reduced. Mortgage-backed securities are a type of amortized bond backed by a pool of mortgages. The principal and interest payments from these mortgages are passed through to bondholders. MBS can provide investors with a relatively stable income stream and the potential for capital appreciation. Asset-backed securities are similar to MBS but are backed by a diverse range of assets, such as auto loans, credit card receivables, and student loans. Like MBS, ABS can offer a steady income and potential for capital appreciation, making them attractive to wealth managers. Collateralized debt obligations are a type of amortized bond backed by a portfolio of fixed-income assets, such as corporate bonds or loans. CDOs are structured into tranches, with different levels of risk and return, providing investors with various options to match their risk tolerance and investment objectives. Active portfolio management involves continuously monitoring and adjusting a portfolio's holdings to capitalize on market opportunities and manage risks. Wealth managers using this approach may actively trade amortized bonds, seeking to profit from changes in interest rates or credit quality. Passive portfolio management involves holding a diversified portfolio of bonds with minimal trading activity. Wealth managers using this approach may invest in amortized bonds through index funds or Exchange-Traded Funds (ETFs), seeking to replicate the performance of a specific bond index or sector. A laddering strategy involves investing in a series of amortized bonds with staggered maturities. This approach can help manage interest rate risk and provide a consistent cash flow for reinvestment of income purposes. Wealth managers using this strategy can tailor the bond ladder to meet their clients' specific risk tolerance and investment objectives. A barbell strategy involves investing in short-term and long-term amortized bonds while avoiding intermediate-term bonds. This strategy can help balance the risks and returns associated with interest rate fluctuations, as changes in interest rates tend to have a greater impact on intermediate-term bonds. Wealth managers using this approach can adjust the allocation between short-term and long-term bonds based on their clients' risk tolerance and market outlook. Yield to maturity (YTM) is a measure of the total return an investor can expect to receive if they hold a bond until it matures. YTM takes into account the bond's current market price, its par value, its coupon rate, and the time to maturity, providing a comprehensive view of the bond's potential performance. Duration is a measure of a bond's sensitivity to interest rate changes, while modified duration adjusts this sensitivity for changes in the bond's yield. These metrics can help wealth managers assess the interest rate risk associated with an amortized bond and make more informed investment decisions. Convexity is a measure of the curvature of a bond's price-yield relationship, which can provide insight into the bond's price sensitivity to interest rate changes. Higher convexity typically indicates a bond is less sensitive to interest rate changes, making it a potentially more attractive investment for wealth managers. Credit ratings are assessments of the creditworthiness of a bond's issuer or the underlying assets. Rating agencies, such as Standard & Poor's, Moody's, and Fitch, assign credit ratings based on their analysis of financial and qualitative factors. Wealth managers can use credit ratings to help evaluate the credit risk associated with an amortized bond. Amortized bonds can be taxable or tax-exempt, depending on the issuer and the nature of the underlying assets. Municipal bonds, for example, are typically tax-exempt at the federal level and may also be exempt from state and local taxes. Wealth managers should consider the tax implications of different bond investments when constructing a client's portfolio. The amortization of bond premiums or discounts can have tax implications for investors. In some cases, bond premiums may be tax-deductible, while bond discounts may be subject to taxes as ordinary income. Wealth managers should be aware of these tax implications and advise their clients accordingly. Wealth managers can employ various strategies to optimize the tax efficiency of their clients' bond portfolios, such as investing in tax-exempt bonds or using tax-deferred accounts. By minimizing the tax impact of their bond investments, wealth managers can help their clients achieve better after-tax returns. Amortized bonds can provide a steady source of income for investors, making them an attractive option for wealth managers seeking to meet their clients' income needs. Investing in amortized bonds can help wealth managers diversify their clients' portfolios, reducing the overall risk and improving the potential for more stable returns. Amortized bonds, with their varying degrees of risk and return, can provide a counterbalance to other asset classes, such as equities or commodities. Amortized bonds can play a significant role in managing a portfolio's overall risk. By carefully selecting bonds with different levels of credit quality, interest rate sensitivity, and maturities, wealth managers can tailor a bond portfolio to meet their clients' risk tolerance and investment objectives. Amortized bonds can be an essential component of a wealth management strategy aimed at achieving long-term financial goals, such as funding retirement, financing a child's education, or purchasing a home. With their potential for income generation, capital appreciation, and risk management, amortized bonds can help investors build and preserve wealth over time. Amortized bonds offer diversification benefits, as they are backed by a wide range of underlying assets. By investing in these bonds, wealth managers can spread risk across multiple investments, reducing the impact of any single default. Amortized bonds provide a regular income stream to investors, as the underlying assets make periodic principal and interest payments. This income stream can be attractive to wealth managers, especially for clients seeking steady income in retirement. Amortized bonds has the potential for capital appreciation, as their value can increase over time. This can result from changes in interest rates or improvements in the credit quality of the underlying assets. Some amortized bonds are indexed to inflation, providing a degree of inflation protection to investors. This can be particularly beneficial for wealth managers seeking to preserve their clients' purchasing power in the face of rising prices. Credit risk is the risk that the issuer of the bond or the underlying assets will default on their obligations. This can result in a loss of principal and interest payments, negatively impacting the bond's value. Prepayment risk is the risk that borrowers of the underlying assets will repay their loans early. This can lead to a decrease in the bond's yield and potential reinvestment risk, as investors may have to reinvest the proceeds at lower interest rates. Interest rate risk is the risk that changes in interest rates will negatively impact the value of the bond. As interest rates rise, the market value of amortized bonds typically declines, resulting in potential capital losses for investors. Liquidity risk is the risk that investors may be unable to sell their bonds at a fair price in a timely manner. Amortized bonds, particularly those backed by less liquid assets, may have limited secondary market liquidity, making it difficult for wealth managers to sell them when needed. Amortized bonds are a significant component of wealth management strategies, offering several advantages and risks. These bonds provide diversification benefits, steady income streams, the potential for capital appreciation, and inflation protection. Wealth managers can use various strategies, such as laddering or barbell approaches to optimize their clients' bond portfolios. Assessing the performance of amortized bonds involves considering metrics like yield to maturity (YTM), duration, modified duration, convexity, and credit ratings. Tax considerations play a role in determining the tax efficiency of bond investments, and wealth managers should be aware of the implications of taxable versus tax-exempt bonds and bond amortization for their clients. Overall, amortized bonds have a crucial role in generating income, diversifying portfolios, managing risk, and achieving long-term financial goals.Definition of Amortized Bonds

