Embarking on retirement planning in your 30s lays a sturdy financial foundation, giving your savings ample time to grow. It's a strategic move that sets the stage for a comfortable and secure retirement. This foresight can be the difference between retiring on your terms or being caught unprepared in your golden years. Early retirement planning is not merely a suggestion; it's a critical step in ensuring financial independence. As life expectancy increases, so does the time you'll spend in retirement. Hence, starting in your 30s can significantly influence the quality of your retirement life. The steps outlined here are designed to navigate the complexities of retirement planning, making the process less daunting and more manageable. Until the 1980s, employers mostly provided defined benefit pensions as retirement plans. As of March 2023, based on the National Compensation Survey by the Bureau of Labor Statistics, only 63% of workers in the private sector have access to such plans. The landscape of retirement planning has significantly shifted in the past few decades. The rise of defined-contribution plans, like 401(k)s, has overtaken the older model of defined-benefit pensions. These plans place the onus of saving and investing for retirement more directly on employees, offering them greater control and increasing their responsibility for managing their retirement funds. This shift reflects a broader trend towards individual financial autonomy in retirement planning. However, it also brings challenges, especially for workers who are less financially literate or who work in sectors with lower access to these plans. Moreover, the current generation is facing unique challenges that impact their retirement planning. The increasing life expectancy means that people need to save more to ensure financial stability over a longer period in retirement. Additionally, the volatility in global markets, influenced by factors such as the COVID-19 pandemic and geopolitical tensions, has added an element of uncertainty to retirement savings and investments. These factors, combined with the rising costs of healthcare and living expenses, make it imperative for individuals to adopt a more proactive and informed approach to retirement planning, emphasizing the need for financial education and planning from an early age. The adage 'time is money' is never truer than when it comes to retirement savings. Starting in your 30s has a profound impact, thanks to the magic of compounding interest. Every year you delay can significantly decrease your retirement nest egg, making an early commitment to saving a non-negotiable aspect of financial planning. Moreover, beginning in your 30s allows for more aggressive investments, as you can weather market fluctuations over time. It gives you the leeway to take calculated risks for higher returns. Before you can plan where you're going, you need to know where you stand. Evaluating your savings and investments is like a financial health check-up; it diagnoses your current situation to prescribe a plan of action. It's essential to scrutinize your savings, debts, and investments to understand your starting point fully. This evaluation should be thorough, encompassing all assets and liabilities. It's not just about how much you've saved but also about how your money is working for you. Are your investments yielding the expected returns? Are there debts eating into your potential savings? These are critical questions to answer. Retirement planning is not a one-size-fits-all endeavor. Each person's needs and goals are unique and shaped by lifestyle choices, aspirations, and personal circumstances. A clear understanding of these needs helps in setting tangible goals for retirement savings. Consider what you envision for your retirement: Travel? Hobbies? A second career? Then, translate these aspirations into financial objectives. How much would you need per year? What's the total sum required to sustain your retirement lifestyle? Setting these goals gives direction to your savings efforts, ensuring that every dollar saved moves you closer to your retirement dream. Debt is often the elephant in the room when it comes to financial planning. It can silently undermine your retirement goals if not managed properly. High-interest debts, like credit card balances or unconsolidated student loans, should be tackled head-on as they can cripple your ability to save effectively. Debt management isn't just about clearing balances; it's about strategic financial structuring. It may mean refinancing loans at lower interest rates or prioritizing debts that impact your credit score. Effective debt management is a critical pillar supporting your retirement plan, ensuring that when you're ready to retire, your debts won't be retiring with you. Compounding interest is the eighth wonder of the world, according to a famous saying, and its power becomes more evident as you analyze its long-term effects. When you start saving in your 30s, you give your investments more time to grow, where the interest you earn begins to earn its own interest. This creates a snowball effect, significantly increasing the size of your retirement fund over time. To harness the full power of compounding, you must start early and save consistently. Even modest amounts saved regularly can amass a substantial sum over several decades. The key is to remain disciplined, resist the temptation to dip into your retirement savings, and let compounding work its magic over the years. Understanding the various retirement accounts available to you is like knowing the tools in a toolbox; each has a specific purpose and can be used to build your financial future. In your 30s, you should be familiar with the differences between 401(k)s, traditional IRAs, and Roth IRAs. Each of these accounts has unique tax advantages that can help your savings grow more efficiently. 