Deferred compensation plans refer to arrangements in which an employee's compensation, such as salary, bonuses, or stock options, is paid out at a later date rather than immediately. These plans are subject to specific taxation rules, which vary based on the type of plan and jurisdiction. In the United States, there are two types of deferred compensation plan: the nonqualified deferred compensation (NQDC) plan and the qualified deferred compensation plan. Each type has its respective taxation rules on contributions, earnings and withdrawals. Qualified deferred compensation plans, such as 401(k) and 403(b) plans, allow employees to make pre-tax contributions, reducing their annual taxable income. Employers can also make contributions to these plans on behalf of their employees, which are generally tax-deductible for the employer. The combined contributions of employees and employers are subject to annual limits set by the IRS. Pre-tax contributions grow tax-deferred within the plan, meaning that investment gains are only taxed once they are withdrawn. In addition to pre-tax contributions, some qualified plans also allow employees to make Roth contributions. These contributions are made after-tax, meaning they do not reduce the employee's taxable income for the year. However, qualified distributions from Roth accounts are generally tax-free, providing a significant tax advantage for individuals who expect their tax rates to be higher in retirement. The funds within a qualified deferred compensation plan grow tax-deferred, meaning that investment gains are not subject to taxes until they are withdrawn. This tax-deferred growth allows the account to grow more quickly than it would in a taxable account, as funds that would have been used to pay taxes can instead be reinvested to generate additional growth. Investments within a qualified deferred compensation plan can include various asset classes, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The specific investment options available within a plan will depend on the plan provider and the choices offered by the employer. By offering diverse investments, these plans allow employees to create a portfolio that aligns with their risk tolerance and long-term financial goals. Distributions from a qualified deferred compensation plan are generally subject to income tax at the individual's ordinary income tax rates. This means the funds are taxed as regular income rather than at the lower capital gains tax rates that would apply to investments in a taxable account. If the individual withdraws funds from the plan before reaching the age of 59½, they may also be subject to a 10% early withdrawal penalty unless an exception applies. Required minimum distributions (RMDs) are mandatory withdrawals that individuals must begin taking from their qualified deferred compensation plans once they reach a certain age, which is currently 73 for most individuals. RMDs are calculated based on the individual's account balance and life expectancy, and failure to take the required distribution can result in significant penalties. Individuals must plan for RMDs and incorporate them into their overall retirement income strategy. Some qualified deferred compensation plans to allow participants to take loans or hardship withdrawals from their accounts under certain circumstances. Loans typically must be repaid within a specified time frame and with interest, which is paid back into the account. While loans are generally not subject to taxes or penalties, they can impact the long-term growth of the account and should be carefully considered. On the other hand, hardship withdrawals are subject to income tax and may also be subject to the 10% early withdrawal penalty if the individual is under the age of 59½. Hardship withdrawals can only be taken under specific circumstances, such as medical expenses, home purchase, or education costs, and are intended to provide financial relief in times of need. However, taking a hardship withdrawal can also have a lasting impact on an individual's retirement savings and should be a last resort option. Non-qualified deferred compensation plans allow employees to defer a portion of their income for payment at a future date, similar to qualified plans. However, NQDCs are not subject to the same contribution limits as qualified plans, providing greater flexibility for high-income earners who the caps on qualified plan contributions may limit. While employee deferrals to an NQDC are not subject to income tax when made, they are generally subject to FICA taxes, which include Social Security and Medicare taxes. Employers can also contribute to NQDCs on their employees' behalf. These contributions are generally tax-deductible for the employer in the year they are made, but the employee must recognize the income when the funds are actually received. Employer contributions to NQDCs are also subject to FICA taxes when credited to the employee's account. Similar to qualified deferred compensation plans, funds within NQDCs grow on a tax-deferred basis. This means that investment gains are subject to taxes once they are withdrawn or distributed. The tax-deferred growth can help the account grow more quickly than it would in a taxable account, as funds that would have been used to pay taxes can instead be reinvested for additional growth. Distributions from NQDCs are subject to ordinary income tax rates, just like qualified deferred compensation plans. However, unlike qualified plans, NQDC distributions are not subject to the 10% early withdrawal penalty. In addition, distributions from NQDCs are subject to FICA taxes if they still need to be paid on the contributions. NQDCs offer more flexibility in terms of distribution timing compared to qualified plans. Distributions can be scheduled to coincide with specific events, such as retirement or a predetermined date, or triggered by unforeseeable emergencies or separation from service. Proper planning around the timing of distributions