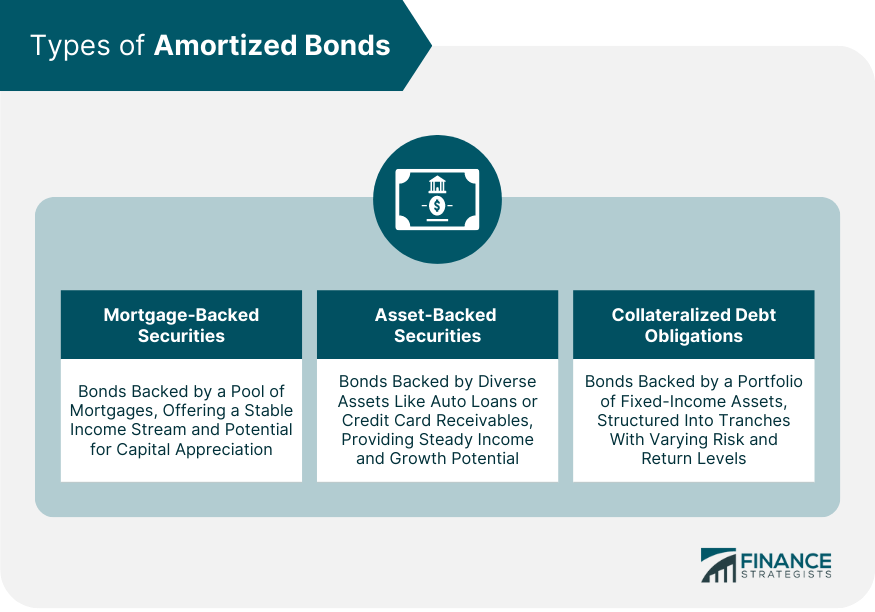

Types of Amortized Bonds

Mortgage-Backed Securities (MBS)

Asset-Backed Securities (ABS)

Collateralized Debt Obligations (CDOs)

