Trading platforms are software applications that serve as digital conduits for buying and selling financial assets like stocks, commodities, currencies, and cryptocurrencies. They are offered by various entities such as brokerage firms, direct market access providers, and even peer-to-peer networks. Features of a trading platform typically include a user-friendly interface, a range of analytical tools, access to various markets, and robust security measures. Costs associated with these platforms can include trading commissions, platform fees, and other hidden charges. It's vital to evaluate platforms based on market accessibility, customer service, fees, and the availability of required tools. As technology advances, future trends in trading platforms are leaning toward the incorporation of artificial intelligence, machine learning, and blockchain technology. These are web-based portals provided by brokerage firms, which give retail investors access to financial markets. Examples include E*TRADE and TD Ameritrade, which offer trading in securities like stocks, bonds, and options. Direct Access Trading (DAT) platforms cater to day traders who need speedy transactions. These platforms provide direct access to market exchanges, bypassing traditional brokerages to enable quicker trade executions. SpeedTrader and Interactive Brokers are prominent examples. Peer-to-Peer (P2P) platforms allow users to trade directly with each other without a middleman. They're popular in the cryptocurrency space, with platforms like Local Bitcoins and Paxful leading the charge. These platforms specialize in trading digital assets, with giants like Coinbase and Binance offering a vast array of cryptocurrencies for trade. A user-friendly interface is crucial for effective trading. It should offer a clean layout with easily navigable charts, indicators, and order windows. A robust platform should provide access to a broad range of financial markets, catering to the diverse needs of investors. In-built analytical tools like charting software, indicators, real-time news feeds, and economic data calendars are essential features to aid traders in making informed decisions. Given the sensitive nature of financial data, a good trading platform should have robust security features such as two-factor authentication and encryption. Trading commissions are fees charged by a trading platform for each trade that is executed. The amount of the commission can vary depending on the platform, the type of trade, and the size of the trade. In addition to trading commissions, some trading platforms also charge a subscription fee for access to premium features. These features can include real-time data feeds, charting tools, and technical analysis software. The subscription fee for these features can vary depending on the platform and the features that are included. There are also a number of hidden costs that can be associated with trading platforms. These hidden costs can include inactivity fees, withdrawal fees, and charges for premium data feeds. Assess whether the platform provides access to the markets you are interested in. Check the quality of customer service, as effective support is vital when you encounter technical issues or have trade-related inquiries. Consider the overall cost, including trading commissions, subscription fees, and potential hidden charges. Ensure the platform provides the trading and analytical tools you require. MetaTrader 4 and 5 are the most popular platforms in forex trading, known for their advanced charting tools. They offer a wide range of technical indicators and analysis tools, as well as the ability to automate trading strategies. Other popular forex trading platforms include cTrader, FXCM Trading Station, and XM Trader. TD Ameritrade's ThinkOrSwim and Interactive Brokers are widely used for their broad market access and sophisticated tools. They offer a wide range of features, including real-time quotes, charting tools, and research Other popular stock trading platforms include E*Trade, Charles Schwab, and Fidelity. Platforms like NinjaTrader and MetaTrader offer a range of features for commodity traders. They offer charting tools, technical analysis, and the ability to trade a wide range of commodities, including futures, options, and CFDs. Other popular commodity trading platforms include TradeStation and Sierra Chart. Binance and Coinbase are leaders in the crypto market, offering a vast array of digital assets. They offer a user-friendly interface, low fees, and a wide range of features, including margin trading and staking. Other popular cryptocurrency trading platforms include Kraken, Bitfinex, and Huobi. Trading platforms, like any technology, can suffer from technical failures, such as outages or glitches. This can potentially disrupt trading activities and lead to losses. Cybersecurity threats also pose a significant risk to trading platforms. These platforms handle sensitive financial data and digital assets, which makes them a target for hackers. If a platform is hacked, traders could lose their money or have their accounts compromised. Leverage allows traders to control a larger position with a smaller amount of capital. However, it can also amplify losses as well as gains. If the market moves against a trader, they could lose more money than they originally invested. In most jurisdictions, stock and forex trading platforms are under the regulatory oversight of government agencies. For instance, in the U.S., the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) oversee stock and forex trading respectively, while in the UK, the Financial Conduct Authority (FCA) plays a similar role. The regulatory landscape for cryptocurrency trading platforms is less clear and varies widely by country. In many cases, they're subject to less oversight than traditional financial platforms, although this is evolving as regulators worldwide develop their approaches to digital assets. Trading platforms are software applications that allow traders to buy and sell financial assets. They offer a variety of features, such as user-friendly interfaces, access to different markets, and trading tools and analytics. There are a number of factors to consider when choosing a trading platform, such as market accessibility, customer service, fees and commissions, and trading tools and indicators. Some popular trading platforms for different markets include MetaTrader 4 and 5 for forex trading, TD Ameritrade's ThinkOrSwim and Interactive Brokers for stock trading, and NinjaTrader and MetaTrader for commodity trading. Trading platforms can be subject to technical failures and cybersecurity threats. Traders should be aware of these risks and take steps to mitigate them. When choosing a trading platform, it is important to do your research and select one that meets your needs and risk tolerance.What Are Trading Platforms?

