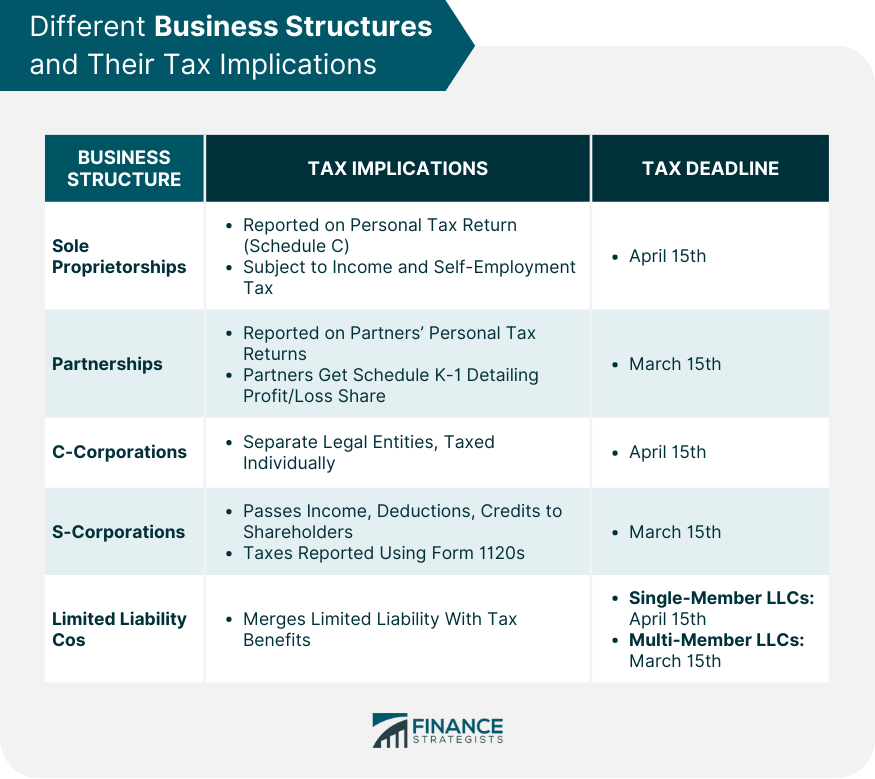

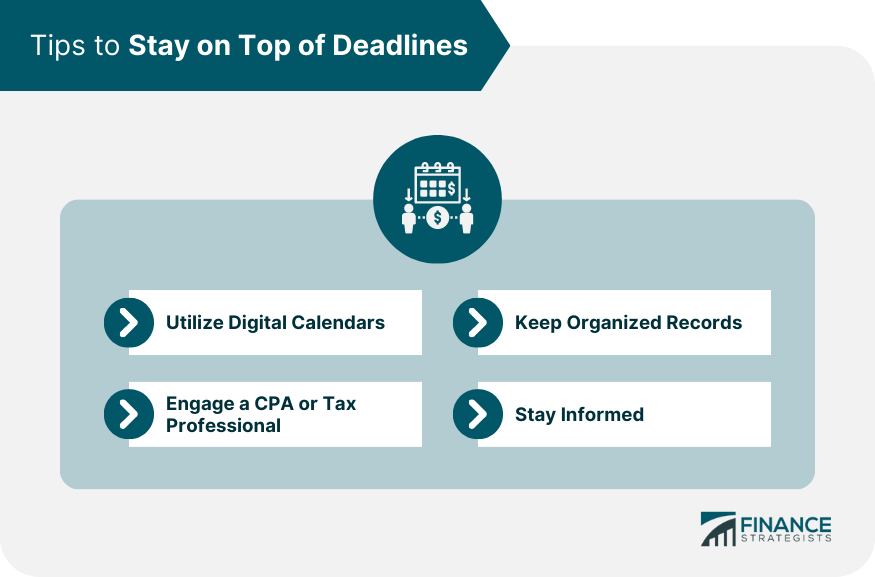

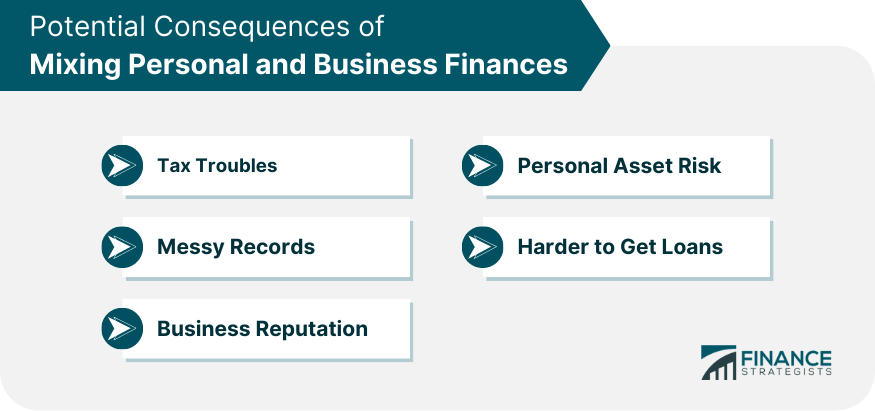

For many individuals and entrepreneurs, the immediate concern is whether business and personal taxes are filed separately. The straightforward answer is yes, they are generally filed separately. However, this depends on the structure of the business. Understanding this distinction is critical for accurate and lawful tax filings. Different business structures impact the method and the forms used for tax filings. Each business structure has its own set of rules when it comes to reporting income and expenses. The type of business structure you choose will dictate how you report this income on your personal tax return, or if a separate business return is required. If you are the sole owner of your business and haven't incorporated or set up a specific legal entity, then you are operating as a sole proprietor. In this structure, the business income is intertwined with your personal income. Income from sole proprietorships is reported directly on the owner's personal tax return using Schedule C, which details profits and losses. While the business itself is not taxed separately, the net income is subject to both income tax and self-employment tax. Tax Deadline: April 15th, the standard deadline for individual tax returns. Extensions: A six-month extension to October 15th is possible, but estimated taxes owed must still be paid by April 15th to avoid penalties. A partnership is when two or more people join together to run a business. The partnership itself doesn't pay income tax. Instead, it files an informational tax return (Form 1065). After filing this form, each partner receives a Schedule K-1, detailing their share of the partnership's profit or loss. These profits or losses are then reported on the individual partners' personal tax returns. Like sole proprietorships, partners are subject to self-employment taxes on their share of the partnership's earnings. Tax Deadline: March 15th. Extensions: An automatic six-month extension to September 15th can be filed. C-Corporations are separate legal entities, distinct from their owners. They are taxed separately from their owners, leading to what is commonly referred to as "double taxation." First, the corporation pays taxes on its profits. Then, any dividends distributed to shareholders (owners) are taxed again on the shareholders' personal tax returns. This double taxation is a significant consideration when deciding on a business structure. While it can lead to a higher overall tax burden, corporations offer benefits, such as limited liability and increased funding opportunities. These entities pay taxes at the corporate level using Form 1120. Tax Deadline: April 15th for corporations in a calendar year. For corporations ending their fiscal year on a different date, the deadline is the 15th day of the fourth month after the end of the corporation's fiscal year. Extensions: An automatic six-month extension to October 15th can be requested. An S-Corporation is a special type of corporation designed to avoid the double taxation issue faced by C-Corporations. S-Corporations pass income, deductions, and credits through to their shareholders, who