Capital gains tax is a levy imposed on the profit realized from the sale of a non-inventory asset such as stocks, bonds, or real estate. The profit, or capital gain, is the difference between the selling price and the original purchase price, or cost basis, of the asset. Capital gains are classified as either short-term or long-term. Short-term gains, from assets held for one year or less, are taxed as ordinary income. Long-term gains, from assets held for more than a year, typically have lower tax rates. The tax rates for both short and long-term capital gains depend on the individual's income level. It's crucial to understand capital gains tax, as it can significantly impact investment returns and financial planning.

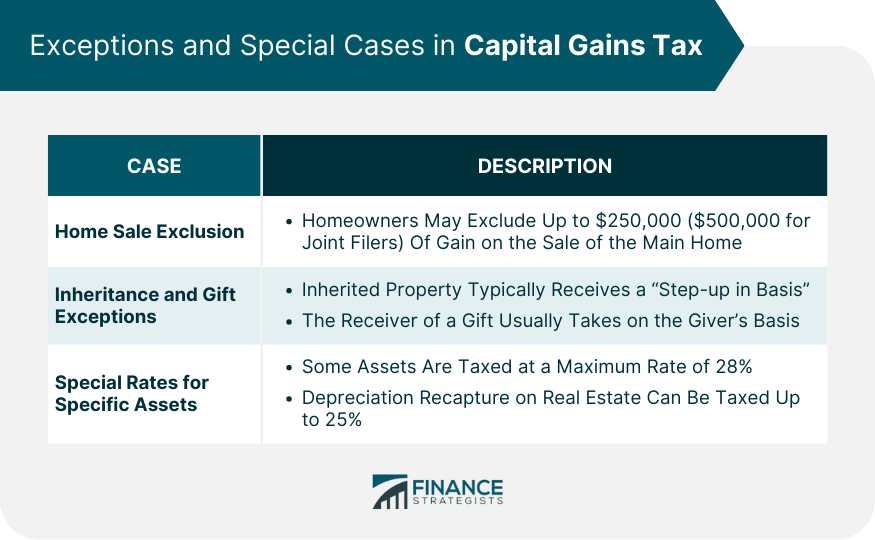

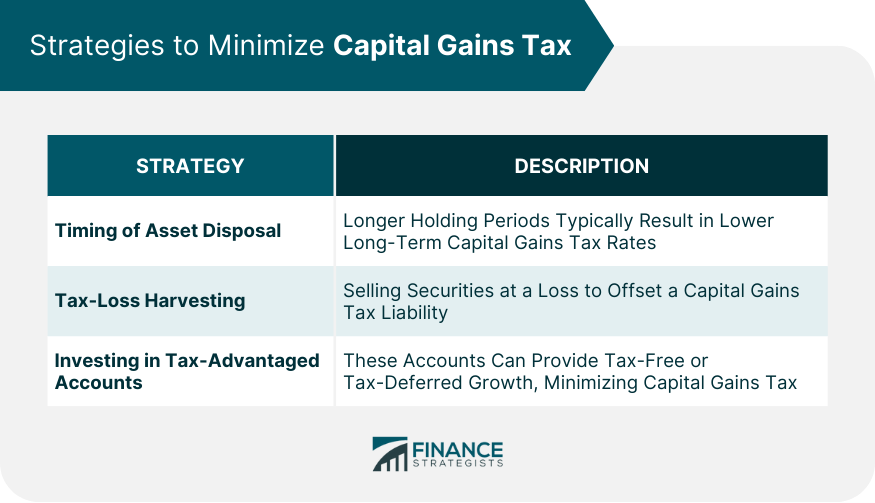

Short-term capital gains are profits from the sale of an asset held for one year or less. These gains are usually taxed at a higher rate because they're considered as regular income under U.S. tax laws. Long-term capital gains stem from selling assets held for more than one year. The tax rates on these gains are typically lower than short-term rates, promoting long-term investment. The rates can vary depending on one's income level and filing status. The key difference between short-term and long-term capital gains lies in the holding period of the asset and the tax rates applied. The distinction aims to balance between encouraging long-term investment for economic stability and ensuring tax fairness. The cost basis of an asset is the original value of an asset for tax purposes, usually the purchase price. It's adjusted for stock splits, dividends, and return of capital distributions. It's essential in determining the capital gain or loss for tax purposes. The selling price is the amount you receive when you sell an asset. The difference between the selling price and the cost basis determines whether you have a capital gain or loss. If the selling price is higher than the cost basis, you have a capital gain. To calculate the capital gain or loss, subtract the cost basis from the selling price. If the result is positive, you have a capital gain. If it's negative, you have a capital loss, which can offset other gains or up to $3,000 of ordinary income. Short-term capital gains are taxed at ordinary income tax rates, which can range from 10% to 37% based on the taxpayer's income level as of the tax year 2024. Long-term capital gains are taxed at rates of 0%, 15%, or 20%, depending on the taxpayer's income. High-income earners may also pay an additional 3.8% Net Investment Income Tax. The home sale exclusion allows homeowners to exclude from taxation up to $250,000 ($500,000 for married couples filing jointly) of gain on the sale of their main home, provided they meet specific criteria. Capital gains tax generally does not apply to inherited property due to the "step-up in basis" rule. For gifts, the receiver usually takes on the giver's basis, potentially leading to capital gains tax when the asset is sold. Certain types of assets are subject to specific tax rates. For example, collectibles and certain small business stocks are taxed at a maximum rate of 28%, and depreciation recapture on real estate can be taxed up to 25%. Managing the timing of asset disposal can help minimize capital gains tax. Holding onto assets for more than one year often results in lower long-term capital gains tax rates. Tax-loss harvesting involves selling securities at a loss to offset a capital gains tax liability. This strategy can help reduce your taxable income and, thus, your overall tax liability. Tax-advantaged accounts, like IRAs or 401(k)s, can provide tax-free or tax-deferred growth, allowing investors to control when they pay taxes on investments, potentially minimizing their capital gains tax. Capital gains and losses are reported on Form 1040, Schedule D, and the related Form 8949 in the U.S. These forms require detailed information about the asset sold, the acquisition and selling price, and the gain or loss. Capital gains should be reported in the tax year the asset was sold. It's important to maintain accurate records of all transactions to properly calculate and report capital gains. Maintaining accurate records is crucial for correct calculation and reporting