Students, whether working part-time, freelancing, or receiving scholarships, often have financial dealings that touch the tax world. Navigating tax responsibilities can appear overwhelming, especially when juggling coursework and perhaps a job. However, with a bit of guidance and understanding, students can confidently address their tax obligations, ensuring they make the most of any available benefits and avoid potential pitfalls. Having a foundational grasp of tax obligations not only provides students with a clear financial picture but can also prevent potential mistakes that might be costly down the line. Many misconceptions surround student tax obligations. While some students might believe they're free from tax duties due to minimal income or their status as students, this isn't always the case. As financial landscapes for students become more complex, the importance of understanding where one stands tax-wise grows. Every year, the IRS sets specific income thresholds that dictate who must file a tax return. These thresholds depend on several factors, including age, filing status, and whether an individual is claimed as a dependent. For students, especially those engaged in part-time work or internships, it's essential to be aware of these limits. This knowledge helps determine if they're required to file and can guide them in tax planning throughout the year. For those who hover around these income thresholds, it's worth noting that even if they're slightly below the mandatory filing requirement, they might still benefit from filing. If any tax was withheld from their paychecks during the year, they might be entitled to a refund. To claim this, they'd need to file a return, making it a potentially profitable exercise. How Being Claimed as a Dependent on Someone Else's Tax Return Can Impact Your Filing Necessity The distinction between being claimed as a dependent and filing independently is crucial for tax obligations. Students, in particular, often find themselves in a gray area, especially if they're still receiving financial support from parents or guardians. When someone claims a student as a dependent, the student's income threshold for filing a tax return typically decreases. Moreover, being claimed as a dependent has other tax implications. For instance, the student might not be eligible for certain tax credits or deductions that they would have otherwise qualified for if filing independently. It's essential for students to communicate with their parents or guardians about this topic. It ensures that both parties are on the same page and helps avoid potential complications or missed tax benefits. Earned income is what most people think of when considering income. For students, this typically encompasses wages from part-time jobs, stipends from internships, or earnings from work-study programs. This money is usually reported on a W-2 form provided by employers at the end of the tax year. However, not all earned income might be subject to federal income tax. Some might be below the taxable threshold, but it's still essential to be aware of all income sources. While the primary consideration with earned income is whether it surpasses the taxable threshold, there's another factor students should be aware of. If they have multiple sources of earned income, even if each source is minimal, collectively, they could push the student over the threshold. This accumulation is something to watch, especially for students juggling multiple part-time jobs or gig work. Beyond the realm of earned income lies unearned income. This category includes money that isn't derived from employment or business operations, such as interest on savings accounts, dividends from investments, or capital gains from the sale of assets. While many students might not have significant unearned income, those with savings accounts or minor investments should be attentive to this income type. Unearned income can be a bit trickier for students, primarily if they're not actively monitoring their financial portfolio. An unexpected dividend or a forgotten old savings account could generate income that, when combined with other income sources, pushes a student past the filing threshold. It's also worth noting that certain types of unearned income might have different tax rates or requirements than standard earned income. Scholarships and grants are blessings for many students, helping reduce the financial burden of education. However, from a tax perspective, not all this money is created equal. Generally, funds from scholarships and grants used directly for tuition, fees, or books are tax-free. But if these funds are used for other expenses, like room and board, they might be considered taxable income. The taxability of scholarships and grants often catches students off guard. It's essential to differentiate between amounts spent on qualified educational expenses and other costs. For instance, if a student receives a comprehensive scholarship that covers tuition, room, and board, only the portion covering room and board might be taxable. Properly documenting these amounts can make tax time smoother and ensure compliance with IRS guidelines. The rise of the gig economy and freelancing opportunities means that more students are venturing into self-employment. Whether it's graphic design, tutoring, or selling products online, these entrepreneurial efforts bring specific tax implications. Unlike traditional employment where employers withhold taxes, self-employed individuals are responsible for their tax calculations and payments. Additionally, self-employed students