Tax filing, for many, is a once-a-year endeavor. It's that distinct period where individuals and businesses prepare and submit their financial statements to the Internal Revenue Service (IRS). Essentially, multiple tax returns involve submitting more than one return for the same tax year. This could be due to a variety of reasons, some of which are legitimate, while others might tread on murky waters. However, the idea is not as straightforward as it seems. Different situations and circumstances lead to the contemplation of multiple filings. The reasons behind considering multiple filings can be vast and varied. For instance, an individual might realize they've made a mistake after submitting their return. Instead of amending the existing return, they might think of submitting a new one. In other cases, business owners with multiple entities might ponder if each entity requires a separate filing. The IRS is quite clear about submitting multiple returns for the same year: it's generally a no-go. Their systems are designed to accept a single return per Social Security number or Employer Identification Number for a given year. Submitting another one could trigger a reject code. However, this doesn't mean there aren't legitimate situations where multiple filings are allowed, but these are the exception, not the norm. While the IRS's stance might seem stringent, it's rooted in ensuring consistency, accuracy, and fraud prevention. By limiting filings to one per entity, they can maintain the integrity of the tax system. There are, of course, exceptions to every rule. One notable example is when married couples choose to file separately instead of jointly. Here, both spouses submit individual returns. Additionally, business owners with multiple entities or partnerships might need to submit a separate return for each entity. It's pivotal to note, however, that these are distinct scenarios and don't involve submitting duplicate returns for the same entity. In some instances, especially for individuals with a complex financial landscape, the tax season might bring about unique challenges. But regardless of the complexity, it's crucial to ensure that each filing adheres to the regulations set forth by the IRS. Venturing into the realm of unauthorized multiple filings can invite a host of problems. The immediate consequence could be a rejection of the second return. However, the fallout might extend beyond mere rejection. Filing multiple returns without proper cause can be seen as an attempt at deceit, potentially leading to penalties, interest charges, and in extreme cases, legal ramifications. Moreover, repeated attempts at unauthorized filings could flag the individual or business in the IRS system. This increases the chances of audits and could invite unnecessary scrutiny in subsequent years. Mistakes happen, and the IRS recognizes this. If post filing, an individual realizes an error in their return, the appropriate course of action isn't to file a new one but to amend the existing return. An amended return, aptly named Form 1040-X, is designed to correct errors and ensure the submitted information aligns with reality. It's a tool to rectify oversights, not to make wholesale changes. An amended return, while a remedy for mistakes, is not a ticket to repeatedly alter one's financial statements. It's essential to approach the process with diligence, accuracy, and authenticity. Not every mistake warrants an amended return. For instance, math errors are often corrected by the IRS during their review. An amended return becomes crucial when there's a change in filing status, income, deductions, or credits. Such discrepancies can significantly affect the tax liability or refund. It's also worth noting the timing. There's a window for submitting an amended return—typically three years from the date the original return was filed or two years from the date the tax was paid, whichever is later. Being mindful of these timelines ensures one doesn't miss out on potential refunds or inadvertently increase their liability. Start by collecting the original return and any new or additional documents that need to be incorporated into the amended filing. Having all relevant information at hand streamlines the process. The IRS's Form 1040-X is specifically designed for amended returns. It provides columns where taxpayers can specify original figures, the changes they're making, and the final, corrected amounts. Properly utilizing this form ensures that the IRS understands the modifications being made. Form 1040-X includes an explanatory section allowing taxpayers to describe the reasons for their amendments. Leveraging this section to provide clear and concise reasons is crucial for transparency and can help expedite the review process. If the amendments made impact other forms or schedules, it's essential to attach them alongside the amended return. This is to maintain a comprehensive and consistent financial record with the IRS. Marriage, while a union of hearts, sometimes necessitates separate financial reporting. Married couples have the option to file jointly or separately. The latter results in two distinct tax returns. It might be beneficial in scenarios where one spouse has significant medical expenses, miscellaneous itemized deductions, or when there's a desire to keep finances separate. However, this choice shouldn't be made lightly. Filing separately often means higher tax rates and the forfeiture of several tax credits and deductions. It's a decision that requires thorough analysis, weighing the pros against the cons. Entrepreneurs with fingers in multiple pies—say, multiple businesses or partnerships—might find themselves in a position to file separate returns for each entity. This isn't a case of duplicate filings but a legitimate