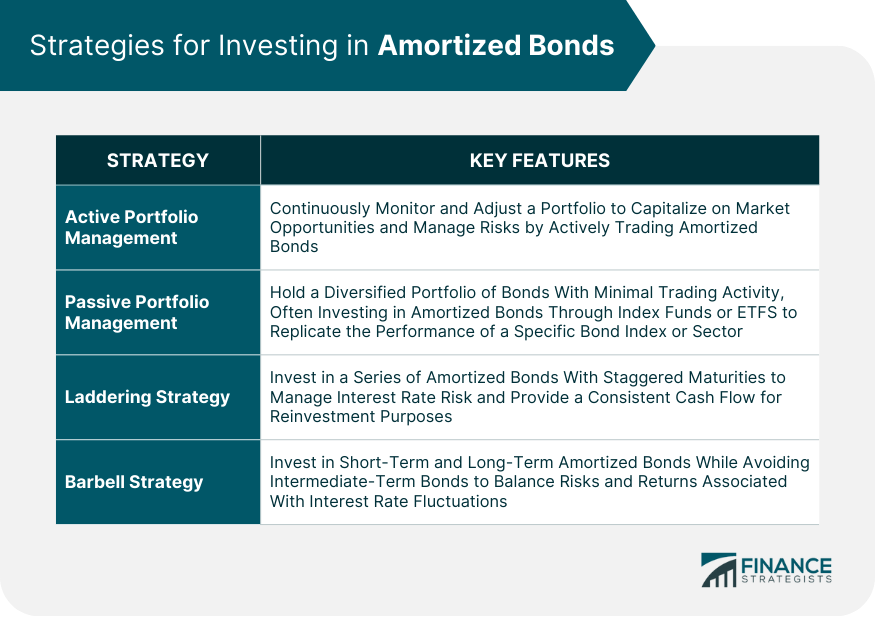

Strategies for Investing in Amortized Bonds

Active Portfolio Management

Passive Portfolio Management

Laddering Strategy

Barbell Strategy

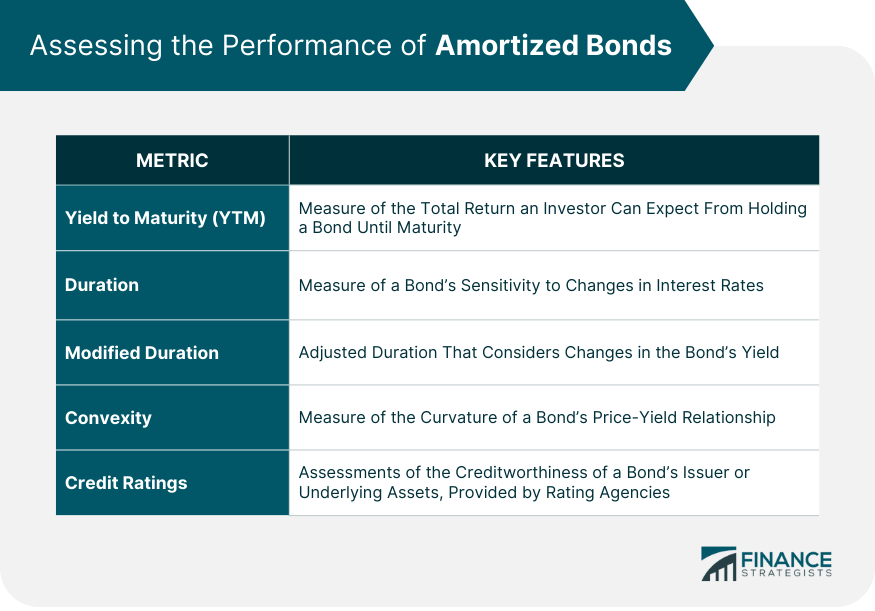

Assessing the Performance of Amortized Bonds

Yield to Maturity (YTM)