have the unique opportunity to deduct certain business-related expenses. These can range from a portion of their home's rent if they have a dedicated workspace, to software subscriptions or travel expenses directly related to their business. However, meticulous record-keeping is paramount. Not only does it aid in accurate tax filings, but it also provides protection if questions or issues arise later. The first step in the tax filing process is understanding one's filing status. Are you a single filer? Could you be claimed as a dependent? Answering these questions sets the stage for the rest of the filing process. Once the status is determined, it's time to gather documentation. This includes all forms that report income, such as W-2s or 1099s, as well as documents detailing educational expenses. Documentation is the backbone of a successful tax filing experience. It provides the hard numbers needed to fill out tax forms and acts as a reference if questions arise later. For students, being diligent about keeping all financial records throughout the year can streamline this step, making tax time less stressful. In today's digital age, students have various options when it comes to filing taxes. They can choose to e-file, which is filing taxes electronically, often through an online platform or software. This method is quick and offers prompt feedback if there are any issues with the return. Alternatively, the traditional paper filing is still an option, though it might be slower. For those who feel daunted by the process, employing a tax professional or using tax software can provide guidance. These resources can guide students through the maze of forms and regulations, ensuring they're compliant and maximizing any refunds or credits. The key is to choose a method that aligns with the individual's comfort level and financial complexity. Armed with documentation and a chosen filing method, it's time to tackle the actual tax forms. For students, this typically means Form 1040, but based on their financial dealings, other forms might come into play. It's crucial to report all income sources, from wages to interest to scholarships. Ensuring completeness in reporting is vital. Not only does it prevent potential issues with the IRS, but it also ensures that students are accurately calculating any owed tax or expected refund. This step might seem tedious, especially for those unfamiliar with tax jargon, but with patience and reference to documentation, it's manageable. Once all income has been reported, the focus shifts to reducing taxable income or the actual tax owed. This is where tax credits and deductions come into play. As discussed earlier, students have access to specific credits and deductions, like the AOC or the Tuition and Fees Deduction. By identifying and claiming these benefits, students can potentially save a significant amount on their taxes. However, it's crucial to ensure eligibility. Making unsupported claims can lead to complications, from a rejected return to potential penalties. With income reported and deductions or credits applied, it's time for the final calculations. Will you be receiving a refund, or do you owe additional tax? Properly reviewing these numbers ensures that there are no surprises down the line. If you find that you owe tax, ensure that you have a plan in place to pay it by the tax deadline to avoid potential penalties. On the flip side, if you're due for a refund, consider your options. Would you prefer a check, or direct deposit? Making these decisions in advance can expedite the refund process. The final step is submission. If you're e-filing, the process is relatively straightforward, often involving a few clicks. For paper filers, it's about ensuring that all documents are in order, correctly addressed, and sent before the deadline. Once the return is submitted, it's essential to keep copies. Having a record of your filed return can be invaluable if questions arise later or if you need to reference it for future financial decisions. For students, it's a good practice to start a filing system, whether digital or paper, to keep track of their tax journey. Navigating the maze of education costs can be daunting. Thankfully, tax credits like the American Opportunity Credit (AOC) and the Lifetime Learning Credit (LLC) are designed to offer some relief. The AOC provides a credit for qualified education expenses for the first four years of higher education. It can be a boon, potentially offering a credit of up to $2,500 per eligible student. On the other hand, the LLC doesn't have a limit on the number of years you can claim it. It offers a maximum annual credit of $2,000 per tax return, counting both undergraduate and graduate level courses. Both credits come with specific eligibility criteria, including income limits. So, while they can be immensely beneficial, it's essential to understand each credit's nuances to ensure eligibility and proper claim. Taxes can be a bit easier to bear with deductions in play, and the Tuition and Fees Deduction is one such relief for students. This deduction allows qualifying students to reduce their taxable income by up to $4,000 for tuition and certain related expenses. It's worth noting that this doesn't directly reduce the tax owed but rather the income on which tax is calculated. However, there's a catch. Students cannot claim this deduction if they're also claiming the AOC or LLC. As such, it's crucial to crunch numbers and determine which option provides the most substantial financial benefit. The right choice could differ from one student to