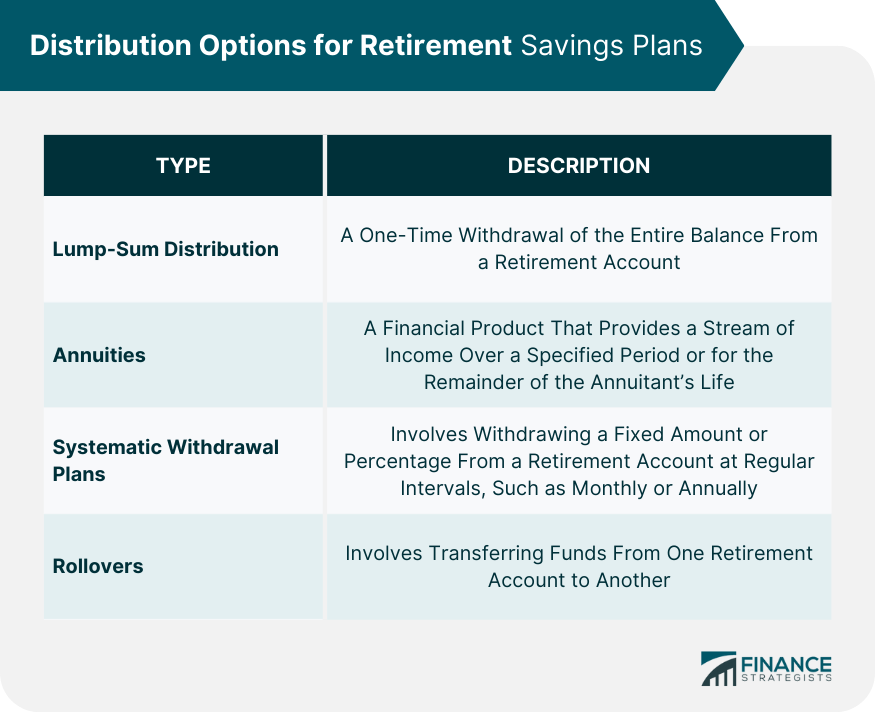

Retirement distribution options refer to how individuals can withdraw funds from their retirement accounts, such as 401(k) plans, individual retirement accounts (IRAs), and other qualified retirement plans, once they reach retirement age. These options are important because they determine how and when retirees can access their savings, and they can have significant tax implications. The most common retirement distribution options include taking a lump-sum distribution, setting up a systematic withdrawal plan, purchasing an annuity, and taking required minimum distributions (RMDs). Each option has its advantages and disadvantages, and the best choice will depend on the individual's financial situation, retirement goals, and tax considerations. There are several distribution options available for accessing funds from retirement savings plans. Each option has unique advantages and disadvantages, as well as tax implications. A lump-sum distribution is a one-time withdrawal of the entire balance from a retirement account. This option may be attractive to individuals who require a large amount of cash immediately, such as for purchasing a home or starting a business. Lump-sum distributions from tax-deferred retirement accounts, like traditional IRAs and 401(k)s, are generally subject to income tax on the entire amount withdrawn. Additionally, if the individual is under 59½ years old, they may be subject to a 10% early withdrawal penalty. The primary advantage of a lump-sum distribution is immediate access to a large sum of money. However, the disadvantages include potential tax liabilities and the loss of future tax-deferred growth on the withdrawn amount. An annuity is a financial product that provides a stream of income over a specified period or for the remainder of the annuitant's life. Annuities can be purchased using funds from a retirement account, effectively converting a lump-sum amount into a regular income stream. There are several types of annuities, each with distinct characteristics: Immediate Annuity: An immediate annuity begins paying income immediately after the purchase and is typically used to provide income during retirement. Deferred Annuity: A deferred annuity accumulates interest and begins paying income once the owner chooses a future date. Fixed Annuity: A fixed annuity provides a guaranteed, fixed income stream for a specified period or for life. Variable Annuity: A variable annuity offers a varying income stream based on the performance of underlying investments chosen by the annuity owner. Taxes on annuity income depend on the type of retirement account used to purchase the annuity and the type of annuity itself. For example, if an annuity is purchased using funds from a traditional IRA, the income will generally be taxed as ordinary income. Conversely, the income may be tax-free if the annuity is purchased with Roth IRA funds. Annuities offer a guaranteed income stream, which can provide financial security and help manage longevity risk. However, they may also have high fees, surrender charges, and limited liquidity. A systematic withdrawal plan involves withdrawing a fixed amount or percentage from a retirement account at regular intervals, such as monthly or annually. There are several types of systematic withdrawal plans: Fixed Dollar Amount: This method involves regularly withdrawing a fixed dollar amount from the retirement account, regardless of market performance. Fixed Percentage: This method involves withdrawing a fixed percentage of the account balance regularly. The dollar amount may vary depending on the account's performance. Required Minimum Distributions (RMDs): For certain tax-deferred retirement accounts, the IRS mandates that individuals begin taking RMDs by April 1 of the year following the year they turn 72. The withdrawal amount is based on life expectancy and account balance. Withdrawals from tax-deferred accounts are typically subject to income tax. Additionally, failing to take RMDs can result in a substantial tax penalty. Systematic withdrawal plans provide a predictable income stream and can be tailored to individual needs. However, they may be subject to a sequence of returns risk, which can erode the account balance if withdrawals occur during market downturns. A rollover involves transferring funds from one retirement account to another, such as from a 401(k) to an IRA. There are several types of rollovers: Direct Rollover: A direct rollover involves transferring funds directly from one retirement account to another without the account holder taking possession of the funds. Indirect Rollover: An indirect rollover involves the account holder taking possession of the funds and then depositing them into a new retirement account within 60 days. Rollover to a Roth IRA: A rollover to a Roth IRA involves converting funds from a tax-deferred account, like a traditional IRA or 401(k), to a Roth IRA. This process is also known as a "Roth conversion." Rollovers are generally not subject to taxes or penalties if done correctly. However, Roth conversions are taxable events and may result in tax liabilities. Rollovers can