Capital gains represent the profit an investor realizes when they sell a capital asset for a price that exceeds its purchase price. These gains are subject to taxation, and depending on the duration of the investment, they can be classified as either short-term or long-term. The tax implications can be significant, prompting many investors to seek strategies to minimize or avoid these taxes altogether.

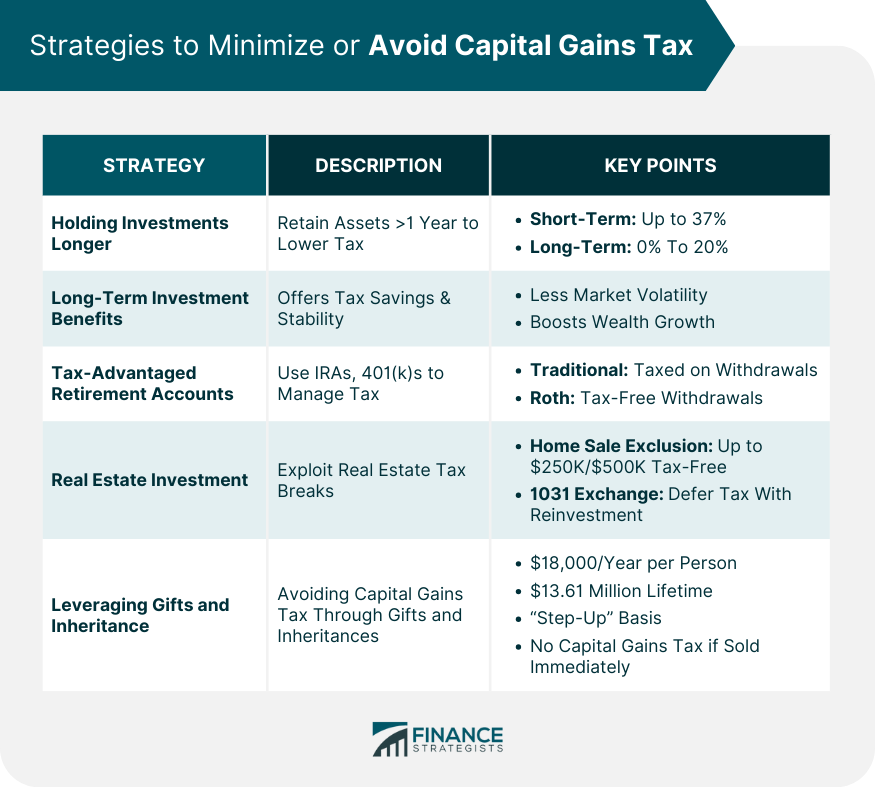

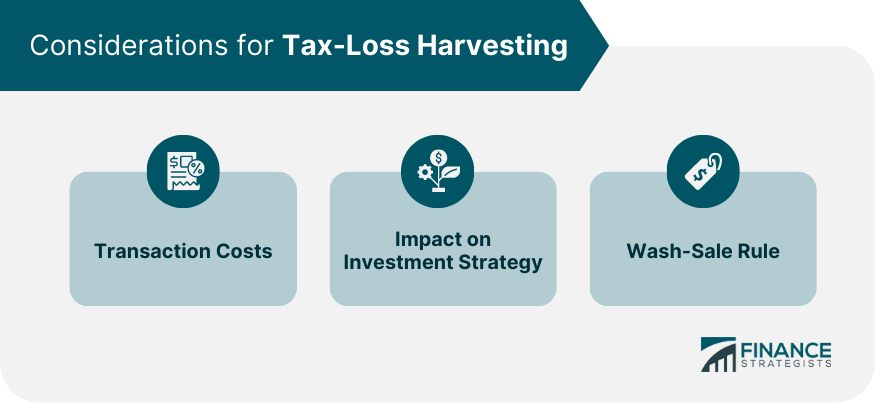

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. A few years back, a client faced hefty capital gains from a booming investment. Instead of selling all at once, we spread the sales over two tax years, leveraging lower brackets and the annual tax-free allowance. This strategy cut the tax bill significantly, turning a potential financial headache into a win. It was a real eye-opener on the power of timing and tax planning. Sometimes, it's not just what you earn, but how you manage it that counts. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Capital gains tax is an inevitable part of investing. But, savvy investors have discovered methods to minimize or avoid this tax legally. Investors are subject to two types of capital gains tax: short-term and long-term. The short-term capital gains tax applies to assets held for a year or less, while the long-term capital gains tax applies to assets held for over a year. Long-term capital gains tax rates are typically lower than short-term rates. Therefore, holding on to your investments for a longer period can significantly reduce the amount of capital gains tax you owe. Short-term capital gains are taxed at the individual's regular income tax rate, which can be as high as 37%, depending on the income bracket. On the other hand, long-term capital gains tax rates vary from 0% to 20%, depending on the individual's income. Consequently, holding onto investments for more than a year can offer substantial tax savings. Apart from the tax benefits, long-term investments often carry less risk and can provide steady returns over time. They are less susceptible to short-term market volatility and can grow through the power of compounding. Therefore, a long-term investment strategy is beneficial for both tax planning and overall wealth growth. One of the most effective ways to avoid capital gains tax is by utilizing tax-advantaged retirement accounts. Traditional IRAs and 401(k) plans allow investors to make tax-deductible contributions, grow their investments tax-deferred, and pay taxes only upon withdrawal. Roth IRAs and 401(k)s, on the other hand, are funded with post-tax dollars, but withdrawals in retirement are tax-free. These retirement accounts provide an opportunity to either defer or completely avoid paying capital gains tax. Any capital gains realized within these accounts do not trigger a tax liability. Thus, these accounts are a powerful tool for managing capital gains tax and growing wealth for retirement. The real estate market provides lucrative opportunities to avoid capital gains tax. If you've sold your home for a profit, the home sale tax exclusion can shield a significant portion of your gain from taxes. The IRS allows individuals to exclude up to $250,000 (or $500,000 for married couples filing jointly) of gain on the sale of their home as long as they've lived in and owned the home for at least two of the past five years. This exclusion can be utilized multiple times throughout your lifetime. Another strategy is the 1031 exchange, named after Section 1031 of the IRS code. A 1031 exchange allows real estate investors to defer capital gains tax by reinvesting the proceeds from the sale of an investment property into a similar type of property within a specific time frame. While 1031 exchanges can provide significant tax benefits, they are subject to strict rules and timelines. Therefore, careful planning and consultation with a tax professional are essential. Gifts and inheritances offer another method of avoiding capital gains tax. Each year, you can gift up to $18,000 per individual without triggering gift taxes. Over your lifetime, you're also allowed to