another, based on their unique financial situation and the specific expenses they've incurred. Student loans are often a necessary evil in the pursuit of higher education. But when it comes to tax time, they can offer a silver lining: the Student Loan Interest Deduction. This allows students (or their parents) to deduct up to $2,500 of the interest paid on student loans each year. This deduction is particularly helpful for recent graduates who've entered the repayment phase and are managing monthly loan payments. Like other tax benefits, the Student Loan Interest Deduction comes with its set of qualifications. There are income limits, and the loan must have been taken out solely for educational purposes. Additionally, the student must be enrolled at least half-time in a program leading to a degree or certificate. Understanding these criteria ensures that those eligible can take advantage of this tax relief. Overpaying taxes is more common than many realize. This often happens when employers withhold more tax from paychecks than is ultimately owed. For students, especially those working part-time or intermittently, this can result in a pleasant surprise: a tax refund. Just because a student's income doesn't exceed the threshold for mandatory filing doesn't mean they shouldn't file. If they've had any tax withheld and are owed a refund, the only way to get it back is through filing a tax return. This highlights an essential aspect of tax planning. Even if not required, proactive filing can have financial benefits. It's a way to ensure that students don't leave money on the table. It's also an opportunity for them to get accustomed to the tax process, making it less daunting in subsequent years when filing might become mandatory. The Earned Income Tax Credit (EITC) is a valuable credit for low-to-moderate-income individuals, acting as a potential financial boost. While many students might assume they don't qualify due to age or dependency status, some might be eligible based on their financial circumstances. This is particularly relevant for older students or those who support families. The EITC's primary aim is to reduce the tax burden on individuals with limited income, and in some cases, it can even result in a refund. Factors influencing eligibility include income level, filing status, and whether the individual has qualifying children. For qualifying students, the EITC can make a significant difference, not only reducing their tax bill but also possibly providing additional funds to support their education or personal needs. Form 1040 is the foundational form for personal income tax returns in the U.S. It's where individuals, including students, report their income, calculate their tax liability, and determine whether they owe additional tax or are due for a refund. It's a comprehensive form, encompassing various income types, deductions, and credits. While the form itself can seem intimidating, especially for first-time filers, it's structured logically. Many students, especially those with straightforward financial situations, might only need to deal with a few sections. However, it's essential to review the entire form, ensuring all applicable income and deductions are appropriately reported. Come tax time, students will often encounter Form 1098-T. This form is provided by educational institutions and reports the amount of qualified tuition and related expenses paid during the tax year. It's a critical document for students, especially if they're claiming educational credits or deductions. It's worth noting that while Form 1098-T provides essential information, it might not capture every educational expense a student has incurred. Thus, it's beneficial for students to keep personal records of their educational costs, cross-referencing them with Form 1098-T to ensure they're maximizing available tax benefits. Any student earning interest, whether from a savings account or an investment, should be familiar with Form 1099-INT. Financial institutions issue this form to individuals who've earned more than $10 in interest during the tax year. It's a concise form, but it plays a pivotal role in ensuring all income is reported correctly. While many students might have minimal interest earnings, especially with today's relatively low-interest rates, it's essential to account for every dollar. Even small amounts of unreported income can lead to discrepancies in a tax return. Form 1099-INT provides a clear snapshot of interest earnings, ensuring that students have the information they need when filing. Understanding tax obligations as a student is imperative to ensure compliance with IRS guidelines and to optimize financial benefits. Students must realize that income thresholds, dependent status, the nature of their income (whether from employment, scholarships, or investments), and self-employment can dictate their need to file. Various tax credits and deductions, such as the American Opportunity Credit, Lifetime Learning Credit, and Tuition and Fees Deduction, are tailored to students, providing potential savings. When tax season arrives, students should gather all necessary documentation, decide on a filing method, ensure accurate reporting of all income and deductions, calculate tax liabilities or refunds, and submit their returns. Keeping organized records is not just crucial for smooth tax filings, but also acts as a foundation for sound financial management. As the complexity of students' financial landscapes increases, the importance of knowledgeable tax practices becomes even more vital.Overview of Tax Obligations as a Student