can minimize the tax impact and provide financial security when needed. Section 409A of the Internal Revenue Code sets forth specific rules and requirements for NQDCs, which are designed to ensure that these plans do not provide excessive benefits or enable individuals to manipulate the timing of income recognition for tax purposes. Compliance with Section 409A is essential for both employees and employers to avoid significant tax penalties and consequences. Failure to comply with Section 409A can result in severe employee tax consequences. If a non-qualified deferred compensation plan is found to be in violation of the rules, the affected employees must immediately recognize all deferred income, even if it has yet to be distributed. Additionally, a 20% penalty tax and interest charges may be assessed on underpaying taxes. Employers can also face penalties and may lose the tax deductions associated with their contributions to the non-compliant plan. To fully benefit from the tax advantages offered by qualified deferred compensation plans, employees should aim to contribute as much as possible within the annual limits set by the IRS. By maximizing contributions, employees can reduce their taxable income, defer taxes on investment gains, and receive matching contributions from their employer, further boosting their retirement savings. Diversifying investments within a qualified deferred compensation plan can manage risk and optimize returns over time. Employees can create a well-rounded portfolio that aligns with their risk tolerance and long-term financial goals by spreading investments across different asset classes, such as stocks, bonds, mutual funds, and ETFs. Careful planning around distributions from qualified deferred compensation plans can help to minimize the tax impact in retirement. This includes coordinating withdrawals with other sources of retirement income, such as Social Security and pensions, as well as considering the potential benefits of Roth conversions or taking advantage of lower tax brackets in certain years. When participating in both a qualified deferred compensation plan and an NQDC, it is essential to coordinate the contributions and distributions from both plans to optimize tax benefits and manage retirement income. For example, an individual may choose to defer a larger portion of their income into an NQDC when they are in a higher tax bracket and then schedule distributions during retirement when they expect to be in a lower tax bracket. Properly timing the distributions from an NQDC can help minimize the tax impact and provide financial security when needed. This may involve scheduling distributions to coincide with specific events or triggering distributions based on unforeseeable emergencies or separation from service. Additionally, coordinating NQDC distributions with other sources of retirement income can help manage taxable income in retirement and potentially reduce overall tax liability. Ensuring compliance with Section 409A is essential for both employees and employers participating in NQDCs. Employees should be aware of the rules and requirements set forth by the IRS, and employers should work with legal and tax professionals to design and administer their plans in accordance with Section 409A. Both parties can avoid the significant tax consequences of non-compliant plans by maintaining compliance. Developing a tax-efficient withdrawal strategy can help minimize taxes and maximize retirement income. This may involve coordinating withdrawals from various sources, such as qualified deferred compensation plans, NQDCs, taxable accounts, and Roth accounts, to manage taxable income and optimize the use of lower tax brackets. Effectively managing taxable income in retirement can help reduce overall tax liability and extend the life of retirement savings. This may involve strategically timing distributions from various sources, such as required minimum distributions, Social Security, and NQDCs, to balance taxable income and take advantage of lower tax brackets when possible. Staying aware of current tax brackets and making strategic decisions about withdrawals and distributions can help individuals manage their tax liability in retirement. By planning distributions to fall within specific tax brackets, individuals can reduce their overall tax burden and preserve more of their retirement savings. This may involve adjusting the timing or amount of distributions from various sources, such as qualified deferred compensation plans, NQDCs, and taxable accounts, to optimize the use of lower tax brackets and minimize taxes. Understanding the taxation of deferred compensation plans is crucial for both employers and employees. Qualified deferred compensation plans, such as 401(k)s, offer tax advantages through pre-tax contributions, tax-deferred growth, and ordinary income tax treatment upon distribution. These plans provide opportunities for maximizing contributions, diversifying investments, and managing distributions to minimize taxes. Non-qualified deferred compensation plans (NQDCs) offer greater flexibility but have different taxation rules. Employee deferrals to NQDCs are subject to FICA taxes, and distributions are taxed as ordinary income. However, NQDCs provide the advantage of tax-deferred growth and no early withdrawal penalty. Proper timing of distributions, coordination with other retirement plans, and adherence to IRS regulations, specifically Section 409A, are essential for optimizing tax benefits and avoiding penalties. Tax planning strategies for deferred compensation plans involve maximizing contributions, diversifying investments, and managing distributions to minimize taxes. By implementing these strategies and seeking professional guidance, individuals and employers can navigate the complexities of deferred compensation plan taxation and make informed decisions to maximize their retirement savings and minimize their tax liabilities.Overview of Deferred Compensation Plan Taxation

