Gift tax planning is the process of strategically giving gifts to family members, friends, or charities in a way that minimizes tax implications for both the giver and receiver. Gift tax planning is an essential aspect of estate planning and wealth management that helps individuals and families transfer wealth efficiently and minimize potential tax liabilities. The gift tax is a federal tax imposed on the transfer of assets, such as cash or property, from one person to another without receiving full payment or consideration in return.

The federal gift tax applies to U.S. citizens and residents who make gifts to others, subject to certain exclusions and exemptions. Some key aspects of the federal gift tax include the annual exclusion, the lifetime exemption, and the gift tax rates. The annual exclusion is an amount that can be gifted to any individual each year without incurring gift tax. As of 2024, the annual exclusion is $18,000 per recipient. This means that a person can gift up to $18,000 to any number of individuals in a year without triggering any gift tax or needing to report the gifts to the Internal Revenue Service (IRS). In addition to the annual exclusion, individuals have a lifetime exemption from gift tax. This exemption is also applied to estate tax, so any amount used during a person's lifetime for gift tax purposes will reduce the available exemption for estate tax purposes. As of 2024, the lifetime exemption is $13.61 million per person. Gifts that exceed the annual exclusion and the lifetime exemption are subject to federal gift tax. The gift tax rates range from 18% to 40%, depending on the total amount of taxable gifts made by the donor. While the federal gift tax applies nationwide, some states also impose their own gift taxes or have specific laws governing gifts. These state-specific exemptions and rates can vary, and it is important for taxpayers to understand the differences between state and federal gift tax laws to ensure compliance and effective gift tax planning. There are several strategies that individuals can employ to optimize their gift tax planning and minimize potential tax liabilities. These strategies include the timing of gifts, valuation of gifts, lifetime exemption planning, gifting to trusts, and using family limited partnerships (FLPs) and limited liability companies (LLCs). One of the simplest strategies for gift tax planning is to make full use of the annual exclusion. By gifting up to the annual exclusion amount to each recipient each year, a person can transfer significant wealth over time without incurring any gift tax liability or using any of their lifetime exemption. In cases where a person wants to make a large gift that exceeds the annual exclusion amount, they can consider spreading the gift over multiple years. This can help to minimize the gift tax impact by using the annual exclusion in each year, reducing the portion of the gift that is subject to gift tax or counts against the lifetime exemption. When gifting interests in a closely-held business or other assets that may be difficult to sell, discounts for minority interests or lack of marketability can be applied to reduce the value of the gift for gift tax purposes. This can result in a lower gift tax liability or a smaller reduction in the lifetime exemption. Proper valuation of real estate or other assets being gifted is essential for gift tax planning. It is important to obtain an accurate appraisal of the fair market value of the asset at the time of the gift to ensure that the gift tax calculations are based on the correct values. Overvaluing or undervaluing a gift can result in incorrect gift tax liabilities and potential penalties. Taxpayers should carefully plan the use of their lifetime exemption to maximize its benefits. This may involve making large gifts during their lifetime to take advantage of the current exemption amount, especially if there is a possibility that the exemption may be reduced in the future due to legislative changes. Keeping track of lifetime gifts is crucial for effective gift tax planning. Taxpayers should maintain accurate records of all gifts made, including those that fall within the annual exclusion, to ensure that they do not inadvertently exceed their lifetime exemption and trigger gift tax liabilities. Gifting to trusts can be an effective strategy for gift tax planning, as well as providing additional benefits such as asset protection and estate planning. An ILIT is a trust that holds a life insurance policy on the grantor's life. The grantor makes annual gifts to the trust to cover the premium payments, and upon the grantor's death, the life