requirement stemming from distinct financial structures and obligations. Each business, depending on its legal structure—be it an LLC, S-corp, or partnership—has its filing needs. Furthermore, these filings aren't merely about profits and losses. They encompass the entire financial story of the entity: investments, depreciations, credits, deductions, and more. Ensuring each narrative is coherent and accurate is paramount to avert complications. Tax considerations for non-residents or those with dual status can be a convoluted affair. These individuals might need to file multiple returns depending on their income sources, duration of stay, and other factors. For example, a non-resident alien receiving income from U.S. sources might need to file Form 1040NR. If the same individual later gains resident status within the same year, a separate return reflecting the resident status might be necessary. Such situations underscore the intricacy of U.S. tax laws. It's a realm where one-size-fits-all doesn't apply, and each individual's circumstances dictate their tax obligations. The allure of multiple filings, especially if done with the intention of gaming the system, can come at a steep price. Financial penalties can be substantial. The IRS might levy interest charges on unpaid amounts, and there could be additional fines for fraudulent filings. These fines, depending on the gravity of the oversight, can range from a small percentage of the unpaid taxes to substantial amounts that could cripple one's finances. It's not just about the immediate penalties either. The repercussions of such actions can have long-term implications, making it harder to negotiate payment plans or secure leniencies in future dealings with the IRS. If the financial penalties weren't daunting enough, unauthorized multiple filings can catapult you into the IRS's radar, increasing the risk of audits. Audits, thorough examinations of one's financial statements and transactions, are exhaustive and can be stressful. While some audits are random, repeated discrepancies in filings can be a surefire trigger. Being under the microscope isn't merely about proving one's financial integrity. It's time-consuming, can demand additional documentation, and might even entail legal representation. One's history with the IRS doesn't fade away. Unauthorized multiple filings, especially if they become a pattern, can taint one's record. This could mean closer scrutiny in subsequent years, delays in processing returns, and even challenges in securing basic tax benefits. In essence, a momentary lapse in judgment can cast a long shadow, making future tax seasons an uphill battle. Moreover, a tarnished record can impact other financial aspects. It could hinder one's ability to secure loans, impact credit scores, or even affect business dealings. Taxes, after all, are not an isolated part of one's financial landscape but interwoven with various facets of life. The world of taxes, with its myriad rules, exceptions, and nuances, can be overwhelming. This is where tax professionals come into play. Their expertise can provide clarity, ensure compliance, and even identify potential savings. Whether it's deciding on the best filing status, understanding the implications of multiple businesses, or navigating the complex terrain of amended returns, professional guidance can be invaluable. Furthermore, in scenarios where mistakes have been made, tax professionals can provide the roadmap to rectification. Their insights can help mitigate potential repercussions and provide a strategy for future filings. Accuracy in tax filings is non-negotiable. It's not merely about avoiding penalties but about upholding one's financial integrity. Ensuring every number, deduction, and credit is genuine is paramount. Transparent reporting, where every transaction is accounted for, and every claim is substantiated, lays the foundation for a hassle-free tax season. Additionally, transparency builds trust. Whether it's with the IRS, financial institutions, or business partners, an impeccable tax record can open doors and create opportunities. It's a testament to one's commitment to financial prudence and integrity. Tax laws are dynamic. They evolve, influenced by socio-economic factors, political decisions, and global events. Staying updated with the latest IRS directives ensures one's filings are in line with current regulations. This is especially crucial for businesses, non-residents, or those with complex financial landscapes. Regularly visiting the IRS website, subscribing to tax news, or even attending tax workshops can provide the necessary updates. After all, being forewarned is forearmed. With the right information, individuals can make informed decisions, minimize liabilities, and maximize benefits. In the intricate landscape of tax returns, filing multiple returns within a single tax year presents both challenges and considerations. The IRS typically accommodates just one return per Social Security or Employer Identification Number annually. However, exceptions arise, such as separate filings for married couples or diverse business entities. While the allure of multiple filings might seem tempting in complex financial scenarios, the repercussions of unauthorized actions can be severe, ranging from financial penalties to increased audit risks. Mistakes, though inevitable, are better addressed through amended returns, not through additional filings. Expert guidance from tax professionals, a commitment to transparent reporting, and staying updated with IRS regulations are essential strategies to navigate this terrain effectively. Above all, maintaining financial integrity and adherence to the established protocols ensures a smooth and compliant tax filing experience.Overview of Multiple Tax Returns

