Navigating the pension application process can be a complex and daunting task, but it is a crucial endeavor for individuals seeking financial security in their retirement years. There are several factors involved in applying for a pension, such as the timing and deadlines that must be adhered to, sources of assistance and information that can provide invaluable support, and a thorough understanding of pension benefits and calculations. Whether you are a government employee, a private sector worker, or a retiree looking to maximize your pension benefits, it is imperative to have the knowledge and insights needed to navigate the application process successfully. Additionally, delving into common issues and challenges faced by pension applicants is vital, learning practical solutions to ensure a smoother journey towards securing your financial future. A crucial first step is to determine your eligibility for a pension, which can depend on various factors like age, employment history, and other specific criteria. Most pension schemes set specific criteria regarding age and employment history. For instance, state pensions might require a minimum number of years of national insurance contributions. Understanding these specifics is crucial as they vary significantly across different pension schemes. Certain pension plans take into account an individual's health and disability status, potentially offering early access or modified benefits. These considerations are particularly Understanding these criteria in detail ensures that you meet the necessary requirements before investing time in the application process. Gathering and preparing the necessary documentation is vital. This step can often be time-consuming but is crucial for a smooth application process. Proper organization and meticulous preparation of documents can prevent delays and complications later on. Valid identification documents, such as a passport or birth certificate, are universally required to prove your identity and age. These documents are the bedrock of your application, confirming your basic eligibility. Detailed records of your employment history and earnings are crucial, especially for pensions tied to your employment. These records not only demonstrate your work history but also play a key role in calculating your pension entitlement. Choosing the right type of pension plan is essential, as each plan comes with its unique benefits and application procedures. Pensions are not a one-size-fits-all solution. Each type of pension, such as state, company, or private pension, has its own set of rules and application processes. Understanding these differences is crucial for selecting the most suitable option. Familiarizing yourself with the specifics of each type can help you maximize your retirement benefits. This involves filling out and submitting your pension application form, a step that requires attention to detail. Ensuring accuracy and completeness in your application can significantly increase the chances of approval. Understanding what happens after you submit your application, including how long it might take to get a decision, is important for setting realistic expectations. Many pension providers offer tools to track the status of your application. This feature not only keeps you informed but also provides peace of mind as you wait for a decision. Gaining insight into how decisions are made on pension applications can help set realistic expectations. Understanding this process can also prepare you for any potential appeals or additional steps you might need to take. This knowledge helps in planning your actions during the waiting period and preparing for any potential follow-up steps. Timing and deadlines play a pivotal role in the pension application process, and understanding them is crucial for a successful outcome. The timing of your application can significantly impact the benefits you receive. Most pension plans have specific eligibility criteria that determine when you can start receiving benefits, often tied to your age and years of service. It's essential to be aware of these requirements and plan your application accordingly. Missing deadlines can result in delayed benefits or even reduced payouts, making it imperative to stay informed about key dates. Moreover, some pension plans have specific windows during which you must submit your application to initiate the process. Failing to meet these deadlines can lead to unnecessary complications and financial setbacks. To navigate this aspect effectively, it's advisable to start the application process well in advance, ensuring you have all necessary documents and information ready. These are primary sources of information and assistance, offering guidance throughout the application process. Their expertise and resources can be invaluable, especially in navigating complex aspects of the application. For personalized advice, consulting with a financial advisor can be particularly beneficial. They can provide tailored guidance based on your individual financial situation and retirement goals. One of the most common issues in pension applications is incomplete or missing documentation. To address this, ensure that you have a comprehensive checklist