Active portfolio management refers to the process of actively managing an investment portfolio with the aim of achieving superior returns compared to the market benchmarks or indexes. It uses various strategies and techniques to select securities and allocate assets based on market trends and conditions, with the ultimate goal of outperforming the market. Active portfolio management involves a more hands-on approach to investing and requires constant monitoring and analysis of market data to make informed investment decisions. Active portfolio management serves two primary purposes. The first is to generate returns that exceed those of the broader market, while the second is to reduce the risk of investment losses. By carefully selecting individual securities and adjusting asset allocations in response to market conditions, active portfolio managers aim to maximize returns while minimizing risk. Active portfolio management involves a range of techniques and strategies that aim to maximize returns while minimizing risk: This involves dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash, based on an investor's risk tolerance, investment goals, and market conditions. Diversifying an investment portfolio reduces risk and increases returns. Active portfolio managers use a range of analytical tools and techniques to select individual securities that they believe will outperform the market. This may involve fundamental analysis or technical analysis. Managers employ various risk management techniques to reduce the risk of investment losses. This may involve setting stop-loss or stop-limit orders, which automatically sell a security when it falls below a certain price, or using options and other derivative securities to hedge against market volatility. Active portfolio managers analyze market trends and conditions in order to identify opportunities to buy or sell securities. This may involve analyzing economic indicators, monitoring news and geopolitical events, or using technical analysis to identify trends and patterns in market data. This involves analyzing a company's financial statements and other key performance indicators to determine its intrinsic value and potential for future growth. Active portfolio managers use fundamental analysis to identify undervalued securities that they believe will outperform the market over the long term. Charts and other market data are used to identify trends and patterns in market data. Active portfolio managers use technical analysis to identify short-term trading opportunities and to time the market in order to maximize returns and reduce risk. Active portfolio management offers several potential benefits for investors: Outperformance of Benchmarks: Active portfolio management has the potential to outperform market benchmarks and indexes, leading to higher returns for investors. Flexibility and Customization: They allow investors to customize their investment portfolios to their specific investment goals and risk tolerance. This can help investors achieve their financial objectives while minimizing risk. Opportunities for Diversification: Investors can diversify their investment portfolios across different asset classes, sectors, and geographies, reducing the risk of investment losses and increasing returns. Active portfolio management is not without its drawbacks, and there are several potential disadvantages that investors should be aware of: Higher Fees and Costs: This can be more expensive than passive management strategies, as active managers typically charge higher fees for their services. These fees can eat into investment returns, reducing overall portfolio performance. Difficulty in Consistently Outperforming the Market: Markets are complex and dynamic, and even the most skilled and experienced managers may struggle to predict market movements with precision. High Risk of Underperformance: Active portfolio management carries a higher risk of underperformance than passive strategies, as active managers are more likely to make investment decisions that lead to losses. Active portfolio management is highly dependent on market trends and conditions: Economic Indicators: Economic indicators such as GDP, inflation, and unemployment rates can have a significant impact on market trends and conditions, and can influence investment decisions. Political and Geopolitical Events: Political and geopolitical events such as elections, trade disputes, and international conflicts can also have a significant impact on market trends and conditions, and can influence investment decisions. Industry Trends and Disruptors: Industry trends and disruptors, such as technological innovation, can have a significant impact on market trends and conditions, and can create new investment opportunities. Interest Rate and Inflation Changes: Changes in interest rates and inflation can also have a significant impact on market trends and conditions, and can influence investment decisions. Currency Fluctuations: Currency fluctuations can affect the performance of international investments, and can have a significant impact on market trends and conditions. Successful active portfolio management requires a disciplined and consistent approach, as well as a deep understanding of market trends and conditions. Investors should set clear investment objectives that align with their financial goals and risk tolerance. This can help investors stay focused and avoid making impulsive investment decisions. It is the responsibility of the investor to conduct regular portfolio reviews to ensure that their investment strategy remains aligned with their investment objectives and risk tolerance. Investors should monitor market trends and conditions and adjust their investment strategies accordingly. This may involve adjusting asset allocations, rebalancing portfolios, or making other investment decisions. They should stay informed of market trends and conditions by regularly reading financial news and analysis, attending investment seminars, and consulting with financial advisors. Successful active portfolio management requires a disciplined and consistent approach, and investors should avoid making impulsive investment decisions based on short-term market movements. Active portfolio management is a dynamic and hands-on investment strategy that involves carefully selecting securities and allocating assets based on market trends and conditions. They use a range of techniques to outperform the market. These techniques include asset allocation, security selection, risk management, market timing, fundamental analysis, and technical analysis. Successful active portfolio managers use a combination of these techniques to identify undervalued securities and adjust asset allocations. While active portfolio management offers several potential benefits, such as the potential for outperformance of benchmarks, customization, and opportunities for diversification, it is not without its drawbacks, such as higher fees and a high risk of underperformance. Investors must stay informed of trends in order to make informed investment decisions. Economic indicators, political and geopolitical events, industry trends and disruptors, interest rate and inflation changes, and currency fluctuations all affect active portfolio management. To succeed in active portfolio management, investors should follow best practices such as setting clear investment objectives, conducting regular portfolio reviews, staying informed of market trends, and maintaining a disciplined and consistent approach. Wealth management services can provide investors with access to experienced and skilled portfolio managers, as well as a range of investment tools and resources that can help them make informed investment decisions.What Is Active Portfolio Management