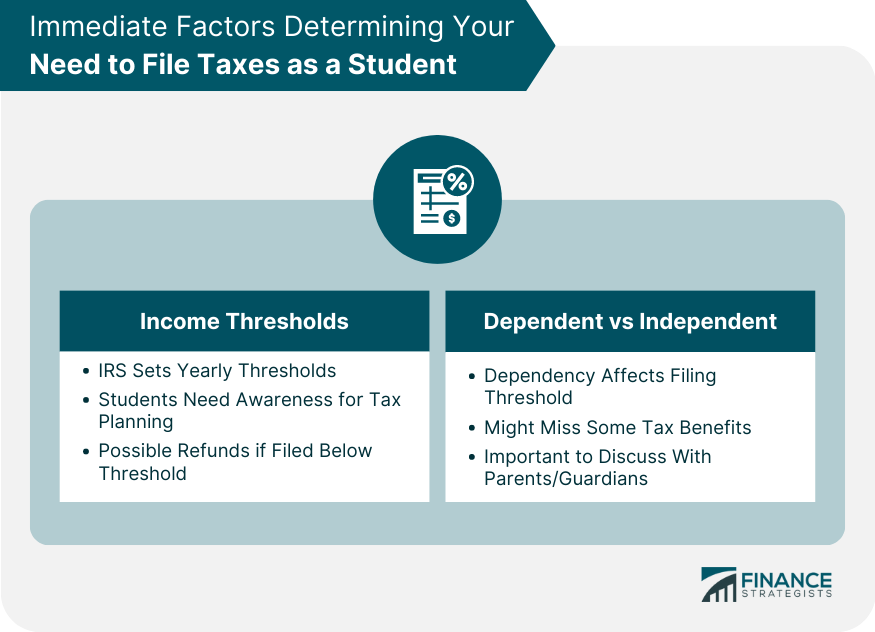

Immediate Factors Determining Your Need to File as a Student

Income Thresholds

Dependent vs Independent

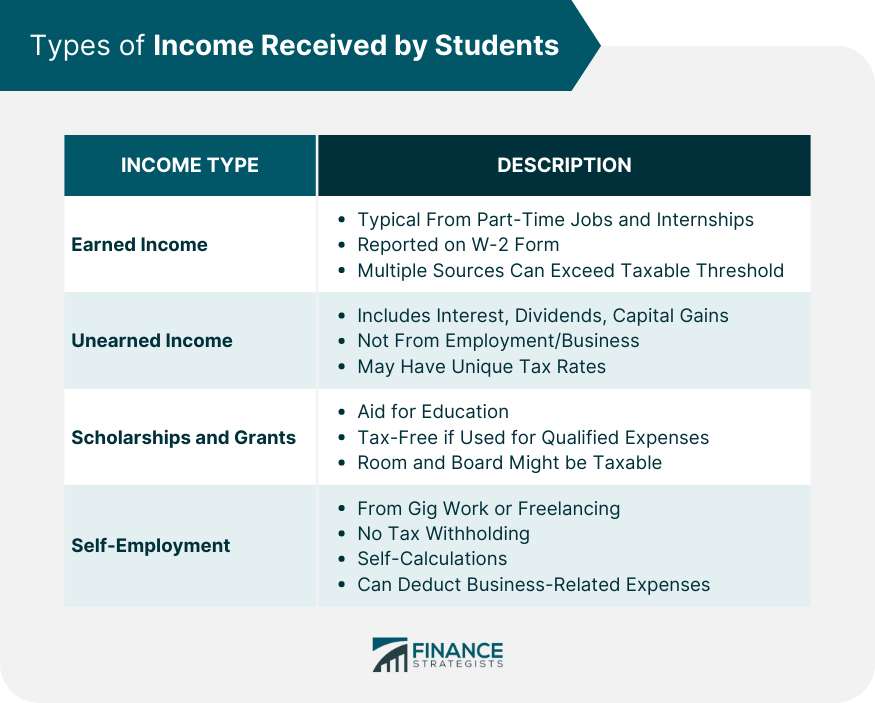

Types of Income Received

Earned Income

Unearned Income

Scholarships and Grants

Self-Employment

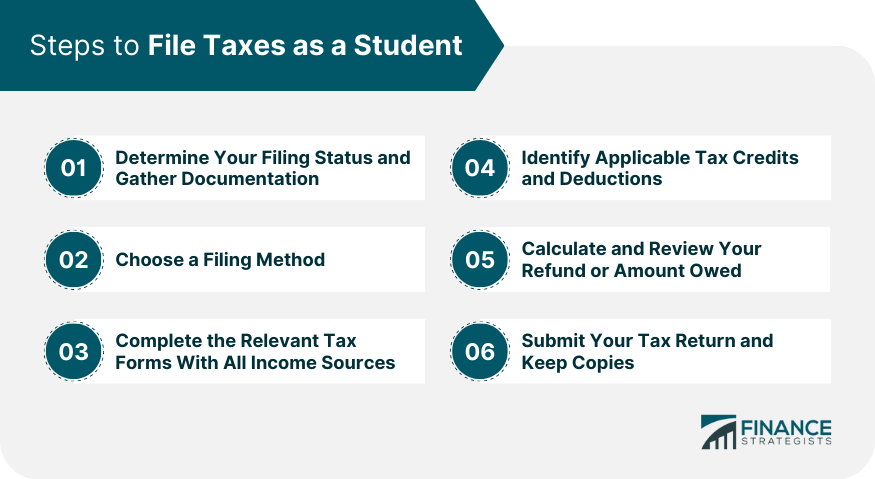

Steps to File Taxes as a Student

Determine Your Filing Status and Gather Documentation

Choose a Filing Method

Complete the Relevant Tax Forms With All Income Sources

Identify Applicable Tax Credits and Deductions

Calculate and Review Your Refund or Amount Owed

Submit Your Tax Return and Keep Copies

Tax Credits and Deductions for Students

American Opportunity Credit and Lifetime Learning Credit

Tuition and Fees Deduction

Student Loan Interest Deduction

Potential Tax Refund Benefits for Students

Overpaid Taxes

Earned Income Tax Credit (EITC)