of capital gains tax. Records should include the date and price of asset acquisition, any adjustments, the selling date and price, and related expenses. Capital gains tax significantly influences the asset holding period, as assets held longer often qualify for lower long-term capital gains tax rates, potentially increasing overall returns. The potential capital gains tax liability can impact an investor's diversification strategy. While diversification is vital, selling assets to achieve it might generate capital gains and result in a tax liability. Capital gains tax also plays a role in retirement planning. Investors might consider strategies to minimize taxes on investments to ensure a comfortable retirement, such as investing in tax-advantaged accounts or carefully timing asset sales. Capital gains tax, derived from the sale of non-inventory assets, plays a significant role in financial planning and investment decisions. The distinction between short-term and long-term capital gains, underscored by their respective tax rates, serves to balance tax fairness with economic stability. Accurate computation of capital gains tax, through the correct determination of cost basis and selling price, is vital. Special cases, like home sale exclusions and inherited property, can significantly influence tax liabilities. Strategic asset management, such as the timing of sales and tax-loss harvesting, can help minimize capital gains tax. Likewise, utilizing tax-advantaged accounts can offer considerable tax benefits. Reporting these taxes requires meticulous record-keeping and adherence to IRS guidelines. As changes in capital gains tax legislation can significantly affect investment strategies, keeping abreast of these changes is crucial. Understanding how capital gains tax works is key to optimizing investment returns and retirement planning.How Does Capital Gains Tax Work?

Types of Capital Gains

Short-Term Capital Gains

Long-Term Capital Gains

Distinction Between Short-Term and Long-Term Capital Gains

Calculation of Capital Gains Tax

Definition of Cost Basis

Role of Selling Price in Capital Gains Tax

Calculating the Gain or Loss

Tax Rates on Capital Gains

Short-Term Capital Gains Tax Rates

Long-Term Capital Gains Tax Rates

Exceptions and Special Cases in Capital Gains Tax

Home Sale Exclusion

Inheritance and Gift Exceptions

Special Rates for Specific Assets

Strategies to Minimize Capital Gains Tax

Timing of Asset Disposal

Utilization of Tax-Loss Harvesting

Investing in Tax-Advantaged Accounts

Reporting Capital Gains Tax

IRS Forms for Reporting Capital Gains

Reporting Schedule for Capital Gains

Importance of Accurate Record Keeping

Role of Capital Gains Tax in Investment Decisions

Influence on Asset Holding Period

Impact on Diversification Strategy

Role in Retirement Planning

Conclusion

How Capital Gains Tax Works FAQs

Capital gains tax is a levy imposed on the profit realized from the sale of a non-inventory asset, such as stocks, bonds, or real estate. The tax applies when you sell an asset for more than you paid for it. The amount of tax you owe depends on how long you held the asset and your income level.

Short-term capital gains tax applies to profits from selling an asset held for a year or less. It's typically taxed at the same rate as your regular income. Long-term capital gains tax, on the other hand, applies to profits from selling assets held for more than a year. This tax is usually lower than the short-term rate.

Strategies to minimize capital gains tax include holding assets for more than a year to qualify for lower long-term rates, utilizing tax-loss harvesting to offset gains with losses, and investing in tax-advantaged accounts like IRAs or 401(k)s.

Not always. The home sale exclusion allows you to exclude from taxation up to $250,000 of gain (or $500,000 for married couples filing jointly) on the sale of your main home, provided you meet certain criteria.

Changes in capital gains tax legislation can significantly impact your tax liability and investment strategy. For example, an increase in tax rates could influence your decision about when to sell an asset. It's important to stay updated with these changes to adapt your financial strategies accordingly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.