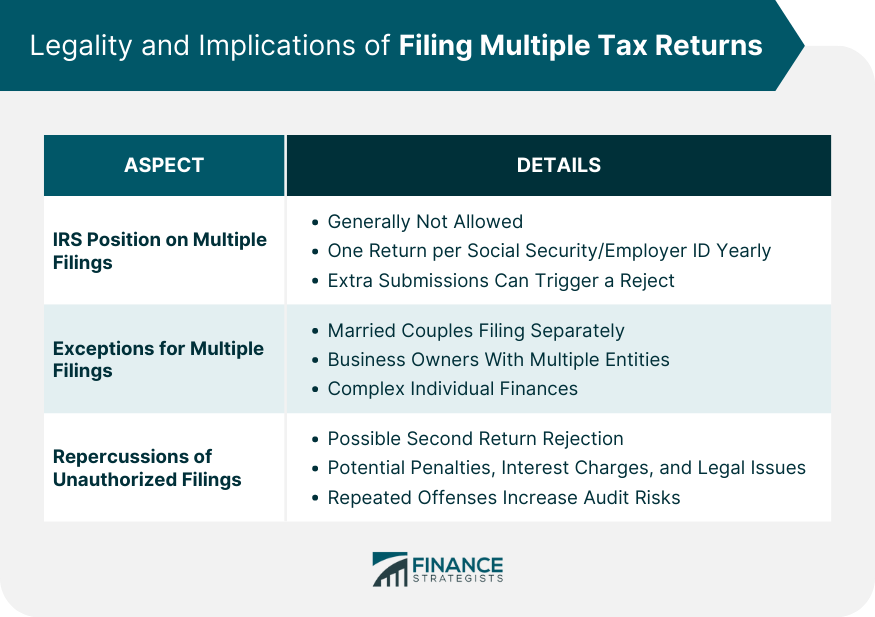

Legality and Implications of Filing Multiple Tax Returns

IRS Position on Multiple Filings for a Single Tax Year

Instances Where Multiple Filings Are Permitted

Potential Repercussions of Unauthorized Filings

Correcting Errors With Amended Tax Returns

What Is an Amended Return?

