Closing a position in trading refers to the act of selling or buying back an existing investment or financial instrument to exit the trade. It involves liquidating or offsetting the position, effectively ending the exposure to that particular asset. Traders close positions for various reasons, such as locking in profits, cutting losses, or adjusting their portfolio's risk exposure. The decision to close a position is typically based on market conditions, trading strategies, and individual risk tolerance. By closing a position, traders realize their gains or losses and free up capital for other investment opportunities. Closing a position varies slightly depending on the market where the trade was made. Stock Market: An investor who has bought shares (long position) can close their position by selling those shares. Conversely, an investor who has borrowed and sold shares (short position) can close their position by buying back the shares. Forex Market: A trader closes a position in the forex market by conducting an equal but opposite trade to the one they used to open the position. Futures Market: A holder of a futures contract can close a position by taking an opposite position in the same contract. Options Market: The holder of an option contract can close a position by either exercising the option, allowing it to expire, or entering into a closing transaction. Closing a position involves carefully analyzing market conditions, deciding on the right time to close, selecting the appropriate order type, and finally, executing the order. Before making the decision to close a position, it is essential to evaluate the current market conditions. Analyze the trends, indicators, and news that may affect the security's price. Assess the market's overall direction and take note of any significant events that could impact your investment. Next, revisit your financial goals and strategies. Consider whether closing the position aligns with your long-term objectives and if it will help achieve your desired risk level. Evaluate the position's performance and determine if it is time to lock in profits or cut losses. Timing is critical when closing a position. Monitor the security's price movement and determine the best time to exit based on your analysis and objectives. Keep in mind that market volatility can affect the price, so be prepared to act quickly if necessary. Choose the right order type for closing your position. Limit orders allow you to specify a price at which you want to close the position, while market orders enable you to close at the current market price. Stop orders are used to close a position when the price reaches a predetermined level, acting as a safety net against further losses. Finally, execute the order to close your position through your broker or trading platform. Ensure that you understand any fees and charges associated with closing the position and factor them into your decision-making process. Closing a position is a vital aspect of successful investing. By following these necessary steps, you can ensure that you are making well-informed decisions that align with your financial goals and strategies. Market conditions play a pivotal role in the decision to close a position. For instance, an investor may decide to close a position if the market is volatile and the security's price is fluctuating significantly. Investors and traders set financial goals and adopt specific strategies that guide their decisions to close positions. For example, a trader might close a position once it has reached a specific profit target. Risk tolerance levels and effective risk management techniques influence the decision to close a position. For instance, a risk-averse investor might choose to close a position if it starts to make a significant loss. Closing a Long Position: A long position is closed by selling the securities that were initially purchased. Closing a Short Position: A short position is closed by buying back the securities initially sold. Closing a Position at a Profit (Take Profit): This occurs when a trader closes a position after the security's price has reached a level that yields the desired profit. Closing a Position at a Loss (Stop Loss): In this scenario, a trader closes a position to prevent further losses when the security's price moves against their expectations. Understanding the Impact of Gains and Losses: Closing a position can either result in a gain or loss, depending on the price movement of the security. These gains or losses impact the overall portfolio performance. Effect on Portfolio Diversification: Closing a position changes the composition of a portfolio, which can affect its diversification and the overall risk. Risk and Volatility Post-Closing a Position: Closing a position can decrease the portfolio's exposure to market volatility and risk, especially if the closed position was significantly impacting the portfolio's risk profile. Limit Order to Close a Position: A limit order allows an investor to close a position at a specified price or better. Market Order to Close a Position: A market order enables an investor to close a position at the current market price. Stop Order to Close a Position: A stop order is set to trigger a sale or purchase once a certain price level is reached, thus closing a position. Using Financial Software and Platforms to Close a Position: There are various software and online trading platforms that investors can use to close a position. These tools provide real-time market data, analytical tools, and a user-friendly interface for placing trades. Brokers play a crucial role in the process of closing a position. They provide a platform for executing trades, offer advice based on market analysis, and ensure smooth transactions. Investors should also consider the costs associated with closing a position, such as brokerage fees, transaction fees, and any tax implications. Investors are legally bound to fulfill their obligations when closing a position, such as paying for the purchased securities or delivering the sold securities. Regulators like the SEC in the US have rules and regulations that investors must follow when closing a position. Non-compliance can lead to penalties and legal action. Closing a position in finance is vital for managing investments. Factors like market conditions, financial goals, and risk tolerance influence the decision. Different markets have specific closing processes, such as selling shares or conducting opposite trades. Timing and order type selection are crucial. Closing impacts portfolio performance, diversification, and risk exposure. Tools like limit orders, market orders, and stop orders aid in closing positions. Brokers provide platforms, advice, and ensure compliance. Legal and regulatory obligations must be met. Understanding the process is essential for effective investment management and overall financial performance. Closing a position signifies exiting an active financial position, which is crucial for successful trading and investment strategies.Definition of Close Position