provide greater investment flexibility and simplify retirement account management. However, they may also have tax implications and require careful planning to avoid penalties. When choosing a retirement distribution option, individuals must consider various risks and factors, such as the sequence of returns risk, longevity risk, inflation risk, tax efficiency, and asset allocation. Additionally, individuals should consider the timing and amount of their Social Security benefits. The sequence of returns risk refers to the possibility of receiving lower returns during the early years of retirement, which can negatively affect the overall retirement income. This risk can be mitigated by diversifying investments and considering a withdrawal rate that adjusts for market fluctuations. Longevity risk refers to the possibility of outliving one's retirement savings. This risk can be managed by considering various sources of retirement income, such as Social Security, annuities, and other guaranteed income sources. Inflation risk refers to the possibility of the purchasing power of retirement income decreasing over time due to inflation. This risk can be addressed by investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), and considering a retirement distribution strategy that includes inflation-adjusted income streams. Tax efficiency is an important consideration when developing a retirement distribution strategy. Strategies that minimize taxes on retirement income can help retirees maintain their standard of living in retirement. Examples include Roth IRA conversions, tax-loss harvesting, and strategically timing withdrawals from different types of retirement accounts. Asset allocation is the process of diversifying investments across different asset classes, such as stocks, bonds, and cash equivalents. This can help manage risk and potentially increase returns. A retirement distribution strategy should take into account the individual's risk tolerance, investment goals, and time horizon. Social Security benefits are a critical component of many retirees' income streams. Individuals should consider the optimal timing and amount of their Social Security benefits, which can be influenced by factors such as their life expectancy, employment history, and marital status. Maximizing Social Security benefits can help provide a more secure retirement income. Early retirement distributions are withdrawals made from a retirement account before the individual reaches the age of 59½. Under the 72(t) rule, individuals can take substantially equal periodic payments (SEPPs) from their retirement accounts without incurring the 10% early withdrawal penalty. The payments must be made at least annually and continue for at least five years or until the individual reaches 59½, whichever is longer. While the 72(t) rule allows individuals to avoid the early withdrawal penalty, income tax is still due on withdrawals from tax-deferred accounts. Early retirement distributions can provide needed income for individuals who retire early or face financial hardship. However, these withdrawals can result in lost tax-deferred growth and potential tax liabilities and may deplete retirement savings. An inherited retirement account is a retirement account passed to a beneficiary upon the account owner's death. Beneficiaries have different options depending on their relationship to the deceased account owner: Spouse: A spouse beneficiary can treat the inherited account as their own, roll it over to their own retirement account, or take distributions as a beneficiary. Non-spouse: Non-spouse beneficiaries may need to establish an inherited IRA, withdraw the entire balance within a specific time frame, or take RMDs based on their life expectancy. The tax implications for inherited retirement accounts depend on the type of account, the beneficiary's relationship to the deceased, and the distribution method chosen. Inheriting a retirement account can provide financial support for beneficiaries, but it may also come with tax liabilities and complex rules for managing inherited assets. Retirement distribution options encompass how individuals can access funds from their retirement accounts, including 401(k) plans, IRAs, and other qualified plans. Common distribution options include lump-sum distributions, annuities, systematic withdrawal plans, and rollovers. Each option has its own tax implications, advantages, and disadvantages, and the choice depends on individual circumstances and goals. Additionally, individuals must consider early retirement distributions, the 72(t) rule, and the handling of inherited retirement accounts. It is also important to understand the different types of retirement savings plans, such as traditional and Roth IRAs, 401(k) and 403(b) plans, 457 plans, SEP IRAs, SIMPLE IRAs, and pensions. Given the complexity of retirement distribution options and the potential impact on financial security, individuals are encouraged to seek guidance from qualified financial professionals to develop a well-informed retirement distribution strategy that aligns with their needs and objectives.What Are Retirement Distribution Options?