Qualified Deferred Compensation Plan Taxation

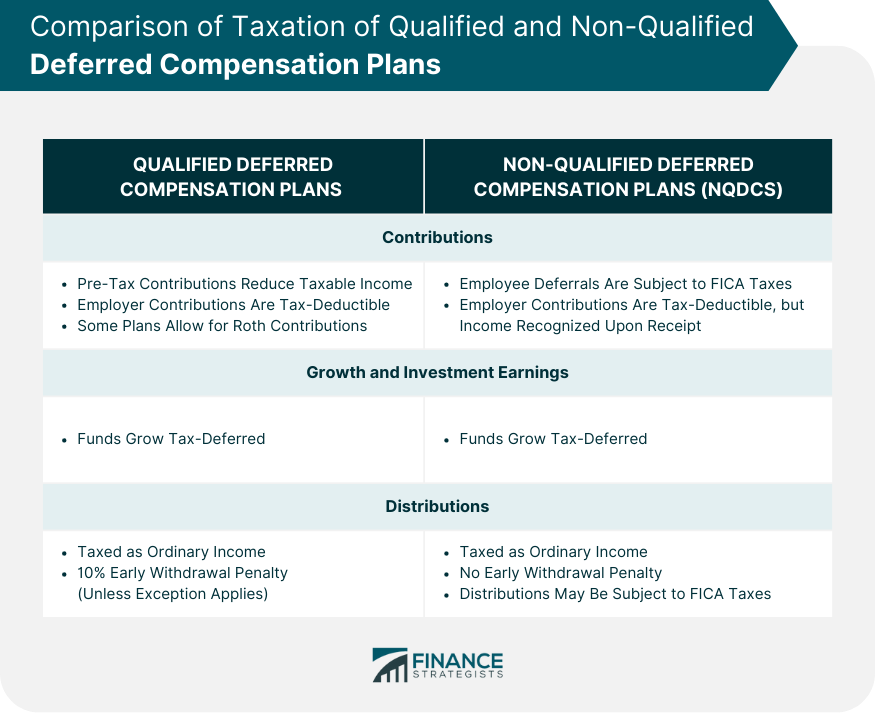

Contributions

Growth and Investment Earnings

Distributions

Taxation of Distributions

Loans and Hardship Withdrawals

Non-Qualified Deferred Compensation Plans (NQDCs) Taxation

Contributions

Employee Deferrals

Employer Contributions

Growth and Investment Earnings

Distributions

Taxation of Distributions

Timing of Distributions

Section 409A Compliance

Importance of Adhering to IRS Regulations

Consequences of Non-Compliance

Tax Planning Strategies for Deferred Compensation Plans

Qualified Plan Strategies

Maximizing Contributions

Diversifying Investments

Managing Distributions to Minimize Taxes

Non-Qualified Plan Strategies

Coordinating With Other Retirement Plans

Timing of Distributions

Section 409A Compliance

Tax-Efficient Withdrawal Strategies

Sequence of Withdrawals

Managing Taxable Income in Retirement

Tax Bracket Management

Conclusion

Deferred Compensation Plan Taxation FAQs

Deferred Compensation Plan Taxation refers to the specific rules and regulations governing the taxation of arrangements where an employee's compensation is paid out at a later date rather than immediately.

For nonqualified deferred compensation plans, taxation occurs when the deferred compensation is actually paid or made available to the employee. At that time, the deferred amounts are generally subject to ordinary income tax at the employee's current tax rate. Additionally, nonqualified deferred compensation plans do not provide the same tax advantages as qualified plans, such as pre-tax contributions and tax-deferred growth.

Yes, early withdrawals from qualified deferred compensation plans, such as 401(k) plans, are generally subject to a 10% early withdrawal penalty if taken before the age of 59½, and are subject to ordinary income tax. However, the penalty has certain exceptions, such as withdrawals due to a disability or certain medical expenses. Nonqualified deferred compensation plans may have their own rules and penalties for early withdrawals, which are specified in the plan documents.

For qualified deferred compensation plans, such as 401(k) plans, contributions are made on a pre-tax basis, and taxes are deferred until the funds are withdrawn. Taxes are typically deferred for nonqualified deferred compensation plans until the employee receives the funds.

Deferred compensation plans can affect Social Security benefits in a couple of ways. First, contributions to qualified deferred compensation plans, such as 401(k) plans, reduce your taxable income for Social Security purposes, which may affect your Social Security benefits calculation. Second, the income you receive from both qualified and nonqualified deferred compensation plans during retirement may impact the taxation of your Social Security benefits. Some of your Social Security benefits may be subject to federal income tax, depending on your overall income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.