Process of Closing a Position

How to Close a Position in Various Financial Markets

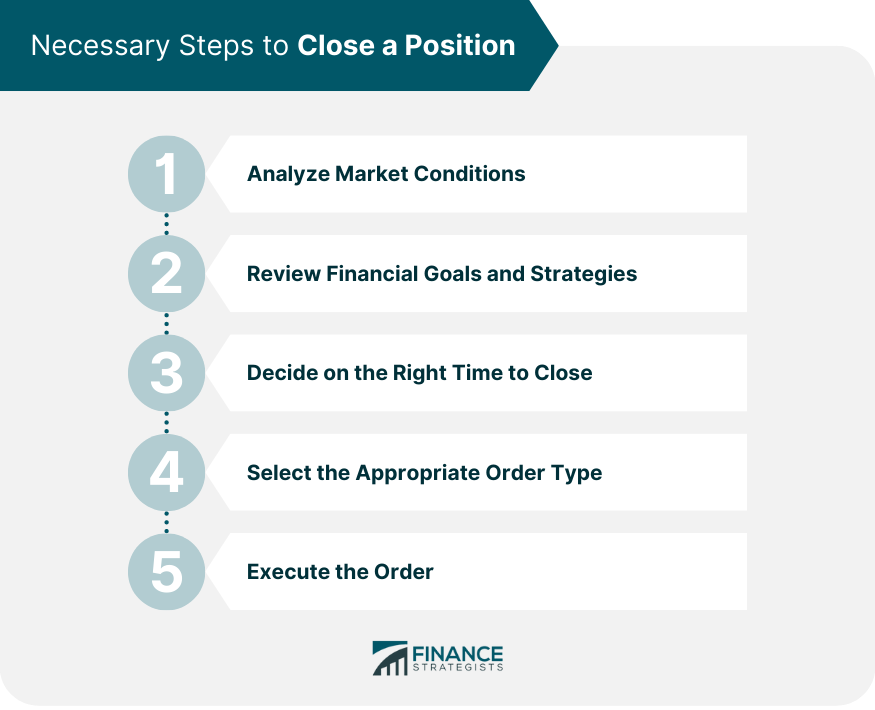

Necessary Steps to Close a Position

Analyzing Market Conditions

Reviewing Financial Goals and Strategies

Deciding on the Right Time to Close

Selecting the Appropriate Order Type

Executing the Order

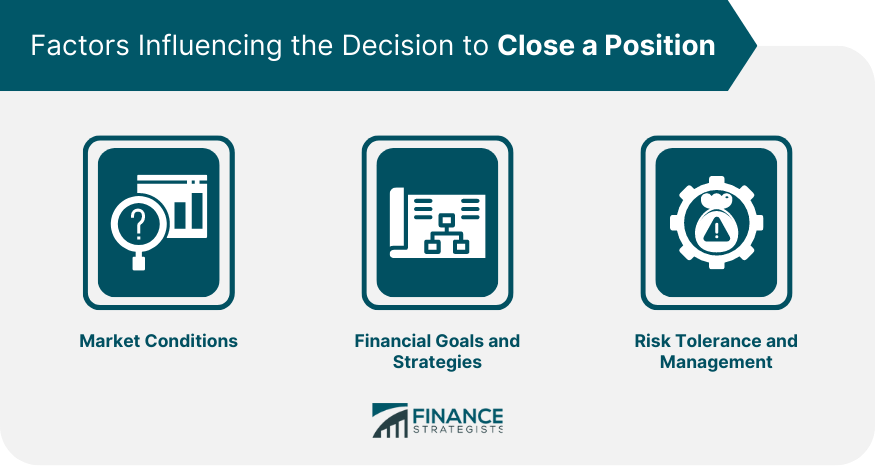

Factors Influencing the Decision to Close a Position

Market Conditions

Financial Goals and Strategies

Risk Tolerance and Management

Different Scenarios of Closing a Position

Impact of Closing a Position on Portfolio Performance

Tools and Techniques to Close a Position

Role of Brokers in Closing a Position

Legal and Regulatory Aspects of Closing a Position

Bottom Line

Close Position FAQs

Closing a position in finance refers to the act of exiting an active trade or investment. If an investor has bought shares (long position), they can close the position by selling those shares. Conversely, if an investor has borrowed and sold shares (short position), they can close the position by buying back the shares.

Closing a position can either result in a gain or loss, which directly impacts the overall portfolio performance. It also affects the portfolio's diversification and risk profile. For instance, closing a risky position can reduce the portfolio's exposure to market volatility.

Several factors influence the decision to close a position, including market conditions, financial goals and strategies, and risk tolerance. For example, an investor might close a position if the market becomes too volatile or if a predetermined profit target has been reached.

Various tools and techniques, such as limit orders, market orders, and stop orders, can be used to close a position. Additionally, financial software and online trading platforms can provide real-time market data and analytical tools to help investors make informed decisions about closing positions.

When closing a position, investors have legal responsibilities to fulfill, such as paying for the purchased securities or delivering the sold securities. They also need to adhere to rules and regulations set by financial regulators, like the SEC in the US. Non-compliance can lead to penalties and legal action.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.