gift up to $13.61 million tax-free. Inherited assets are subject to a "step-up" basis. This means that the cost basis of the asset is stepped up to the fair market value at the time of the donor's death. Therefore, if you sell the asset immediately, you'll owe no capital gains tax. Tax-loss harvesting is a valuable tax management strategy; however, certain factors deserve careful attention: Transaction Costs: Assess the expenses involved in executing trades for harvesting losses. Impact on Investment Strategy: Evaluate how tax-loss harvesting aligns with your overall investment goals. Wash-Sale Rule: Beware of the 30-day restriction when claiming a loss on security repurchased within that period. While it's prudent to minimize tax liability, it's important to do so legally and ethically. Tax evasion, such as under-reporting income or inflating deductions, is illegal. Tax avoidance, on the other hand, is legal and involves using tax laws to minimize your tax burden. All the strategies outlined in this article are methods of legal tax avoidance. Ethically, everyone should pay their fair share of taxes to support public goods and services. At the same time, it's fair to use legal means to minimize your tax burden. Tax fraud can lead to heavy fines and even imprisonment. Therefore, it's crucial to understand the tax laws and regulations and adhere to them strictly. If unsure, always consult a tax professional. Minimizing or avoiding capital gains tax can be achieved through a variety of legal strategies. By holding onto investments for longer than a year, investors can take advantage of lower long-term capital gains tax rates. Tax-advantaged retirement accounts, like IRAs and 401(k)s, offer opportunities to grow investments tax-deferred or tax-free. Real estate strategies, such as the home sale tax exclusion and 1031 exchanges, provide methods to shield or defer capital gains tax. However, investors must be careful to follow all rules and regulations to ensure they are practicing legal tax avoidance, not illegal tax evasion. If in doubt, always consult with a tax professional. Ultimately, smart tax planning is crucial for maximizing wealth and minimizing unnecessary tax burdens.Capital Gains Overview

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Core Strategies to Minimize or Avoid Capital Gains Tax

Holding on to Investments Longer

Explanation of Long-Term vs Short-Term Capital Gains

Advantages of Long-Term Investments

Utilizing Tax-advantaged Retirement Accounts

Overview of Retirement Accounts (IRA, 401k, and Others)

Tax Benefits of These Accounts

Using Home Sales and Real Estate Investment to Avoid Capital Gains Tax

Applying the Home Sale Tax Exclusion

Rules Governing Home Sale Tax Exclusion

Implementing a 1031 Exchange for Real Estate Investments

Defining a 1031 Exchange

Pros and Cons of 1031 Exchange

Leveraging Gifts and Inheritance

Understanding Gift Taxes and Exclusions

Rules and Regulations Around Inherited Assets

Important Considerations for Tax-Loss Harvesting

Legal and Ethical Aspects of Avoiding Capital Gains Tax

Distinguishing Legal Tax Evasion from Illegal Tax Avoidance

Ethical Implications of Tax Planning

Potential Legal Repercussions for Tax Fraud

Bottom Line

How to Avoid Capital Gains FAQs

Holding on to investments for over a year qualifies for lower long-term capital gains tax rates, ranging from 0% to 20%, resulting in potential tax savings.

Tax-advantaged retirement accounts like Traditional IRAs and 401(k)s allow tax-deferred growth, and Roth IRAs offer tax-free withdrawals, reducing the impact of capital gains tax.

The home sale tax exclusion allows individuals to exclude up to $250,000 (or $500,000 for married couples) of gain on selling their primary home if lived in and owned it for at least two years.

A 1031 exchange lets real estate investors defer capital gains tax by reinvesting proceeds from selling an investment property into a similar property within a specific timeframe.

Tax-loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income and potentially lowering overall tax liability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.