then report these on their personal tax returns. Though S-Corporations avoid double taxation, they have strict eligibility criteria. For instance, they can't have more than 100 shareholders, and all shareholders must be U.S. citizens or resident aliens. These entities report taxes using Form 1120S and provide shareholders with a Schedule K-1. Deadline: March 15th. Extensions: A six-month extension to September 15th is available upon request. Limited Liability Companies (LLCs) offer a flexible business structure, merging the limited liability benefits of a corporation with the tax advantages of a partnership. Depending on state law and how the LLC chooses to be taxed, it can be treated as a sole proprietorship, partnership, or corporation for tax purposes. The members of an LLC can decide if they want the company to be taxed as a separate entity or if they want the company's income to pass through to the members' personal tax returns. This flexibility allows LLCs to adapt their tax strategy as the business grows and changes. Tax Deadline: April 15th, the standard deadline for individual tax returns. Extensions: A six-month extension to October 15th is possible, but estimated taxes owed must still be paid by April 15th to avoid penalties. Tax Deadline: March 15th. Extensions: An automatic six-month extension to September 15th can be filed. Utilize Digital Calendars: Modern digital calendars, like Google Calendar or Apple Calendar, allow users to set recurring events and reminders. Set these for all tax dates relevant to your business and enable notifications. Engage a CPA or Tax Professional: Not only can they advise on tax planning and preparation, but they'll also ensure you're aware of and meet all deadlines, particularly if they change. Keep Organized Records: Proper record-keeping throughout the year will simplify the process when it's time to file. This also means you won't be rushing to gather documentation as a deadline approaches. Stay Informed: Tax laws and dates can change. Joining professional business associations or subscribing to tax-related newsletters can keep you updated Understanding which expenses are deductible is critical for minimizing tax liabilities. For an expense to be deductible, it needs to satisfy two primary criteria: Ordinary Expenses: Refers to any cost that is deemed common and accepted in a specific industry or line of business. These expenses are typically recurring and are anticipated by businesses operating in that sector. Necessary Expenses: Defined by the IRS as one that is deemed helpful and appropriate for a business. It doesn’t need to be absolutely indispensable, but it should have a clear connection to the operation and promotion of the business. On the contrary, personal expenses—costs not directly associated with running the business—are typically not deductible. However, there are exceptions when a personal expense has a clear business purpose. For instance, if you use your personal car for business trips, a portion of the car's expenses could be deductible. Keeping personal and business finances separate is a fundamental rule for entrepreneurs, and for good reason. Here are 5 potential consequences of mixing personal and business finances: Tax Troubles: When