insurance proceeds pass to the trust beneficiaries free of estate tax. By gifting the premium payments to the ILIT, the grantor can utilize their annual exclusion and remove the life insurance proceeds from their taxable estate. A GRAT is a trust where the grantor transfers assets to the trust and retains the right to receive an annuity payment for a specified term. At the end of the term, the remaining trust assets pass to the beneficiaries. If the assets in the trust appreciate in value during the term, the appreciation can be transferred to the beneficiaries free of gift tax. GRATs can be an effective strategy for transferring wealth to the next generation while minimizing gift tax liability. CLTs and CRTs are trusts that benefit both charitable organizations and non-charitable beneficiaries. With a CLT, the charitable organization receives income from the trust for a specified term or the grantor's lifetime, and the remaining trust assets pass to the non-charitable beneficiaries at the end of the term. With a CRT, the non-charitable beneficiaries receive income from the trust for a specified term or the grantor's lifetime, and the remaining trust assets pass to the charitable organization at the end of the term. FLPs and LLCs can be used to transfer assets, such as interests in a closely-held business or real estate, to family members while retaining control over the assets and obtaining valuation discounts for gift tax purposes. By gifting minority interests or non-controlling interests in the FLP or LLC, the taxpayer can reduce the value of the gift and minimize the gift tax impact. Taxpayers who make gifts that exceed the annual exclusion or are otherwise subject to gift tax must file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. This form is used to report the taxable gifts made during the year and calculate any gift tax due. It is also used to track the taxpayer's use of their lifetime exemption. It is important for taxpayers to maintain accurate records of all gifts made, including the date of the gift, the recipient, the value of the gift, and any gift tax returns filed. This information is essential for gift tax planning and ensuring compliance with gift tax laws and regulations. In addition to federal gift tax reporting requirements, some states may have their own reporting requirements for gifts. Taxpayers should consult their state tax authorities or a tax professional to ensure that they are aware of and comply with any state-specific gift tax reporting requirements. There are several special gift tax considerations that taxpayers should be aware of when engaging in gift tax planning. These considerations include gifts to non-citizen spouses, gifts to charitable organizations, gifts of appreciated assets, and education and medical expenses. Gifts between spouses are generally not subject to gift tax due to the unlimited marital deduction. However, this deduction does not apply when the recipient spouse is a non-citizen. Gifts to qualified charitable organizations are generally not subject to gift tax and can be deducted from the donor's taxable income, subject to certain limitations. This can provide significant tax benefits and incentives for taxpayers to make charitable gifts as part of their gift tax planning strategy. Gifting appreciated assets, such as stocks or real estate, can provide additional tax benefits for the donor. The recipient of the gift takes on the donor's cost basis in the asset, and when the asset is eventually sold, the capital gains tax is paid based on the original cost basis. This allows the donor to avoid paying capital gains tax on the appreciation while transferring the asset to the recipient. Payments made directly to an educational institution or medical provider for the benefit of another person are not considered taxable gifts and are not subject to gift tax. This provides an additional opportunity for taxpayers to transfer wealth without incurring gift tax liability. Gift tax planning is an essential aspect of financial and estate planning for individuals and families seeking to transfer wealth efficiently and minimize gift tax liabilities. By understanding the key components of gift tax laws and regulations, utilizing annual exclusions and lifetime exemptions, and employing various strategies such as gifting to trusts, FLPs, or LLCs, taxpayers can optimize their gift tax planning and achieve their wealth transfer goals. Staying informed of changes in gift tax laws and regulations, monitoring economic trends, and leveraging technology can help taxpayers adapt their gift tax planning strategies to changing circumstances.What Is Gift Tax Planning?