Retirement Distribution Options

Lump-Sum Distribution

Annuities

Systematic Withdrawal Plans

Rollovers

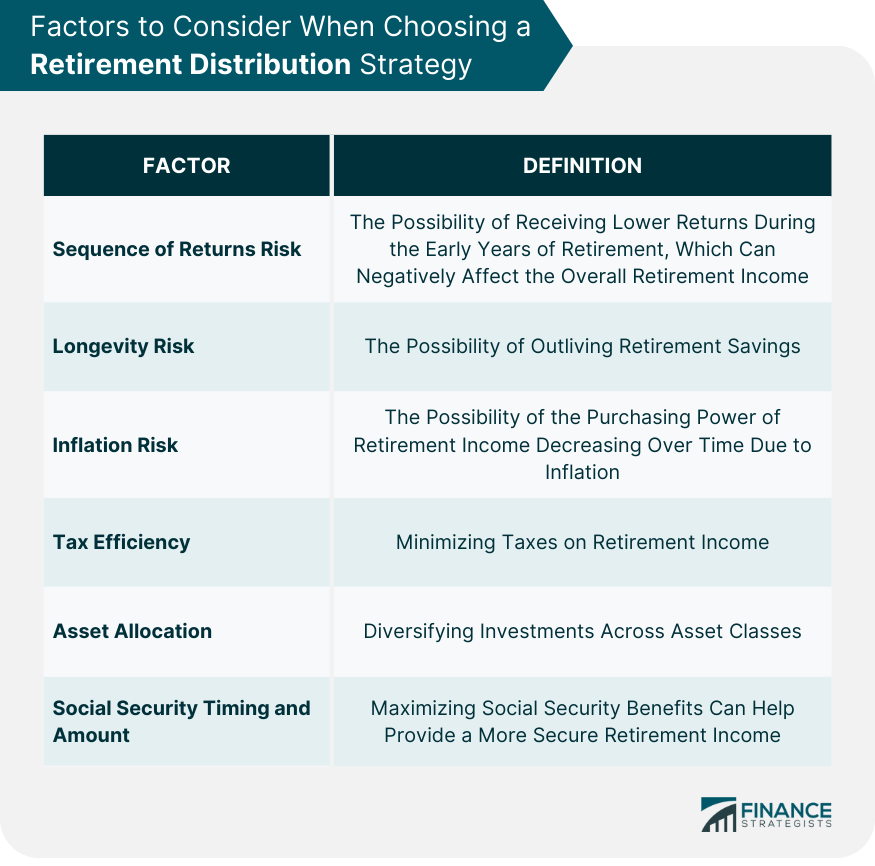

Factors to Consider When Choosing a Retirement Distribution Option

Sequence of Returns Risk

Longevity Risk

Inflation Risk

Tax Efficiency

Asset Allocation

Social Security Timing and Amount

Special Considerations for Retirement Distribution Options

Early Retirement Distributions

Inherited Retirement Accounts

Conclusion

Retirement Distribution Options FAQs

Retirement distribution options refer to the various methods that an individual can use to access their retirement funds or assets after retirement.

Common retirement distribution options include lump-sum withdrawals, systematic withdrawals, annuities, and rollovers to an IRA or another qualified retirement plan.

A lump-sum withdrawal is a one-time payment of the entire retirement account balance to the retiree.

An annuity is a type of retirement income option where an individual makes a lump sum payment or a series of payments to an insurance company, in exchange for a guaranteed income stream for a specified period or for the individual's lifetime.

Yes, retirees can change their retirement distribution options if they find that the chosen option is not meeting their needs or if their financial circumstances change. However, some distribution options, such as annuities, may have restrictions or penalties for changing or terminating the contract.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.