401(k)s, often offered by employers, allow for high annual contributions and sometimes come with matching contributions, which can significantly boost your retirement savings. IRAs, on the other hand, offer more investment options and flexibility. Roth IRAs, funded with after-tax dollars, promise tax-free withdrawals in retirement, making them a powerful tool for long-term savings. Asset allocation involves dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash. The idea is to optimize the balance between risk and reward according to your specific financial situation and risk tolerance. Diversification, a key component of asset allocation, mitigates risk by spreading investments across various financial instruments, industries, and other categories. A well-diversified portfolio can withstand market volatility and provide steadier growth over time. In your 30s, you're in a prime position to take advantage of more aggressive allocations, typically heavier in stocks, which have historically provided higher returns over long periods. As you age, you can gradually shift to a more conservative allocation to protect your accumulated wealth. Risk tolerance is your ability and willingness to endure swings in market value for the potential of higher returns. It's a personal measure that should be reassessed periodically as your life circumstances change. Your time horizon, the expected time until you begin making withdrawals, is equally important in shaping your investment strategy. In your 30s, with a long time horizon until retirement, you may be able to tolerate more risk because you have more time to recover from market downturns. This could mean investing in growth-oriented assets, like stocks or mutual funds. As you age, your risk tolerance typically decreases, warranting a shift to more conservative investments to preserve capital. Real estate investment can be a lucrative way to create a passive income stream for retirement, serving as a tangible asset that typically appreciates over time. In your 30s, investing in real estate allows you to leverage your time and income to acquire properties that could provide rental income now and in the future. With a long-term perspective, you can weather the real estate market's cyclical nature and benefit from potential capital gains. Rental income offers the dual advantage of providing a steady cash flow while the property itself may increase in value. It's important to consider the responsibilities of being a landlord and the need for property management. However, if managed well, real estate can be a substantial part of your retirement portfolio, offering diversification beyond stocks and bonds. Starting a side business or investing in passive income ventures can amplify your retirement savings. These entrepreneurial efforts can fill gaps in your income and accelerate your financial goals. In your 30s, you likely possess the energy, drive, and time horizon to build a business that could provide substantial income now and into retirement. Passive income ventures, such as writing a book, creating an online course, or investing in dividend-paying stocks, can generate ongoing income with little daily effort after the initial investment of time or capital. The key is to identify opportunities that align with your interests and skills, ensuring that the work you put in now continues to pay dividends in the future. Healthcare is a significant consideration in retirement planning, as costs can be one of the largest expenses during retirement. In your 30s, it may seem premature to think about healthcare in old age, but planning now can prevent financial strain later. Estimating your future healthcare expenses can inform how much you need to save to cover medical costs in retirement. Start by considering your current health, family medical history, and projected healthcare inflation. Factor in the cost of health insurance premiums, out-of-pocket expenses, and long-term care insurance. Preparing for these costs now can help you avoid the financial shock that healthcare expenses can cause in retirement. A Health Savings Account (HSA) is a powerful tool in retirement planning, offering triple tax advantages: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are not taxed. If you have a high-deductible health plan, contributing to an HSA in your 30s can build a substantial reserve for healthcare costs in retirement. Funds in an HSA roll over from year to year, so there's no pressure to spend the balance annually, allowing the account to grow over time. After age 65, you can withdraw funds for non-medical expenses without penalty, paying only income tax on the withdrawal. This flexibility makes the HSA a valuable component of a well-rounded retirement strategy. Life's milestones—marriage, children, and home buying—can reshape your financial landscape, often in ways that are both profound and subtle. As these events unfold in your 30s, they can significantly influence your retirement planning. A marriage may mean merging finances and aligning retirement goals with your partner. The birth of a child introduces new financial responsibilities and the potential need for college savings plans, which can affect how much you're able to contribute to your retirement. Adapting to these changes requires a flexible retirement planning approach. It's not about choosing between saving for your child's education and your retirement but about finding a balance that allows for both. Adjusting your budget, revisiting your investment strategies, and ensuring you have adequate insurance coverage become key steps in recalibrating your financial plan to accommodate these life events. Your 30s will likely be a juggling act of various financial goals. While retirement savings should remain a priority, it's essential to balance this with other objectives like paying off debt or saving for a down payment on a home. It's a financial balancing act requiring careful prioritization and a keen awareness of your long-term financial health. The key to this balancing act is understanding the interplay between different financial goals and how they can be integrated into a cohesive plan. For example, paying off high-interest debt can free up more money for retirement savings