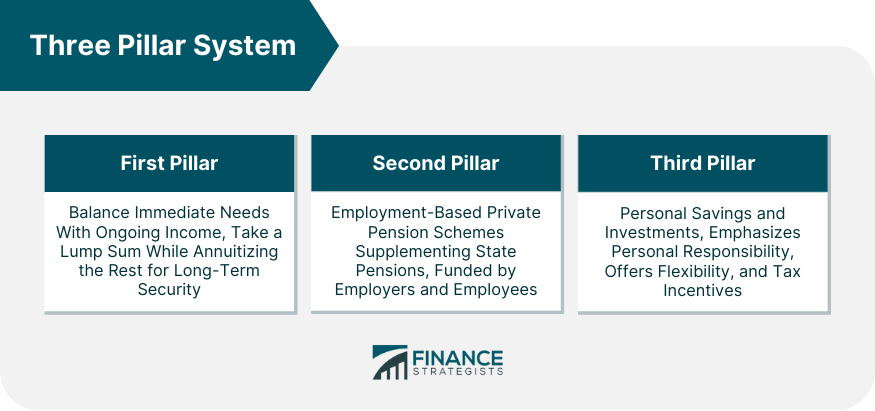

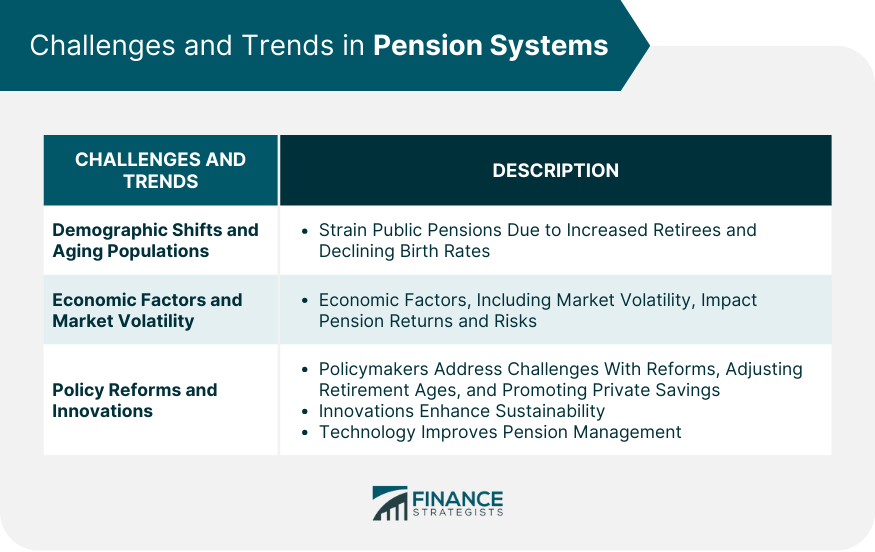

Pension pillars form the foundation of retirement systems globally, offering a structured approach to financial security for individuals post-retirement. These pillars, each distinct in its function and structure, collectively ensure a more balanced and comprehensive retirement plan. Over time, pension systems have evolved significantly, adapting to changing demographics, economic conditions, and societal needs. The concept of pension pillars is not static; it varies across countries, influenced by cultural, economic, and political factors. The historical development of pension systems reflects an ongoing effort to balance adequacy, sustainability, and equity. Originally conceived as a means to provide for the elderly, pension systems have become more complex, incorporating various sources of retirement income. This evolution mirrors broader economic and social trends, including aging populations, shifts in labor markets, and changing family structures. Understanding this background is essential for grasping the current state and future direction of pension systems. The first pillar of pension systems typically involves state-provided pensions. These are generally characterized by their universal coverage and aim to prevent poverty in old age. Funded through taxation or social security contributions, these pensions often provide a basic income, ensuring a minimum standard of living for retirees. However, the sustainability of this pillar is increasingly challenged by demographic changes, such as aging populations, which strain the funding mechanisms. Different countries have adopted varied approaches to their public pension systems. For instance, some offer flat-rate benefits to all retirees, while others calculate benefits based on earnings and contributions. These differences reflect varying social and economic priorities, demonstrating the diverse ways nations address the challenge of providing for their aging populations. The second pillar encompasses occupational or private pension schemes, which are typically employment-based. These pensions play a crucial role in supplementing state pensions and are often funded through contributions from both employers and employees. The management and type of these schemes can vary significantly, ranging from defined benefit plans to defined contribution plans. Regulatory frameworks play a critical role in shaping these schemes, ensuring their solvency and the protection of members' interests. The diversity in occupational pension schemes reflects the differing labor market structures and cultural attitudes towards retirement planning, with some systems emphasizing collective arrangements and others individual choice. The third pillar involves personal or individual savings and investments. It emphasizes the importance of personal responsibility in retirement planning, offering flexibility and control to individuals in managing their retirement savings. This pillar includes a variety of investment options, such as individual retirement accounts (IRAs), real estate, and other personal savings. Governments often incentivize these personal savings through tax benefits, aiming to encourage individuals to save for their retirement. However, this pillar also involves risks, as individuals must make informed investment decisions and manage the potential impact of market volatility on their retirement funds. One of the foremost challenges facing pension systems worldwide is the demographic shift towards older populations. This aging trend has significant implications for pension systems, primarily affecting the sustainability of public pension schemes. As the ratio of working-age individuals to retirees decreases, the financial burden on social security systems increases, raising concerns about their long-term viability. This demographic challenge is compounded by other factors, such as increased life expectancy and declining birth rates. These trends necessitate a reevaluation of existing pension models and potentially, the development of new strategies to ensure financial security for future generations of retirees. Economic factors, including market volatility, interest rates, and inflation, significantly impact pension systems, particularly the second and third pillars. Occupational and personal pension schemes often rely on investment returns, making them susceptible to economic fluctuations. The 2008 financial crisis, for example, had a profound impact on private pension funds, highlighting the risks associated with market-dependent retirement savings. Policymakers and pension fund managers must navigate these economic challenges while striving to provide stable and adequate retirement incomes. This involves balancing investment risks with the need for growth, ensuring that pension funds can meet their long-term obligations to beneficiaries. In response to these challenges, there is a growing trend towards policy reforms and innovations in pension systems. Governments and pension authorities are exploring various strategies, such as adjusting retirement ages, modifying benefit formulas, and encouraging private savings. Innovations in pension design, like tiered benefits and indexed pensions, are being implemented to enhance sustainability and adaptability. Technology also plays a vital role in reforming pension