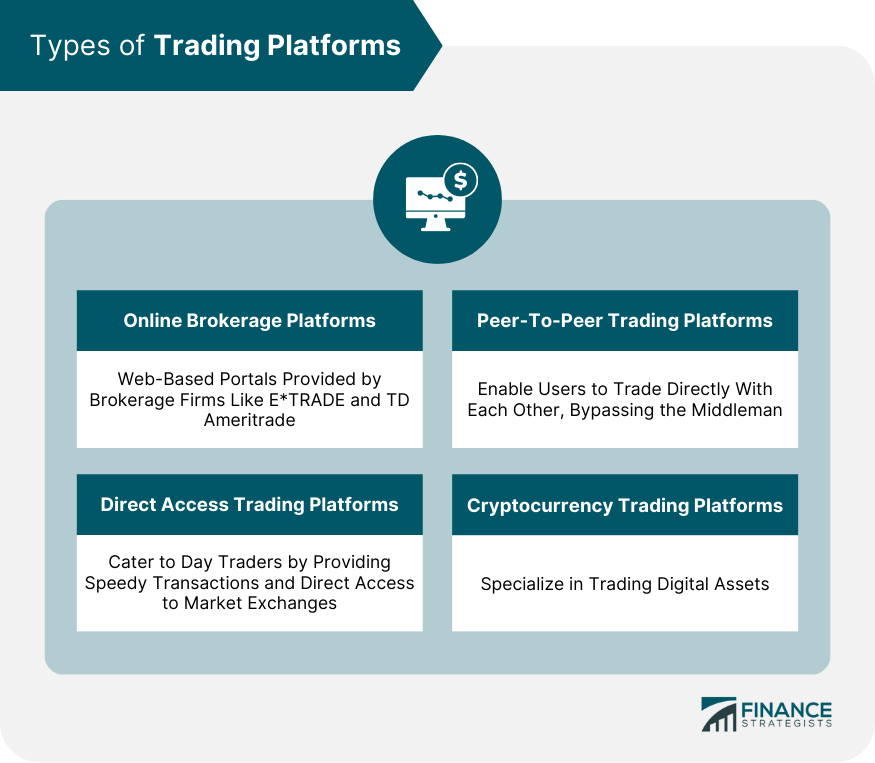

Types of Trading Platforms

Online Brokerage Platforms

Direct Access Trading Platforms

Peer-To-Peer Trading Platforms

Cryptocurrency Trading Platforms

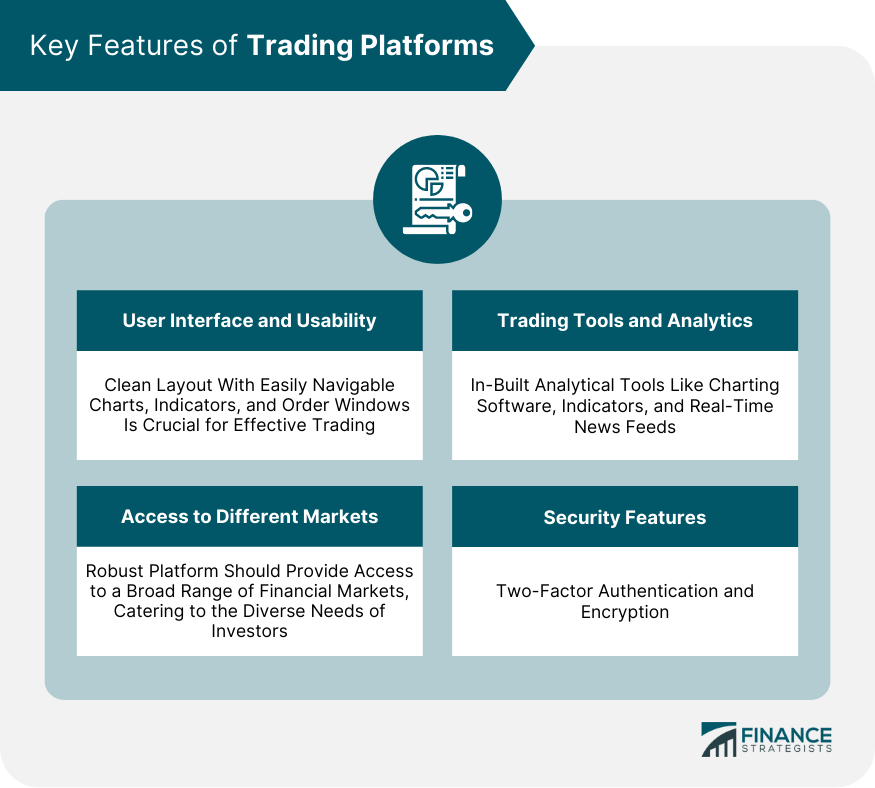

Key Features of Trading Platforms

User Interface and Usability

Access to Different Markets

Trading Tools and Analytics

Security Features

Understanding Costs Associated With Trading Platforms

Trading Commissions

Platform Fees

Hidden Costs

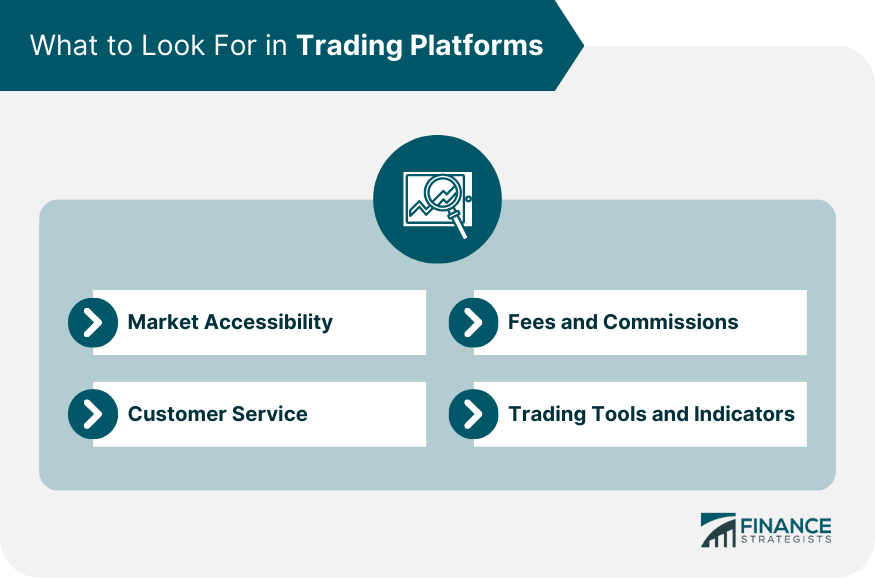

Evaluating Trading Platforms: What to Look For

Market Accessibility

Customer Service

Fees and Commissions

Trading Tools and Indicators

Popular Trading Platforms in Different Markets

Forex Trading Platforms

Stock Trading Platforms

Commodity Trading Platforms

Cryptocurrency Trading Platforms

Risks Associated With Trading Platforms

Technical Failures

Security Risks

Risks From High Leverage

Regulatory Oversight

Cryptocurrency Regulation

Conclusion

Trading Platforms FAQs

A trading platform is a software application that allows investors to buy and sell financial assets such as stocks, commodities, currencies, and cryptocurrencies. They typically provide various tools for analysis, access to multiple markets, and robust security measures.

Key features to look for in a trading platform include a user-friendly interface, access to different markets, trading and analytical tools, and robust security features. The costs associated, including trading commissions, platform fees, and potential hidden charges, are also important considerations.

Trading platforms come in various forms, including online brokerage platforms, direct access trading platforms, peer-to-peer trading platforms, and cryptocurrency trading platforms. The choice of platform depends on the trader's specific needs, such as speed, market access, cost, and the type of asset being traded.

Risks associated with trading platforms include technical failures, security risks, and the risks from high leverage. It's important for traders to ensure they're using a platform with robust security features and that they understand the potential financial risks of trading, particularly when using leverage.

The future of trading platforms is being shaped by technological advancements like artificial intelligence, machine learning, and blockchain. These technologies are expected to enhance predictive analytics, algorithmic trading, and risk management, while improving the security and transparency of trading operations. Emerging trends, such as social trading and robo-advisors, are also influencing the development of trading platforms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.