Gift Tax Laws and Regulations

Federal Gift Tax

Annual Exclusion

Lifetime Exemption

Gift Tax Rates

State Gift Tax Laws

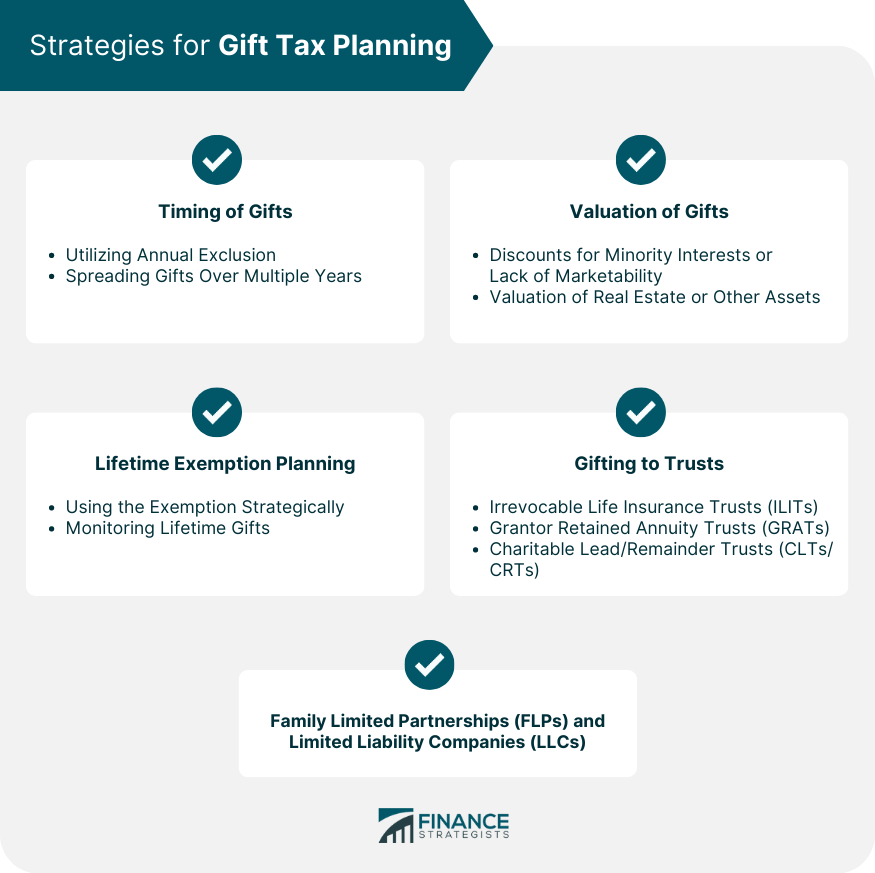

Strategies for Gift Tax Planning

Timing of Gifts

Utilizing Annual Exclusion

Spreading Gifts Over Multiple Years

Valuation of Gifts

Discounts for Minority Interests or Lack of Marketability

Valuation of Real Estate or Other Assets

Lifetime Exemption Planning

Using the Exemption Strategically

Monitoring Lifetime Gifts

Gifting to Trusts

Irrevocable Life Insurance Trusts (ILITs)

Grantor Retained Annuity Trusts (GRATs)

Charitable Lead/Remainder Trusts (CLTs/ CRTs)

Family Limited Partnerships (FLPs) and Limited Liability Companies (LLCs)

Gift Tax Reporting Requirements

Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return

Record-Keeping for Gifts

State-Specific Reporting Requirements

Special Gift Tax Considerations

Gifts to Non-citizen Spouses

Gifts to Charitable Organizations

Gifts of Appreciated Assets

Education and Medical Expenses

Conclusion

Gift Tax Planning FAQs

Gift tax planning refers to the process of making strategic gifts to family members, friends, or charities in a way that minimizes the tax implications for both the giver and receiver.

In most cases, the person making the gift (the giver) is responsible for paying gift tax. However, the recipient of the gift may have to pay taxes on any income generated by the gift.

For 2024, the gift tax exclusion is $18,000 per person, per year. This means that you can give up to $18,000 to as many people as you like without having to pay gift tax or file a gift tax return.

Some gift tax planning strategies include using the annual gift tax exclusion, making gifts to a 529 college savings plan, setting up a charitable trust, and using a family limited partnership.

If you don't plan for gift tax, you may end up paying more in taxes than necessary, or you may face penalties for failing to file a gift tax return. Additionally, your recipients may end up with a larger tax burden than they expected.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.