When to Consider an Amended Return

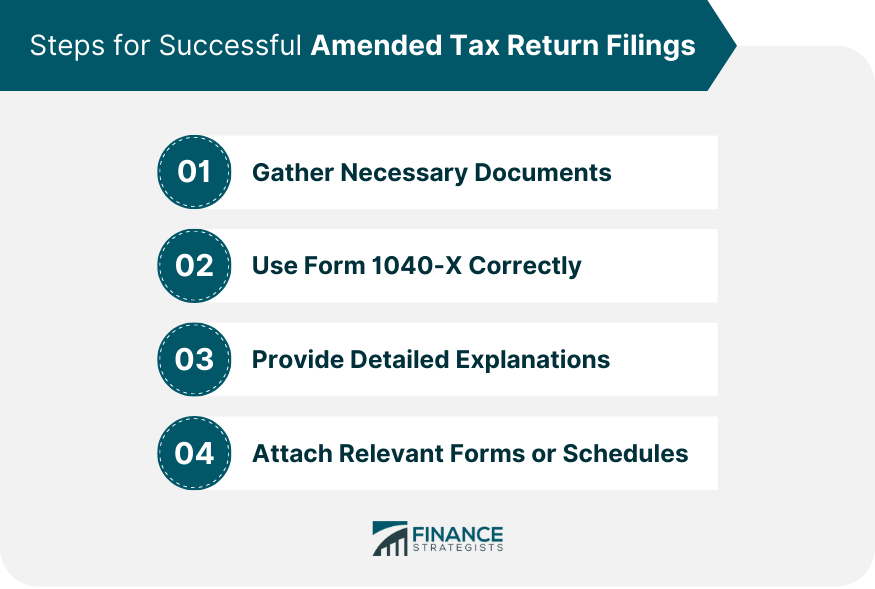

Steps for Successful Amended Tax Return Filings

Gather Necessary Documents

Use Form 1040-X Correctly

Provide Detailed Explanations

Attach Relevant Forms or Schedules

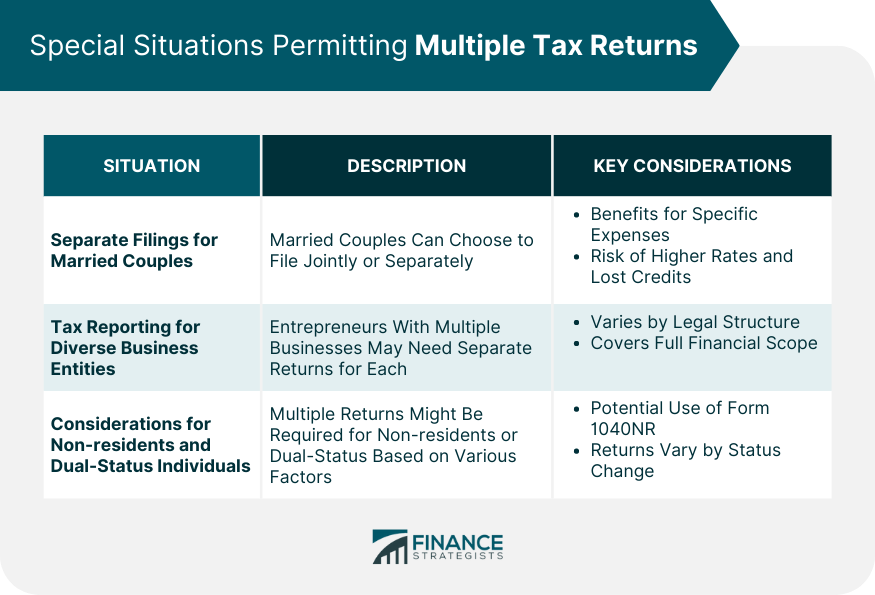

Special Situations Permitting Multiple Tax Returns

Separate Filings for Married Couples

Tax Reporting for Diverse Business Entities

Considerations for Non-residents and Dual-Status Individuals

Potential Risks and Penalties of Multiple Tax Filings

Financial Consequences of Unauthorized Multiple Filings

Audit Risks and Ensuing Investigations

Long-Term Impacts on Future Filings

Recommendations and Best Practices for Multiple Tax Filings

Value of Tax Professionals' Guidance

Commitment to Accurate and Transparent Reporting

Keeping Abreast With Current IRS Directives

Bottom Line

Can You File Multiple Tax Returns? FAQs

Generally, the IRS allows one return per Social Security or Employer Identification Number. Exceptions exist, like separate filings for married couples.

Instead of filing a new return, you should submit an amended return using Form 1040-X to correct errors.

Yes, unauthorized filings can result in financial penalties, increased risk of audits, and potential legal ramifications.

Couples may file separately due to significant medical expenses, miscellaneous itemized deductions, or a desire to keep finances separate.

Tax experts provide clarity, ensure compliance, rectify mistakes, and help navigate the complexities of the tax landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.