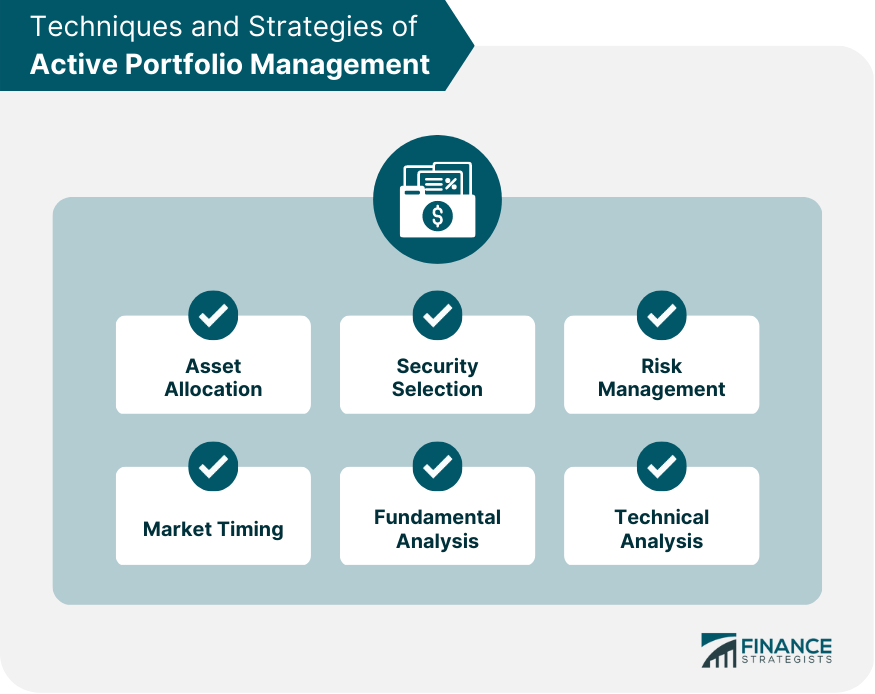

Techniques and Strategies of Active Portfolio Management

Asset Allocation

Security Selection

Risk Management

Market Timing

Fundamental Analysis

Technical Analysis

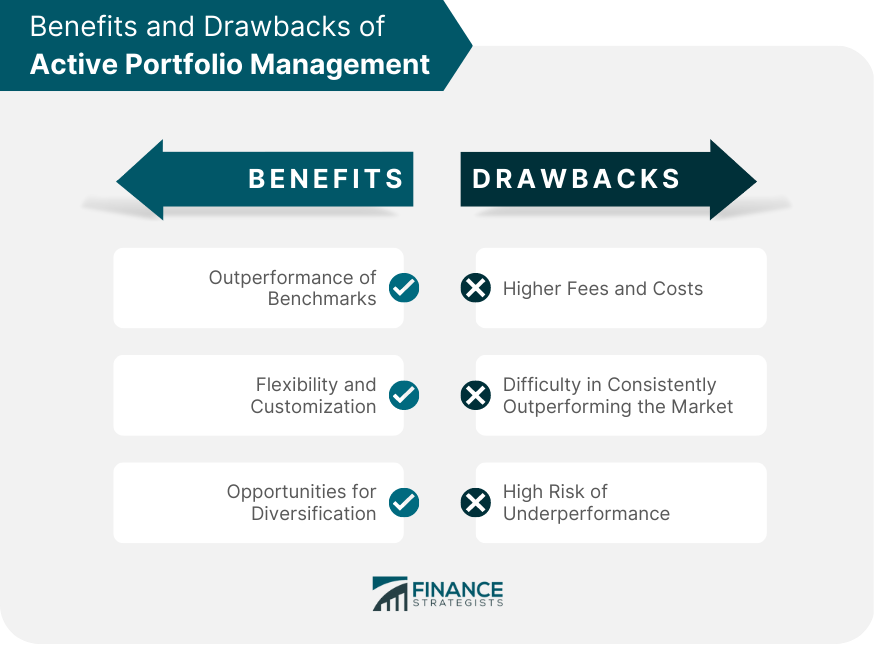

Benefits of Active Portfolio Management

Drawbacks of Active Portfolio Management

Market Trends and Conditions Affecting Active Portfolio Management

Best Practices in Active Portfolio Management

Setting Clear Investment Objectives

Conducting Regular Portfolio Reviews

Monitoring and Adjusting Investment Strategies

Staying Informed of Market Trends and Conditions

Maintaining a Disciplined and Consistent Approach

Final Thoughts

Active Portfolio Management FAQs

Active portfolio management is a hands-on investment approach where investors and fund managers use various strategies to select securities and allocate assets with the aim of achieving superior returns compared to market benchmarks or indexes.

The potential benefits of active portfolio management include outperformance of benchmarks, flexibility and customization, and opportunities for diversification.

The drawbacks of active portfolio management include higher fees and costs, difficulty in consistently outperforming the market, and a high risk of underperformance.

Active portfolio management involves a range of techniques and strategies, including asset allocation, security selection, risk management, market timing, fundamental analysis, and technical analysis.

Some best practices in active portfolio management include setting clear investment objectives, conducting regular portfolio reviews, monitoring and adjusting investment strategies, staying informed of market trends and conditions, and maintaining a disciplined and consistent approach.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.