you mix personal and business money, it can be hard to figure out what you owe in taxes. If you claim personal expenses as business deductions by mistake, you could end up owing more taxes and even face fines. Messy Records: Mixing funds can lead to jumbled records, making it tough to track how much money your business is making or spending. This confusion can prevent you from making smart choices about your business's future. Business Reputation: Paying for business stuff from a personal account can seem unprofessional to clients or partners. They might start doubting if your business is solid or if you take it seriously. Personal Asset Risk: If your business runs into legal problems, and you haven't kept your finances separate, you might have to use your own money or assets, like your house, to settle business debts. Harder to Get Loans: If your records are mixed up with personal expenses, banks might think your business isn't doing well and might not lend you the money you need. The process of filing business and personal taxes separately depends on the structure of the business. Different business structures entail distinct methods and forms for tax filings, directly impacting how income and expenses are reported. Sole proprietorships mix personal and business income, with profits and losses reported on personal returns via Schedule C. Partnerships file informational returns and distribute Schedule K-1 forms, reporting profits or losses on partners' personal returns, subjecting them to self-employment taxes. C-Corporations face "double taxation," while S-Corporations channel income to shareholders' personal returns, avoiding double taxation. LLCs offer flexibility, with potential taxation as sole proprietorships, partnerships, or corporations based on member choices. Organized records, professional tax help, and staying updated on tax laws are vital for effective tax management. By navigating these considerations, individuals and entrepreneurs can ensure proper tax compliance and optimized financial management.Can Business and Personal Taxes Be Filed Separately?

Different Business Structures and Their Tax Implications

Sole Proprietorships

Partnerships

C-Corporations

S-Corporations

Limited Liability Companies (LLCs)

Single-Member LLCs

Multi-Member LLCs

Tips to Stay on Top of Deadlines

Understanding Deductible Expenses

Potential Consequences of Mixing Personal and Business Finances

Conclusion

Can You File Business and Personal Taxes Separately? FAQs

Yes, you can generally file business and personal taxes separately, but it depends on your business structure.

Different business structures have varying rules for reporting income and expenses, influencing whether you can file taxes separately.

Sole proprietorships mix personal and business income, while partnerships report profits or losses on partners' personal returns via Schedule K-1.

C-Corporations experience "double taxation" where profits are taxed at the corporate and personal levels. S-Corporations pass income through to shareholders' personal returns.

LLCs offer flexibility, potentially being taxed as sole proprietorships, partnerships, or corporations based on member choices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.