of all required documents before beginning the application process. If you find that a document is missing or outdated, act promptly to obtain or update it. In cases where certain documents are unavailable, seek advice from the pension provider or a financial advisor on acceptable alternatives. Pension eligibility criteria can be complex, leading to confusion and potential errors in the application. To mitigate this, thoroughly review the eligibility requirements of the specific pension plan you are applying for. If there are uncertainties, don't hesitate to reach out to the pension provider for clarification. In some cases, it may be beneficial to consult a financial advisor who can provide personalized guidance based on your circumstances. Delays in the pension application process can be frustrating and may occur due to various reasons, including administrative backlogs or incomplete applications. To minimize delays, submit a complete and accurate application from the outset. Keep track of your application’s progress and maintain regular communication with the pension provider. If you encounter significant delays, inquire about the cause and ask for an estimated timeline for resolution. Receiving a rejection for a pension application can be disheartening, but it's important to understand that it’s not always the end of the road. Firstly, seek to understand the specific reasons for the rejection. Once you have clarity on why the application was denied, explore the options available for rectifying the issues. This might involve gathering additional documentation, appealing the decision, or reapplying after addressing the identified shortcomings. Maintaining proactive communication with the pension provider throughout the application process is key. This not only helps in staying informed about the status of your application but also in quickly addressing any issues or queries that might arise from either end. Complex issues or persistent challenges might require expert intervention. Don't hesitate to seek advice from financial advisors or pension consultants who specialize in retirement planning and offer tailored solutions to your problems. By being proactive, well-informed, and responsive, you can effectively navigate through the common challenges in the pension application process, paving the way for a smoother and more efficient path to securing your pension benefits. Remember, addressing issues promptly and efficiently not only expedites the application process, but also reduces the stress and uncertainty associated with securing your financial future in retirement. Your pension amount is often directly linked to your work history and the contributions you've made (or have been made on your behalf) over the years. In many cases, the longer you've worked and the more you've contributed, the higher your pension benefits. For company and private pensions, the specifics of the plan, such as contribution matching or profit-sharing aspects, can significantly affect the final amount. The age at which you choose to retire plays a critical role in determining your pension benefits. Early retirement can lead to reduced benefits in some schemes, as you're drawing the pension over a longer period. Conversely, delaying retirement often results in higher monthly payments, as the accumulation period is extended and the distribution phase is shortened. In many pension plans, particularly those that are employment-based, the pension amount is calculated based on your earnings history. The final pension might be a percentage of your average salary over your last few years of employment or the highest salary years. Some pensions include provisions for inflation adjustments, aiming to maintain the purchasing power of your retirement income over time. Understanding whether your pension is indexed for inflation is crucial for long-term financial planning. If your pension plan includes survivor benefits, this might affect the amount you receive. These benefits ensure that a spouse or other designated beneficiaries continue to receive income after your death, often at a reduced rate. The journey to securing a pension is underpinned by a thorough understanding and careful navigation of the application process. It begins with assessing eligibility, where factors like age, employment history, and individual health and disability considerations play a pivotal role. The importance of meticulous document preparation cannot be overstated, as it lays the foundation for a smooth application process. Choosing the right pension plan is critical, as each type offers unique benefits and has specific application procedures. Post-submission, it's essential to stay informed and proactive, tracking your application and understanding the decision process. Addressing common issues promptly, such as documentation gaps or eligibility confusion, is key to avoiding delays. Ultimately, understanding how your pension is calculated and effectively managing it post-approval ensures that it meets your changing needs throughout retirement. Being well-informed, prepared, and proactive at every step is crucial in securing a comfortable and financially stable retirement.Overview of the Pension Application Process