Duration and Modified Duration

Convexity

Credit Ratings

Tax Considerations for Amortized Bonds

Taxable vs Tax-Exempt Bonds

Tax Implications of Amortization

Strategies for Tax-Efficient Investing

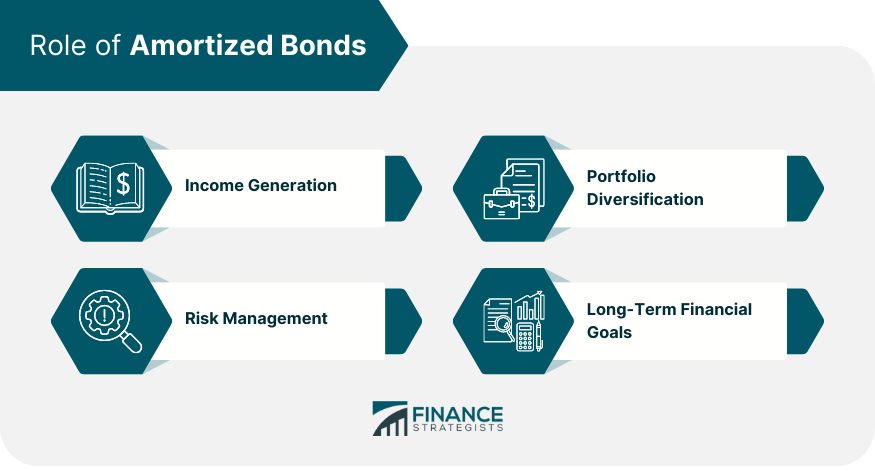

Role of Amortized Bonds

Income Generation

Portfolio Diversification

Risk Management

Long-Term Financial Goals

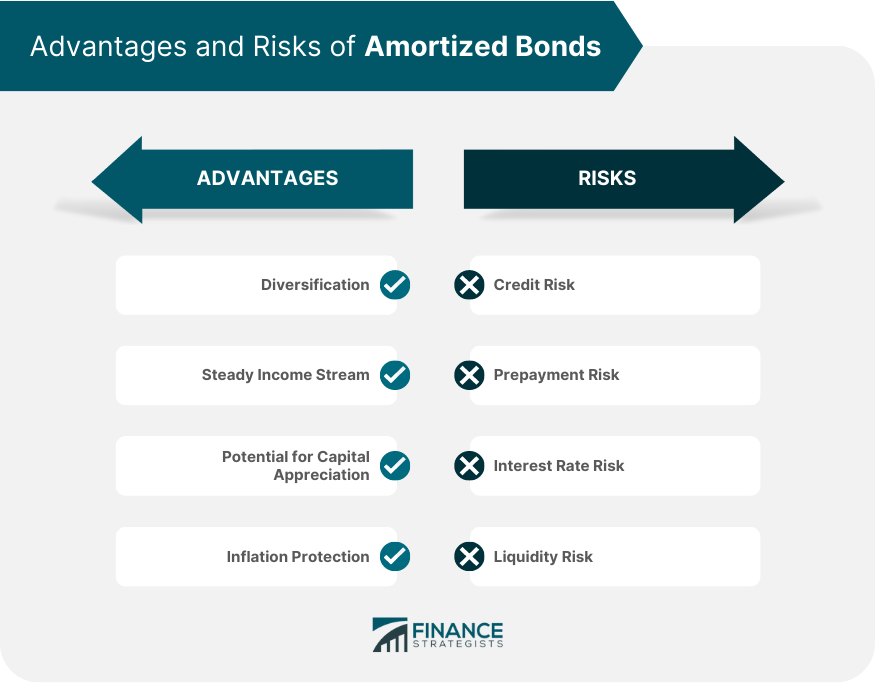

Advantages of Amortized Bonds

Diversification

Steady Income Stream

Potential for Capital Appreciation

Inflation Protection

Risks Associated With Amortized Bonds

Credit Risk

Prepayment Risk

Interest Rate Risk

Liquidity Risk

Bottom Line

Amortized Bonds FAQs

An amortized bond is a type of fixed-income security backed by a pool of assets, such as mortgages or loans, that make periodic principal and interest payments to bondholders. Amortized bonds play a crucial role in wealth management because they offer diversification, steady income streams, and potential for capital appreciation, making them attractive investments for managing risk and achieving long-term financial goals.

There are three main types of amortized bonds: mortgage-backed securities (MBS), asset-backed securities (ABS), and collateralized debt obligations (CDOs). MBS are backed by a pool of mortgages, ABS are backed by various assets like auto loans or credit card receivables, and CDOs are backed by a portfolio of fixed-income assets such as corporate bonds or loans.

Investing in amortized bonds offers several advantages, including diversification, a steady income stream, potential for capital appreciation, and inflation protection. These benefits make amortized bonds attractive for wealth managers seeking to manage risk, generate income, and achieve their clients' long-term financial objectives.

The primary risks associated with amortized bonds are credit risk, prepayment risk, interest rate risk, and liquidity risk. Credit risk is the possibility of default by the bond issuer or the underlying assets, prepayment risk involves borrowers repaying their loans early, interest rate risk refers to the impact of changing interest rates on the bond's value, and liquidity risk is the potential difficulty in selling the bond at a fair price in a timely manner.

Wealth managers can integrate amortized bonds into their clients' portfolios through various strategies, such as active or passive portfolio management, laddering, or barbell strategies. By carefully selecting bonds with different levels of risk and return, considering the tax implications, and balancing the portfolio's overall risk, wealth managers can help their clients achieve their financial goals while maintaining a diversified investment portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.