Capital gains tax is a levy on the profit made from selling an asset that has increased in value. Assets liable to capital gains tax include stocks, bonds, precious metals, real estate, and even collectibles. This levy can directly impact the net return on investment, making it a critical factor in investment planning. There are two types of capital gains - short-term and long-term. Short-term gains are from assets held for less than a year and are usually taxed as ordinary income. Long-term gains, from assets held for more than a year, are taxed at a lower rate to encourage long-term investment. The rates vary and are often influenced by a variety of factors, including the investor's tax bracket. The classification of capital gains also plays a pivotal role in determining an investor's tax liability. Pension funds, being large investment pools, typically invest in assets that appreciate over time. The goal is to generate enough return to cover the future pension payments to the beneficiaries of the fund. Given that these assets may include stocks, bonds, and other investments subject to capital gains tax, it's important to understand how this tax applies to pension funds. Pension funds themselves are generally tax-exempt entities, meaning they do not pay taxes on the income they generate from their investments. However, the beneficiaries of these pension funds—those who receive distributions—are subject to tax. This distinction between the tax liabilities of pension funds and their beneficiaries is crucial to understand as it has significant implications on the net returns from pension fund investments. How capital gains tax affects the growth and distribution of pension funds can be quite complex. One critical point to note is that pension funds, due to their tax-exempt status, can reinvest the full amount of their returns without having to set aside money to pay capital gains tax. This allows for greater growth potential compared to taxable investment accounts, which can significantly enhance the long-term value of the pension fund. When it comes to receiving distributions, the situation can be different. With defined contribution pensions, like 401(k)s, the distributions are typically taxed as ordinary income—not as capital gains—regardless of the underlying investments' nature. In contrast, defined benefit pensions offer pre-determined payouts, the taxation of which can depend on a variety of factors, including the recipient's tax bracket and the source of the pension income. This differential tax treatment further underscores the importance of understanding your pension plan's specifics. Public pension funds are set up by government entities for their employees. These funds benefit from certain tax exemptions that private pension funds do not. In both cases, however, the tax on capital gains is deferred, meaning that it isn't paid until the beneficiary starts receiving distributions. This tax deferment is an attractive feature as it allows the fund to grow without being eroded by tax liabilities. For self-employed individuals, pension funds—such as Simplified Employee Pension (SEP) IRAs or solo 401(k)s—provide a way to save for retirement with tax advantages. Similar to defined contribution plans, the contributions are often tax-deductible, and taxes are paid upon distribution. These funds provide a crucial means for self-employed individuals to plan for their retirement while also managing their current tax liability. These pension funds are typically set up by employers for their employees, with both the employer and employee making contributions. As with other types of pension funds, the capital gains tax is deferred until distributions begin. The structure of these funds often allows for a significant accumulation of retirement savings, thus ensuring financial security in the post-retirement phase. One such strategy is tactical asset allocation, which involves maintaining a diversified portfolio and adjusting the mix of assets based on market conditions and investment goals. This approach can help manage risk and potentially increase returns, which could help offset the tax impact. Furthermore, smart asset allocation can add a layer of resilience to your portfolio, helping to protect your pension fund from market downturns. Another strategy is to consider more tax-efficient investments. For instance, index funds and ETFs tend to generate fewer capital gains due to their passive management style, making them potentially more tax-efficient options for pension fund investments. These investment types, with their lower turnover rates, could be a strategic addition to your pension portfolio. When it comes time to take distributions from the pension fund, it's also essential to plan carefully. With defined contribution plans, for example, it might make sense to take distributions more slowly to stay in a lower tax bracket and thus reduce the overall tax burden. By optimizing the drawdown strategy, you could potentially retain more of your pension fund for a longer period. Capital gains tax, which is imposed on the profit generated from selling assets that have appreciated in value, plays a pivotal role in shaping an investor's overall financial landscape. Its implications extend to the realm of pension funds as well. While pension funds themselves are usually tax-exempt, the beneficiaries who receive distributions are taxed, creating a nuanced landscape of financial obligations. A pivotal takeaway is the distinction between the fund's tax-exempt status allowing for reinvestment without capital gains tax, thus amplifying growth, and the taxation upon distribution, dependent on the nature of the pension plan. Various pension funds, be it public, private, self-employed, or employer-sponsored, defer capital gains tax until distributions begin. To navigate this intricate field, investors can employ strategies like tactical asset allocation, embracing tax-efficient investments like ETFs and index funds, and optimizing pension drawdowns.Overview of How Capital Gains Tax Works