systems. Digital platforms and data analytics offer new ways to manage pension schemes more efficiently and transparently. As policymakers and pension administrators adapt to these changing landscapes, the focus remains on ensuring that pension systems continue to provide secure and adequate retirement incomes. Governments play a pivotal role in shaping pension systems, setting policy objectives, and implementing tools to achieve these goals. The primary objectives often include ensuring the adequacy of retirement incomes, maintaining the sustainability of pension systems, and promoting equity among different segments of the population. To achieve these objectives, governments employ various policy tools, such as setting legal frameworks for private pensions, providing tax incentives for personal savings, and reforming public pension schemes. The effectiveness of these tools depends on the broader economic and social context, requiring a nuanced and dynamic policy approach. A critical challenge for governments in managing pension systems is balancing sustainability with the adequacy of retirement incomes. This involves ensuring that pension systems are financially viable in the long term while providing sufficient income to retirees. The tension between these two goals is often at the heart of pension reform debates. Striking the right balance requires careful consideration of demographic trends, economic conditions, and social expectations. It often involves difficult trade-offs, such as adjusting retirement ages, modifying benefit formulas, and encouraging private savings. These decisions are crucial in shaping the future of pension systems and the well-being of retirees. In an increasingly interconnected world, international standards and cooperation play a significant role in shaping pension policies. Global organizations like the International Labour Organization (ILO) and the Organisation for Economic Co-operation and Development (OECD) provide guidelines and frameworks for pension systems, promoting best practices and facilitating knowledge sharing among countries. International cooperation is particularly important in addressing challenges that transcend national borders, such as demographic shifts and global economic trends. By working together, countries can learn from each other's experiences and develop more effective and resilient pension systems. Pension pillars are integral to global retirement systems, each playing a unique role in ensuring financial security for retirees. These systems have evolved to adapt to demographic shifts, economic fluctuations, and societal changes. The first pillar, public pensions, faces sustainability challenges due to aging populations. The second pillar, occupational pensions, and the third pillar, personal savings, are increasingly vital in supplementing state pensions, though they come with their own risks and regulatory needs. Governments play a critical role in balancing the sustainability and adequacy of these systems while adhering to international standards and fostering cooperation. As the world continues to change, ongoing innovation, policy reform, and international collaboration will be key in ensuring that pension systems remain robust, equitable, and capable of providing for future generations.Pension Pillars Overview

Three Pillar System

First Pillar: Public or State Pensions

Second Pillar: Occupational or Private Pensions

Third Pillar: Personal or Individual Savings

Challenges and Trends in Pension Systems

Demographic Shifts and Aging Populations

Economic Factors and Market Volatility

Policy Reforms and Innovations

Role of Government and Regulation

Policy Objectives and Tools

Balancing Sustainability and Adequacy

International Standards and Cooperation

Bottom Line

Pension Pillar FAQs

Pension pillars are the foundational components of retirement systems worldwide, consisting of public pensions (first pillar), occupational or private pensions (second pillar), and personal savings (third pillar). They collectively ensure financial security for retirees by providing a structured approach to retirement planning.

The primary challenge facing public pensions is the demographic shift towards aging populations, which strains funding mechanisms. As the ratio of working-age individuals to retirees decreases, concerns about the long-term sustainability of public pension systems increase.

Economic factors, including market volatility, significantly affect occupational and personal pension schemes. These schemes often rely on investment returns, making them susceptible to economic fluctuations, as seen during events like the 2008 financial crisis.

Governments play a pivotal role in shaping pension systems by setting policy objectives, which typically include ensuring retirement income adequacy, sustainability of pension systems, and promoting equity among the population. They employ various policy tools to achieve these goals.

International cooperation, facilitated by organizations like the International Labour Organization (ILO) and the OECD, helps shape pension policies by providing guidelines and promoting best practices. It is crucial in addressing global challenges such as demographic shifts and economic trends, enabling countries to learn from each other's experiences and develop more effective pension systems.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.