in the long run. Similarly, purchasing a home can be seen as a long-term investment that contributes to your net worth. Strategic planning ensures that progress toward one goal doesn't come at the expense of another. Taxes can take a significant bite out of your retirement savings if not properly planned for. It's essential to understand the tax implications of your retirement accounts, as different types of accounts are taxed in various ways. Traditional retirement accounts like a 401(k) or traditional IRA provide tax deductions now but are taxed upon withdrawal. Conversely, Roth accounts are funded with after-tax dollars, growing tax-free and offering tax-free withdrawals in retirement. In your 30s, taking the time to understand these differences can lead to more informed decisions about where to place your savings. For instance, if you expect to be in a higher tax bracket in retirement, contributing to a Roth account may be more beneficial. Conversely, if you expect to be in a lower tax bracket, a traditional account might make more sense. Tax planning is a crucial aspect of retirement planning that can greatly impact the growth and accessibility of your retirement funds. Developing strategies for tax-efficient withdrawals in retirement can significantly extend the life of your retirement savings. The order in which you withdraw funds from your various retirement accounts can impact your tax bill and the longevity of your savings. Understanding how to strategically draw down your assets to minimize taxes is an essential part of retirement planning. One common strategy is to withdraw from taxable accounts first, allowing your tax-advantaged accounts more time to grow. Alternatively, you might consider a Roth conversion ladder, which involves converting portions of a traditional IRA to a Roth IRA over time, potentially reducing taxes in the long run. Consulting with a tax advisor can help you develop a withdrawal strategy that aligns with your financial situation and retirement goals. The allure of immediate gratification can often overshadow the importance of future benefits, leading many to favor short-term gains over long-term prosperity. This short-sightedness can manifest in inadequate savings rates, delaying retirement contributions, or opting out of employer-sponsored retirement plans. Such missteps in your 30s can derail your financial future, making it difficult to catch up later. To avoid these pitfalls, it’s essential to cultivate a vision that extends into the decades ahead. Consider the compound effect of today’s financial decisions on your retirement. Embrace a mindset that prioritizes future financial security as much as present-day desires. This may mean making sacrifices now, like forgoing the latest gadget or luxury car, for a more secure and comfortable retirement. One of the most common mistakes is underestimating how much you'll need to live comfortably in retirement. This miscalculation can lead to a savings shortfall, which is particularly risky if you outlive your funds. In your 30s, it may be challenging to envision your financial needs in retirement, but it's crucial to make an educated estimate that accounts for inflation, healthcare costs, and potential lifestyle changes. Consider using retirement calculators to project your needs, and review these estimates regularly as your income and living expenses evolve. It’s also wise to err on the side of caution by saving more than you think you’ll need. Creating a cushion can help ensure you’re prepared for the unexpected expenses that inevitably arise during retirement. An annual review of your financial plan is akin to a routine health checkup—it’s a crucial part of maintaining long-term financial wellness. This regular assessment allows you to adjust your savings goals, investment choices, and retirement strategies in response to life changes, market conditions, or shifts in your long-term objectives. In your 30s, these reviews can be particularly revealing as your career advances, your income potentially increases, and your financial goals become more defined. During these reviews, examine your portfolio’s performance, reassess your risk tolerance, and consider any changes in tax laws that might affect your savings. If you’ve experienced any major life events, such as a change in marital status or the addition of a child, your retirement plan should be updated to reflect these new circumstances. Consistent reviews ensure your retirement plan remains aligned with your evolving life and goals. The financial markets and your personal life are in constant flux, and your retirement plan must be flexible enough to adapt to these changes. Economic downturns, for instance, may test your risk tolerance and could necessitate a more conservative approach to your investments. On the flip side, a booming market might provide opportunities to take some gains and reinvest in different assets. Personal circumstances, such as a significant salary increase or an unexpected inheritance, also warrant adjustments to your retirement plan. These changes can allow you to increase your retirement contributions or diversify your investments. A vigilant eye on both market trends and personal changes will help you tailor your retirement strategy to ensure it remains robust and responsive to the dynamics of your financial journey. In the journey of retirement planning in your 30s, the twin beacons of early planning and consistent action cannot be overstated. Embrace the exponential growth of compounding interest, wisely choose retirement accounts, and diversify investments for robust growth. Navigate life's milestones with financial agility, ensuring each step contributes to your retirement vision. Mitigate tax impacts through informed strategies and sidestep common pitfalls by avoiding short-term thinking, underestimating retirement costs, and neglecting annual financial reviews. Your 30s are a formative decade for retirement planning; use them to build a strong foundation that will support you for years to come.Overview of Retirement Planning