Capital Gains Tax and Pension Funds

Impact of Capital Gains Tax on Pension Funds

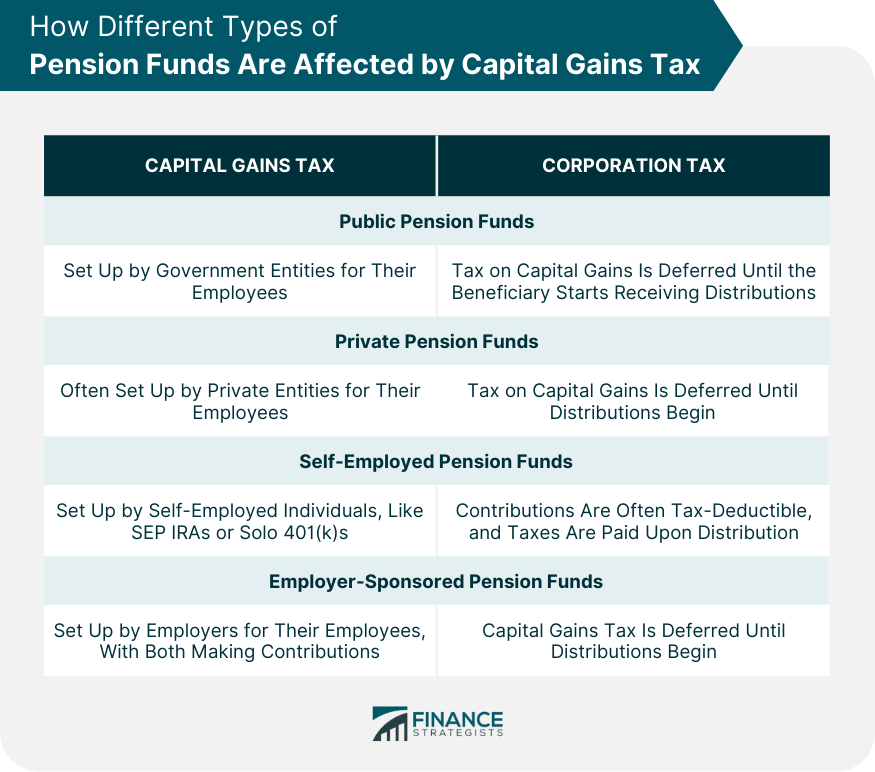

How Different Types of Pension Funds Are Affected by Capital Gains Tax

Public Pension Funds vs Private Pension Funds

Self-Employed Pension Funds

Employer-Sponsored Pension Funds

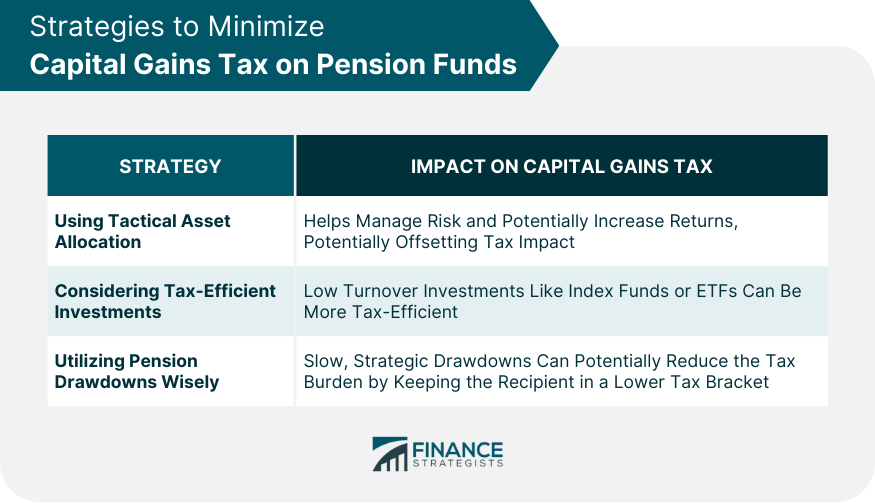

Strategies to Minimize Capital Gains Tax on Pension Funds

Using Tactical Asset Allocation

Considering Tax-Efficient Investments

Utilizing Pension Drawdowns Wisely

Bottom Line

Understanding How Capital Gains Tax Works on Pension Funds FAQs

Capital gains tax affects the investments within pension funds. While pension funds themselves are tax-exempt, beneficiaries pay tax on distributions.

Whether public, private, self-employed, or employer-sponsored, all pension funds are subject to tax deferment. The tax is paid when the beneficiary starts receiving distributions.

Yes, capital gains tax can impact pension fund growth. However, pension funds are tax-exempt entities, enabling them to reinvest the full amount of their returns, potentially leading to more significant growth.

Strategies include tactical asset allocation, considering tax-efficient investments, and wisely planning pension drawdowns. Each aims to optimize the growth of pension funds while minimizing tax impact.

Legislative shifts and tax law changes can impact capital gains tax rules. Staying updated can help investors adjust their retirement strategies accordingly for a financially secure retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.