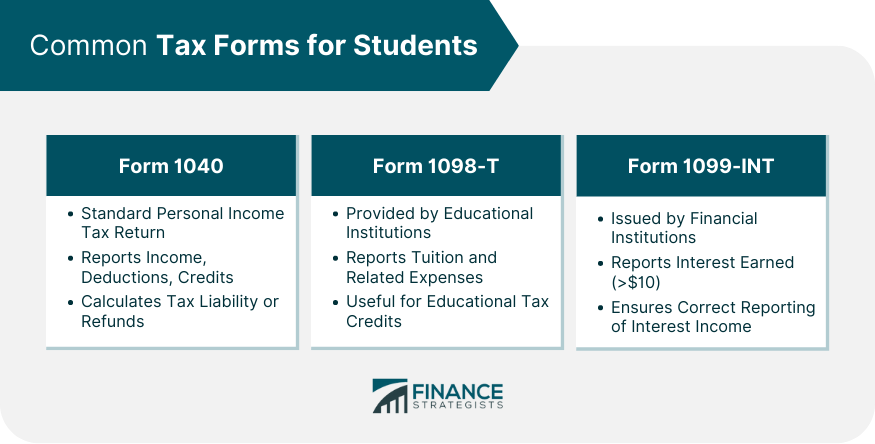

Common Tax Forms for Students

Form 1040

Form 1098-T

Form 1099-INT

Bottom Line

Do You Need to File Taxes as a Student? FAQs

Students must consider their earned and unearned income, determine if they meet the income threshold for filing, and understand available credits and deductions.

Students often use Form 1040 for personal income, Form 1098-T for tuition statements, and Form 1099-INT for reporting interest income.

Yes, students can access the American Opportunity Credit, Lifetime Learning Credit, and deductions for tuition, fees, and student loan interest.

Scholarships and grants can be taxable if they exceed tuition and related expenses or are used for other costs like room and board.

Students might face financial penalties and interest, and they could lose out on potential refunds or tax benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.