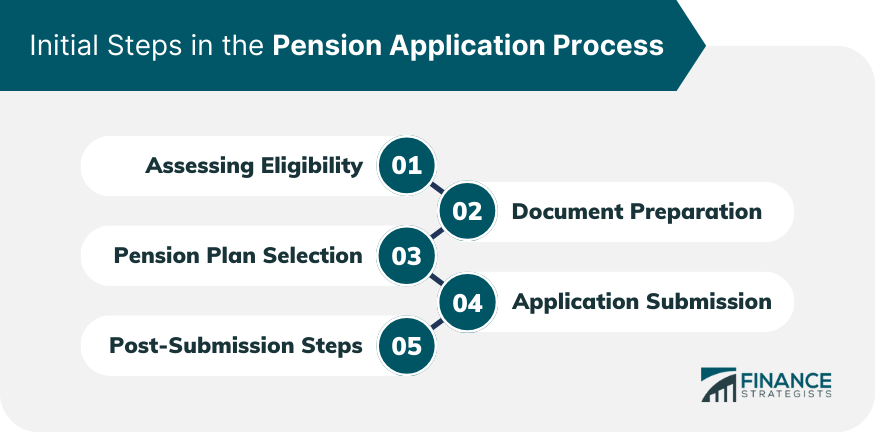

Initial Steps in the Pension Application Process

Assessing Eligibility

Age and Employment History Requirements

Health and Disability

Document Preparation

Proof of Identity and Age

Employment Records

Pension Plan Selection

Application Submission

Post-Submission Steps

Application Tracking

Decision Process

Timing and Deadlines in the Pension Application Process

Sources of Assistance and Information in the Pension Application Process

Pension Providers and Government Offices

Financial Advisors

Addressing Common Issues and Challenges in the Pension Application Process

Missing Documentation

Eligibility Confusion

Application Delays

Handling Rejections

Proactive Communication

Seeking Expert Advice

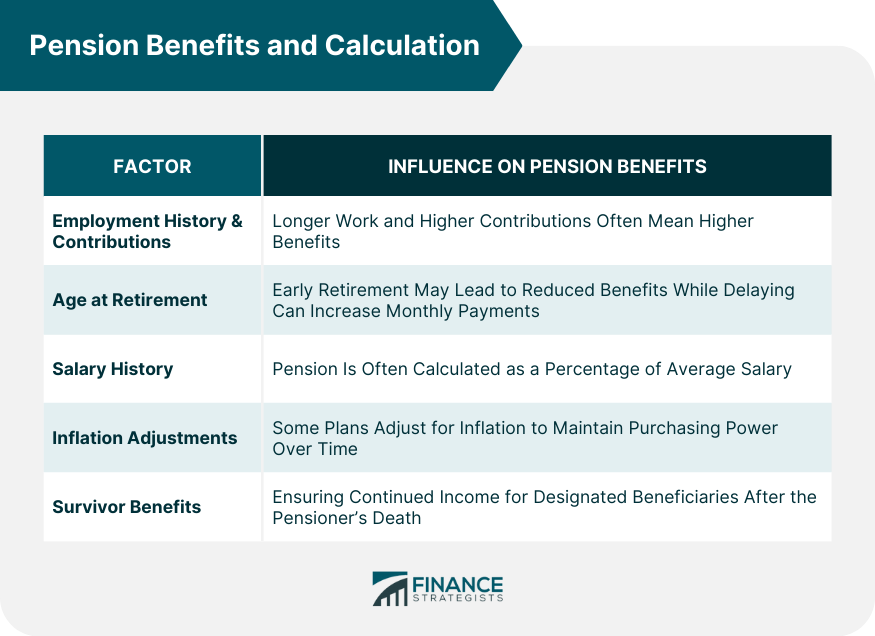

Understanding Pension Benefits and Calculation

Employment History and Contributions

Age of Retirement

Salary History

Inflation Adjustments

Survivor Benefits

Final Thoughts

Pension Application Process FAQs

The pension application process involves assessing eligibility, gathering necessary documents, selecting the right pension plan, submitting an application, and following post-submission procedures.

Begin the pension application process by determining your eligibility based on age, employment history, and other criteria, and then gather all required documentation such as proof of identity and employment records.

Common challenges in the pension application process include missing documentation, eligibility confusion, application delays, and handling rejections or appeals.

Yes, many pension providers offer online tools or services to track the status of your pension application process, providing updates and peace of mind.

In the pension application process, it's important to understand the different types of pension plans (state, company, private) and their unique benefits and requirements to choose the most suitable option for your retirement needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.