Understanding the Retirement Landscape in Your 30s

Retirement Trends and Statistics for the Current Generation

Impact of Starting to Save in Your 30s

Assessing Your Current Financial Health

Evaluate Your Current Savings and Investment Status

Understand Your Retirement Needs and Setting Goals

Role of Debt Management in Retirement Planning

Maximizing Retirement Savings in Your 30s

Power of Compounding Interest

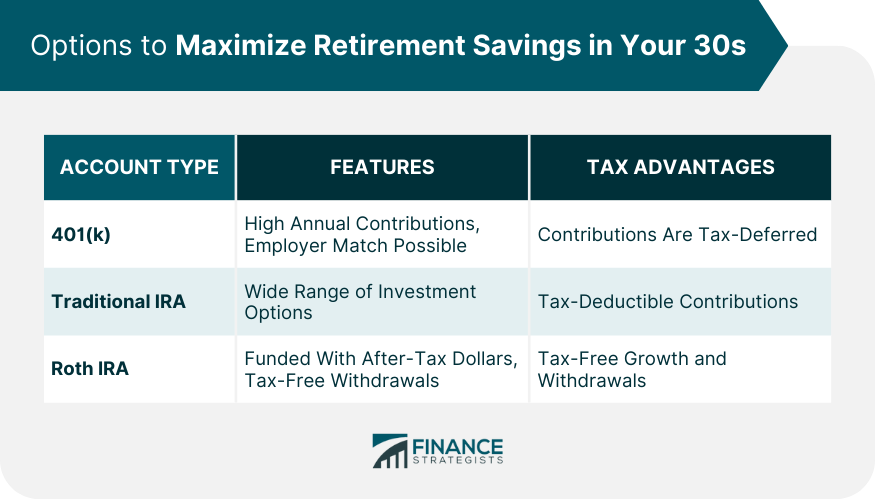

Types of Retirement Accounts

Investment Strategies for Long-Term Growth

Asset Allocation and Diversification

Risk Tolerance and Time Horizon

Additional Retirement Income Streams

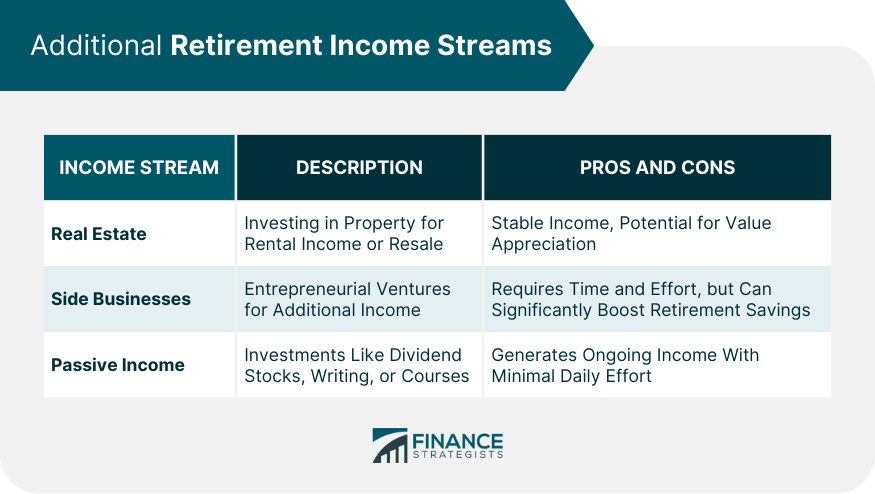

Real Estate and Rental Income

Side Businesses and Passive Income Ventures

Planning for Healthcare Costs

Estimate Future Healthcare Expenses

Health Savings Account (HSA) and Its Benefits for Retirement

Life Events and Retirement Planning

Adapt to Life Changes

Balance Retirement Savings With Other Financial Goals

Tax Planning and Retirement

Understand Tax Implications of Retirement Savings

Strategies for Tax-Efficient Withdrawal in Retirement

Retirement Planning Mistakes to Avoid in Your 30s

Short-Term Thinking and Lack of Long-Term Planning

Underestimating the Cost of Retirement

Regular Review and Adjustment of Retirement Plans

Importance of Annual Financial Reviews

Adjusting Your Plan for Market Changes and Personal Circumstances

Final Thoughts

Planning for Retirement in Your 30s FAQs

It allows more time for your investments to grow through compounding interest and provides a larger window to recover from market downturns.

Assess your current financial health, including debts, savings, and investments, to set realistic retirement goals.

Prioritize your savings, consider employer matches, and create a budget that allows for both retirement savings and other financial objectives.

Focus on diversified, long-term investments tailored to your risk tolerance, and take advantage of tax-efficient retirement accounts.

Conduct an annual financial review to adjust for life changes, market conditions, and shifts in your long-term goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.